A career in asset management is one of the most challenging and intellectually stimulating paths in the financial industry. It's a field where strategic thinking, analytical prowess, and a deep understanding of global markets converge. For those who excel, the financial rewards can be substantial, with many professionals earning well into the six figures and beyond. But what does an asset management salary truly look like?

This guide will break down the compensation you can expect, from your first day as an analyst to your years as a seasoned portfolio manager. We’ll explore the key factors that drive your earning potential, supported by up-to-date data from authoritative sources, to give you a clear picture of this lucrative career path.

What Does an Asset Manager Do?

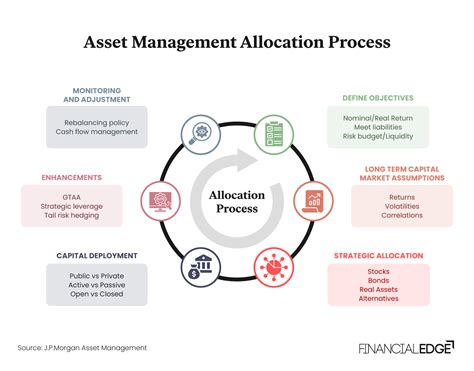

Before diving into the numbers, it’s essential to understand the role. Think of an asset manager as a financial steward and strategist. Their primary responsibility is to grow a portfolio of assets on behalf of their clients, which can be individuals (high-net-worth), corporations, or institutions like pension funds and endowments.

Their day-to-day responsibilities include:

- Conducting in-depth research on stocks, bonds, real estate, and other investment vehicles.

- Developing and executing investment strategies to meet client goals and risk tolerance.

- Monitoring market trends and economic indicators to make informed decisions.

- Managing risk to protect and preserve client capital.

- Communicating performance and strategy to clients and stakeholders.

It's a high-stakes role that demands a blend of quantitative skill and qualitative judgment, and the compensation structure is designed to reward success.

Average Asset Management Salary

Salaries in asset management are composed of two main parts: a base salary and a performance bonus. The bonus can often equal or even exceed the base salary, especially at senior levels and at top-performing firms.

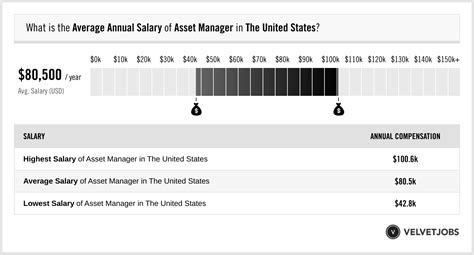

According to data from Salary.com, the median base salary for an Asset Manager in the United States is approximately $124,190 as of 2024, with a typical range falling between $108,490 and $145,190.

However, total compensation tells a more complete story. Glassdoor reports a higher average total pay of around $140,400 per year, which includes base salary and additional compensation like cash bonuses and profit sharing. This figure highlights the critical role of variable pay in this profession.

Compensation grows significantly with experience:

- Entry-Level (Analyst): Typically, professionals start as research analysts. Payscale reports that an entry-level Financial Analyst can expect an average salary of around $70,000, with asset management roles often starting higher, in the $80,000 to $100,000 range including signing bonuses.

- Mid-Career (Associate/Manager): With 3-7 years of experience, professionals can move into associate or manager roles. Base salaries often move into the $120,000 to $170,000 range, with total compensation pushing well into the high-100s or low-200s.

- Senior-Level (VP/Portfolio Manager/Director): At this level, compensation becomes heavily tied to the performance of the assets under management (AUM). Base salaries can range from $175,000 to $250,000+, but total compensation, including bonuses, can easily reach $300,000 to over $1,000,000 for top performers at successful firms.

Key Factors That Influence Salary

Your salary isn't just a single number; it's influenced by a combination of critical factors. Understanding these drivers is key to maximizing your career earnings.

### Level of Education

A strong educational foundation is the price of entry. A bachelor's degree in finance, economics, accounting, or a related quantitative field is standard. However, advanced degrees and certifications can significantly boost your earning potential.

- Master of Business Administration (MBA): An MBA from a top-tier business school is a common pathway to high-level roles in asset management. It not only provides advanced financial knowledge but also offers invaluable networking opportunities, often leading to higher starting salaries post-graduation.

- Chartered Financial Analyst (CFA®): The CFA charter is considered the gold standard in the investment management industry. Earning this designation requires passing three rigorous exams and demonstrates a mastery of investment analysis and portfolio management. Professionals with a CFA charter often command a salary premium and are highly sought after by employers.

### Years of Experience

Experience is arguably the most significant determinant of salary in asset management. The career ladder is well-defined, with compensation rising steeply at each rung.

1. Analyst (0-3 Years): Focuses on research, financial modeling, and supporting senior managers.

2. Associate (3-5 Years): Takes on more responsibility, often managing smaller parts of a portfolio and having more client interaction.

3. Vice President / Portfolio Manager (5-10+ Years): Directly responsible for investment decisions and the performance of a portfolio or fund.

4. Managing Director / Partner (15+ Years): Leads entire teams or business units, with compensation tied directly to the firm's overall profitability and AUM.

As you advance, the bonus portion of your pay becomes a much larger percentage of your total compensation, rewarding your direct impact on the firm's success.

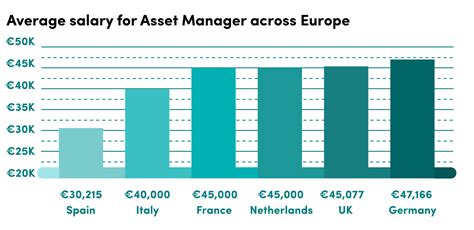

### Geographic Location

Where you work matters. Major financial hubs offer the highest concentration of asset management firms, larger pools of capital, and, consequently, the highest salaries.

- Top-Tier Cities: New York City is the epicenter of finance in the U.S., consistently offering the highest salaries. Other major hubs like San Francisco, Chicago, Boston, and Charlotte also offer highly competitive compensation packages, though often adjusted for a slightly lower cost of living than NYC.

- Other Regions: While salaries may be lower outside of these financial centers, they are still typically very strong relative to local averages.

According to Salary.com, an Asset Manager in New York, NY, can expect to earn about 20% more than the national average, showcasing the significant impact of location.

### Company Type

The type of firm you work for has a massive impact on your compensation structure and ceiling.

- Hedge Funds & Private Equity: These firms offer the highest earning potential. Compensation is heavily performance-based, with massive bonuses and "carried interest" (a share of profits) for successful fund managers. The environment is high-pressure and high-risk.

- Large Investment Banks (e.g., Goldman Sachs, J.P. Morgan Asset Management): These bulge-bracket firms offer very competitive, structured salaries and bonuses. They provide excellent training, prestige, and a clear career path.

- Traditional Asset Managers (e.g., Fidelity, T. Rowe Price, Vanguard): These firms manage mutual funds and other long-term investment products. While bonuses may be less astronomical than at hedge funds, salaries are still excellent, and the work-life balance is often considered more sustainable.

- Boutique & Family Offices: These smaller firms can offer a wide range of compensation. A successful boutique firm can be extremely lucrative, while others may offer more modest pay.

### Area of Specialization

"Asset management" is a broad field. Specializing in complex or high-growth areas can lead to higher pay.

- Alternative Investments: Specialists in private equity, real estate, hedge funds, or private credit are in high demand and can command premium salaries due to the complexity and illiquid nature of these assets.

- Quantitative Analysis ("Quants"): Professionals who use sophisticated mathematical models and algorithms to drive investment strategies are highly compensated for their specialized technical skills.

- Equities vs. Fixed Income: While both are core areas, top-performing equity portfolio managers, especially in niche sectors like technology or healthcare, have historically had very high earning potential.

Job Outlook

The future for financial professionals, including asset managers, looks bright. According to the U.S. Bureau of Labor Statistics (BLS), employment for Financial Managers is projected to grow 16 percent from 2022 to 2032, a rate that is much faster than the average for all occupations.

The BLS attributes this growth to the increasing complexity of financial products and the need for skilled professionals to manage the retirement funds of an aging population and navigate an increasingly global investment landscape. This strong demand ensures that asset management will remain a promising and well-compensated career for years to come.

Conclusion

A career in asset management offers a direct path to significant financial success for those with the right skills, dedication, and strategic mindset. While a six-figure salary is the norm, your ultimate earning potential is uncapped and directly tied to your performance and choices.

For anyone considering this path, the key takeaways are clear:

- Aim for a high six-figure total compensation, with potential for seven figures at senior levels.

- Prioritize education, with an MBA or a CFA charter acting as powerful career accelerators.

- Understand that experience is paramount, with compensation growing exponentially as you climb the career ladder.

- Be strategic about location and firm type, as financial hubs and high-performance firms offer the greatest rewards.

For those with a passion for the markets and an unwavering drive for excellence, asset management presents one of the most compelling and financially rewarding careers in the modern economy.