If you're analytical, strategic, and fascinated by the engine of the global economy, a career in asset management could be an incredibly rewarding path. This field is not only intellectually stimulating but also offers significant financial rewards. It's a career where performance and expertise can lead to a lucrative six-figure salary, with top earners commanding even higher compensation through substantial bonuses.

This article will serve as your comprehensive guide to understanding an asset manager's salary. We'll explore the average compensation, break down the key factors that dictate your earning potential, and look at the future outlook for this dynamic profession.

What Does an Asset Manager Do?

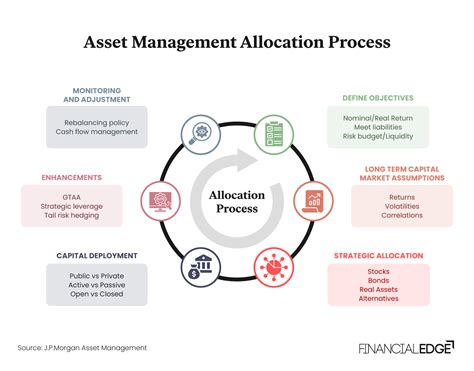

At its core, an asset manager is a financial steward. Their primary responsibility is to strategically manage and grow a client's portfolio of assets to meet specific financial goals. These clients can range from individual high-net-worth investors to large institutional entities like pension funds, insurance companies, and university endowments.

Key responsibilities include:

- Market Research & Analysis: Deeply analyzing financial markets, economic trends, and individual securities (stocks, bonds, real estate, etc.).

- Strategy Development: Creating and executing investment strategies tailored to a client's risk tolerance and objectives.

- Portfolio Management: Making buy, sell, and hold decisions for the assets within the portfolio.

- Risk Management: Identifying and mitigating potential financial risks to protect the client's capital.

- Client Relations & Reporting: Communicating performance, strategy, and market outlook to clients.

Essentially, an asset manager works to make their clients' money make more money, navigating the complexities of the financial world to deliver returns.

Average Asset Manager Salary

When discussing compensation in finance, it's crucial to look beyond the base salary. While the base provides a stable foundation, total compensation—which includes bonuses, commissions, and profit-sharing—presents a more accurate picture of an asset manager's earnings.

- Average Base Salary: According to data from leading salary aggregators, the median base salary for an Asset Manager in the United States typically falls between $115,000 and $130,000 per year.

- Typical Salary Range: As reported by Salary.com, the salary range for an Asset Manager usually spans from $95,000 at the lower end (often for entry-level or junior roles) to over $155,000 for senior-level professionals.

- Total Compensation: This is where the numbers become truly compelling. Glassdoor reports that the estimated total pay for an asset manager can reach $145,000 to $170,000 or more, with the "additional pay" portion (bonuses and profit-sharing) often adding $30,000 to $50,000+ to the base salary. For top performers at leading firms, bonuses can equal or even exceed their base salary.

Key Factors That Influence Salary

Your salary as an asset manager isn't a single, fixed number. It's a dynamic figure influenced by a combination of critical factors. Understanding these drivers is key to maximizing your earning potential.

### Level of Education

Education is the bedrock of a career in finance. While a bachelor's degree is the standard entry point, advanced credentials can significantly accelerate your career and compensation trajectory.

- Bachelor's Degree: A degree in Finance, Economics, Accounting, or a related quantitative field is considered the minimum requirement.

- Master's Degree: An MBA from a top-tier business school or a Master's in Finance (MSF) is highly valued. It often qualifies candidates for higher-level positions and can lead to a significantly higher starting salary.

- Professional Certifications: The Chartered Financial Analyst (CFA) designation is the gold standard in the investment management industry. Earning the CFA charter demonstrates a profound mastery of investment analysis and portfolio management and is a powerful signal to employers, often resulting in substantially higher pay and more senior roles.

### Years of Experience

Experience is arguably the most significant factor in determining an asset manager's salary. The industry rewards a proven track record of successful performance and market navigation.

- Entry-Level (Analyst, 0-3 years): Professionals starting their careers often begin as research analysts. In this phase, base salaries typically range from $70,000 to $95,000, with smaller annual bonuses as they learn the ropes.

- Mid-Career (Associate/Manager, 4-9 years): With a solid track record, professionals move into manager roles with more autonomy. Base salaries climb to the $100,000 to $150,000 range, and performance bonuses become a much more significant part of their total compensation.

- Senior-Level (VP/Director, 10+ years): Senior asset managers, directors, or partners are responsible for major portfolios and firm strategy. Base salaries often exceed $160,000 - $250,000, but their total compensation can soar well beyond that, driven by bonuses tied directly to the performance and size of the assets they manage (AUM).

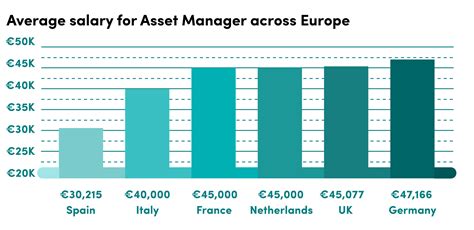

### Geographic Location

Where you work matters. Major financial centers offer higher salaries to attract top talent and to account for a higher cost of living. The highest-paying cities for asset managers in the U.S. include:

- New York, NY

- San Francisco, CA

- Boston, MA

- Chicago, IL

- Charlotte, NC

An asset manager in New York City or San Francisco can expect to earn 20-40% above the national average, reflecting the heavy concentration of top-tier investment firms in these hubs.

### Company Type

The type of firm you work for has a massive impact on your compensation structure and ceiling.

- Large Investment Banks & Hedge Funds: Firms like Goldman Sachs, J.P. Morgan Chase, and Bridgewater Associates offer some of the highest potential compensation. Pay is heavily tied to performance, and year-end bonuses can be exceptionally large, but these are often high-pressure environments.

- Traditional Asset Management Firms: Companies like BlackRock, Vanguard, or Fidelity manage vast sums of money for a diverse client base. They offer competitive and well-structured compensation packages with strong bonus potential.

- Boutique Firms: Smaller, specialized firms may focus on a specific niche, like sustainable investing or emerging markets. Compensation can be very competitive and may include equity, but can also be more volatile.

- Corporate Finance & Insurance Companies: Many large corporations and insurers employ asset managers to manage their own pension funds and investment portfolios. These roles often offer excellent stability and work-life balance, though the bonus potential may be more modest compared to a hedge fund.

### Area of Specialization

The assets you manage influence your value. Specializing in complex, high-growth, or niche areas can lead to premium pay.

- Public Equities and Fixed Income: These are the most common specializations. While compensation is strong, the fields are very competitive.

- Alternative Investments: This is where some of the highest earnings are found. Specialists in private equity, venture capital, real estate, and hedge fund strategies are highly sought after. The complexity, lack of liquidity, and high potential returns of these assets command top-dollar compensation for those with the requisite expertise.

Job Outlook

The future for financial professionals, including asset managers, looks bright. According to the U.S. Bureau of Labor Statistics (BLS), employment for "Financial Managers" is projected to grow 16 percent from 2022 to 2032, which is significantly faster than the average for all occupations.

This robust growth is driven by several factors, including:

- A growing global economy and increasing pools of wealth that require professional management.

- The increasing complexity of financial products and regulations.

- An aging population in need of expert retirement planning and wealth management services.

Conclusion

A career as an asset manager is a demanding yet highly rewarding endeavor. While the path requires a strong educational foundation, a commitment to continuous learning, and a resilient mindset, the financial and professional rewards are substantial.

Here are the key takeaways for anyone considering this career:

- High Earning Potential: Expect a six-figure base salary that is significantly enhanced by performance-based bonuses, especially as you gain experience.

- Success is a Formula: Your salary is a direct result of your education (CFA is a major plus), experience level, location, and the type of firm and assets you specialize in.

- Strong Future Demand: The need for skilled asset managers is growing faster than average, ensuring strong job security and opportunities for years to come.

If you are driven by strategy and results, a career in asset management offers a clear and compelling path to professional success and financial prosperity.