In the intricate world of finance and insurance, where billion-dollar decisions hinge on the careful assessment of risk, the underwriter stands as a critical gatekeeper. They are the analytical minds who determine whether a risk—be it a new mortgage, a life insurance policy, or a complex commercial liability—is worth taking. For those with a sharp mind for detail and a knack for analytical thinking, the entry point to this rewarding profession is often the role of an Associate Underwriter.

But what does this career truly offer? Beyond the intellectual challenge lies a fundamental question for any aspiring professional: what is the earning potential? An associate underwriter salary is more than just a number; it's a reflection of the value, skill, and responsibility inherent in the role. The average base salary for an Associate Underwriter in the United States typically falls between $55,000 and $75,000, but this is merely the starting point of a lucrative and stable career trajectory.

I remember speaking with a newly-hired associate underwriter at a large commercial insurance carrier years ago. She described her job not as "approving or denying applications," but as "solving a puzzle where the pieces are financial statements, risk reports, and market trends." This perspective shift—from a transactional task to a strategic challenge—is what separates a good underwriter from a great one and is the key to unlocking the highest salary potential in this field.

This comprehensive guide will illuminate every facet of the associate underwriter career. We will dissect salary expectations, explore the factors that can significantly increase your earnings, and map out a clear path to get you started.

### Table of Contents

- [What Does an Associate Underwriter Do?](#what-does-an-associate-underwriter-do)

- [Average Associate Underwriter Salary: A Deep Dive](#average-associate-underwriter-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does an Associate Underwriter Do?

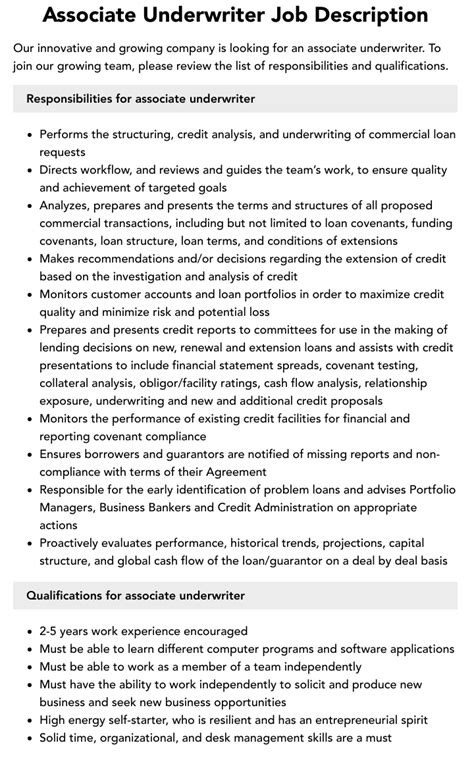

At its core, an Associate Underwriter is an apprentice risk analyst. They work under the guidance of senior underwriters to learn the art and science of risk assessment. Their primary function is to help evaluate the eligibility of an applicant for insurance policies or loans by meticulously examining data and ensuring it aligns with the company's risk tolerance and underwriting guidelines.

Think of them as detectives of financial risk. They gather clues from various documents—applications, credit reports, medical histories, property appraisals, and financial statements—and piece them together to form a complete picture of the applicant's risk profile. This role is foundational; it’s where future underwriting leaders build the instincts and technical skills necessary for a long-term career.

While the specific duties vary by industry (e.g., insurance vs. mortgage), the core responsibilities remain consistent.

Common Daily Tasks and Responsibilities:

- Application Review: Performing an initial review of insurance or loan applications to ensure all required information and documentation is present and accurate.

- Data Collection and Verification: Gathering supplementary information from various sources, such as credit bureaus, motor vehicle records, or medical information bureaus. They may also communicate directly with agents, brokers, or loan officers to clarify details.

- Risk Analysis: Using established guidelines and specialized software, they analyze the collected data to identify potential risks and red flags. This involves assessing factors like credit history, financial stability, property condition, or health status.

- Guideline Adherence: Ensuring that every application is evaluated strictly against the company's predefined underwriting policies and "risk appetite." They learn to identify when an application falls outside these guidelines and requires escalation.

- Preparing Files for Senior Review: Compiling a comprehensive file for each application, complete with all documentation, analysis, and a preliminary recommendation for a senior underwriter to review and make a final decision.

- Communication: Acting as a liaison between the underwriting department and external partners like insurance agents or mortgage brokers, providing status updates and explaining information requirements.

### A Day in the Life of an Associate Underwriter

To make this more concrete, let's walk through a typical day for an Associate Underwriter working in commercial property insurance.

8:30 AM: The day begins with a cup of coffee and a review of the assigned case queue. The underwriting software has flagged five new small business applications for review. The first one is a restaurant seeking property and liability coverage.

9:00 AM: The associate dives into the restaurant application. They check for completeness, noting that the fire suppression system details are vague. They open the attached supplemental documents, reviewing the business's financial statements for the last two years and a third-party inspection report of the property.

10:15 AM: After analyzing the initial file, the associate drafts an email to the insurance agent who submitted the application. The email clearly requests specific details about the kitchen's fire suppression system (make, model, and last inspection date) and asks for clarification on a dip in revenue from two quarters ago. They know the senior underwriter will demand this information.

11:00 AM: The team has a weekly pipeline meeting. The underwriting manager discusses market trends, highlighting increased claims related to water damage in their region. The team discusses how this might affect their risk assessment for properties with older plumbing. The associate takes diligent notes.

12:00 PM: Lunch break.

1:00 PM: The agent for the restaurant case has replied with the requested information. The fire suppression system is up to code. The revenue dip was due to a temporary closure for a planned renovation, which is a satisfactory explanation. The associate updates the file with this new information.

2:00 PM: Using the company's rating software, the associate inputs all the verified data. The system generates a preliminary premium based on the risk profile. The risk profile is clean and falls well within the company's guidelines for this type of business.

3:30 PM: The associate completes their summary report for the restaurant application. The report details the risk characteristics, confirms compliance with all guidelines, and includes a recommendation for approval at the quoted premium. They forward the entire file to their mentor, a Senior Underwriter, for final sign-off.

4:00 PM: The rest of the afternoon is spent working on the other files in the queue, identifying information gaps, and preparing them for a deeper analysis tomorrow. The work is methodical, detailed, and crucial to the company's financial health.

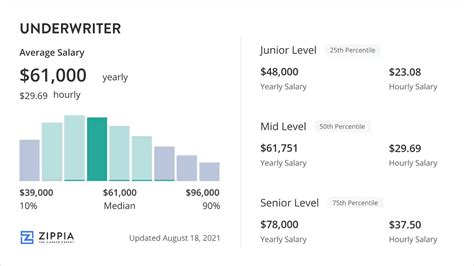

Average Associate Underwriter Salary: A Deep Dive

The salary for an Associate Underwriter is a compelling aspect of the career path, offering a comfortable living wage at the entry-level with significant growth potential. Compensation is not just a base salary; it's a total package that often includes bonuses and robust benefits.

To provide a clear and trustworthy picture, we've aggregated data from several authoritative sources. It's important to remember that these are national averages, and salaries can vary significantly based on the factors we'll explore in the next section.

National Salary Averages and Ranges

Here’s how the numbers break down according to leading salary aggregators (data retrieved in late 2023/early 2024):

- Salary.com: Reports the average Associate Underwriter salary in the United States is $65,064, with a typical range falling between $58,011 and $73,812.

- Payscale: Shows a similar median salary of $62,250, with the overall range spanning from $49,000 to $81,000 per year.

- Glassdoor: Estimates the total pay (base plus additional compensation) for an Associate Underwriter to be around $69,836 per year, with a likely range of $56,000 to $89,000.

- Zippia: Places the average salary slightly higher at $71,595, indicating a potential upward trend in compensation for this role.

Synthesizing this data, a realistic expectation for a candidate with a relevant bachelor's degree and 0-2 years of experience is a base salary in the $60,000 to $70,000 range.

Salary Progression by Experience Level

An Associate Underwriter role is a stepping stone. As you gain experience, skills, and autonomy, your title and salary will advance accordingly. Here is a typical salary progression for an underwriter in the insurance industry.

| Career Stage | Typical Experience | Common Titles | Average Base Salary Range | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | 0-3 years | Associate Underwriter, Underwriter Trainee | $58,000 - $75,000 | Assisting senior staff, data entry, learning guidelines, handling simple/low-limit cases. |

| Mid-Career | 3-7 years | Underwriter, Commercial Underwriter | $75,000 - $100,000 | Managing a dedicated book of business, handling moderately complex files, having limited binding authority. |

| Senior/Experienced| 7-15 years | Senior Underwriter, Lead Underwriter | $100,000 - $140,000+ | Handling the most complex, high-value accounts, mentoring junior staff, significant binding authority. |

| Management | 10+ years | Underwriting Manager, Director of Underwriting | $130,000 - $200,000+ | Managing a team of underwriters, setting departmental strategy and risk appetite, P&L responsibility. |

*Source: Data compiled and synthesized from Salary.com, Payscale, and industry observations.*

Dissecting the Total Compensation Package

Your annual salary is only one part of the equation. The financial services and insurance industries are known for offering comprehensive compensation packages that significantly increase your overall earnings.

- Annual Bonuses: This is a major component of an underwriter's pay. Bonuses are typically tied to both individual and company performance. Individual metrics might include productivity (number of files processed), quality (audit scores), and profitability of the accounts you underwrite. Company performance is based on the firm's overall profitability for the year. For an Associate Underwriter, a bonus might range from 5-10% of their base salary, while a Senior Underwriter's bonus could be 15-25% or more.

- Profit Sharing: Some companies, particularly mutual insurance companies or privately held firms, offer a profit-sharing plan. A portion of the company's annual profits is distributed among employees, often as a contribution to their retirement accounts. This directly aligns the employee's interests with the company's success.

- Retirement Savings (401k): A strong 401(k) or 403(b) plan with a generous employer match is standard. A common offering is a dollar-for-dollar match up to 4-6% of your salary. This is essentially free money and a critical component of long-term wealth building.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a given. Many large insurers also offer wellness stipends for gym memberships, mental health support through Employee Assistance Programs (EAPs), and generous parental leave policies.

- Paid Time Off (PTO): The industry generally offers competitive vacation, sick, and personal day allowances, often starting at three weeks per year and increasing with tenure.

- Professional Development and Tuition Reimbursement: This is a standout benefit in the underwriting field. Companies actively encourage and often fully fund the pursuit of professional designations like the CPCU (Chartered Property Casualty Underwriter). Earning these designations not only makes you better at your job but also directly leads to promotions and higher salary bands.

When evaluating a job offer, it's crucial to look beyond the base salary and calculate the value of the total compensation package. A job with a $65,000 base salary but a 10% bonus potential and a 6% 401(k) match is financially superior to a $70,000 offer with no bonus and a 3% match.

Key Factors That Influence an Associate Underwriter Salary

While we have established a solid baseline for an Associate Underwriter's salary, your specific earnings can be significantly higher or lower based on a combination of critical factors. Understanding these levers is the key to maximizing your income throughout your career. This section provides an in-depth analysis of the variables that have the most substantial impact on your paycheck.

### ### Level of Education and Professional Certifications

Your educational background serves as the foundation of your career and plays a significant role in your starting salary and long-term growth.

Educational Degrees:

- Bachelor's Degree (Standard): A four-year degree is the standard requirement for most Associate Underwriter positions. The most sought-after majors are Finance, Business Administration, Economics, and Mathematics/Statistics. These programs equip candidates with the quantitative, analytical, and business acumen necessary for the role. A candidate with a relevant degree from a reputable university may command a starting salary at the higher end of the typical range.

- Associate's Degree: While less common, an Associate's Degree in business or a related field can be a viable entry point, particularly at smaller companies or for roles like an "Underwriting Assistant." However, you may start at a lower salary point (e.g., $45,000 - $55,000) and will likely be expected to complete your Bachelor's degree to advance to an Underwriter role.

- Master's Degree (MBA, MS in Finance): An advanced degree is generally not required for an Associate role but can be a powerful accelerator for career advancement. An MBA can fast-track an individual into leadership positions, while a specialized Master's in Finance or Risk Management can make a candidate highly attractive for complex specialty lines, potentially leading to a higher starting salary and a quicker path to a Senior Underwriter or management role.

Professional Certifications (The Salary Multiplier):

In the underwriting world, professional designations are not just resume-boosters; they are direct drivers of salary and promotion. Companies actively invest in employees who pursue them.

- Chartered Property Casualty Underwriter (CPCU): This is the gold standard designation in the P&C insurance industry. Administered by The Institutes, it is a rigorous series of eight courses and exams covering topics from insurance law and risk management to accounting. Earning a CPCU designation can lead to an average salary increase of 10-15% and is often a prerequisite for senior and management-level positions. Many companies offer cash bonuses of several thousand dollars upon completion.

- Chartered Life Underwriter (CLU): This is the premier designation for professionals in the life insurance and estate planning fields. It demonstrates deep expertise in life insurance, annuities, and wealth management. Similar to the CPCU, it signals a high level of commitment and expertise, leading to higher salaries and more advanced opportunities.

- Mortgage Underwriter Certifications (NAMU): The National Association of Mortgage Underwriters (NAMU) offers several respected certifications, such as the Certified Master Mortgage Underwriter (CMMU). These are highly valued in the banking and mortgage lending industry and can provide a distinct advantage in both hiring and salary negotiations.

- Associate in Underwriting (AU): Also offered by The Institutes, the AU designation is a great stepping-stone for new underwriters. It provides foundational knowledge and can give a salary bump early in one's career before committing to the more intensive CPCU.

### ### Years of Experience: The Career Trajectory

Experience is arguably the single most important factor in determining an underwriter's salary. The profession relies heavily on pattern recognition and judgment, which are honed over years of reviewing thousands of files.

- 0-2 Years (Associate/Trainee): At this stage, you are primarily learning. Your salary reflects your status as an investment for the company. You handle the least complex cases with heavy oversight. Salary Range: $58,000 - $75,000.

- 3-6 Years (Mid-Level Underwriter): You have mastered the fundamentals and can now work independently on a book of business. You have developed some expertise in a specific line and are trusted to make decisions on moderately complex files. This is where you see the first significant jump in salary. Salary Range: $75,000 - $100,000.

- 7-15 Years (Senior Underwriter): You are now a subject matter expert. You handle the largest, most complex, and highest-risk accounts. You mentor junior underwriters, and your decisions have a direct and significant impact on the company's profitability. Your deep expertise is highly valued and compensated accordingly. Salary Range: $100,000 - $140,000+.

- 15+ Years (Manager/Director): With extensive experience, the path leads to leadership. This involves managing teams, setting underwriting strategy for a region or an entire line of business, and collaborating with executive leadership. Compensation at this level is very high and heavily weighted towards performance bonuses. Salary Range: $130,000 - $200,000+.

### ### Geographic Location: Where You Work Matters

The cost of living and the concentration of corporate headquarters create significant salary disparities across the United States. Working in a major financial hub will almost always result in a higher salary than working in a rural area, even for the exact same role.

Highest-Paying States and Metropolitan Areas for Underwriters:

- New York, NY: As a global financial center, NYC offers some of the highest salaries, but this is offset by an extremely high cost of living.

- San Francisco/San Jose, CA: The Bay Area's tech and finance sectors drive up wages for all professional roles.

- Boston, MA: A hub for both insurance and finance, Boston offers competitive salaries.

- Chicago, IL: Home to many large insurance carriers and financial institutions, Chicago is a major center for underwriting talent.

- Hartford, CT: Known as the "Insurance Capital of the World," Hartford has a high concentration of insurance headquarters and, consequently, competitive pay for underwriters.

- Dallas, TX: A rapidly growing business and financial hub with a more moderate cost of living compared to coastal cities.

Illustrative Salary Variation by City (for a Mid-Career Underwriter):

- New York, NY: ~$105,000

- Chicago, IL: ~$95,000

- Dallas, TX: ~$90,000

- Des Moines, IA: ~$85,000

- Boise, ID: ~$80,000

*Note: These are estimates to show relative differences.*

The rise of remote work has started to blur these lines. Some companies are now hiring talent from anywhere in the country, but they may adjust salaries based on a "geographic differential" tied to the employee's location. However, securing a remote role with a company based in a high-cost-of-living area can be a strategic way to maximize real income.

### ### Company Type & Size

The type of company you work for will influence your salary, work environment, and career path.

- Large National/Global Insurance Carriers (e.g., Chubb, AIG, Travelers): These giants offer highly structured training programs, excellent benefits, and clear career paths. Salaries are competitive and often come with reliable bonus structures. The work can be more specialized and bureaucratic.

- Regional Insurance Companies: These smaller carriers may offer slightly lower base salaries but can provide a better work-life balance, a more collaborative culture, and broader experience, as you might work on more varied types of risk.

- Banks and Mortgage Lenders (e.g., JP Morgan Chase, Bank of America): Mortgage underwriting is a distinct path. Salaries are comparable to insurance, but the work environment is tied to the boom-and-bust cycles of the housing market.

- Managing General Agents (MGAs) and Wholesalers: These are specialty intermediaries that underwrite unique or hard-to-place risks on behalf of insurance carriers. Working for an MGA can be entrepreneurial and highly specialized, often leading to very high earning potential for top performers who become experts in a specific niche.

- Insurtech Startups: These tech-focused companies offer a dynamic, fast-paced environment. Base salaries might be slightly lower than at established carriers, but they are often supplemented with stock options, which can have a massive upside if the company succeeds.

### ### Area of Specialization

Not all underwriting is the same. Specializing in a complex, high-demand field is one of the most effective ways to accelerate your salary growth.

- Property & Casualty (P&C): This is a vast field. Commercial Lines (underwriting businesses) generally pays more than Personal Lines (underwriting individuals for auto/home) due to the higher complexity and premium values.

- Life & Health Insurance: This requires a deep understanding of medical terminology, mortality tables, and health risks. It's a stable and well-compensated specialization.

- Mortgage Underwriting: A specialized field focused on assessing the creditworthiness of borrowers and the value of the property. Senior mortgage underwriters who can handle complex government-backed loans (FHA/VA) or jumbo loans are always in demand.

- Specialty and Surplus Lines: This is where the highest salaries are often found. These underwriters assess unique and high-stakes risks that standard carriers won't cover. Examples include:

- Cyber Insurance: A booming field requiring an understanding of technology and cybersecurity risks.

- Professional Liability (Errors & Omissions): Insuring professionals like doctors, lawyers, and architects.

- Marine & Aviation Insurance: Highly technical and specialized.

- Environmental Liability: Assessing risks related to pollution and environmental damage.

Expertise in these niche areas is rare and highly compensated.

### ### In-Demand Skills

Beyond your title and specialization, a specific set of skills can make you a more valuable and higher-paid underwriter.

- Strong Analytical and Quantitative Skills: The ability to interpret financial statements, statistical data, and complex reports is non-negotiable. Advanced proficiency in Microsoft Excel is a minimum requirement.

- Data Savvy and Tech Proficiency: As the industry automates, underwriters who are comfortable with technology will excel. Experience with specific underwriting platforms (e.g., Duck Creek, Guidewire) is a plus. Basic knowledge of data analysis tools like SQL or data visualization tools like Tableau can set you apart and open doors to more analytical roles.

- Exceptional Attention to Detail: A single missed detail in a 100-page file can lead to a multi-million dollar loss. This is one of the most critical traits of a successful underwriter.

- Decision-Making and Judgment: Underwriting is not always black and white. You must be able to weigh various factors, use your judgment, and make a sound, defensible decision.

- Communication and Negotiation Skills: You must be able to clearly articulate your reasoning for a decision to agents, brokers, and internal stakeholders. In senior roles, you may need to negotiate terms and pricing, which requires a blend of analytical backing and interpersonal skill.

Job Outlook and Career Growth

The career outlook for underwriters is a topic of much discussion, largely due to the rise of automation and artificial intelligence. While this presents challenges, it also creates significant opportunities for those willing to adapt. The narrative is not one of disappearance, but of evolution.

The Official Data: A Nuanced Picture

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, employment of insurance underwriters is projected to decline 4 percent from 2022 to 2032. This projection can be alarming at first glance, but it requires careful interpretation.

The BLS attributes this decline primarily to the automation of routine underwriting tasks. Automated underwriting software can now instantly analyze vast amounts of data for simple, standardized applications like personal auto or homeowners insurance. The system can pull credit scores, motor vehicle records, and property data, and issue a policy decision in seconds without human intervention. This has reduced the need