Considering a career as an auto adjuster? It's a dynamic field that blends analytical investigation with hands-on problem-solving, offering a rewarding path for those who thrive on detail and negotiation. But beyond the day-to-day responsibilities, a critical question for any prospective professional is: what is the earning potential?

The good news is that a career as an auto adjuster offers a competitive salary with significant room for growth. While entry-level professionals can expect a solid starting wage, experienced and specialized adjusters can command salaries well into the upper five figures, with some even breaking the six-figure mark.

This article provides a data-driven look at auto adjuster salaries, exploring the factors that influence your pay and the long-term outlook for this essential profession.

What Does an Auto Adjuster Do?

Before diving into the numbers, it's important to understand the role. An auto adjuster—also known as an auto damage appraiser or claims adjuster—is the insurance company's primary investigator following a vehicle-related claim. Their core mission is to determine the extent of the insurer's liability by performing a range of critical tasks, including:

- Inspecting damaged vehicles to assess the scope of the damage.

- Interviewing the policyholder, claimants, and any witnesses.

- Reviewing police reports and medical documentation.

- Using specialized software to estimate repair costs.

- Negotiating fair settlements with policyholders or their legal representatives.

- Identifying potential fraud.

It’s a role that requires a unique blend of technical knowledge, strong communication skills, and an analytical mindset to ensure claims are settled accurately and efficiently.

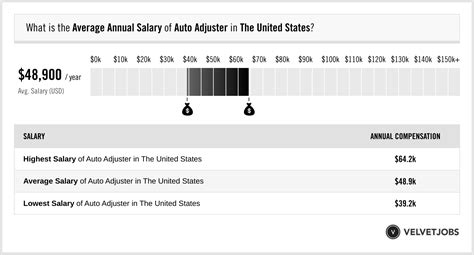

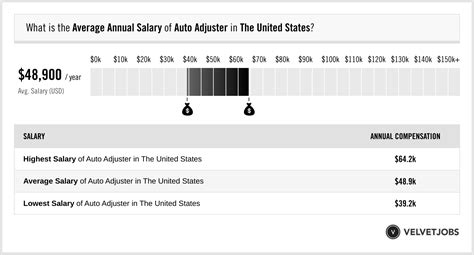

Average Auto Adjuster Salary

The salary for an auto adjuster is competitive and reflects the skilled nature of the work. While numbers vary based on several factors, we can establish a strong baseline using data from authoritative sources.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all "Claims Adjusters, Appraisers, Examiners, and Investigators" was $76,140 in May 2023. The BLS notes that the lowest 10 percent earned less than $51,180, while the top 10 percent earned more than $105,730.

Reputable salary aggregators provide a more focused look at the auto-specific role:

- Salary.com reports that the median salary for an "Auto Damage Appraiser" in the United States is approximately $72,500, with a typical range falling between $62,000 and $83,000.

- Payscale data indicates an average base salary for an Auto Claims Adjuster is around $65,000, with total pay increasing significantly with experience and potential bonuses.

- Glassdoor lists an average total pay (including base salary and additional compensation like bonuses) for a Claims Adjuster in the U.S. at around $75,000 per year.

Taking these sources together, a newly hired auto adjuster can expect to start in the $55,000 to $65,000 range, with the majority of mid-career professionals earning between $65,000 and $85,000. Senior-level and highly specialized adjusters can regularly command salaries of $90,000 or more.

Key Factors That Influence Salary

Your specific salary as an auto adjuster isn't a single number; it's a range influenced by a combination of critical factors. Understanding these variables is key to maximizing your earning potential.

### Level of Education and Certifications

While a bachelor’s degree is not always a strict requirement, it is increasingly preferred by major insurance carriers and can lead to a higher starting salary and more direct paths to management. Degrees in business, finance, or automotive technology are particularly relevant. More importantly, state licensing and professional certifications are powerful salary boosters. Many states require adjusters to pass an exam to earn a license. Furthermore, industry-recognized certifications, such as the I-CAR (Inter-Industry Conference on Auto Collision Repair) Platinum certification, demonstrate a high level of technical expertise and can make you a more valuable—and higher-paid—candidate.

### Years of Experience

Experience is one of the most significant drivers of salary growth in this field. As you gain expertise in handling more complex claims and navigating difficult negotiations, your value to an employer increases dramatically.

- Entry-Level (0-2 years): In this phase, you are learning company procedures and claim evaluation basics. Salaries typically range from $55,000 to $65,000.

- Mid-Career (3-9 years): With proven competence, you’ll be trusted with higher-value, more complex claims and have greater autonomy. Expect earnings in the $65,000 to $80,000 range.

- Senior/Experienced (10+ years): Senior adjusters often manage teams, handle major litigation files, or specialize in high-value claims. Their deep expertise allows them to earn $80,000 to $100,000+.

### Geographic Location

Where you work matters. Salaries for auto adjusters are often higher in major metropolitan areas and states with a higher cost of living, such as California, New York, and Massachusetts. Furthermore, regions prone to heavy traffic or severe weather events (like hurricanes in Florida or hail in Texas) may have a higher demand for adjusters, which can also drive up wages. Conversely, salaries in rural areas or states with a lower cost of living may fall below the national average.

### Company Type

The type of company you work for directly impacts your compensation structure.

- Large National Insurers (e.g., Progressive, GEICO, State Farm): These companies typically offer competitive, structured salary bands, excellent benefits, and clear career progression paths. They are a common and stable employer for many adjusters.

- Third-Party Administrators (TPAs): TPAs manage claims on behalf of other companies. Salaries here are competitive but can be more variable than at large direct insurers.

- Independent Adjusting Firms: Independent adjusters are self-employed or work for firms that contract their services to multiple insurance carriers. This path offers the highest earning potential, as independents are often paid a percentage of the claim value. During high-demand periods, such as after a natural disaster, their income can be substantial, though it comes with less stability and the need for strong business skills.

### Area of Specialization

Specializing in a high-demand niche is a surefire way to increase your salary.

- Standard Auto Claims: This is the most common path and forms the baseline for salary expectations.

- Catastrophe (CAT) Adjusting: CAT adjusters are deployed to disaster zones. Due to the long hours, challenging conditions, and high volume of claims, they can earn significant income in short periods, often exceeding typical annual salaries.

- Specialty and Heavy Equipment: Adjusters who can accurately assess damage to commercial trucks, RVs, marine craft, or classic cars possess rare skills and are compensated accordingly.

- Litigation and Complex Claims: These adjusters handle claims that are heading to court or involve serious bodily injury. This specialization requires deep policy knowledge and negotiation prowess, placing these professionals among the top earners in the field.

Job Outlook

The career outlook for claims adjusters is undergoing a transformation. The BLS projects a 6% decline in employment for adjusters from 2022 to 2032. This is largely attributed to the increasing use of technology, such as AI-powered photo-estimating software and automated claims processing systems, which can handle simple, low-value claims more efficiently.

However, this statistic doesn't signal the end of the profession. The BLS still projects approximately 23,500 openings for claims adjusters each year, on average, over the decade. These openings will arise from the need to replace workers who retire or transfer to other occupations.

The key takeaway is that the role of the auto adjuster is evolving, not disappearing. The demand will remain strong for skilled professionals who can manage complex, high-stakes claims that require human judgment, empathy, and negotiation—tasks that technology cannot yet replicate.

Conclusion

A career as an auto adjuster offers a path to a stable and financially rewarding future. With a median salary in the $70,000s and a clear trajectory for growth, it provides a comfortable living for dedicated professionals.

Your earning potential is directly in your control, heavily influenced by your commitment to continuous learning, your years of experience, and your willingness to specialize. For individuals with strong analytical skills, a calm demeanor under pressure, and a genuine desire to help people navigate difficult situations, becoming an auto adjuster is an excellent career choice with a promising financial horizon.