The role of a Chief Operating Officer (COO) represents the pinnacle of operational leadership—a position of immense responsibility, strategic importance, and significant financial reward. For ambitious professionals aiming for the C-suite, understanding the compensation landscape for a COO is a critical step. While salaries can vary dramatically, they consistently rank among the highest in the corporate world, with total compensation often reaching well into the high six-figures and, in many cases, surpassing the million-dollar mark.

This guide will break down the average COO salary, explore the key factors that dictate earning potential, and provide a clear outlook for this prestigious career path.

What Does a Chief Operating Officer Do?

Often described as the "second-in-command" to the Chief Executive Officer (CEO), the COO is the executive responsible for managing the company's day-to-day operations. While the CEO sets the long-term vision and strategy, the COO is the master integrator who translates that vision into an efficient, executable, and profitable reality.

Key responsibilities typically include:

- Overseeing daily business operations across multiple departments (e.g., production, marketing, HR, and sales).

- Implementing business strategies and plans set by the executive team.

- Managing budgets, resource allocation, and company performance metrics (KPIs).

- Leading and mentoring department heads to foster a culture of excellence and accountability.

- Driving operational efficiency and process improvement initiatives to scale the business.

Essentially, the COO ensures that the intricate machinery of the business runs smoothly, allowing the CEO to focus on external stakeholders, long-term vision, and market positioning.

Average COO Salary

Pinpointing a single "average" salary for a COO can be misleading because compensation is heavily influenced by factors like company size, industry, and bonuses. It's more accurate to look at a range of data points, including base salary, bonuses, and total compensation.

- Total Compensation (The Big Picture): The most comprehensive view includes base salary, bonuses, and equity. According to Salary.com, the median total compensation for a Chief Operating Officer in the United States is $485,381 as of early 2024. The typical range for total compensation is vast, generally falling between $366,423 and $637,422, with the top 10% of COOs earning well over $800,000.

- Average Base Salary: Looking at base pay alone, the numbers are still substantial. Payscale reports an average base salary for a COO at approximately $153,000 per year. However, this figure is an aggregate that includes COOs at smaller businesses and non-profits. Glassdoor reports a higher average base pay of around $178,000, with average total pay (including bonuses and stock) reaching approximately $281,000.

- Broader Context from the BLS: The U.S. Bureau of Labor Statistics (BLS) groups COOs under the category of "Top Executives." As of May 2023, the median annual wage for this category was $194,920. It is crucial to note that this BLS figure includes a wide array of executive roles across companies of all sizes, which explains why it is lower than figures reported for COOs at larger, publicly-traded companies.

The key takeaway is that COO compensation is not just a salary; it's a package. Bonuses, profit sharing, and stock options often constitute a significant portion—sometimes more than 50%—of a COO's total annual earnings.

Key Factors That Influence COO Salary

Your earning potential as a COO is not a fixed number. It’s a dynamic figure shaped by a combination of your qualifications, your experience, and the environment in which you work.

### Level of Education

A strong educational background is a prerequisite for a C-suite position. A bachelor's degree in business administration, finance, or a field relevant to the company's industry is the minimum requirement. However, a Master of Business Administration (MBA) is the gold standard and is often expected for top-tier roles. An MBA from a prestigious university can significantly increase earning potential and open doors to positions at larger, higher-paying corporations.

### Years of Experience

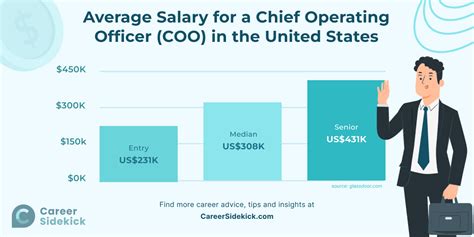

Experience is arguably the single most important factor. A COO is not an entry-level position; it's a role earned after decades of proven leadership and operational success.

- Early-Stage COO (e.g., at a startup or small company): A professional with 10-15 years of experience stepping into their first COO role might see a base salary in the $150,000 to $220,000 range, often supplemented with significant equity.

- Mid-Career COO (Mid-sized company): With 15-20+ years of experience and a track record of success, a COO can command a base salary from $220,000 to $350,000, plus substantial annual bonuses.

- Senior COO (Large, public corporation): An experienced COO at a Fortune 500 company can expect a base salary of $400,000+, with total compensation packages that regularly exceed $1,000,000 when bonuses and stock grants are included.

### Geographic Location

Where a company is headquartered has a direct impact on salary, primarily due to cost of living and the concentration of corporate headquarters. Major metropolitan hubs offer the highest compensation. Cities like New York, the San Francisco Bay Area, Boston, and Chicago lead the nation in executive pay. A COO role in a major city can command a salary 15-30% higher than the national average, while a similar role in a smaller, rural market will likely pay less.

### Company Type

The size, stage, and structure of a company are massive determinants of COO pay.

- Startups: Offer lower base salaries but provide significant equity (stock options). The risk is high, but if the company succeeds, the financial payout can be astronomical.

- Small to Medium-Sized Businesses (SMBs): Provide stable, competitive salaries and bonuses, but total compensation is unlikely to reach the levels seen at large public companies.

- Large Public Corporations: These are the top payers, offering high base salaries, large cash bonuses tied to performance, and lucrative long-term incentives like restricted stock units (RSUs).

- Non-Profit Organizations: A non-profit COO will have a salary that is considerably lower than their for-profit counterparts. The compensation is respectable for the sector but is driven by the organization's mission and budget, not by profit generation.

### Area of Specialization

The industry in which you operate plays a significant role. Industries with high revenue, complex operations, and significant growth potential tend to pay their executives more. Top-paying sectors for COOs include:

- Technology (SaaS, FinTech, Biotech)

- Finance and Banking

- Healthcare

- Manufacturing and Energy

A COO with specialized expertise in a high-demand field like supply chain management for a global retailer or clinical operations for a biotech firm can command a premium salary.

Job Outlook

The demand for skilled and effective operational leaders is timeless. According to the U.S. Bureau of Labor Statistics (BLS), employment for "Top Executives" is projected to grow 3 percent from 2022 to 2032, which is about as fast as the average for all occupations.

This steady growth reflects the ongoing need for strategic leadership to navigate complex markets, drive efficiency, and ensure business resilience. As new companies are formed and existing ones expand, the need for a capable second-in-command to manage internal operations will remain constant, ensuring a stable and promising career outlook for qualified individuals.

Conclusion

The path to becoming a Chief Operating Officer is a marathon, not a sprint. It requires a powerful blend of education, deep industry experience, and a proven talent for leadership. While the role is demanding, the rewards are exceptional.

For aspiring professionals, the key takeaways are:

1. Look Beyond Base Salary: Total compensation—including bonuses and equity—is the true measure of a COO's earnings.

2. Experience is Paramount: Build a career marked by progressive leadership roles and measurable operational achievements.

3. An MBA is a Powerful Differentiator: Higher education, particularly from a top business school, can significantly accelerate your career and earning potential.

4. Be Strategic About Industry and Location: Targeting high-growth industries in major economic centers will lead to the most lucrative opportunities.

For those with the ambition, strategic mindset, and operational expertise, the journey to becoming a COO offers an unparalleled opportunity to shape an organization's future and achieve significant financial success.