Being a property manager is about more than just collecting rent and fixing leaky faucets. You are the steward of a multi-million dollar asset, the architect of a community, and the crucial link between owners and residents. It’s a career that demands a unique blend of financial acumen, people skills, and operational savvy. If you're drawn to the dynamic world of real estate and are looking for a role with tangible impact and significant growth potential, this path might be for you. But beyond the responsibilities, what is the financial reality? The average property manager salary is a compelling figure, often starting strong and growing substantially with experience and specialization.

I once knew a property manager named Sarah who took over a neglected 150-unit apartment building. It was known for slow maintenance response and a general lack of community. Within two years, through meticulous financial management, proactive communication, and a focus on resident events, she had transformed it into one of the most sought-after properties in the neighborhood, increasing its value by over 20%. Her story isn't just about improving a building; it’s a testament to the immense value a skilled property manager brings, and her compensation grew to reflect that incredible impact.

This comprehensive guide will serve as your roadmap to understanding the financial landscape of a property management career. We will dissect the average property manager salary, explore every factor that influences your earning potential, and provide a step-by-step plan to launch and advance your career.

### Table of Contents

- [What Does a Property Manager Do?](#what-does-a-property-manager-do)

- [Average Property Manager Salary: A Deep Dive](#average-property-manager-salary-a-deep-dive)

- [Key Factors That Influence a Property Manager's Salary](#key-factors-that-influence-a-property-managers-salary)

- [Job Outlook and Career Growth for Property Managers](#job-outlook-and-career-growth-for-property-managers)

- [How to Become a Property Manager: A Step-by-Step Guide](#how-to-become-a-property-manager-a-step-by-step-guide)

- [Conclusion: Is a Property Management Career Right for You?](#conclusion-is-a-property-management-career-right-for-you)

What Does a Property Manager Do?

At its core, a property manager is responsible for the operational and financial oversight of a real estate asset on behalf of the owner. Their primary goal is to maximize the property's value and revenue while ensuring it remains a safe, functional, and desirable place for tenants. This is a multifaceted role that requires wearing many hats, often on the same day.

The responsibilities can be broken down into four key pillars:

1. Financial Management: This is the bedrock of the role. Property managers are responsible for setting competitive rent prices, collecting rent payments, and aggressively pursuing delinquencies. They create and manage the annual operating budget, meticulously track all income and expenses, and prepare regular financial reports for the property owner or investment group. This includes everything from paying utility bills and vendor invoices to analyzing financial statements to identify opportunities for cost savings and revenue enhancement.

2. Tenant and Occupancy Management: The property manager is the face of the property for current and prospective tenants. This involves marketing vacant units, screening applicants, and handling all aspects of the leasing process, from drafting agreements to conducting move-in inspections. Once a tenant is in place, the manager is the primary point of contact for all questions, concerns, maintenance requests, and conflict resolution. A key metric for success is maintaining high occupancy rates and fostering positive tenant relations to encourage lease renewals.

3. Facility and Maintenance Operations: Keeping the property in pristine condition is paramount. The manager oversees all maintenance and repair work, from routine preventative tasks like HVAC servicing to emergency responses like a burst pipe. This involves coordinating with a team of on-site maintenance staff or sourcing and managing third-party vendors and contractors. They conduct regular property inspections to ensure safety, cleanliness, and compliance with all local, state, and federal housing codes.

4. Administration and Legal Compliance: There is a significant administrative and legal component to property management. This includes maintaining meticulous records of leases, inspections, and correspondence. Crucially, property managers must have a deep understanding of and ensure strict adherence to all relevant laws, including landlord-tenant laws, Fair Housing regulations, and eviction procedures. A misstep in this area can lead to significant legal and financial repercussions for the property owner.

### A Day in the Life of a Multifamily Property Manager

To make this more tangible, let's walk through a typical day:

- 8:30 AM: Arrive at the office. Start the day by reviewing the property's financial dashboard—checking daily occupancy, move-ins/outs, and any new maintenance requests that came in overnight. Respond to urgent emails from the regional manager and a resident with a noise complaint.

- 9:30 AM: Lead a morning huddle with the leasing consultant and maintenance supervisor. Discuss the "make-ready" status of vacant apartments, review the day's scheduled tours, and prioritize maintenance tickets.

- 10:30 AM: Conduct a property walk. Inspect the common areas, pool, and fitness center for cleanliness and safety issues. Note a broken sprinkler head and create a work order. Greet several residents along the way.

- 11:30 AM: Meet with a flooring contractor to get a quote for replacing the carpet in an upcoming vacant unit. Negotiate pricing and schedule the work.

- 12:30 PM: Lunch break while reviewing applicant files. Run background and credit checks and verify income for three prospective tenants.

- 1:30 PM: A resident comes to the office to report a leak under their sink. Immediately dispatch the maintenance supervisor to assess the situation.

- 2:00 PM: Show a two-bedroom apartment to a prospective tenant. Highlight the community amenities and answer questions about the lease terms and local schools.

- 3:00 PM: Focus on administrative tasks. Approve vendor invoices for payment, review the monthly delinquency report, and begin drafting the weekly owner's report.

- 4:30 PM: Follow up on the noise complaint from the morning by calling both residents involved to mediate a resolution. Document the conversation in the property management software.

- 5:30 PM: One last check of emails and work orders before heading home, already thinking about tomorrow's budget review meeting.

This example illustrates the dynamic, problem-solving nature of the job. It's a constant juggling act that requires exceptional organization, communication, and composure under pressure.

Average Property Manager Salary: A Deep Dive

Now for the central question: What can you expect to earn as a property manager? The compensation structure is often more complex than a simple annual salary, but we can establish a strong baseline by looking at data from authoritative sources.

It's important to note that salary data can vary slightly between sources due to different methodologies (e.g., employer-reported data vs. user-submitted data). By synthesizing information from several reputable platforms, we can create a highly accurate picture.

National Averages and Ranges

According to the most recent data from the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Property, Real Estate, and Community Association Managers was $60,650 in May 2023. The BLS provides a broad range, stating that the lowest 10 percent earned less than $31,560, and the highest 10 percent earned more than $132,770. This wide range highlights the significant impact of the influencing factors we will discuss later.

Let's look at what leading salary aggregators report, which often reflects more recent, user-reported data:

- Salary.com (as of late 2023): Reports the median salary for a Property Manager in the United States to be $107,034. Their typical range falls between $92,933 and $122,868. This higher figure often includes managers of larger or more complex commercial properties.

- Payscale.com (as of late 2023): Shows an average base salary of $59,077 per year. They also note that bonuses can reach up to $10,000 and profit sharing can add another $11,000, bringing the total pay potential significantly higher.

- Glassdoor.com (as of late 2023): Indicates a total pay average of $79,849 per year in the United States, with a "likely range" of $60,000 to $106,000. This figure includes an estimated base pay of $63,678 and additional pay (bonuses, commission) of around $16,171.

Why the difference? The BLS data is comprehensive but may lump various types of managers together. Salary.com often skews towards more experienced roles in corporate settings, while Payscale and Glassdoor provide a blend based on user submissions. The most realistic takeaway is that a typical property manager can expect a base salary in the $60,000 to $80,000 range, with significant upward potential based on performance and other factors.

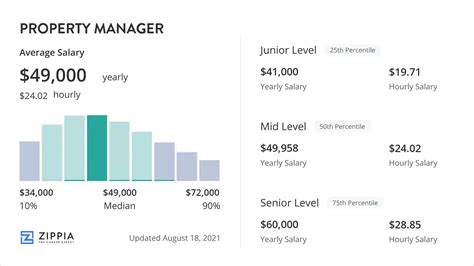

### Salary by Experience Level

Your earnings as a property manager will grow substantially as you gain experience, take on more responsibility, and prove your ability to enhance asset value. Here’s a breakdown of what you can expect at different stages of your career.

| Career Stage | Years of Experience | Typical Base Salary Range | Key Responsibilities & Focus |

| :--- | :--- | :--- | :--- |

| Entry-Level Property Manager | 0-2 years | $45,000 - $65,000 | Assisting senior managers, handling tenant communication, coordinating maintenance, processing applications. Focus on learning operational basics and company procedures. |

| Mid-Career Property Manager | 3-8 years | $65,000 - $90,000 | Managing a property or small portfolio independently, creating and managing budgets, supervising staff, negotiating vendor contracts. Focus on operational efficiency and financial performance. |

| Senior Property Manager | 9-15 years | $90,000 - $120,000+ | Overseeing a large, complex property or a regional portfolio of properties, developing strategic plans, mentoring junior managers, significant financial reporting and owner relations. |

| Regional/Director Level | 15+ years | $120,000 - $200,000+ | Setting strategy for a large geographic region, managing a team of Senior Property Managers, high-level financial oversight (P&L), new business development, managing investor relations. |

*(Salary data is an aggregation from Payscale, Glassdoor, and industry reports.)*

### A Closer Look at Total Compensation

Base salary is only one piece of the puzzle. Total compensation is a much better indicator of your overall earning potential. Here are the other components you'll frequently encounter:

- Performance Bonuses: This is the most common form of additional compensation. Bonuses are typically paid annually or quarterly and are tied to specific Key Performance Indicators (KPIs). These can include:

- Net Operating Income (NOI): Exceeding the budgeted NOI is often the single biggest driver of a manager's bonus.

- Occupancy Rate: Maintaining occupancy above a certain threshold (e.g., 95%).

- Lease Renewals: Achieving a high percentage of tenant renewals.

- Budget Adherence: Coming in under budget on controllable expenses.

A strong performance can result in a bonus equivalent to 10-25% of your base salary.

- Leasing Commissions: While more common for on-site leasing agents, some property managers, especially at smaller properties, earn a commission for each new lease they sign personally. This can range from $100 to $500 per lease.

- Profit Sharing: Some management companies, particularly smaller, privately-owned firms, offer profit-sharing plans. This allows managers to receive a percentage of the property's or company's overall profits.

- On-Site Housing Benefits: A significant and often overlooked perk, particularly in residential property management, is a free or heavily discounted apartment. In a high-cost-of-living city, a "free" apartment worth $2,500 per month is equivalent to an additional $30,000 in pre-tax annual income. This benefit can dramatically increase your effective compensation.

- Standard Benefits: Like any professional role, this includes health insurance, dental and vision coverage, 401(k) retirement plans (often with a company match), and paid time off.

When evaluating a job offer, it's crucial to look at the entire compensation package. A role with a slightly lower base salary but a generous bonus structure and free housing could be far more lucrative than a role with a higher base salary alone.

Key Factors That Influence a Property Manager's Salary

Your salary isn't a fixed number; it's a dynamic figure influenced by a powerful combination of your qualifications, your location, and the nature of the property you manage. Mastering these factors is the key to maximizing your earning potential throughout your career. This section will provide an exhaustive breakdown of what truly moves the needle on your paycheck.

###

Level of Education & Professional Certifications

While you can enter the field without a four-year degree, your educational background and professional credentials have a direct and measurable impact on your salary ceiling and career trajectory.

- High School Diploma / Associate's Degree: It is possible to become a property manager with a high school diploma, typically by working your way up from a leasing agent or assistant manager position. However, your starting salary may be at the lower end of the spectrum, and advancement to senior roles can be more challenging without further education or significant experience.

- Bachelor's Degree: A bachelor's degree is the preferred qualification for most mid-to-large-sized management companies and is often a prerequisite for corporate or regional management roles. Degrees in Business Administration, Finance, Real Estate, or Accounting are highly relevant and can command a higher starting salary. A graduate with a relevant degree is seen as having a stronger foundational understanding of the financial and strategic aspects of the job, justifying a salary premium of 10-15% over a non-degreed candidate for the same role.

- Professional Certifications: This is arguably the most powerful lever you can pull to increase your salary and demonstrate your expertise. Industry certifications are a signal to employers that you have achieved a high level of professional competence. The most prestigious certifications are offered by the Institute of Real Estate Management (IREM) and the National Association of Residential Property Managers (NARPM).

- Certified Property Manager (CPM®): Offered by IREM, the CPM is the premier certification in the industry, often considered the "MBA of property management." It requires a rigorous curriculum covering financial analysis, asset management, and ethics, as well as a comprehensive experience portfolio and a final exam. IREM's own data shows that CPMs earn, on average, more than double the salary of their non-certified peers. This certification is a virtual requirement for high-level executive and portfolio management roles.

- Accredited Residential Manager (ARM®): Also from IREM, the ARM is a highly respected certification specifically for managers of residential properties. It's an excellent stepping stone to the CPM and demonstrates a high level of proficiency in residential management. Earning an ARM can lead to a significant salary bump and positions you for more complex site-level management roles.

- Master Property Manager (MPM®): Offered by NARPM, this is the top-tier designation for residential property management specialists. Achieving MPM status signifies a high level of experience and leadership within the residential sector.

- State-Required Licenses: Many states require property managers to hold a real estate broker's license or a specific property management license. While this is a baseline requirement in those states, obtaining it demonstrates a commitment to legal and ethical standards and is a non-negotiable for employment.

###

Years of Experience

As shown in the table above, experience is a primary driver of salary growth. However, it's not just about the number of years; it's about the *quality* and *progression* of that experience.

- 0-2 Years (The Foundation): In this phase, you are learning the ropes. Your value is in your ability to execute tasks efficiently and provide excellent customer service. Salary growth comes from mastering the fundamentals and becoming a reliable team member.

- 3-8 Years (The Manager): You are now expected to operate with more autonomy. Your value shifts from task execution to proactive management. You are responsible for a property's budget, staff, and overall performance. Salary increases are tied to your ability to hit financial targets (NOI, occupancy) and effectively lead a team. A manager who can successfully turn around a struggling property or consistently outperform their budget can command a salary at the top end of the mid-career range.

- 9+ Years (The Strategist): At the senior and regional levels, your focus transcends day-to-day operations. Your value lies in your strategic thinking. You analyze portfolios, identify opportunities for acquisition or repositioning, develop long-term capital improvement plans, and mentor the next generation of managers. Your compensation is heavily tied to the overall financial performance of your portfolio and your contribution to the company's growth. Bonuses and long-term incentives become a much larger portion of your total pay.

###

Geographic Location

Where you work is one of the most significant factors determining your salary. A property manager's pay is closely tied to the local cost of living and the prevailing real estate market values. A manager overseeing a $50 million building in a major metro area will naturally earn more than one managing a $5 million property in a rural town.

Here’s a comparative look at how average property manager salaries can vary across different U.S. metropolitan areas, based on data from Salary.com and Glassdoor:

| City | Cost of Living Index | Average Salary Range (Mid-Career) | Notes |

| :--- | :--- | :--- | :--- |

| San Jose, CA | High | $95,000 - $135,000+ | Tech-driven economy, extremely high housing costs, and high property values drive top-tier salaries. |

| New York, NY | High | $90,000 - $130,000+ | High demand for skilled managers for luxury residential and complex commercial properties. |

| Boston, MA | High | $85,000 - $125,000 | A competitive market with a mix of historic buildings and new developments requiring specialized skills. |

| Denver, CO | Medium-High | $70,000 - $100,000 | A fast-growing market with strong demand for multifamily housing managers. |

| Chicago, IL | Medium | $68,000 - $98,000 | A large, stable market with diverse property types, offering solid earning potential. |

| Atlanta, GA | Medium | $65,000 - $95,000 | A booming Sun Belt city with a rapidly expanding rental market. |

| Houston, TX | Medium-Low | $62,000 - $92,000 | Lower cost of living but a massive real estate market provides ample opportunity. |

| Cleveland, OH | Low | $55,000 - $80,000 | Salaries are lower, reflecting the lower cost of living and property values. |

Generally, you will find the highest salaries in major metropolitan areas on the West and East Coasts, followed by major cities in states like Colorado, Texas, and Georgia. The Midwest and parts of the South tend to have salaries closer to or slightly below the national median.

###

Company Type & Size

The type of company you work for profoundly affects your compensation structure, benefits, and career path.

- Large National Management Firms (e.g., Greystar, Cushman & Wakefield, Lincoln Property Company): These corporations manage vast portfolios across the country. They typically offer more structured salary bands, excellent benefits packages, and clear paths for advancement. You'll likely find higher base salaries and well-defined bonus programs tied to corporate KPIs. The trade-off can be a more corporate, less entrepreneurial environment.

- Real Estate Investment Trusts (REITs) (e.g., AvalonBay, Equity Residential): These are publicly traded companies that own and often manage their own properties. They are known for being very data-driven and focused on shareholder value. Compensation is often very competitive, with strong bonus potential and sometimes stock options or grants, directly linking your performance to the company's stock price.

- Small to Mid-Sized Local/Regional Firms: These companies offer a more intimate, hands-on environment. Base salaries might be slightly less predictable than at large corporations, but they can offer greater flexibility and more direct profit-sharing opportunities. A successful manager who contributes directly to the firm's growth may see a more immediate and substantial financial reward.

- Working Directly for a Private Owner/Investor: Managing a small portfolio for a single high-net-worth individual or a small family office can be a unique experience. The role may be less structured, but compensation can be highly negotiable and may include a direct percentage of the profits or an equity stake in the properties over time.

###

Area of Specialization

Not all property management is the same. The type of property you manage is a critical determinant of your salary, with more complex and higher-value assets commanding higher pay.

- Commercial Property Management: This is generally the most lucrative specialization. Commercial managers oversee office buildings, retail centers, and industrial properties. Leases are longer and more complex (e.g., triple net leases), tenants are businesses, and the financial analysis is more sophisticated. Commercial property managers often need a strong background in finance and contract law and are compensated accordingly. Senior commercial managers overseeing Class A office towers can earn well into the six figures.

- Residential Property Management (Multifamily): This is the largest sector and the most common entry point into the career. It involves managing apartment communities of all sizes. While the base salary may be slightly lower than in commercial, the total compensation can be very attractive due to significant bonus potential based on occupancy and NOI, as well as the valuable perk of on-site housing.

- Community Association Management (HOA/Condo): These managers work for homeowner or condominium associations. The role is less about managing the physical asset and more about enforcing bylaws, managing budgets for common areas, and mediating between residents. It requires strong diplomatic and administrative skills. Salaries are generally comparable to the lower-to-mid range of residential management.

- Specialized Properties: Managing niche properties like student housing, senior living facilities, or self-storage facilities requires specialized knowledge and can offer competitive salaries. For example, a manager of a large, upscale senior living community with healthcare components will have responsibilities that warrant a higher salary.

###

In-Demand Skills

Beyond your background, the specific skills you cultivate can make you a more valuable—and thus, higher-paid—candidate.

- Financial Acumen: This is non-negotiable. The ability to create a budget from scratch, perform variance analysis, read and interpret a P&L statement, and understand concepts like CapEx and ROI is what separates a good manager from a great one.

- Proficiency with Property Management Software: Expertise in industry-standard software like Yardi, AppFolio, or RealPage is a hard requirement for most jobs. The ability to leverage these tools for reporting, analytics, and efficiency is highly valued.

- Sales and Marketing Skills: A property is a product, and a manager must know how to sell it. Understanding digital marketing, social media outreach, and effective leasing techniques to minimize vacancy is a direct contributor to revenue.

- Leadership and Team Management: As you advance, your ability to hire, train, and motivate a team of leasing agents, maintenance staff, and administrative assistants becomes critical.

- Negotiation and Conflict Resolution: Whether you are negotiating a multi-year contract with a landscaping vendor or mediating a dispute between two tenants, strong negotiation and de-escalation skills save money and preserve relationships.

- Knowledge of Building Systems: While you don't need to be an HVAC technician, a solid understanding of major building systems (HVAC, plumbing, electrical) allows you to more effectively manage maintenance staff and evaluate vendor proposals.

- Legal and Regulatory Knowledge: A deep understanding of the Fair Housing Act, the Americans with Disabilities Act (ADA), and local landlord-tenant laws is essential for mitigating risk. This knowledge is priceless to an owner.

By strategically developing these skills, you transition from being a simple administrator to a true asset manager, a professional who doesn't just maintain a property but actively enhances its value. That is the key to unlocking the highest levels of compensation in this field.

Job Outlook and Career Growth for Property Managers

When choosing a career, long-term stability and opportunities for advancement are just as important as the starting salary. For property managers, the future looks both stable and promising, driven by fundamental economic and social trends.

### Strong and Steady Job Growth

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, employment for Property, Real Estate, and Community Association Managers is projected to grow 3 percent from 2022 to 2032. While this is about as fast as the average for all occupations, it translates to a significant number of job openings. The BLS projects about 39,100 openings for these managers each year, on average, over the decade.

Most of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire. This creates a consistent and reliable demand for