The role of a bank teller is a cornerstone of the financial services industry. Often serving as the first point of human contact for customers, tellers are the face of the bank or credit union they represent. For many, it's a valuable entry point into a rewarding career in finance. But what is the earning potential for this critical role?

While the teller position is typically an entry-level job, compensation can vary significantly. Nationally, the average salary for a teller hovers around $37,000 to $40,000 per year. However, entry-level positions may start closer to $30,000, while experienced senior tellers in high-demand areas can earn upwards of $48,000 or more.

This article will provide a data-driven look at what a teller earns and, more importantly, the key factors that can help you maximize your income in this profession.

What Does a Teller Do?

Before diving into the numbers, it's essential to understand the responsibilities of a teller. The role has evolved beyond simple cash handling. Today, a successful teller is a blend of a customer service specialist, a problem-solver, and a sales professional.

Key responsibilities include:

- Processing Transactions: Accurately handling deposits, withdrawals, loan payments, and money transfers.

- Customer Service: Answering account-related questions, resolving issues, and providing a positive and professional banking experience.

- Cash Management: Managing and balancing a cash drawer, adhering to strict security protocols.

- Identifying Customer Needs: Recognizing opportunities to introduce customers to other bank products and services, such as loans, credit cards, or new account types, and referring them to personal bankers or specialists.

- Compliance: Following all bank policies and federal regulations to ensure the security and legality of all transactions.

Average Teller Salary

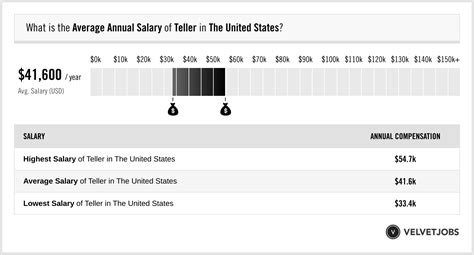

Salary data from multiple authoritative sources gives us a clear picture of a teller's earning potential. It's important to look at the median (the midpoint) as well as the overall range to understand how salaries can progress.

- The U.S. Bureau of Labor Statistics (BLS) reports that the median annual wage for tellers was $37,880 in May 2023. The BLS also provides a salary spectrum: the lowest 10% of tellers earned less than $30,220, while the top 10% earned more than $48,430.

- Salary.com reports a slightly higher median salary for a "Bank Teller I" at $38,474 as of May 2024. Their typical range falls between $34,220 and $43,450.

- Glassdoor lists a national average base pay of $39,890 per year, based on user-submitted salary data.

These figures represent a national baseline. Your actual earnings will be shaped by a combination of the factors below.

Key Factors That Influence Salary

Not all teller jobs are compensated equally. To understand your potential earnings, you must consider several key variables.

### Level of Education

For a standard teller position, a high school diploma or equivalent is typically the only educational requirement. However, further education can significantly impact your career trajectory and long-term earnings. An associate's or bachelor's degree in fields like finance, business, or accounting may not dramatically increase your starting salary as a teller, but it makes you a prime candidate for promotions to higher-paying roles like Lead Teller, Personal Banker, Assistant Branch Manager, or Loan Officer.

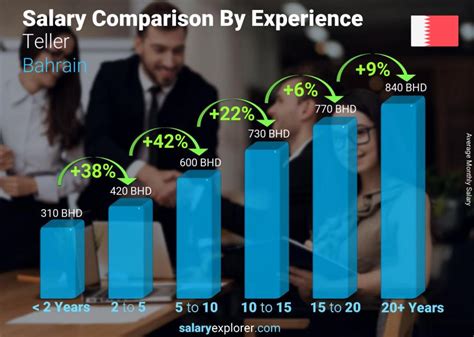

### Years of Experience

Experience is one of the most direct influencers of a teller's salary. As you gain expertise in handling complex transactions, building customer relationships, and understanding bank products, your value to the institution increases.

- Entry-Level Teller (0-2 years): Often starts at the lower end of the salary spectrum, typically between $30,000 and $35,000.

- Experienced Teller (3-5+ years): With a proven track record, a teller can expect to earn closer to the national median, in the $36,000 to $42,000 range.

- Senior/Head Teller: This supervisory role involves mentoring junior tellers, managing vault operations, and handling complex customer issues. According to Payscale, a Head Teller can earn an average of 10-20% more than a standard teller, often pushing their salary into the $45,000+ range.

### Geographic Location

Where you work matters immensely. Salaries are often adjusted to reflect the local cost of living and the demand for financial professionals in that market. Metropolitan areas with a high cost of living tend to offer higher wages.

According to BLS data, some of the top-paying states for tellers include:

1. District of Columbia: $47,650 (Mean Wage)

2. Washington: $45,860

3. Massachusetts: $45,010

4. California: $44,790

5. Connecticut: $44,400

Conversely, states with a lower cost of living may offer salaries below the national average.

### Company Type

The type of financial institution you work for can also affect your compensation package.

- Large National Banks (e.g., JPMorgan Chase, Bank of America): These institutions often have highly structured pay scales and may offer slightly higher base salaries to remain competitive in major markets. They also typically provide clear paths for internal advancement.

- Regional and Community Banks: While their base salaries might be in line with the national average, they can offer strong community ties and a different work culture.

- Credit Unions: As not-for-profit, member-owned organizations, credit unions are known for excellent benefits packages and a strong focus on member service. Their salaries are competitive, and they often foster a collaborative environment that can lead to career growth.

### Area of Specialization

The modern teller role is diversifying. Some tellers take on specialized responsibilities that come with higher pay. This could include becoming a "universal banker," a hybrid role that blends traditional teller duties with personal banking tasks like opening new accounts or discussing loan products. Tellers who consistently excel at cross-selling financial products may also earn commissions or bonuses on top of their base salary, significantly boosting their total compensation.

Job Outlook

It's important to address the future of the profession. The U.S. Bureau of Labor Statistics projects a 12% decline in employment for tellers from 2022 to 2032. This decline is largely attributed to the rise of online and mobile banking, which has automated many routine transactions.

However, this statistic does not tell the whole story. While the number of traditional transaction-focused tellers may decrease, the need for skilled, customer-centric professionals in bank branches remains. The role is evolving from a transaction processor into a relationship builder and financial guide. Tellers who develop strong interpersonal, problem-solving, and sales skills will remain in high demand and are well-positioned for advancement into roles that technology cannot replace.

Conclusion

The role of a teller is a fantastic launching pad for a career in finance, offering stable employment and a clear path for growth. While the national average salary provides a solid benchmark, your individual earning potential is in your hands.

Key Takeaways:

- Average Salary: Expect a national average salary in the range of $37,000 to $40,000, with the potential to earn more.

- Experience Pays: Gaining experience and moving into a Senior or Head Teller role is the most direct way to increase your salary.

- Location is Crucial: Working in a major metropolitan area or a high-paying state can significantly boost your income.

- The Future is About Skills: While automation is changing the job, tellers who focus on customer relationships, problem-solving, and sales will not only secure their position but also open doors to higher-paying opportunities within the bank.

For anyone considering this career, the teller position offers invaluable experience and a firsthand look at the workings of the financial world—a solid foundation on which to build a prosperous future.