A bachelor's degree in accounting is more than just an academic achievement; it's a gateway to a stable, respected, and financially rewarding career. If you're considering this educational path, one of your primary questions is likely about salary potential. The good news is that the demand for skilled accountants remains consistently strong, translating into competitive compensation.

So, what can you expect to earn? While entry-level salaries are attractive, the long-term potential is even more impressive. The U.S. Bureau of Labor Statistics (BLS) reports a median annual salary of $78,000 for accountants and auditors as of May 2022. With experience, specialization, and strategic career moves, top earners in the field can command salaries well over $132,000.

This guide will break down the salary you can expect with a bachelor's in accounting, the key factors that influence your earnings, and the bright future of this essential profession.

What Do Professionals with a Bachelor's in Accounting Do?

Before diving into the numbers, it's important to understand the role. Professionals with a bachelor's in accounting are the financial guardians of an organization. They are responsible for tracking, analyzing, and reporting on the financial health of a business, government agency, or non-profit. They ensure that financial records are accurate, taxes are paid properly, and financial operations run smoothly and ethically.

Key responsibilities often include:

- Preparing and analyzing financial statements (income statements, balance sheets).

- Managing ledgers and reconciling bank accounts.

- Ensuring compliance with tax laws and regulations.

- Auditing financial records to check for accuracy and fraud.

- Advising management on financial decisions, budgeting, and cost-saving measures.

- Utilizing accounting software and technology to streamline financial processes.

Average Bachelor's in Accounting Salary

The "average" salary for an accountant can vary based on the data source, but they all paint a positive picture. It's most helpful to look at a combination of median figures and salary ranges to understand the full landscape.

- Authoritative Median: The U.S. Bureau of Labor Statistics (BLS) provides the most comprehensive data, reporting a median annual wage of $78,000 for accountants and auditors in May 2022. The full range is broad, with the lowest 10 percent earning less than $48,560 and the highest 10 percent earning more than $132,690.

- Real-Time Aggregators: Salary aggregators provide a more real-time snapshot. As of late 2023/early 2024:

- Salary.com reports that the typical salary range for a Staff Accountant in the United States falls between $64,101 and $77,501.

- Payscale highlights the impact of experience, showing an average early-career salary for a professional with a Bachelor of Science in Accounting at around $62,000, which grows to over $108,000 by mid-career.

- Glassdoor lists the average U.S. base pay for an Accountant at $71,150 per year, with total pay (including potential bonuses) being higher.

These figures show a strong starting point for graduates and significant growth potential as they advance in their careers.

Key Factors That Influence Salary

Your salary is not a single, fixed number; it's a dynamic figure influenced by several critical factors. Understanding these variables is key to maximizing your earning potential.

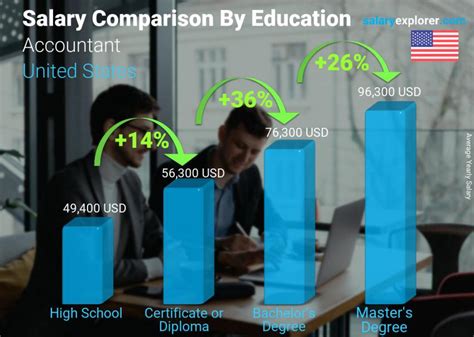

### Level of Education & Certification

While a bachelor's degree is the standard entry requirement, further credentials are the single most powerful way to boost your salary. The Certified Public Accountant (CPA) license is the gold standard in the industry. To become a CPA, you typically need 150 semester hours of education (30 more than a standard bachelor's), pass a rigorous exam, and meet experience requirements. According to a study cited by the AICPA, CPAs can earn 5-15% more than their non-certified counterparts, a premium that often grows throughout their career. A Master's in Accounting, Master's in Taxation, or an MBA can also lead to higher-level positions and increased pay.

### Years of Experience

Experience is a primary driver of salary growth in accounting. Your career and salary will typically progress through distinct stages:

- Entry-Level (0-3 years): As a Staff Accountant or Junior Auditor, you'll focus on foundational tasks. Salaries typically range from $55,000 to $75,000, depending on the market and company.

- Mid-Career (4-10 years): As a Senior Accountant or Accounting Manager, you take on more complex responsibilities, supervise junior staff, and participate in strategic planning. Salaries in this range often climb to $80,000 to $115,000+.

- Senior-Level (10+ years): With extensive experience, professionals can advance to roles like Controller, Director of Finance, or even Chief Financial Officer (CFO), where salaries can easily exceed $150,000 to $200,000 and beyond.

### Geographic Location

Where you work matters significantly. Major metropolitan areas with a high cost of living and a high concentration of large corporations typically offer higher salaries to attract talent. According to BLS data, the top-paying states for accountants include:

- District of Columbia

- New York

- New Jersey

- California

- Massachusetts

An accountant in New York City or San Francisco will command a much higher salary than one in a smaller, rural town, but this is offset by the significant difference in living expenses.

### Company Type

The type of organization you work for has a profound impact on your compensation and career path.

- Public Accounting (e.g., The "Big Four"): Firms like Deloitte, PwC, EY, and KPMG are known for offering competitive starting salaries, excellent training, and prestigious experience. While the hours can be demanding, starting here often fast-tracks a career and leads to high-paying exit opportunities in corporate accounting.

- Corporate (Private) Accounting: Working "in-house" for a company in any industry (from tech to manufacturing) involves managing that single company's finances. Salaries are competitive, and work-life balance is often considered better than in public accounting.

- Government: Working for federal agencies (like the IRS, FBI, or GAO) or state and local governments offers unparalleled job security and excellent benefits. While starting salaries may be slightly lower than in the private sector, the overall compensation package is often very strong.

- Non-Profit: These organizations are mission-driven. Salaries are generally lower than in the for-profit sector, but the work can be incredibly rewarding for those passionate about a specific cause.

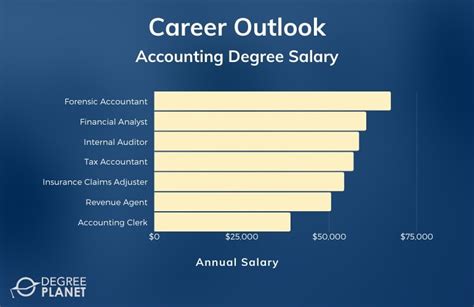

### Area of Specialization

As you advance in your career, specialization can lead to higher earnings. In-demand niches command a premium salary. Key specializations include:

- Forensic Accounting: Investigating financial crimes and fraud.

- Tax Accounting: Specializing in complex corporate or international tax law.

- Auditing: This can be external (working for a public accounting firm to audit clients) or internal (working for a company to ensure its own controls are effective).

- Information Technology (IT) Auditing: A high-demand niche that combines accounting with cybersecurity and technology systems.

- Managerial Accounting: Focusing on internal financial analysis to help management make strategic business decisions.

Job Outlook

The future for accounting professionals is bright and stable. The BLS projects that employment for accountants and auditors will grow by 4 percent from 2022 to 2032, which is as fast as the average for all occupations.

This steady growth is fueled by a complex global economy, ever-changing tax laws and financial regulations, and an increased focus on preventing financial fraud. The BLS anticipates about 126,500 openings for accountants and auditors each year over the decade, many of which will result from the need to replace workers who retire or transfer to different occupations.

Conclusion

A bachelor's in accounting is a wise investment that opens the door to a secure and lucrative career. While a graduate can expect a competitive starting salary in the $55,000 to $75,000 range, that is only the beginning.

Your ultimate earning potential is in your hands. By pursuing a professional certification like the CPA, gaining diverse experience, choosing a high-demand specialization, and strategically selecting your industry and location, you can build a career that is both intellectually challenging and financially rewarding. For those with a knack for numbers, a strong ethical compass, and a desire for professional growth, accounting remains one of the most reliable paths to long-term success.