A career as a treasury analyst offers a unique blend of financial strategy, risk management, and operational execution, placing you at the financial core of an organization. For those with a sharp, analytical mind and an interest in corporate finance, this path is not only intellectually stimulating but also financially rewarding. With median salaries often exceeding $90,000 and significant room for growth, understanding the factors that shape a treasury analyst's earning potential is crucial for aspiring and current professionals.

This guide provides a data-driven look into treasury analyst salaries, exploring the key variables that can impact your compensation, from experience and location to the powerful effect of professional certifications.

What Does a Treasury Analyst Do?

Before diving into the numbers, it's important to understand the role. A treasury analyst is essentially the guardian of a company's cash. They ensure the organization has enough liquidity to meet its obligations, manage financial risks, and optimize its cash and capital structure.

Key responsibilities typically include:

- Cash Flow Forecasting: Projecting daily, weekly, and monthly cash positions to anticipate funding needs or investment opportunities.

- Liquidity Management: Managing bank accounts, concentrating cash, and executing short-term borrowing or investing activities.

- Risk Management: Analyzing and mitigating financial risks, primarily related to foreign exchange (FX) rates and interest rate fluctuations.

- Bank Relationship Management: Serving as a primary contact for banking partners and managing banking services and fees.

- Reporting and Analysis: Creating detailed reports on cash positions, debt covenants, and investment performance for senior management.

In essence, treasury analysts ensure the financial engine of the company runs smoothly and efficiently.

Average Treasury Analyst Salary

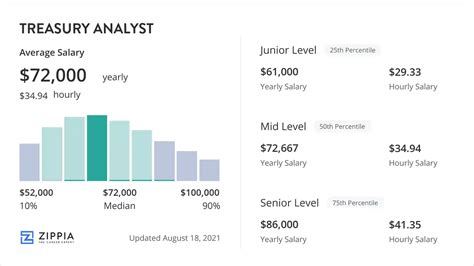

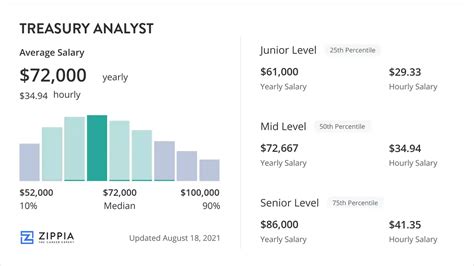

The compensation for a treasury analyst is competitive, reflecting the critical nature of the role. While figures vary based on multiple factors, we can establish a solid baseline using data from leading sources.

According to Salary.com, the median salary for a Treasury Analyst I in the United States is $70,690 as of April 2024, with a typical range falling between $64,490 and $77,390. For a more experienced Treasury Analyst II, the median jumps to $92,490, with a common range of $83,590 to $102,590.

Glassdoor reports a higher national average total pay of $98,850 per year, which includes an estimated base pay of $85,000 and additional pay (like cash bonuses and profit sharing) of around $13,850. This highlights the importance of variable compensation in this field.

To summarize the general landscape:

- Entry-Level (0-2 years): $65,000 - $80,000

- Mid-Career (3-5 years): $80,000 - $105,000

- Senior/Lead (5+ years): $100,000 - $130,000+

Key Factors That Influence Salary

Your specific salary will be determined by a combination of personal qualifications and market forces. Here are the most significant factors that influence a treasury analyst's earnings.

### Level of Education

A bachelor's degree in finance, accounting, or economics is the standard entry requirement. However, advanced credentials can provide a significant salary boost. An MBA or a Master's in Finance can open doors to higher-level positions and command a starting salary premium.

More impactful within the treasury field is the Certified Treasury Professional (CTP) designation. Offered by the Association for Financial Professionals (AFP), the CTP is the global standard of excellence in treasury. The AFP's 2023 Compensation Report notes that professionals holding the CTP earn, on average, 16% more than their non-certified peers. This certification signals a deep understanding of corporate liquidity, capital, and risk management, making it a powerful tool for salary negotiation.

### Years of Experience

Experience is arguably the most critical factor in determining salary. The career path offers clear and rewarding progression.

- Entry-Level (Analyst I): In the first few years, your focus will be on executing daily cash management tasks, gathering data, and preparing reports. Your salary will be in the lower end of the range, reflecting your learning curve.

- Mid-Career (Analyst II / Senior Analyst): With 3-5 years of experience, you take on more complex analytical work, such as building forecast models, analyzing bank fees, and participating in risk hedging strategies. This added responsibility comes with a significant jump in compensation.

- Senior-Level (Senior/Lead Analyst or Treasury Manager): Professionals with over five years of experience often move into senior or managerial roles. They oversee junior analysts, manage key banking relationships, and contribute to strategic decisions about capital structure and risk policy. Salaries at this level regularly cross the six-figure mark.

### Geographic Location

Where you work matters. Salaries are typically higher in major metropolitan areas and financial hubs to account for a higher cost of living and greater demand for talent. Cities with a high concentration of corporate headquarters, like New York, San Francisco, Chicago, and Charlotte, tend to offer the highest salaries for treasury professionals.

For example, data from Salary.com shows that a Treasury Analyst II in New York, NY, can expect to earn a median salary approximately 20% higher than the national median. Conversely, salaries in smaller, lower-cost-of-living cities will likely be closer to or slightly below the national average.

### Company Type

The size and type of your employer play a major role in your earning potential.

- Fortune 500 / Large Multinational Corporations: These companies have complex, global treasury operations involving multiple currencies, international banking partners, and sophisticated risk exposures. They demand top talent and pay a premium for it. These are typically the highest-paying employers.

- Mid-Sized Companies: A mid-sized firm will still have robust treasury needs but on a smaller scale. Salaries are competitive but may not reach the top-tier levels of a massive multinational.

- Startups and Small Businesses: In a smaller organization, the treasury function may be blended with other accounting or finance roles. While the experience can be broad, the salary may be on the lower end of the spectrum due to resource constraints.

### Area of Specialization

Within the treasury department, certain specializations are more complex and command higher pay. While many analysts have generalist responsibilities, developing expertise in a high-value area can accelerate your career and earnings.

- Cash & Liquidity Management: This is the foundational area of treasury and is essential in every company.

- Financial Risk Management: Professionals who specialize in hedging foreign exchange (FX) or interest rate risk are highly valued, especially in global companies. This requires advanced analytical skills and a deep understanding of derivative instruments.

- Capital Markets & Corporate Finance: This specialization involves activities like managing the company's debt portfolio, executing share repurchase programs, and analyzing M&A financing. This is the most strategic area of treasury and often leads to the highest-paying roles, such as Treasury Director or Treasurer.

Job Outlook

The career outlook for treasury analysts is very positive. The U.S. Bureau of Labor Statistics (BLS) groups treasury analysts under the broader category of "Financial and Investment Analysts." For this group, the BLS projects job growth of 8% from 2022 to 2032, which is "much faster than the average for all occupations."

The BLS cites globalization, a growing range of complex financial products, and the need for in-depth risk analysis as key drivers for this growth. As companies continue to navigate a volatile global economy, the expertise of treasury professionals in managing cash and mitigating risk will remain in high demand.

Conclusion

The role of a treasury analyst is a compelling career choice for financially-minded individuals seeking a challenging and stable profession. The salary potential is strong, with a clear path for advancement that rewards experience, continuous learning, and strategic specialization.

For those considering this path, the key takeaways are:

- Expect a competitive starting salary with significant growth potential, with medians for experienced analysts reaching the $90,000-$100,000 range.

- Your earnings are heavily influenced by your experience, location, and the size of your employer.

- Investing in advanced credentials, particularly the Certified Treasury Professional (CTP) designation, is one of the most effective ways to boost your salary and career prospects.

- The job outlook is strong, driven by the ongoing need for expert financial and risk management.

By building a solid educational foundation and strategically developing your skills, you can unlock a successful and highly rewarding career in corporate treasury.