Introduction

You're considering a Bachelor of Business Administration (BBA), and one question looms large, underpinning all the late-night study sessions and tuition calculations to come: *What is the real earning potential?* It’s a smart question. A BBA is a significant investment of time, energy, and money, and understanding the return on that investment is crucial. This degree is often touted as a golden ticket to the corporate world, a versatile key that can unlock countless doors. But what lies behind those doors in terms of financial reward?

The truth is, a "bachelors in business administration salary" isn't a single number but a dynamic spectrum. While a recent BBA graduate might start in the $55,000 to $70,000 range, seasoned professionals with the same degree can easily command salaries well into the six-figure territory, often exceeding $150,000 or more when factoring in bonuses and leadership responsibilities. The ultimate figure on your paycheck is shaped by a powerful combination of your chosen specialization, geographic location, years of experience, and the specific skills you bring to the table.

Early in my career consulting for a fast-growing tech startup, I saw firsthand how our BBA-educated business analyst transformed chaotic data into a strategic roadmap. Her ability to speak the language of finance, operations, *and* marketing was the linchpin that held our growth strategy together, and she was compensated accordingly because her value was undeniable. This guide is designed to give you that same clarity—to move beyond vague promises and provide a data-driven, comprehensive look at the financial realities and immense potential of a BBA.

We will dissect every factor that influences your salary, explore the most lucrative career paths, and provide a step-by-step roadmap to help you not only land a job but maximize your long-term earning power.

### Table of Contents

- [What Do BBA Graduates Do? A Look at Common Career Paths](#what-do-bba-graduates-do)

- [Average Bachelor's in Business Administration Salary: A Deep Dive](#average-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for BBA Holders](#job-outlook-and-career-growth)

- [How to Get Started and Maximize Your BBA](#how-to-get-started)

- [Conclusion: Is a BBA Worth It?](#conclusion)

What Do BBA Graduates Do? A Look at Common Career Paths

One of the most common misconceptions is that a Bachelor of Business Administration leads to a single, specific job titled "Business Administrator." In reality, a BBA is not a job title; it's a launchpad. The degree equips you with a foundational understanding of how every part of an organization works—from accounting and finance to marketing and human resources. This holistic knowledge makes BBA graduates versatile candidates for a wide array of roles across nearly every industry.

Think of a BBA as a toolkit. You learn the principles of financial statements, market analysis, supply chain logistics, project management, and organizational leadership. The career you build depends on which tools you choose to specialize in and sharpen.

Here are some of the most common career paths for BBA graduates:

- Business Analyst / Management Analyst: These professionals are the problem-solvers of the business world. They analyze an organization's operations, structures, and data to identify inefficiencies and recommend solutions for improvement. They bridge the gap between business needs and technological solutions.

- Financial Analyst: Working in corporate finance, investment banking, or asset management, financial analysts guide investment decisions. They build financial models, analyze market trends, evaluate company performance, and prepare reports to help leadership make sound financial choices.

- Marketing Specialist / Manager: These graduates use their understanding of consumer behavior and market dynamics to develop and execute campaigns that build brand awareness and drive sales. Roles can range from digital marketing and social media management to market research and brand strategy.

- Human Resources (HR) Specialist / Generalist: Focusing on the people side of the business, HR professionals handle recruitment, onboarding, employee relations, compensation and benefits, and training and development. They ensure the organization attracts and retains top talent while complying with labor laws.

- Operations Manager / Supply Chain Analyst: These roles are for those who love logistics and efficiency. They oversee the entire process of production and delivery, from sourcing raw materials to managing inventory and ensuring products reach the customer on time and on budget.

- Account Manager / Sales Representative: In these client-facing roles, BBA graduates leverage their knowledge of business principles to build relationships, understand client needs, and sell products or services. Success in this area is often tied to strong interpersonal skills and a deep understanding of the value proposition.

### A Day in the Life: Junior Business Analyst

To make this more concrete, let’s imagine a day in the life of "Alex," a BBA graduate working as a Junior Business Analyst at a mid-sized e-commerce company.

- 9:00 AM - Daily Stand-Up Meeting: Alex joins a brief meeting with the project team (including a project manager, a software developer, and a marketing lead) to discuss progress on a new website feature. Alex’s role is to ensure the feature requirements align with the initial business goals.

- 9:30 AM - Data Analysis: Alex’s manager has asked for a report on customer checkout abandonment rates over the last quarter. Using Excel and the company's analytics software (like Tableau or Google Analytics), Alex pulls the data, identifies key drop-off points in the process, and begins creating charts to visualize the trends.

- 11:00 AM - Stakeholder Interview: Alex meets with a manager from the customer service department to understand the common complaints they receive about the checkout process. This qualitative information provides crucial context for the quantitative data.

- 1:00 PM - Lunch & Learn: The company hosts a lunch session where the Head of Finance presents the quarterly earnings report. Alex’s BBA background helps in understanding the P&L statements and balance sheets being discussed.

- 2:00 PM - Report Writing: Alex synthesizes the data analysis and the stakeholder interview into a clear, concise report. The report outlines the problem (high abandonment rate), provides data-backed evidence, and offers three potential solutions for the tech team to investigate.

- 4:00 PM - Project Planning: Alex works with the project manager to translate the report's recommendations into actionable "user stories" for the development team, ensuring the technical work will directly address the business problem.

- 5:00 PM - Wrap Up: Alex responds to emails and plans the next day's tasks, which include preparing for a presentation of the findings to senior management.

This example illustrates the BBA's power in action: a combination of analytical skills (data analysis), communication (meetings, reports), and a broad understanding of business functions (marketing, finance, tech).

Average Bachelor's in Business Administration Salary: A Deep Dive

Now for the central question: what can you expect to earn with a BBA? The salary landscape is broad, but by examining data from authoritative sources, we can paint a very clear picture. It's essential to look at the entire compensation package, not just the base salary.

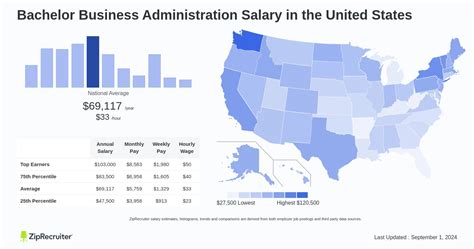

According to Payscale's 2024 data, the average base salary for a professional holding a Bachelor of Business Administration (BBA) degree is approximately $71,000 per year. However, this is just an average. The typical salary range for BBA holders spans from $47,000 on the low end (often for entry-level administrative or support roles) to $119,000 on the high end for experienced managers and specialists.

Salary.com provides a slightly different but complementary view, reporting that the median salary for jobs requiring a bachelor's degree in business falls around $75,401. Their data shows a range that can extend well over $125,000 for senior-level individual contributors and managers in high-paying fields like finance and technology.

### Salary by Experience Level

Your earning potential grows significantly as you gain experience, solve more complex problems, and take on leadership responsibilities. Here’s a breakdown of typical salary progression for a BBA graduate, based on aggregated data from Payscale and Glassdoor.

| Experience Level | Years of Experience | Typical Salary Range (Base) | Common Job Titles |

| ------------------- | ------------------- | --------------------------- | ----------------------------------------------- |

| Entry-Level | 0-2 Years | $55,000 - $72,000 | Business Analyst, Marketing Coordinator, HR Assistant, Junior Accountant, Sales Development Rep |

| Mid-Career | 3-8 Years | $70,000 - $105,000 | Financial Analyst, Operations Manager, Senior Business Analyst, Marketing Manager, HR Generalist, Account Executive |

| Senior/Experienced | 9-15+ Years | $100,000 - $150,000+ | Senior Manager (Finance, Marketing, Ops), Director of Operations, Senior Product Manager, Finance Director |

*Source: Synthesized from 2024 data from Payscale.com, Salary.com, and Glassdoor.*

As the table shows, the first few years out of college are about building a foundation. The most significant salary jumps often occur in the mid-career stage, as you transition from executing tasks to managing projects, people, and strategy.

### Beyond the Base Salary: Understanding Total Compensation

A critical mistake many early-career professionals make is focusing solely on the base salary. In the business world, total compensation is a much more important metric. Your BBA positions you for roles where performance is often rewarded directly.

Here are the key components of a typical compensation package:

- Base Salary: The fixed, predictable amount you earn bi-weekly or monthly. This is the foundation of your compensation.

- Annual Bonuses: These are often tied to company performance and/or individual performance. In fields like finance, consulting, and sales, bonuses can be substantial, sometimes ranging from 10% to 50% (or more) of your base salary. Glassdoor data frequently shows that roles like Financial Analyst or Account Manager have significant "additional pay" categories that include cash bonuses.

- Profit Sharing: Some companies, both large and small, distribute a portion of their annual profits to employees. This aligns employee interests with company success and can provide a significant end-of-year boost to your income.

- Commission: For sales-focused roles (e.g., Account Executive, Sales Manager), commission is a primary driver of earnings. A lower base salary is often offset by a high commission potential, meaning top performers can vastly out-earn their peers in non-sales roles.

- Stock Options / Equity: Particularly common in startups and large tech companies, stock options or Restricted Stock Units (RSUs) give you ownership in the company. While this isn't immediate cash, it can lead to a massive financial windfall if the company performs well or goes public.

- Benefits Package: Never underestimate the value of a strong benefits package. This includes:

- Health Insurance: A plan with low premiums and deductibles can save you thousands of dollars a year.

- Retirement Savings (401k/403b): A generous employer match (e.g., a dollar-for-dollar match up to 6% of your salary) is essentially free money and a powerful tool for wealth-building.

- Paid Time Off (PTO): A generous PTO policy enhances work-life balance and has tangible value.

- Other Perks: Tuition reimbursement, wellness stipends, and professional development budgets can also add significant financial value.

When evaluating a job offer, always calculate the total compensation. An offer with a $70,000 base salary and a 15% target bonus plus a strong 401(k) match is far more lucrative than a flat $75,000 salary with no bonus and a poor benefits plan.

Key Factors That Influence Your Salary

Your BBA is the entry ticket, but several key variables will determine whether you're sitting in the bleachers or the box seats when it comes to salary. Understanding and strategically navigating these factors is the difference between a decent career and a highly lucrative one.

### 1. Level of Education and Certifications

While this guide focuses on a BBA, what you do with and beyond that degree matters immensely.

- BBA vs. BSBA: Some universities offer a Bachelor of Science in Business Administration (BSBA). While the core curriculum is similar, a BSBA often requires more quantitative coursework (advanced math, statistics). This can give graduates a slight edge for highly analytical roles like financial quantitative analyst or data scientist, potentially leading to a higher starting salary in those niche fields.

- The Power of an MBA: The single most impactful educational step for a BBA holder looking to maximize earnings is pursuing a Master of Business Administration (MBA). An MBA, particularly from a top-tier program, is an accelerator for both salary and career progression. According to a 2023 report from the Graduate Management Admission Council (GMAC), the median starting salary for MBA graduates was $125,000, significantly higher than the median for bachelor's degree holders. An MBA signals advanced strategic knowledge and leadership potential, making it a common prerequisite for executive-level roles.

- Professional Certifications: Certifications demonstrate specialized expertise and a commitment to your field. They can directly translate to higher pay and more senior roles.

- Project Management Professional (PMP): Globally recognized, it’s a must-have for serious project managers. The Project Management Institute (PMI) reports that PMP holders earn, on average, 16% more than their non-certified peers.

- Certified Public Accountant (CPA): Essential for a career in public accounting and highly valuable for corporate finance roles. It unlocks higher-level positions and significantly boosts earning potential.

- Chartered Financial Analyst (CFA): The gold standard for investment management professionals. Earning a CFA charter is a rigorous process but can lead to some of the highest salaries in the finance industry.

- SHRM-CP or SHRM-SCP: For HR professionals, these certifications from the Society for Human Resource Management validate your expertise and are often required for HR manager and director roles.

### 2. Years of Experience

As shown in the salary table, experience is arguably the most significant driver of salary growth. This isn't just about time served; it's about the accumulation of skills, successes, and institutional knowledge.

- 0-2 Years (The Foundation Phase): At this stage, you're learning the ropes. Your value is in your potential, your work ethic, and your ability to execute assigned tasks. Salaries are typically in the entry-level range of $55,000 - $72,000. The goal here is to absorb as much as possible and prove your reliability.

- 3-5 Years (The Specialization Phase): You’ve moved from a generalist to a specialist. You can now manage small projects independently and are seen as a go-to person for specific tasks. This is where the first major salary jump occurs, with typical earnings moving into the $70,000 - $95,000 range. This is also a common time for a promotion from "Analyst" to "Senior Analyst" or from "Specialist" to "Manager."

- 6-10 Years (The Leadership Phase): You are now managing not just projects, but potentially people and strategy. Your value is in your ability to lead teams, manage budgets, and make decisions that impact the department or business unit. Salaries regularly cross the six-figure mark, often landing in the $95,000 - $130,000 range. Titles like "Senior Manager" or "Director" become common.

- 10+ Years (The Executive Phase): At this level, you are shaping the direction of the business. Your focus is on long-term strategy, P&L responsibility, and cross-functional leadership. Base salaries can range from $130,000 to $200,000+, with total compensation often being significantly higher due to large bonuses and equity. This is the realm of VPs, C-suite executives, and senior directors.

### 3. Geographic Location

Where you work can have as much of an impact on your salary as what you do. A Business Analyst in San Francisco will earn dramatically more than one in Omaha, Nebraska. However, this is always a trade-off with the cost of living.

According to the U.S. Bureau of Labor Statistics (BLS), Metropolitan areas with major corporate headquarters, tech hubs, and financial centers consistently offer the highest salaries for business professionals.

Top-Paying Metropolitan Areas for Business and Financial Occupations:

| Metropolitan Area | Annual Mean Wage |

| ----------------------------- | ---------------- |

| San Jose-Sunnyvale-Santa Clara, CA | $136,890 |

| San Francisco-Oakland-Hayward, CA | $122,590 |

| New York-Newark-Jersey City, NY-NJ-PA | $116,610 |

| Bridgeport-Stamford-Norwalk, CT | $115,220 |

| Boston-Cambridge-Nashua, MA-NH | $108,740 |

*Source: BLS Occupational Employment and Wage Statistics, May 2022 data for Business and Financial Occupations.*

Conversely, non-metropolitan and rural areas in states with lower costs of living will offer lower salaries. A starting salary that feels low in a major city might provide a very comfortable lifestyle in a different region. The rise of remote work has complicated this, but many companies still adjust salaries based on a "geo-differential," paying employees in high-cost areas more than those in low-cost areas, even for the same remote role.

### 4. Company Type & Size

The type of organization you work for has a profound effect on both your salary and your overall work experience.

- Large Corporations (Fortune 500): These companies typically offer higher base salaries, structured career paths, and exceptional benefits packages. They have the resources to pay top dollar for talent. For example, a Senior Financial Analyst at a company like Google or Procter & Gamble will likely earn more in base salary than their counterpart at a smaller regional company.

- Startups: The compensation model here is different. Base salaries may be lower than at large corporations to conserve cash. However, this is often offset by the potential for significant equity (stock options). If the startup succeeds, this equity can be worth far more than the salary difference. The work is often fast-paced with broad responsibilities.

- Mid-Sized Companies: These can offer the best of both worlds: more stability and better benefits than a startup, but more agility and opportunity for impact than a massive corporation. Salaries are competitive but may not reach the absolute top-tier of the market.

- Government / Public Sector: Government jobs at the federal, state, and local levels are known for stability, excellent benefits (pensions, healthcare), and work-life balance. Base salaries are often lower than in the private sector, especially at the senior levels. For example, the BLS reports the 2022 median pay for Management Analysts was $95,290, but this can vary significantly between a private consulting firm and a government agency.

- Non-Profit Organizations: Working for a non-profit is often a mission-driven choice. Salaries are almost always lower than in the for-profit sector, as revenue is reinvested into the cause rather than paid out to shareholders. The compensation is often more intrinsic (satisfaction from the work) than extrinsic (financial).

### 5. Area of Specialization

This is arguably the most important choice you will make in your BBA program and early career. Specializing in a high-demand, high-value area is the fastest way to a lucrative career.

Here’s a comparative look at median salaries for common BBA career paths, using BLS 2022 data:

- Finance (High Potential):

- Financial Analysts: Median Pay: $95,570 per year. Roles in investment banking or private equity can be substantially higher.

- Personal Financial Advisors: Median Pay: $95,390 per year. Top advisors can earn significantly more based on their client base.

- Technology / Information Systems (Highest Crossover Potential):

- BBA graduates who specialize in Management Information Systems (MIS) or work as IT Business Analysts are in high demand. Roles like Product Manager or IT Project Manager often have median salaries exceeding $120,000, as they blend business acumen with technical understanding.

- Marketing (Variable Potential):

- Market Research Analysts: Median Pay: $68,230 per year.

- Marketing Managers: Median Pay: $140,040 per year. The path to a high salary in marketing often involves moving into a leadership role and demonstrating a clear ROI on marketing spend, especially with digital marketing skills.

- Operations & Supply Chain (Strong & Growing):

- Logisticians / Supply Chain Analysts: Median Pay: $77,520 per year.

- Operations Managers: This is a broad category, but experienced managers in complex industries like manufacturing or tech can earn well over $100,000. The BLS lists the median pay for General and Operations Managers at $98,100.

- Human Resources (Stable & Solid):

- Human Resources Specialists: Median Pay: $64,240 per year.

- Human Resources Managers: Median Pay: $130,000 per year. Similar to marketing, the significant salary increase comes with the transition to a managerial role with strategic responsibility.

### 6. In-Demand Skills

Your degree gets you the interview; your skills get you the job and the salary. In today's data-driven world, certain skills are worth a premium.

High-Value Hard Skills:

- Data Analysis: Proficiency in tools like Microsoft Excel (Advanced), SQL, Tableau, or Power BI is no longer optional—it's expected. The ability to not just pull data, but to analyze it and derive actionable insights, is a massive value-add.

- Financial Modeling: For any finance-related role, the ability to build sophisticated financial models to forecast revenue, value a company, or analyze an investment is a core, high-value skill.

- Project Management Methodologies: Knowledge of frameworks like Agile and Scrum is highly sought after, especially in tech and product development. It shows you can manage complex projects in a fast-paced, iterative environment.

- CRM Software: Expertise in platforms like Salesforce is invaluable for sales, marketing, and customer service roles. It shows you understand how to manage the