Thinking of a leadership role in banking? A career as a bank branch manager offers a dynamic and rewarding path that blends financial acumen, sales leadership, and people management. It's a cornerstone position in the retail banking world, and it comes with significant responsibility and earning potential. But what does that potential look like in concrete numbers?

For aspiring or current banking professionals, understanding the salary landscape is crucial. A bank branch manager's salary can vary widely, but typically ranges from $65,000 to over $115,000 annually, with total compensation, including bonuses, pushing those figures even higher. This guide will break down what you can expect to earn and the key factors that will shape your income.

What Does a Bank Branch Manager Do?

Think of a bank branch manager as the CEO of their branch. They are ultimately responsible for the branch's overall success. Their duties are multifaceted and require a diverse skill set, balancing operational excellence with strategic growth.

Key responsibilities include:

- Team Leadership: Hiring, training, coaching, and managing a team of tellers, personal bankers, and loan officers.

- Sales and Growth: Driving branch performance by setting and achieving sales goals for products like loans, mortgages, investment services, and new accounts.

- Operational Excellence: Ensuring the branch runs smoothly, efficiently, and in compliance with all banking regulations and security procedures.

- Customer Relationship Management: Serving as the face of the bank in the local community, resolving complex customer issues, and building long-term relationships with valuable clients.

- Financial Reporting: Analyzing branch performance data and reporting on profitability, sales, and operational metrics to regional management.

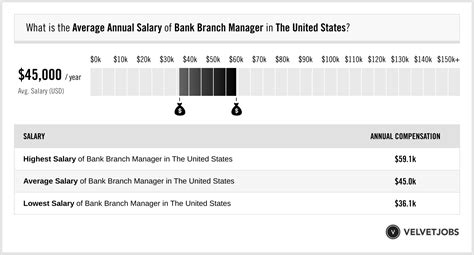

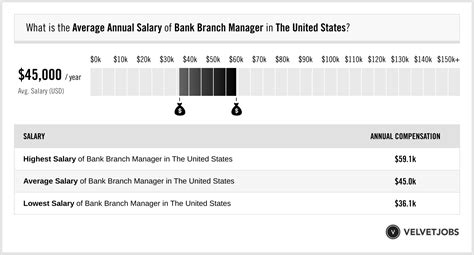

Average Bank Branch Manager Salary

While salaries can vary, data from multiple authoritative sources provides a clear picture of typical earnings. It's important to look at both base salary and total compensation, which includes bonuses, commissions, and profit-sharing that are common in this performance-driven role.

- According to Salary.com, the median annual base salary for a Bank Branch Manager in the United States is approximately $86,926 as of early 2024. The typical salary range falls between $77,414 and $98,719.

- Payscale reports a similar average salary of $72,500 per year, but highlights that bonuses can add up to $20,000 and profit-sharing can contribute another $10,000 to the total compensation package.

- Data from Glassdoor indicates an average total pay (including base and additional pay) of around $96,500 per year for bank branch managers.

It's also useful to consider the broader category under which this role falls. The U.S. Bureau of Labor Statistics (BLS) groups bank branch managers under "Financial Managers." For this larger category, the median pay was significantly higher at $156,100 per year in May 2023. While this group includes higher-earning corporate finance roles, it effectively illustrates the upward mobility and long-term earnings potential available within the financial management sector.

Key Factors That Influence Salary

Your specific salary as a bank branch manager isn't a single number—it's determined by a combination of critical factors. Understanding these variables will help you negotiate your compensation and plan your career trajectory.

### Level of Education

A solid educational foundation is typically a prerequisite for a management role in banking. Most banks require a bachelor’s degree in a relevant field like finance, business administration, or economics. While a bachelor's degree will get you in the door, an advanced degree, such as a Master of Business Administration (MBA), can significantly increase your earning potential and qualify you for roles at larger branches or in regional management, leading to a substantial salary boost.

### Years of Experience

Experience is one of the most significant drivers of salary growth in this profession. Banks place a high value on proven leadership and a track record of success. As you gain experience managing teams and growing branch revenue, your value—and your paycheck—will increase accordingly.

Payscale provides a helpful breakdown of how salary progresses with experience:

- Entry-Level (0-5 years): A manager in the early stages of their career can expect to earn an average total compensation of around $64,000.

- Mid-Career (5-10 years): With solid experience, the average total compensation rises to approximately $78,000.

- Experienced (10-20 years): Seasoned branch managers with a decade or more of experience earn an average of $85,000.

- Late-Career (20+ years): Managers with extensive experience can command salaries averaging $88,000 or more, often with greater bonus potential.

### Geographic Location

Where you work matters—a lot. Salaries for bank branch managers are heavily influenced by the cost of living and the demand for financial professionals in a specific metropolitan area. Branches in major financial hubs and high-cost-of-living cities will almost always offer higher base salaries to attract and retain talent. For example, a branch manager in New York City, San Francisco, or Boston will likely earn significantly more than a manager in a smaller, rural town.

### Company Type

The size and type of the financial institution you work for is a major factor.

- Major National Banks (e.g., JPMorgan Chase, Bank of America, Wells Fargo): These institutions typically manage larger branches with higher deposit levels, more complex operations, and larger teams. As a result, they tend to offer higher base salaries, more structured bonus programs, and extensive benefits packages.

- Community Banks and Credit Unions: These smaller institutions may offer slightly lower base salaries, but can provide other compelling benefits, such as a stronger work-life balance, a close-knit company culture, and a direct connection to the local community. Their bonus structures may also be heavily tied to local growth.

### Area of Specialization

Not all bank branches are the same. A manager’s area of focus can impact their compensation, particularly their bonus potential. A manager of a standard retail branch will have a different earnings profile than a manager who specializes in:

- High-Net-Worth or Private Banking: These roles involve managing relationships with affluent clients and carry much higher revenue targets, leading to significantly higher compensation.

- Business Banking: Managers with a strong background in commercial lending and who successfully grow the branch's portfolio of business clients often receive substantial performance-based bonuses.

Job Outlook

The career outlook for financial managers, including bank branch managers, is very positive. According to the U.S. Bureau of Labor Statistics, employment for financial managers is projected to grow 16 percent from 2022 to 2032. This is much faster than the average for all occupations.

This robust growth is driven by the increasing complexity of financial products and the growing need for sound financial management and wealth planning services, particularly as the population ages. While automation and online banking are changing the nature of retail banking, the need for skilled managers to lead teams, drive growth, and handle complex client relationships remains strong.

(Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Financial Managers)

Conclusion

A career as a bank branch manager is a challenging yet highly rewarding path for those with a passion for finance, leadership, and community engagement. The salary is competitive and offers significant room for growth, heavily influenced by your experience, location, and the type of institution you work for.

Key takeaways for aspiring managers:

- Expect a Solid Income: The national median salary hovers in the $70,000 to $90,000 range, with total compensation often approaching or exceeding six figures.

- Experience is Your Greatest Asset: Your earnings will grow substantially as you build a proven track record of leading teams and achieving sales goals.

- Location and Bank Type Matter: Pursuing opportunities in major metropolitan areas or at large national banks can lead to higher earnings.

- The Future is Bright: With a strong projected job growth, the demand for skilled financial leaders is set to continue, ensuring a stable and prosperous career path for years to come.