Understanding your compensation is one of the most critical aspects of managing your career. At the heart of any job offer lies the annual base salary—the foundational number that determines your regular, guaranteed income. While the national median base salary for full-time workers in the U.S. is approximately $59,540 per year as of the first quarter of 2024 (U.S. Bureau of Labor Statistics), this figure is just the beginning of the story. Your personal earning potential can vary dramatically based on your industry, experience, and location.

This guide will demystify the concept of annual base salary, explore the key factors that dictate its size, and empower you to better understand your own value in the professional marketplace.

What is an Annual Base Salary?

An annual base salary is the fixed, pre-tax amount of money an employer pays an employee over the course of a year. This is your guaranteed income for the work you perform, paid out in regular increments (e.g., weekly, bi-weekly, or monthly).

Think of it as the foundation of your financial compensation package. It does not typically include other forms of payment or benefits, such as:

- Variable Pay: Performance bonuses, commissions, or profit-sharing.

- Equity: Stock options or restricted stock units (RSUs).

- Benefits: The monetary value of health insurance, retirement contributions (like a 401(k) match), or paid time off.

- Overtime Pay: Additional wages earned for working beyond the standard workweek (common for non-exempt employees).

When you receive a job offer, the annual base salary is the headline number, but it's crucial to evaluate it as part of the total compensation package.

Average Salaries: A National Snapshot

To understand what a "good" base salary is, it's helpful to look at the national landscape. According to the U.S. Bureau of Labor Statistics (BLS), the median usual weekly earnings for full-time wage and salary workers was $1,145 in the first quarter of 2024. This translates to an annual median salary of $59,540.

"Median" means that half of all workers earn more than this amount, and half earn less. However, averages vary widely by profession. For example:

- Software Developers: The median annual wage was $131,490 in May 2023 (BLS).

- Registered Nurses: The median annual wage was $86,070 in May 2023 (BLS).

- Marketing Managers: The median annual wage was $158,440 in May 2023 (BLS).

- Retail Salespersons: The median annual wage was $35,100 in May 2023 (BLS).

These figures highlight why it's essential to research the specific salary benchmarks for your field and experience level.

Key Factors That Influence Salary

Your annual base salary isn't a random number; it's determined by a blend of factors that reflect the value you bring to an employer. Understanding these elements can help you strategically increase your earning potential.

###

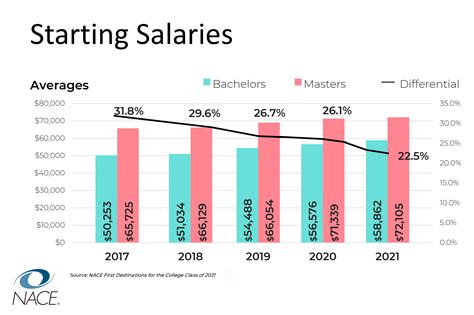

Level of Education

Education is a powerful driver of income. Statistically, higher levels of academic attainment correlate directly with higher median earnings. According to 2023 data from the BLS:

- High School Diploma: Median usual weekly earnings of $889 (approx. $46,228 annually).

- Bachelor's Degree: Median usual weekly earnings of $1,532 (approx. $79,664 annually).

- Master's Degree: Median usual weekly earnings of $1,760 (approx. $91,520 annually).

- Doctoral or Professional Degree: Median usual weekly earnings of $2,185 (approx. $113,620 annually).

A degree often acts as a signal to employers that you possess specialized knowledge, critical thinking skills, and the discipline to complete long-term goals.

###

Years of Experience

Experience is perhaps the most significant factor in salary growth within a specific career path. Employers pay a premium for proven expertise and a track record of success. Salary aggregator Payscale provides a clear model for how experience impacts earnings:

- Entry-Level (0-1 year): Professionals are learning the ropes and typically earn at the lower end of the salary band for their role.

- Mid-Career (5-9 years): With substantial experience, individuals can perform their roles with greater autonomy and efficiency, commanding a significantly higher salary.

- Senior/Late-Career (20+ years): Professionals at this level often hold leadership, strategic, or high-level individual contributor roles, placing them at the top of the pay scale for their profession.

For example, an entry-level Financial Analyst might earn around $65,000, while a senior-level Financial Analyst with over 10 years of experience could earn upwards of $95,000 or more, according to data from Salary.com.

###

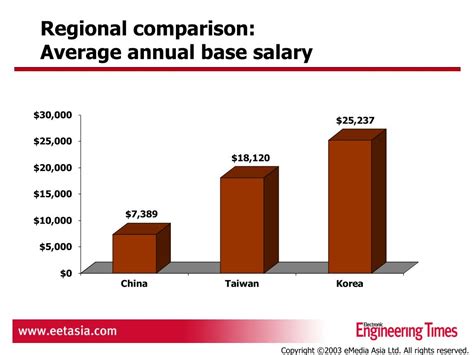

Geographic Location

Where you work matters—a lot. Salaries are often adjusted to the local cost of living and labor market demand. A job in a major metropolitan area like San Francisco or New York City will almost always offer a higher base salary than the exact same job in a smaller city in the Midwest.

According to Glassdoor's salary data, a Marketing Manager in San Jose, CA might have an average base salary of $130,000, whereas the same role in St. Louis, MO might average around $90,000. While the salary is higher in San Jose, so is the cost of housing, taxes, and daily expenses. The rise of remote work has complicated this, with some companies adopting location-based pay, while others offer a single national rate.

###

Industry and Company Type

The industry you work in and the type of company that employs you are major determinants of pay.

- Industry: Fields like Technology, Finance, and Pharmaceuticals are known for offering higher-than-average base salaries due to high revenue per employee and intense competition for talent. In contrast, industries like non-profit, education, and hospitality may offer lower base salaries but provide other non-monetary rewards.

- Company Size & Type: Large, established corporations often have more structured and higher pay bands than small businesses or startups. However, a tech startup might offer a lower base salary but compensate with potentially lucrative stock options. Publicly traded companies may also offer higher salaries than privately held ones.

###

Area of Specialization

Within any given profession, specialization can lead to a significant salary premium. A generalist often earns less than a specialist who possesses in-demand, niche skills.

For example, within the IT field:

- An IT Support Specialist might earn a median salary of around $60,000.

- A more specialized Cloud Engineer could earn a median of $120,000.

- A highly specialized AI/Machine Learning Engineer can command a median salary exceeding $150,000.

This is because the supply of talent with these niche skills is lower, while the demand is extremely high, driving up wages.

The Future of Compensation: Trends to Watch

The conversation around salary is evolving. The BLS Occupational Outlook Handbook projects steady growth across many professional sectors, but how that growth translates to salary is being shaped by new trends:

- Pay Transparency: A growing number of states and cities are enacting laws requiring employers to disclose salary ranges in job postings. This empowers candidates and aims to reduce pay gaps.

- Remote Work Impact: The normalization of remote work continues to challenge traditional location-based pay models, forcing companies to create new compensation strategies.

- Focus on Total Rewards: Increasingly, savvy professionals and leading employers are looking beyond base salary to the "Total Rewards" package—evaluating bonuses, equity, benefits, and flexibility as a holistic measure of a job's value.

Conclusion

Your annual base salary is the bedrock of your financial well-being, but it is just one piece of a larger puzzle. To truly maximize your earning potential and make informed career decisions, you must:

- Understand Your Baseline: Know what your skills are worth by researching salary data from reliable sources like the BLS, Payscale, and Glassdoor for your specific role, location, and experience level.

- Recognize the Influencers: Appreciate how your education, experience, location, and specialization directly impact your value in the job market.

- Think Holistically: Always evaluate the total compensation package. A slightly lower base salary at a company with an incredible 401(k) match, generous bonuses, and a great work-life balance may be worth more in the long run.

By arming yourself with this knowledge, you are no longer a passive recipient of a salary number. You become an active, informed participant in your career journey, ready to negotiate your worth and build a financially secure future.