Understanding Your Worth: A Deep Dive into Basic Salary

Navigating the professional world requires a firm grasp of compensation. At the heart of every job offer and pay stub is the basic salary—the foundational number that dictates your earnings and financial planning. Understanding this concept is not just an academic exercise; it's the first step toward negotiating effectively, comparing job offers intelligently, and maximizing your lifetime earning potential. This article will demystify the "basic salary definition," explore the factors that determine it, and show you how to leverage this knowledge for a more prosperous career.

What is Basic Salary? A Clear Definition

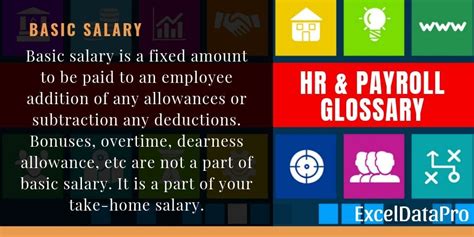

A basic salary is the fixed, regular amount of money an employee receives from an employer before any extras are added or deductions are made. It is the core component of your compensation package and is typically expressed as an annual, monthly, or hourly figure.

Think of it as the predictable bedrock of your income. It does not include:

- Bonuses or Commissions: Performance-based payments are not part of the basic salary.

- Overtime Pay: Extra pay for working beyond standard hours is calculated separately.

- Benefits and Perks: The monetary value of health insurance, retirement contributions (like a 401(k) match), or company cars is not included.

- Allowances: Stipends for housing, travel, or meals are considered separate from the basic salary.

In essence, if a job offer states a "salary of $75,000," that figure is your annual basic salary. It's the number from which all other calculations, like taxes and withholdings, will be made.

### Basic Salary vs. Gross Salary vs. Net Salary

It's vital to distinguish basic salary from two other common terms:

- Gross Salary: This is your total earnings *before* any deductions. It includes your basic salary plus any additional earnings like overtime, bonuses, or commissions for that pay period. In many cases, if you have no additional earnings, your gross salary will be the same as your basic salary for that period.

- Net Salary (Take-Home Pay): This is the actual amount of money you receive in your bank account after all deductions—such as federal and state taxes, Social Security, Medicare, health insurance premiums, and retirement contributions—have been taken out of your gross salary.

Example:

- Basic Salary: $80,000 per year

- Gross Pay (for one month, with a $1,000 bonus): $6,667 (monthly basic) + $1,000 = $7,667

- Net Pay (for that month, after taxes & deductions): ~$5,500 (this is a rough estimate and varies greatly)

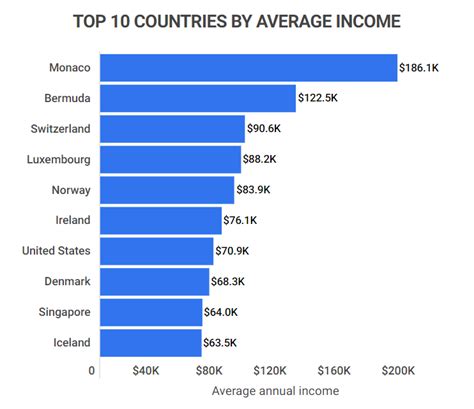

Average Basic Salary: A National Snapshot

Since "basic salary" is a concept, it doesn't have its own average. Instead, we look at the average basic salaries for all workers to establish a benchmark.

According to the U.S. Bureau of Labor Statistics (BLS), the median weekly earnings for full-time wage and salary workers in the United States was $1,145 in the fourth quarter of 2023. This translates to an annual median basic salary of approximately $59,540.

However, this is just a national average. A typical salary range is vast, stretching from minimum wage for entry-level service jobs to well over $200,000 for senior professionals in high-demand fields like medicine, technology, and law. Your personal basic salary will be determined by a combination of critical factors.

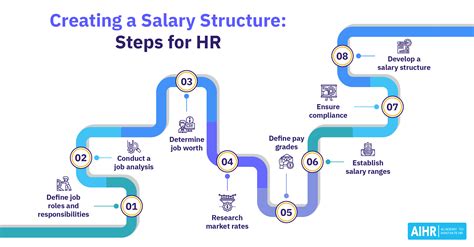

Key Factors That Influence Salary

This is the most important part of understanding your earning potential. Your basic salary isn't arbitrary; it's a market-driven figure influenced by several key variables.

###

Level of Education

There is a direct and well-documented correlation between education level and income. A higher degree often serves as a signal to employers that you possess specialized knowledge, critical thinking skills, and perseverance.

- BLS Data (2022): The U.S. Bureau of Labor Statistics reports a clear earnings ladder based on education:

- High School Diploma: Median of $853/week ( ~$44,356/year)

- Bachelor's Degree: Median of $1,432/week ( ~$74,464/year)

- Master's Degree: Median of $1,661/week ( ~$86,372/year)

- Doctoral/Professional Degree: Median of $2,083/week ( ~$108,316/year)

###

Years of Experience

Experience is a powerful driver of salary. As you accumulate years in a profession, you build practical skills, industry knowledge, and a proven track record of results, making you more valuable to an employer.

- Entry-Level (0-2 years): You are learning the ropes and your salary is at the lower end of the scale for your role.

- Mid-Career (3-8 years): You have proven your competence and can operate independently. This is often where the most significant salary growth occurs.

- Senior/Lead (8+ years): You are now an expert, potentially managing teams or projects. Your salary is at the top end of the range, reflecting your strategic value.

For example, according to Payscale, the average salary for a Software Developer changes dramatically with experience:

- Entry-Level: ~$68,000

- Mid-Career: ~$92,000

- Experienced (10+ years): ~$115,000

###

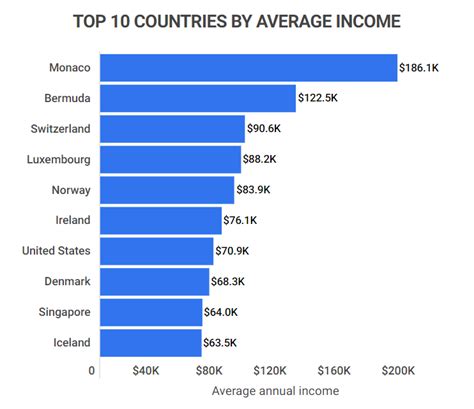

Geographic Location

Where you work matters—a lot. Salaries are adjusted based on the local cost of living and the demand for talent in that specific market. A job in a major metropolitan hub like New York City or San Francisco will have a significantly higher basic salary than the exact same job in a smaller, rural town.

For instance, using Salary.com's calculator, a Marketing Manager role with identical experience might have these drastically different average basic salaries:

- San Francisco, CA: $145,500

- Chicago, IL: $122,800

- Des Moines, IA: $105,700

###

Company Type and Industry

The size, stage, and industry of a company heavily influence its compensation strategy.

- Startups: May offer a lower basic salary but compensate with potentially lucrative stock options.

- Large Corporations: Often provide higher basic salaries, structured bonuses, and comprehensive benefits packages.

- Non-Profit/Government: Tend to offer lower basic salaries than the private sector but often provide excellent job security and benefits.

- High-Margin Industries (e.g., Tech, Finance, Pharma): Typically pay much higher salaries than lower-margin industries (e.g., Retail, Hospitality).

###

Area of Specialization

Within any given field, specialists almost always earn more than generalists. Possessing in-demand, niche skills reduces the talent pool and increases your leverage. For example, within the IT field:

- A general IT Support Specialist might earn an average of $59,790 (Payscale).

- A specialized Cybersecurity Analyst, a field with high demand and a critical skill set, earns an average of $81,500 (Payscale), with senior roles easily clearing six figures.

Job Outlook: The Importance of a Growing Field

While there is no "job outlook" for a definition, understanding this concept is critical when evaluating the outlook for your chosen career. When the BLS projects strong growth for a profession, it signals high demand for those skills. High demand with limited supply almost always leads to rising basic salaries.

For example, the BLS projects the employment of Data Scientists to grow by 35% from 2022 to 2032, much faster than the average for all occupations. This immense demand is why data scientists command high basic salaries, with Glassdoor reporting a total pay average of $127,500 per year in the United States. Choosing a career in a growing field is a strategic way to ensure your basic salary keeps pace with or outpaces inflation over time.

Conclusion: Your Salary, Your Power

Defining "basic salary" is the first and most critical step toward taking control of your financial future. It is the stable, predictable foundation of your earnings, separate from variable bonuses or the value of benefits.

Here are the key takeaways for any professional:

- Know the Definition: Basic salary is your fixed pay before any extras or deductions.

- Understand the Factors: Your earning potential is a blend of your education, experience, location, industry, and specialization.

- Use Knowledge as Leverage: By understanding what determines salary, you can negotiate job offers more confidently and make strategic career moves—like pursuing a certification or being open to relocation—to increase your basic pay.

By demystifying this core concept, you transform from a passive recipient of a paycheck into an active architect of your career and wealth.