A career as a benefits analyst offers a rewarding path for detail-oriented professionals passionate about shaping employee well-being and company culture. This critical Human Resources role is not only impactful but also financially promising. If you're considering this career, you're likely asking a key question: what is a typical benefits analyst salary?

The answer is encouraging. While salaries vary, a benefits analyst in the United States can expect to earn a competitive wage, with average salaries often ranging from $60,000 to over $100,000 depending on a variety of key factors.

This guide will break down what a benefits analyst does, explore the average salary ranges, and detail the crucial factors that will influence your earning potential in this growing field.

What Does a Benefits Analyst Do?

Before diving into the numbers, it’s important to understand the role. A benefits analyst is a specialist within the Human Resources department responsible for researching, analyzing, administering, and evaluating a company's employee benefits programs. Their work ensures that the company's offerings are competitive, cost-effective, and compliant with all legal regulations.

Key responsibilities often include:

- Analyzing Data: Evaluating the cost and effectiveness of current benefits plans, such as health insurance, retirement (401k), disability, and paid time off.

- Market Research: Benchmarking the company’s benefits package against those of competitors to ensure it remains attractive for recruiting and retaining top talent.

- Compliance & Reporting: Ensuring all benefits programs adhere to federal, state, and local regulations, such as the ACA, ERISA, and COBRA.

- Vendor Management: Liaising with insurance brokers, retirement plan administrators, and other benefits vendors.

- Employee Communication: Acting as a point of contact for employees with questions about their benefits and helping to communicate plan changes during open enrollment.

Average Benefits Analyst Salary

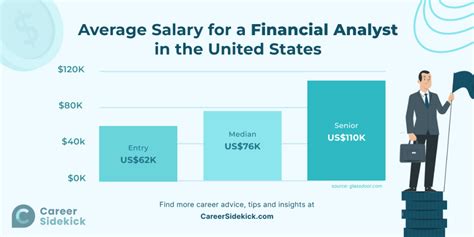

Salary data shows a strong and stable market for benefits professionals. While figures vary slightly between data aggregators due to different methodologies, they paint a consistent picture of a well-compensated role.

According to Salary.com, the median annual salary for a Benefits Analyst in the United States is approximately $71,570 as of early 2024. However, this is just the midpoint. The typical salary range usually falls between $64,000 and $80,000.

Similarly, Payscale reports an average salary of $67,250 per year, while Glassdoor lists an average base pay of around $73,000 per year, with total pay increasing with bonuses and other forms of additional compensation.

This range reflects the path of a typical benefits analyst, from an entry-level position to a more seasoned professional. Senior benefits analysts with significant experience and specialized skills can easily command salaries exceeding $95,000 to $110,000.

Key Factors That Influence Salary

Your specific salary as a benefits analyst isn't set in stone. Several key factors will directly impact how much you can earn. Understanding these variables is the first step to maximizing your career's financial potential.

### Level of Education

A bachelor's degree is typically the minimum requirement for a benefits analyst role. Degrees in Human Resources, Finance, Business Administration, or a related field are most common. However, advanced education and certifications can provide a significant salary boost.

- Master's Degree: An MBA or a Master's in Human Resources (MHR) can open doors to higher-level strategic roles and management positions, commanding a higher salary.

- Professional Certifications: Earning industry-recognized certifications demonstrates expertise and a commitment to the profession. Key certifications that can increase your market value include:

- Certified Employee Benefit Specialist (CEBS): A highly respected credential covering all aspects of health and retirement benefits.

- SHRM Certified Professional (SHRM-CP) or Senior Certified Professional (SHRM-SCP): Broad HR certifications that add credibility.

- WorldatWork's Certified Benefits Professional® (CBP): A specialized certification focused on strategic benefits management.

### Years of Experience

Experience is arguably the most significant driver of salary growth in this field. As you gain more experience, you take on more complex tasks, from vendor negotiations to strategic plan design.

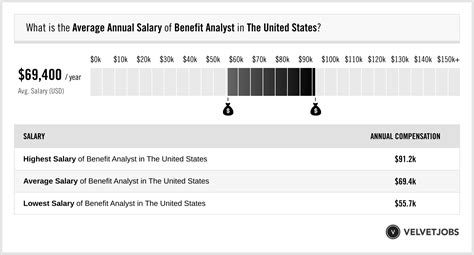

- Entry-Level (0-2 years): Analysts at this stage focus on administration, data entry, and responding to employee inquiries. Salaries typically range from $55,000 to $65,000.

- Mid-Career (3-8 years): With a solid foundation, these professionals handle more in-depth analysis, compliance reporting, and open enrollment management. Their salaries often fall between $65,000 and $85,000.

- Senior or Lead Analyst (9+ years): Senior analysts often lead projects, mentor junior staff, and play a key role in strategic benefits planning and vendor selection. They can expect to earn $85,000 to $110,000+.

### Geographic Location

Where you work matters. Salaries for benefits analysts are significantly higher in major metropolitan areas with a high cost of living and a high concentration of large corporations.

For example, cities like San Francisco, New York City, Boston, and Washington D.C. will offer substantially higher salaries than the national average to compensate for the higher cost of living. Conversely, salaries in smaller cities and rural areas will likely be closer to the lower end of the national range. Always research the local market when considering a job offer.

### Company Type

The size and type of the employing organization play a crucial role in compensation.

- Large Corporations (Fortune 500): These companies have complex, multi-state or international benefits plans and the resources to pay top dollar for skilled analysts to manage them.

- Tech & Finance Industries: These sectors are known for offering highly competitive compensation and benefits packages to attract premier talent, and they pay their HR and benefits staff accordingly.

- Consulting Firms: Benefits analysts working for consulting firms often advise multiple clients and may earn a premium for their broad expertise.

- Small to Mid-Sized Businesses (SMBs) & Non-Profits: These organizations typically have smaller budgets and less complex benefits plans, which usually translates to salaries on the lower end of the spectrum.

### Area of Specialization

As you advance in your career, developing a specialization can make you a more valuable and higher-paid asset. Niche expertise is in high demand.

- Retirement Planning: Expertise in 401(k), 403(b), and pension plan administration and compliance is highly valuable.

- Health and Wellness: With rising healthcare costs, analysts who can design and manage effective and affordable health and wellness programs are critical.

- International Benefits: For global companies, analysts who understand the complexities of expatriate benefits and different national regulations can command a premium salary.

- Benefits Technology: Expertise in Human Resource Information Systems (HRIS) and benefits administration platforms is a sought-after technical skill.

Job Outlook

The career outlook for benefits professionals is positive and stable. According to the U.S. Bureau of Labor Statistics (BLS), employment for "Compensation, Benefits, and Job Analysis Specialists" is projected to grow 7 percent from 2022 to 2032, which is faster than the average for all occupations.

The BLS attributes this growth to the ongoing need for organizations to attract and retain talent in a competitive market. Furthermore, as benefits regulations and healthcare laws continue to evolve, the need for knowledgeable specialists to ensure compliance will remain strong. This projects a solid, long-term demand for skilled benefits analysts.

Conclusion

A career as a benefits analyst is a stable, engaging, and financially rewarding path. While national averages provide a solid benchmark—typically $64,000 to $80,000—your ultimate earning potential is largely in your hands.

By focusing on your professional development, you can significantly increase your salary over time. Invest in your education and certifications, gain hands-on experience across different facets of benefits administration, and consider specializing in a high-demand area. With the right strategy, you can build a lucrative and impactful career ensuring employees are healthy, happy, and secure.