Reaching the level of Partner at a Big 4 accounting firm—Deloitte, PwC, Ernst & Young (EY), or KPMG—is widely considered the pinnacle of a career in public accounting. It's a role synonymous with prestige, leadership, and significant financial reward. For ambitious professionals and students mapping out their futures, one question looms large: what does a Big 4 partner actually earn? While the exact figures are famously guarded, the compensation potential is substantial, with average earnings ranging from $450,000 to well over $1,000,000 annually.

This article will demystify the Big 4 partner salary, breaking down the compensation structure, the factors that drive earnings, and what it takes to reach this elite professional tier.

What Does a Big 4 Partner Do?

Before diving into the numbers, it's crucial to understand the role. A Big 4 partner is far more than a senior accountant; they are a business owner and a strategic leader within the firm. Their responsibilities are vast and carry immense weight. Key duties include:

- Business Development: Actively pursuing and winning new client business, which is a primary driver of their compensation.

- Client Relationship Management: Serving as the ultimate point of contact and trusted advisor for the firm's most important clients.

- Team Leadership: Managing, mentoring, and developing large teams of directors, managers, and staff, shaping the next generation of leaders.

- Quality Assurance and Risk Management: Signing off on audits, tax filings, and major consulting projects, which carries significant personal and firm-wide liability.

- Strategic Vision: Contributing to the overall strategy and profitability of their specific practice area (e.g., Audit, Tax, Advisory) and the firm as a whole.

In essence, a partner is responsible for generating revenue, managing risk, and leading people—all while upholding the firm's brand and quality standards.

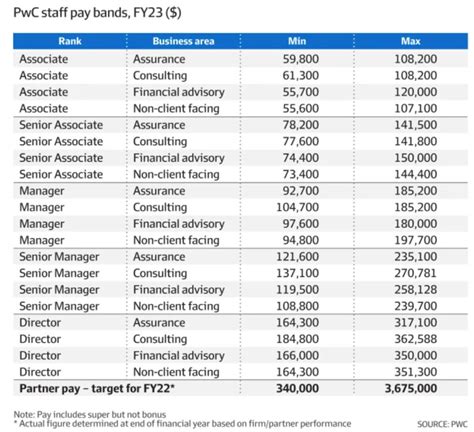

Average Big 4 Partner Salary

It is important to clarify that a Big 4 partner’s compensation is not a straightforward salary. Instead, it is typically a complex package composed of a base salary, performance bonuses, and, most importantly, a share of the firm’s profits, often referred to as a "draw." This profit-sharing model means that compensation can fluctuate based on the firm's and the individual partner's performance each year.

Based on an analysis of data from authoritative sources, here is a typical breakdown:

- Overall Average Range: Most Big 4 partners can expect to earn between $450,000 and $900,000 per year. Data from Salary.com places the average Partner salary in the U.S. at around $625,984, with a typical range falling between $513,382 and $762,352.

- Junior Partners (First 1-3 years): Newly admitted partners, sometimes called "salaried partners" or "non-equity partners," often start in the $300,000 to $500,000 range. Their compensation is more weighted towards a fixed salary as they build their "book of business."

- Senior/Equity Partners: With several years of experience and a substantial client portfolio, senior partners who hold equity in the firm can see their annual compensation soar to $700,000 to over $3,000,000. These top earners are typically in high-demand specializations and major metropolitan markets.

*Source: Salary.com, Glassdoor, and industry reports.*

Key Factors That Influence Salary

The wide salary range is a direct result of several key variables. A partner's final take-home pay is a finely tuned reflection of their value to the firm.

Years of Experience

Experience is arguably the most significant factor, but not just total years in the industry. What truly matters is the number of years as a partner. A partner’s career progresses through tiers. A first-year partner is focused on establishing their leadership and growing their client portfolio. A tenured, senior equity partner has a proven track record of generating millions in revenue, holds key leadership roles within the firm, and therefore commands a much larger share of the profits.

Area of Specialization

The service line in which a partner specializes has a direct impact on their earning potential, as some services command higher fees and are in greater demand.

- Advisory (Consulting): This is often the most lucrative practice. Partners specializing in high-growth areas like M&A advisory, cybersecurity, digital transformation, and strategy consulting can earn at the very top of the pay scale.

- Tax: While traditional tax compliance is a staple, partners in specialized fields like International Tax, Transfer Pricing, or M&A Tax are highly valued and well-compensated due to the complexity and high stakes of their work.

- Audit (Assurance): As the traditional backbone of the Big 4, audit partners have stable and significant earnings. While perhaps not reaching the peaks of top advisory roles, partners on large, high-risk public clients are still among the highest earners in the business world.

Geographic Location

As with most professions, where you work matters. Partners in major financial hubs with a high concentration of Fortune 500 clients will earn significantly more than those in smaller, regional offices. Cities like New York, San Francisco, Chicago, and London offer the highest compensation due to the market size and cost of living. A partner in a Midwest regional office will still earn an exceptional living but will likely fall into the lower end of the overall partner pay range.

Company Type

While all are "Big 4," Deloitte, PwC, EY, and KPMG are separate global networks of member firms. The overall profitability of a specific firm in a given year directly affects the size of the profit pool available to be distributed to partners. For example, if Deloitte’s advisory practice has a blockbuster year, its advisory partners will see that success reflected in their compensation. Furthermore, a partner's individual contribution—measured by the revenue they generate and the clients they manage—is paramount. A partner with a $20 million book of business will invariably earn more than a partner with a $5 million book, regardless of the firm.

Level of Education

At the partner level, education is more of a foundational prerequisite than a direct salary driver. A bachelor's degree in accounting, finance, or a related field is the minimum entry point. A Master's degree (such as a Master of Accountancy or an MBA) and a Certified Public Accountant (CPA) license are considered standard requirements for anyone on the partner track. While these qualifications won't directly increase a partner's draw, they are essential for building the technical expertise and credibility required to even be considered for partnership.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track "Big 4 Partner" as a distinct profession, it does provide data for the broader category of Accountants and Auditors. The BLS projects a growth rate of 4% for this profession from 2022 to 2032, which is about as fast as the average for all occupations. The median pay for accountants in May 2022 was $78,000 per year.

However, this figure represents the entire profession. The demand for high-level, specialized expertise—the kind partners provide—remains incredibly strong. As globalization, complex regulations, cybersecurity threats, and the demand for ESG (Environmental, Social, and Governance) reporting continue to grow, the strategic guidance of Big 4 partners will be more critical than ever, ensuring a robust and secure outlook for those who reach this level.

Conclusion

Becoming a partner at a Big 4 firm is the result of a 15-to-20-year journey marked by immense dedication, consistent high performance, and exceptional leadership. The financial rewards reflect this demanding path. For those aspiring to this role, the key takeaways are:

- Compensation is Performance-Based: Your earnings are not a fixed salary but a share in the success you help create for the firm.

- Specialize Wisely: High-demand areas like advisory and specialized tax services offer the highest earning potential.

- Focus on Value Creation: The ultimate driver of your compensation will be your ability to generate revenue, manage key client relationships, and lead teams effectively.

While the path is challenging, achieving the rank of partner at a Big 4 firm offers unparalleled professional fulfillment and a level of financial security that is among the highest in the professional services industry. For those with the ambition and resilience to make the journey, the rewards are well worth the effort.