Introduction: Decoding Your Earning Potential in a Critical Healthcare Role

Are you seeking a career that sits at the very heart of the healthcare industry, a role that combines meticulous detail with significant impact, all without requiring years of medical school? Do you want a profession with a stable, promising future and a clear path to a comfortable income? If so, you may have found your calling as a Medical Billing and Coding Specialist.

This isn't just another administrative job; it's the financial backbone of every hospital, clinic, and physician's office. In this role, you become a translator, converting complex medical diagnoses, procedures, and services into a universal language of alphanumeric codes. This translation is the critical step that allows healthcare providers to be paid for their work, ensuring the entire system can continue to function and care for patients. The national average salary for a proficient billing and coding specialist often hovers between $48,000 and $58,000 annually, with experienced, certified professionals in high-demand areas earning well over $75,000 or more.

I remember once helping an elderly family member decipher a confusing Explanation of Benefits (EOB) from their insurance company. It was a jumble of codes, adjustments, and denials that felt impenetrable. A patient, knowledgeable billing specialist at the clinic spent twenty minutes on the phone with us, calmly explaining what each code meant and why a specific service was initially denied, and outlined the exact steps she was taking to appeal it. In that moment, I truly understood: these specialists aren't just processing paperwork; they are patient advocates, financial detectives, and essential communicators who bring clarity and resolution to a complex system.

This guide is designed to be your definitive resource for understanding the medical billing and coding specialist salary. We will move beyond simple averages and conduct a deep, analytical dive into every factor that influences your paycheck, from your first entry-level position to a senior leadership role. We will explore the job outlook, dissect the skills that command top dollar, and provide a clear, step-by-step roadmap to launch and advance your career.

### Table of Contents

- [What Does a Medical Billing and Coding Specialist Do?](#what-do-they-do)

- [Average Medical Billing and Coding Specialist Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Get Started in This Career](#get-started)

- [Conclusion: Is This Career Right for You?](#conclusion)

---

What Does a Medical Billing and Coding Specialist Do?

At its core, the role of a medical billing and coding specialist is to ensure that healthcare providers are accurately and efficiently compensated for the services they provide. This is a two-part process involving two distinct but deeply intertwined functions: medical coding and medical billing. While some professionals specialize in one area, many handle both, especially in smaller practices.

Medical Coding: The Art of Translation

The "coding" part of the job is an analytical and detail-oriented process. Coders are responsible for reviewing patient charts, which include the physician's notes, lab and radiology results, and other documentation. Their primary task is to translate this information into standardized codes. There are three main code sets they must master:

1. ICD-10-CM (International Classification of Diseases, 10th Revision, Clinical Modification): These are diagnostic codes. They answer the question, "Why did the patient seek care?" Every known disease, symptom, injury, and condition has a corresponding ICD-10 code.

2. CPT (Current Procedural Terminology): These codes describe the actual services the provider performed, such as an office visit, a surgical procedure, or a laboratory test. They answer the question, "What did the doctor do?"

3. HCPCS Level II (Healthcare Common Procedure Coding System): These codes represent medical supplies, equipment, and services not covered by CPT codes, such as ambulance services, durable medical equipment (like walkers or oxygen tanks), and specific drugs.

A coder's accuracy is paramount. An incorrect code can lead to a claim being denied, a provider being underpaid, or even accusations of fraud.

Medical Billing: The Path to Reimbursement

The "billing" part of the job takes the translated codes and uses them to create a "superbill" or claim. This claim is a formal request for payment sent to the patient's insurance company (the payer). The billing specialist's duties include:

- Claim Creation and Submission: Creating accurate claims with all necessary information, including patient demographics, insurance details, and the correct codes.

- Payment Posting: Posting payments from insurance companies and patients to the correct accounts.

- Denial Management and Appeals: Investigating why a claim was denied, correcting any errors, and resubmitting it or filing a formal appeal. This is a critical, problem-solving aspect of the role.

- Patient Invoicing: Billing patients for their portion of the cost, such as deductibles, co-pays, and co-insurance.

- Following Up: Pursuing unpaid claims with insurance companies and patients to ensure timely payment.

### A Day in the Life of a Medical Coder/Biller

To make this more tangible, let's imagine a day for "Alex," a Certified Professional Coder (CPC) working remotely for a mid-sized orthopedic group.

- 8:00 AM: Alex logs into the practice's Electronic Health Record (EHR) system. The first task is to review the "coding queue," which contains patient charts from the previous day's appointments.

- 8:15 AM - 11:00 AM: Alex opens the first chart for a patient who had a knee arthroscopy. Alex carefully reads the surgeon's operative report, the anesthesiologist's notes, and the initial diagnosis. Alex assigns the correct CPT code for the surgical procedure, an ICD-10-CM code for the underlying condition (e.g., a meniscal tear), and any relevant HCPCS codes for supplies used. Alex does this for 15-20 more charts, ranging from simple office visits to complex fracture repairs.

- 11:00 AM - 12:00 PM: Alex switches to the billing software to "scrub" the claims generated from the morning's coding. This software runs an automated check for common errors, but Alex manually reviews a few complex ones to ensure accuracy before they are electronically submitted to various insurance companies like Blue Cross, Aetna, and Medicare.

- 1:00 PM - 3:30 PM: The afternoon is dedicated to "accounts receivable." Alex pulls a report of claims that are over 30 days old. Alex sees a claim that was denied by an insurer for "lack of medical necessity." Alex goes back into the patient's chart, pulls the physician's detailed notes justifying the procedure, drafts a formal appeal letter citing the evidence, and resubmits the claim.

- 3:30 PM - 4:30 PM: Alex takes a few calls from patients who are confused about their bills. Alex calmly explains their EOB, clarifies what their insurance covered, and sets up a payment plan for one patient.

- 4:30 PM - 5:00 PM: Alex finishes the day by running a report on coding productivity and denial rates to send to the practice manager, flagging a recurring denial issue from a specific payer that needs to be addressed.

This snapshot shows the blend of analytical work, problem-solving, and communication that defines the role.

---

Average Medical Billing and Coding Specialist Salary: A Deep Dive

Understanding the earning potential is a primary motivator for anyone exploring a new career. For medical billing and coding specialists, the salary landscape is promising and multifaceted, with significant room for growth. Let's break down the numbers from the most authoritative sources.

### National Averages and Salary Ranges

It's important to look at data from multiple sources to get a well-rounded picture. The U.S. government provides the most reliable baseline, while salary aggregators offer real-time, user-reported data that can capture more nuance.

- U.S. Bureau of Labor Statistics (BLS): The BLS groups these professionals under the category "Medical Records and Health Information Specialists." As of its most recent update (May 2023), the BLS reports:

- Median Annual Wage: $48,780, which means half of the workers in the occupation earned more than that amount and half earned less.

- Lowest 10% Earned: Less than $34,630

- Highest 10% Earned: More than $81,030

This BLS data is the gold standard for its statistical rigor but can sometimes lag behind real-time market trends and may not fully capture the higher earnings of specialists with in-demand certifications.

- Salary.com: This platform often provides slightly higher figures, reflecting data from HR departments. As of late 2023/early 2024, they report for a "Medical Billing and Coding Specialist":

- Median Salary: $56,413

- Typical Range: Between $51,688 and $62,028

- Payscale: Payscale offers detailed breakdowns based on user-reported data, which is excellent for analyzing the impact of experience. As of early 2024, their data shows:

- Average Base Salary: $46,957

- Salary Range: $34,000 to $68,000 per year.

- Glassdoor: This site combines user-reported salaries with job listings. As of early 2024, they report for a "Medical Coder":

- Total Pay Average: $58,639 per year

- Likely Range: $48,000 to $72,000 per year.

Key Takeaway: A reasonable expectation for a national average salary is between $47,000 and $58,000. Entry-level positions will start in the $35,000-$45,000 range, while senior-level, certified specialists can easily push past $70,000, especially in the right location and specialty.

### Salary Progression by Experience Level

Your value—and therefore your salary—grows significantly as you gain experience and prove your accuracy and efficiency. Here is a typical salary trajectory, compiled from Payscale and Salary.com data:

| Experience Level | Typical Years of Experience | Typical Annual Salary Range | Key Responsibilities & Skills |

| :--- | :--- | :--- | :--- |

| Entry-Level Specialist | 0-1 years | $35,000 - $48,000 | Basic data entry, verifying patient information, coding simple charts (e.g., primary care visits), posting payments. Focus is on learning the systems and fundamental codes. |

| Mid-Career Specialist | 2-5 years | $45,000 - $60,000 | Handling more complex coding (e.g., minor procedures, multiple diagnoses), managing claim denials, communicating with payers, beginning to specialize in a medical field. Often holds a core certification like the CPC. |

| Senior Specialist/Auditor | 5-10 years | $55,000 - $75,000+ | Coding complex cases (e.g., major surgeries, oncology), auditing other coders' work for accuracy and compliance, training junior staff, managing difficult appeals, generating high-level financial reports. |

| Manager/Supervisor | 10+ years | $65,000 - $90,000+ | Overseeing a team of coders and billers, managing department workflow, negotiating with insurance companies, ensuring HIPAA and regulatory compliance, developing department policies and budgets. |

### Beyond the Base Salary: Understanding Total Compensation

Your annual salary is only one piece of the compensation puzzle. Many full-time billing and coding specialists receive a comprehensive benefits package that adds significant value.

- Bonuses: Bonuses are common, especially in private practices or billing companies. They are often tied to performance metrics like coding accuracy, the team's "clean claim rate" (the percentage of claims accepted on the first submission), or overall revenue collection. According to Payscale, annual bonuses can range from $500 to over $4,000.

- Profit Sharing: Some private practices offer profit-sharing plans, where employees receive a portion of the company's profits. This can range from $400 to $5,000 or more, depending on the practice's profitability.

- Health Insurance: This is a standard and valuable benefit, with employers typically covering a significant portion of the premium for medical, dental, and vision insurance.

- Paid Time Off (PTO): Includes vacation days, sick leave, and paid holidays.

- Retirement Plans: Access to a 401(k) or 403(b) plan, often with an employer match, is a critical component of long-term financial planning.

- Professional Development: Many employers will pay for continuing education units (CEUs) required to maintain your certification, and some may even pay for you to earn new, advanced certifications. This is a huge perk that directly invests in your future earning power.

When evaluating a job offer, it's crucial to look at the total compensation package, not just the base salary. A job with a slightly lower salary but excellent health benefits, a generous 401(k) match, and paid professional development could be worth far more in the long run.

---

Key Factors That Influence Your Salary

While national averages provide a useful benchmark, your individual salary as a medical billing and coding specialist will be determined by a specific set of factors. Mastering these elements is the key to maximizing your income throughout your career. This is the most critical section for understanding how to actively increase your value in the job market.

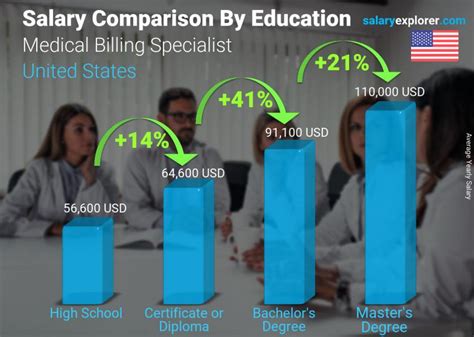

### ### Level of Education and Certification

This is arguably the single most important factor, especially early in your career. While you can technically enter the field with just a high school diploma, your earning potential is significantly capped without formal training and, most importantly, professional certification.

Educational Pathways:

- Certificate/Diploma Program (6-12 months): This is the most common and fastest route. These focused programs, offered by community colleges and vocational schools, teach the fundamentals of medical terminology, anatomy, and the core coding systems (ICD-10, CPT, HCPCS). Graduates are prepared to sit for a certification exam.

- Associate of Applied Science (A.A.S.) Degree (2 years): An associate's degree provides a more comprehensive education. In addition to core coding and billing courses, the curriculum includes general education requirements and deeper dives into topics like healthcare law and ethics, pharmacology, and health information management. This degree often leads to a higher starting salary and can be a stepping stone to a bachelor's degree.

- Bachelor of Science (B.S.) in Health Information Management (HIM) (4 years): While not required for most coding jobs, a bachelor's degree is the standard for advancing into management, compliance, and analyst roles. A degree in HIM qualifies you for the prestigious Registered Health Information Administrator (RHIA) credential, which opens doors to leadership positions with salaries often exceeding $90,000 - $100,000.

The Power of Certification:

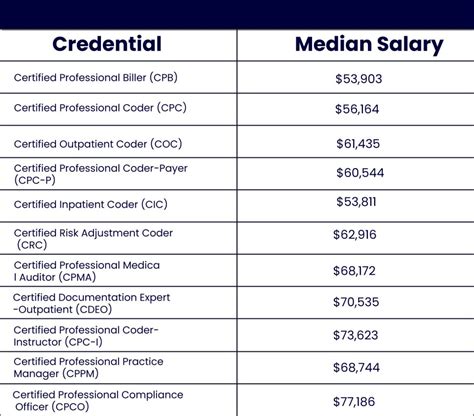

Certification is the industry's stamp of approval. It demonstrates to employers that you have a verified level of knowledge and are committed to the profession. Holding a certification is often a non-negotiable requirement for all but the most basic entry-level jobs. The two main certifying bodies are AAPC and AHIMA.

- AAPC (American Academy of Professional Coders):

- Certified Professional Coder (CPC): This is the gold standard for physician-based coding (outpatient settings like clinics and doctor's offices). Holding a CPC can increase your salary potential by up to 20% compared to non-certified coders, according to AAPC's own salary survey. The average salary for a CPC holder is approximately $58,885.

- Certified Outpatient Coder (COC): Formerly CPC-H, this is for coding in hospital outpatient facilities, like emergency departments or ambulatory surgery centers.

- Certified Inpatient Coder (CIC): This is for hospital inpatient coding, which is generally more complex and often comes with higher pay.

- AHIMA (American Health Information Management Association):

- Certified Coding Associate (CCA): An entry-level credential that demonstrates fundamental coding competency.

- Certified Coding Specialist (CCS): A more advanced credential that is highly respected, particularly in the hospital setting (inpatient and outpatient). It signifies mastery of both major code sets. CCS-certified professionals often command higher salaries, on par with or sometimes exceeding those with a CPC.

- Certified Coding Specialist – Physician-based (CCS-P): Similar to the CPC, this focuses on physician-based settings.

Impact on Salary: The message is clear: get certified. An uncertified coder will struggle to get past the $40,000 mark in most markets. A certified coder immediately jumps into the $45,000-$55,000 range, with the door wide open for further growth.

### ### Years of Experience

As detailed in the previous section, experience is a direct driver of salary. However, it's not just about the number of years; it's about the *quality* and *diversity* of that experience.

- 0-2 Years (Foundation Building): Your salary will be in the entry-level range. The goal here is to absorb as much as possible. Seek roles that expose you to different types of coding, even if the pay is modest. Your primary asset is your accuracy and willingness to learn.

- 2-5 Years (Proficiency and Speed): You've moved beyond the basics. You can code accurately and efficiently. You understand the revenue cycle and can troubleshoot common denials. This is where you'll see your first significant salary jumps, moving firmly into the national average range. You should be holding a core certification like the CPC or CCS.

- 5-10 Years (Expertise and Specialization): You are now a seasoned professional. You can handle the most complex cases, your accuracy is impeccable, and you may be the go-to person for difficult questions. This is the ideal time to pursue a specialty certification (see below), which will unlock the next tier of earnings, pushing you into the $65,000+ range.

- 10+ Years (Leadership and Strategy): With a decade or more of experience, you are qualified for leadership roles. You can become a coding auditor, a compliance officer, a revenue cycle manager, or a department supervisor. These roles leverage your deep expertise for strategic purposes and come with leadership-level salaries.

### ### Geographic Location

Where you live and work has a massive impact on your paycheck. Salaries are adjusted for the local cost of living and the demand for healthcare services. The rise of remote work has slightly flattened these differences, but location remains a powerful factor.

Top-Paying States: States with high costs of living and large, complex healthcare systems tend to pay the most. According to BLS data and salary aggregators, the highest-paying states for this profession include:

1. District of Columbia: Average salaries often exceed $65,000.

2. New Jersey: A hub for pharmaceutical and healthcare companies, with averages around $63,000 - $65,000.

3. California: Major metropolitan areas like San Francisco, San Jose, and Los Angeles offer high salaries (often $60,000 - $70,000+) to offset the high cost of living.

4. Maryland: Proximity to D.C. and a robust healthcare sector lead to high wages.

5. Massachusetts: Home to world-renowned hospitals and a thriving biotech industry.

Top-Paying Metropolitan Areas:

- San Jose-Sunnyvale-Santa Clara, CA

- San Francisco-Oakland-Hayward, CA

- Trenton, NJ

- New York-Newark-Jersey City, NY-NJ-PA

Lower-Paying States: Conversely, states with a lower cost of living and more rural populations will typically have lower average salaries, often in the $38,000 - $45,000 range. These can include states like Mississippi, Alabama, Arkansas, and West Virginia. However, the lower cost of living can make these salaries go much further than a higher salary in an expensive city.

### ### Company Type & Work Environment

The type of facility you work for significantly influences your salary, responsibilities, and career path.

- Large Hospitals and Health Systems: These are often the highest-paying employers. They offer excellent benefits, stability, and abundant opportunities for specialization (e.g., working only on cardiology or oncology cases). You might work as an inpatient coder, which is more complex and commands a higher salary than outpatient coding. The average salary in a large hospital system can be 10-15% higher than in a small practice.

- Physician's Offices and Small Clinics: These settings may offer slightly lower starting salaries, but they provide invaluable experience. You will likely be a "jack-of-all-trades," handling both coding and billing, talking to patients, and managing the entire revenue cycle. This broad experience is highly valuable early in your career.

- Third-Party Billing Companies/Revenue Cycle Management (RCM) Firms: These companies are hired by practices and hospitals to handle their billing and coding. They can be high-pressure, production-focused environments, but they are an excellent place to learn quickly and be exposed to multiple medical specialties. Salaries are competitive but often heavily tied to performance bonuses.

- Government Agencies: Working for an organization like the Department of Veterans Affairs (VA) or a military hospital offers incredible job security and federal benefits. The salary may not reach the absolute highest peaks of the private sector, but the total compensation package is often superior.

- Remote Work: The demand for remote coders has exploded. This offers flexibility and removes geographic barriers. Remote salaries tend to align with the national average or the average of the company's location, not necessarily the employee's. A company based in California might pay a remote worker in Texas a California-level wage, which is a significant advantage.

### ### Area of Specialization

Just as doctors specialize, so do coders. Gaining expertise in a complex and lucrative medical specialty is one of the fastest ways to increase your salary. General family practice coding is the baseline; specialized coding is the next level.

High-Value Specialties:

- Surgical Coding: Coding for complex surgical procedures requires an in-depth understanding of anatomy and surgical techniques. It's a high-stakes area where accuracy is critical, and surgical coders are well-compensated.

- Interventional Radiology: This field involves minimally invasive, image-guided procedures and has its own complex set of coding rules. It is a highly sought-after and well-paid specialty.

- Oncology and Hematology: Coding for cancer treatment involves complex drug regimens (chemotherapy), radiation therapy, and multiple stages of care, making it a challenging and rewarding specialty.

- Cardiology: From diagnostic tests to complex catheterizations and heart surgeries, cardiology coding is intricate and in high demand.

- Risk Adjustment Coding (CRC - Certified Risk Adjustment Coder): This is a rapidly growing field. Risk adjustment coders review patient charts to ensure all chronic conditions are properly documented. This data is used to predict healthcare costs for certain patient populations (especially in Medicare Advantage plans). CRCs are in high demand and often command salaries $5,000 - $15,000 higher than general coders.

### ### In-Demand Skills

Beyond certifications and experience, a specific set of hard and soft skills can make you a more valuable—and higher-paid—employee.

Hard Skills:

- EHR/EMR Software Proficiency: Expertise in major Electronic Health Record systems like Epic, Cerner, or Allscripts is a huge plus.

- Code Set Mastery: Deep, fluent knowledge of ICD-10-CM, CPT, and HCPCS Level II is the absolute foundation.

- Medical Terminology and Anatomy: You must be able to understand the language of medicine to be an effective coder.

- Compliance and Auditing Knowledge: Understanding HIPAA, fraud and abuse laws (Stark Law, Anti-Kickback Statute), and how to perform internal audits is a high-level skill that leads to senior roles.

- Data Analysis: The ability to use tools like Excel to analyze denial trends, coder productivity, and payer performance is increasingly valuable.

Soft Skills:

- Extreme Attention to Detail: A single misplaced digit in a code can cause a claim to be denied. Meticulousness is not optional.

- Analytical and Investigative Skills: When a claim is denied, you must become a detective, figuring out the "why" and building