Introduction

What does it truly mean to reach the pinnacle of the world's largest asset manager? For many ambitious finance professionals, the title "Managing Director" at BlackRock represents more than just a job—it's the culmination of a decade or more of relentless dedication, strategic brilliance, and exceptional performance. It signifies a position of immense responsibility, shaping the flow of trillions of dollars and influencing the global economy. Naturally, with such a high-stakes role comes a level of compensation that places it among the most lucrative in the professional world. A Managing Director role at BlackRock is not just a career achievement; it's a life-altering one, with total compensation packages frequently entering the seven-figure range.

While the exact figures are closely guarded, aggregated data and industry insights paint a clear picture of substantial financial rewards, often comprising a significant base salary augmented by performance-based bonuses that can dwarf the base itself. In my years as a career analyst, I've seen countless professionals aspire to this level. I once mentored a young analyst whose eyes would light up when discussing the strategic complexity of BlackRock's Aladdin platform. For her, the MD title wasn't just about the money; it was about earning a seat at the table where the future of investment technology was being decided. That's the dual allure of this role: profound impact matched by extraordinary reward.

This comprehensive guide will demystify the BlackRock Managing Director position. We will dissect the salary structure, explore the myriad factors that dictate earnings, analyze the career trajectory, and provide a detailed roadmap for those who dare to aim for this apex of the financial industry.

### Table of Contents

- [What Does a BlackRock Managing Director Do?](#what-does-a-blackrock-managing-director-do)

- [Average BlackRock Managing Director Salary: A Deep Dive](#average-blackrock-managing-director-salary-a-deep-dive)

- [Key Factors That Influence a BlackRock MD's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Senior Financial Leaders](#job-outlook-and-career-growth)

- [How to Become a Managing Director at BlackRock](#how-to-get-started-in-this-career)

- [Conclusion: Is the Climb to MD Worth It?](#conclusion)

What Does a BlackRock Managing Director Do?

The title "Managing Director" (MD) at BlackRock is not a monolith. It is the highest senior-level title before the firm's executive leadership committee, and MDs are the key leaders, revenue generators, and strategic visionaries across the firm's vast ecosystem. While their specific duties vary dramatically depending on their group—from Portfolio Management to Sales, or from Technology to Risk—their core responsibilities coalesce around four key pillars: Leadership, Commercial Impact, Strategy, and Risk Management.

An MD is far more than just an exceptional individual contributor. They are leaders of teams, often overseeing a department or a significant business function. This involves mentoring and developing talent, setting team goals, managing performance, and fostering a culture of excellence and collaboration. They are responsible for the "people" aspect of the business, ensuring their teams are motivated, skilled, and aligned with the firm's objectives.

Commercially, an MD is expected to have a direct and measurable impact on the firm's bottom line. For a Portfolio Manager, this means delivering superior investment returns (alpha). For a salesperson or relationship manager, it means cultivating and expanding relationships with institutional clients like pension funds and sovereign wealth funds, bringing in and retaining assets under management (AUM). For an MD within the Aladdin business, it means driving the adoption and success of BlackRock's proprietary technology platform. They own a P&L (Profit and Loss) and are accountable for its performance.

Strategically, MDs are expected to think beyond the day-to-day. They contribute to the long-term vision of their business group and the firm at large. This could involve identifying new investment opportunities, developing new products, pushing into new geographic markets, or innovating on the firm's technological infrastructure. They are the on-the-ground experts whose insights inform the decisions made by BlackRock's most senior executives.

Finally, in a firm that manages over $10 trillion in assets, risk management is paramount. Every MD is a steward of the firm's capital and reputation. They are responsible for identifying, assessing, and mitigating risks within their domain, whether it's market risk, operational risk, or reputational risk.

### A "Day in the Life" of a BlackRock Managing Director (Portfolio Management)

To make this tangible, consider a hypothetical day for an MD in the Active Equities division:

- 5:30 AM: Wake up, scan global market news (Bloomberg, Financial Times, Wall Street Journal) while checking pre-market activity in the U.S. and closing positions in Asia.

- 7:00 AM: Arrive at the office. Attend the morning research meeting with analysts and junior portfolio managers. Debate overnight news, review analyst reports, and discuss potential shifts in portfolio positioning.

- 9:00 AM: The team's weekly strategy call. The MD leads a discussion on macroeconomic trends, sector allocations, and performance attribution for the previous week. They challenge assumptions and make final decisions on tactical trades.

- 10:30 AM: A call with a major institutional client. The MD provides a detailed update on the fund's performance, explains their current investment thesis, and answers sophisticated questions about risk exposure and market outlook.

- 12:00 PM: Lunch with a sell-side analyst from a major investment bank to get their perspective on a specific industry or company.

- 1:30 PM: One-on-one meeting with a Vice President on the team for a career development and coaching session.

- 2:30 PM: A deep-dive session with the quantitative research team to review a new risk model they are proposing for the portfolio.

- 4:00 PM: U.S. market close. Review the day's trades and the portfolio's final performance.

- 4:30 PM: Internal meeting with other MDs from different investment groups to discuss cross-asset opportunities and firm-wide strategic initiatives, such as a new push into sustainable investing.

- 6:00 PM: Begin reviewing materials for the next day, respond to critical emails, and prepare for an early-morning call with the London office.

- 7:30 PM: Depart the office for a client dinner or industry event.

This schedule highlights the intense blend of market analysis, client service, people management, and strategic thinking that defines the role.

Average BlackRock Managing Director Salary: A Deep Dive

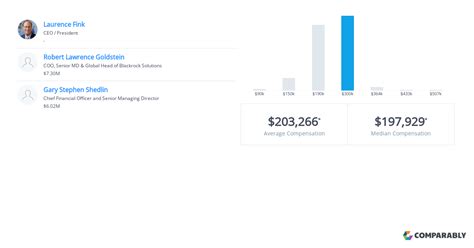

Dissecting the compensation for a BlackRock Managing Director requires looking beyond a simple salary figure. The total reward is a complex package, heavily weighted towards variable, performance-based pay. While BlackRock does not publicly disclose its compensation structure, a wealth of self-reported data from current and former employees on platforms like Glassdoor and Levels.fyi, combined with industry reports, allows us to construct a highly accurate picture.

As of late 2023 and early 2024, the total compensation for a Managing Director at BlackRock in a major financial hub like New York City typically ranges from $800,000 to over $2,500,000 annually. For top-performing MDs in high-impact groups, total compensation can be significantly higher.

This figure is comprised of three main components:

1. Base Salary: This is the fixed, guaranteed portion of the compensation. It provides a stable foundation but represents a smaller part of the overall package compared to the bonus. For an MD, the base salary is substantial, ensuring a high standard of living irrespective of annual performance.

- Typical Range: $350,000 to $500,000. According to Glassdoor data, the estimated base pay for a BlackRock MD is around $397,000 per year (Glassdoor, 2024).

2. Annual Bonus (Cash): This is the primary variable component and is where performance is most directly rewarded. The bonus is highly discretionary and is determined by a combination of individual performance, team/group performance, and overall firm profitability. An MD who has had a stellar year in a group that has also outperformed can expect a bonus that is a significant multiple of their base salary.

- Typical Range: $400,000 to $1,500,000+. The bonus can range from 1x to 4x+ the base salary.

3. Long-Term Incentives (LTI) & Deferred Compensation: To retain top talent and align their interests with the long-term success of the firm, a significant portion of the variable compensation is often delivered as deferred stock or other long-term incentive plans. This equity typically vests over a multi-year period (e.g., three to five years), creating powerful "golden handcuffs" that discourage senior talent from leaving.

- Typical Value: This can add another $100,000 to $500,000+ to the annual compensation value, depending on the grant size and stock performance.

### Compensation Breakdown by Career Stage (within the MD rank)

The MD title itself has an internal hierarchy and pay scale based on tenure, scope of responsibility, and impact. We can break it down into three general tiers:

| MD Tier | Typical Experience at MD Level | Estimated Base Salary Range | Estimated Total Compensation Range | Key Characteristics |

| --------------------- | ------------------------------ | --------------------------- | -------------------------------- | ------------------------------------------------------------------------------------------------------- |

| Newly Promoted MD | 0-3 years | $350,000 - $425,000 | $750,000 - $1,200,000 | Recently promoted from Director. Still building their leadership brand and P&L responsibility. |

| Established MD | 3-8 years | $400,000 - $475,000 | $1,000,000 - $2,000,000 | Manages a significant team or client book. Consistent track record of high performance. A key leader. |

| Senior/Group Head MD | 8+ years | $450,000 - $500,000+ | $2,000,000 - $5,000,000+ | Leads a major business line or region. Significant strategic influence. Part of the firm's top leadership circle. |

*(Source: Analysis based on aggregated data from Glassdoor, Levels.fyi, Wall Street Oasis forums, and industry compensation reports, 2023-2024. These are estimates for a New York-based role and can vary significantly.)*

It is crucial to understand that the "bonus" culture is central to Wall Street and asset management. The year-end number is what truly matters. A weak bonus year, even with a high base salary, is seen as a negative signal about performance and future prospects at the firm. Conversely, a blockbuster bonus solidifies an MD's standing and influence.

Key Factors That Influence a BlackRock MD's Salary

The wide range in total compensation—from under $1 million to several million dollars—is not arbitrary. It's driven by a precise, albeit complex, set of factors. For anyone aspiring to this level, understanding these drivers is as important as mastering the technical skills of finance. Here, we delve into the six most critical elements that determine an MD's paycheck.

### 1. Business Unit and Area of Specialization

This is arguably the most significant factor. Where an MD sits within BlackRock's sprawling organization has a direct correlation with their earning potential. Compensation is tightly linked to the revenue, profitability, and strategic importance of their specific group.

- Alpha-Generating vs. Beta-Generating Roles: MDs in "alpha-generating" active management roles (e.g., Active Equities, Hedge Funds, Private Equity, Private Credit) generally have higher compensation potential. Their pay is directly linked to performance fees (carry or "promote" in private markets), which can be immense in good years. An MD running a successful multi-billion dollar private credit fund will have a vastly different pay ceiling than one managing an index fund.

- Alternatives (Private Markets): This is currently one of the most lucrative areas. As institutional investors pour capital into private equity, infrastructure, and private credit, the MDs who source, execute, and manage these deals are exceptionally well-compensated. Their pay structure often includes a share of the "carried interest," which is the fund's share of profits—a potentially enormous sum.

- Sales & Relationship Management: Top MDs in institutional sales who manage relationships with massive sovereign wealth funds or state pension plans can also earn enormous sums. Their bonus is tied to "net flows"—how much new money they bring into the firm and retain. Securing a single $500 million mandate can translate into a massive bonus.

- Aladdin (Technology): The Aladdin platform is BlackRock's "crown jewel." An MD in a commercial or strategic role for Aladdin has high earning potential, as they are driving a high-margin, scalable technology business that is core to the firm's identity and future growth.

- iShares (ETFs): While often seen as a "beta" business, the sheer scale of iShares is staggering. An MD in a strategic product development or sales role within iShares can be extremely well-compensated, though perhaps with a slightly lower ceiling than a top-performing private equity MD.

- Cost Centers (Risk, Compliance, Operations): While absolutely critical to the firm, roles in functions not directly tied to revenue generation typically have lower variable compensation. An MD in Risk Management will be highly paid, but their bonus pool is generally smaller than that of their counterparts in client-facing or investment roles.

### 2. Individual and Group Performance (The P&L)

At the MD level, you eat what you kill. Performance is everything. This is measured against specific, pre-agreed-upon Key Performance Indicators (KPIs).

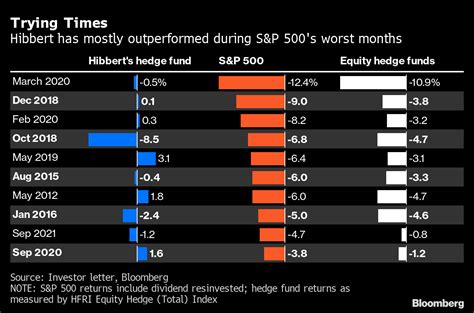

- For Portfolio Managers: The primary metric is investment performance relative to a benchmark and peers. Generating "alpha" (excess return) is the goal. Other factors include risk-adjusted returns (Sharpe ratio) and managing the portfolio within its stated risk parameters.

- For Sales Professionals: The metric is clear: AUM growth and net new business. How much money did you and your team bring in? How many key client relationships did you win or deepen?

- For Functional Leaders: Performance might be measured by successful project execution, budget management, improvements in efficiency, or mitigation of specific risks.

The performance of the MD's entire group or business unit is just as important. An individual can have a great year, but if their division misses its overall revenue targets, the bonus pool for that group will shrink, impacting everyone's final number.

### 3. Geographic Location

Where an MD is physically based has a significant impact on their salary, driven by cost of living, local market competition for talent, and the strategic importance of the office.

- Tier 1 Hubs (New York, London): These are the epicenters of global finance and command the highest compensation packages. The concentration of talent, clients, and deal flow in these cities necessitates top-tier pay to attract and retain the best. A New York-based MD represents the benchmark for peak earnings.

- Tier 2 Hubs (Hong Kong, San Francisco, Singapore): These are also major financial centers with extremely high compensation, often on par with or just slightly below New York and London. San Francisco, with its proximity to the tech and venture capital world, can offer particularly high pay for MDs focused on those sectors. Hong Kong and Singapore are gateways to the vast Asian market.

- Tier 3 Hubs (Zurich, Frankfurt, Boston, Chicago): These cities have robust financial industries and host significant BlackRock operations. Compensation is still exceptional but may carry a slight discount (5-15%) compared to Tier 1 locations.

- Regional Offices (Atlanta, Wilmington, Edinburgh): BlackRock has large operational hubs in these cities. While the cost of living is lower, so is the compensation for senior roles. An MD in a non-investment, operational role in Atlanta might earn significantly less than a client-facing MD in New York, though their salary would still be in the high six figures and place them at the very top of the local market.

### 4. Level of Education and Credentials

By the time a professional reaches the MD level, their undergraduate institution is less important than their track record. However, certain advanced degrees and certifications are table stakes and serve as powerful signaling mechanisms.

- MBA (Master of Business Administration): An MBA from a top-tier "M7" school (Harvard, Stanford, Wharton, etc.) is the most common and valuable credential. It provides a rigorous analytical toolkit, but more importantly, it provides an unparalleled professional network that is invaluable for business development and career progression. Many MDs who didn't start their careers in finance use a top MBA as their entry point.

- CFA (Chartered Financial Analyst): The CFA charter is the gold standard for investment management professionals. It demonstrates a deep and comprehensive mastery of investment analysis, portfolio management, and ethics. For MDs in investment-centric roles (portfolio management, research), holding the CFA charter is almost a prerequisite. It signals a serious commitment to the craft.

- -CAIA (Chartered Alternative Investment Analyst): As alternative investments become more central to BlackRock's strategy, the CAIA designation has grown in prominence. It's particularly valuable for MDs in the private equity, hedge fund, and real estate groups.

### 5. Years of Experience and Career Trajectory

There is no shortcut to the MD title. It is a rank earned over time through consistent, high-level performance. The typical career path at a firm like BlackRock is highly structured:

1. Analyst (2-3 years)

2. Associate (3-4 years)

3. Vice President (VP) (4-6 years)

4. Director (4-6 years)

5. Managing Director

This path typically takes 12 to 20 years. An MD is expected to have deep domain expertise built over a long and successful career. A "new" MD is likely in their mid-to-late 30s at the absolute earliest, with most reaching the rank in their early 40s. A Senior MD who leads a large division will have 20-25+ years of experience. This deep well of experience, judgment, and client trust is precisely what the firm is paying for. The salary and bonus potential grows substantially with each step up this ladder, with the jump from Director to MD being the most significant in terms of both responsibility and compensation.

### 6. In-Demand Skills

Beyond credentials and experience, a specific set of high-value skills can dramatically increase an MD's worth to the firm.

- Technical Skills: While an MD may not be building financial models from scratch daily, they must possess a deep understanding of them. For quantitative roles, proficiency in Python, R, and SQL is increasingly required. For all MDs, expertise in the Aladdin platform is non-negotiable.

- Leadership and People Management: An MD's success is tied to their team's success. The ability to recruit, mentor, and lead high-performing teams is a skill that directly translates into higher compensation.

- Client Relationship Management & Salesmanship: For client-facing MDs, the ability to build trust, communicate a complex investment thesis clearly, and ultimately persuade a client to entrust the firm with billions of dollars is the most valuable skill they possess.

- Strategic and Commercial Acumen: This is the ability to see the bigger picture, identify new revenue opportunities, and think like a business owner. An MD who can successfully pitch and launch a new product or strategy that gathers billions in AUM is invaluable.

- Specialized Knowledge (ESG, Technology, etc.): MDs with deep expertise in high-growth, in-demand areas like Environmental, Social, and Governance (ESG) investing, or the application of AI/Machine Learning in portfolio management, can command a premium.

Job Outlook and Career Growth for Senior Financial Leaders

While the U.S. Bureau of Labor Statistics (BLS) does not track "Managing Director" as a specific job category, we can analyze the outlook for related, broader professions like "Top Executives" and "Financial Managers" to understand the macroeconomic trends shaping this career path.

The BLS projects that employment for Top Executives will grow by 3 percent from 2022 to 2032, which is about as fast as the average for all occupations. This translates to about 213,900 openings each year, on average, over the decade. Most of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire (BLS, 2023).

For Financial Managers, the outlook is significantly more robust. The BLS projects a 16 percent growth in employment from 2022 to 2032, which is much faster than the average for all occupations. This will result in about 79,100 openings each year. The BLS attributes this strong growth to the increasing complexity of the global financial environment and a growing need for expertise in financial and investment management.

What does this mean for an aspiring BlackRock MD?

1. Fierce Competition for Top Roles: The "Top Executive" data suggests that while the overall number of senior leadership positions is growing slowly, competition for the most prestigious roles—like an MD at BlackRock—will remain incredibly intense. There are far more qualified Directors and VPs than there are available MD slots.

2. Growth is in Complexity: The "Financial Manager" data is more telling. The asset management industry is not just growing; it's becoming more complex. The demand is for leaders who can navigate intricate new products (private credit, infrastructure), new regulations, and new technologies (AI, data science). This is where the opportunity lies.

### Emerging Trends and Future Challenges

The path to MD and the nature of the role itself are being reshaped by several powerful trends:

- The Rise of Alternatives: The explosive growth in private markets is the single biggest trend. Aspiring MDs must develop an understanding of illiquid assets, as this is where the highest fees and growth are concentrated.

- Technology and AI Integration: AI will not replace the MD, but it will augment their capabilities. MDs of the future must be tech-savvy leaders who can leverage data science, machine learning models, and platforms like Aladdin to make better investment and business decisions. Those who cannot adapt will be left behind.

- Fee Compression in Public Markets: The relentless downward pressure on fees for traditional stocks and bonds (especially index funds) means that MDs in these areas must justify their value through scale, efficiency, or demonstrable alpha.

- The ESG Mandate: Sustainable investing is no longer a niche. It is a core component of institutional client demands. MDs across all functions must be fluent in ESG principles and be able to integrate them into their investment process and client conversations.

### How to Stay Relevant and Advance

For those already on the path, staying relevant and positioning for the final promotion to MD requires a forward-looking approach:

- Develop a "Spike": Become the go-to expert in a high-growth area. This could be a specific type of alternative investment, a particular application of technology, or a deep understanding of ESG integration.

- Embrace a Commercial Mindset Early: Don't wait until you're a Director to think about the P&L. From the Associate level onwards, constantly ask how your work contributes to the bottom line. Propose ideas that can generate revenue or improve efficiency.

- Build Your Network Internally and Externally: Your performance gets you to the VP level. Your network gets you to MD. Cultivate strong relationships with senior leaders across different divisions within the firm. Be visible. Externally, build a network of clients, peers at other firms, and industry contacts.

- Never Stop Learning: The financial world is dynamic. Continuously update your skills. If you see AI becoming important in your group, take an online course. If clients are asking about infrastructure, read everything you can. The learning never stops.

How to Become a Managing Director at BlackRock: The Long-Term Playbook

The journey to becoming a Managing Director at a firm like BlackRock is a marathon, not a sprint. It requires a deliberate, multi-stage strategy that begins with foundational education and extends through decades of dedicated professional excellence. Here is a step-by-step guide for aspiring professionals.

### Step 1: Build an Elite Educational Foundation (Ages 18-22)

The path typically begins at a "target" or "semi-target" university. These are schools from which top-tier investment banks and asset managers actively recruit.

- Academics: Pursue a degree in a rigorous, quantitative field like Finance, Economics, Computer Science, Engineering, or Mathematics. A high GPA (3.7+) is essential to pass the initial resume screens.

- Extracurriculars: Participate in finance clubs, investment competitions, and student-managed investment funds. Take on leadership roles to demonstrate initiative and teamwork.

### Step 2: Secure Prestigious Internships (Summers during University)

Internships are the primary gateway to a full-time offer. The goal is to secure a "bulge bracket" investment banking or asset management internship after your junior year.

- Networking: Start early. Use your university's alumni network to connect with professionals for informational interviews. Attend career fairs and company presentations.

- Preparation: Prepare relentlessly for technical interviews. You