Navigating your career path in California means understanding not just your job duties, but also the state's specific labor laws that govern your compensation. One of the most critical concepts is the "exempt" employee classification, which determines eligibility for overtime pay. For 2025, the minimum salary to qualify for this status is projected to be $66,560 per year.

However, this figure is a legal floor, not a career ceiling. Most exempt professionals in the Golden State earn significantly more, with salaries for specialized roles in major metro areas often exceeding $150,000. This guide will break down the 2025 exempt salary threshold, what it means to be an exempt employee, and the key factors that will drive your actual earnings well beyond this legal minimum.

What Does It Mean to Be an Exempt Employee in California?

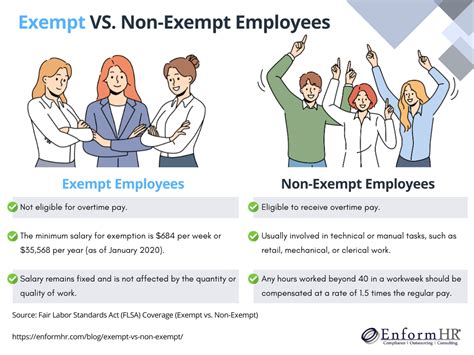

Being an "exempt employee" is not a job title but a legal classification under California labor law. An exempt employee is "exempt" from certain wage and hour regulations, most notably overtime pay, minimum wage, and meal and rest break requirements.

To be legally classified as exempt in California, an employee must meet three strict criteria, often called the "three-part test":

1. Salary Basis Test: The employee must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

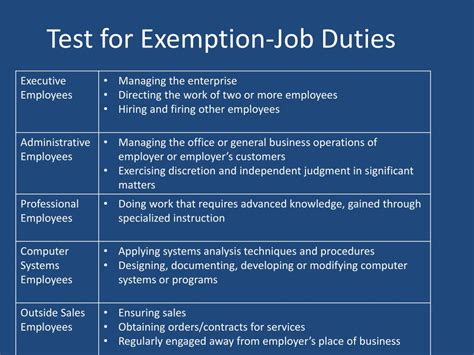

2. Duties Test: The employee's primary duties must consist of executive, administrative, or professional tasks as defined by state law. This involves work that is intellectual or creative in nature and requires the exercise of discretion and independent judgment.

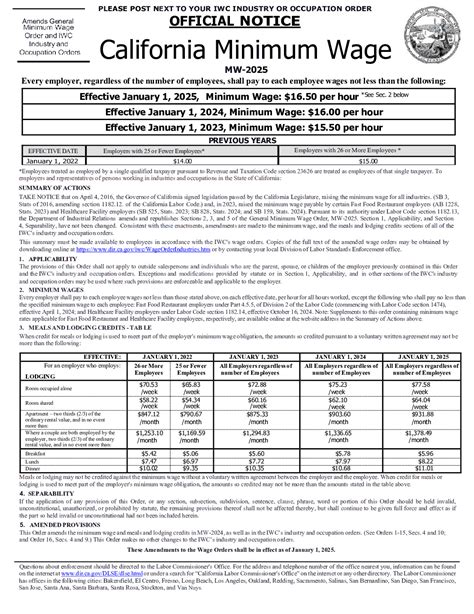

3. Salary Level Test: The employee must earn a monthly salary that is at least two times the state's minimum wage for full-time employment (40 hours/week). This is the focus of our 2025 analysis.

If an employee does not meet *all three* of these requirements, they are considered "non-exempt" and are entitled to overtime pay and other protections.

California's Minimum Exempt Salary for 2025

The minimum salary threshold for exempt employees in California is directly tied to the statewide minimum wage. The formula is:

(State Minimum Wage x 2) x 40 hours x 52 weeks

As of 2024, California's minimum wage is $16.00 per hour. While the rate for 2025 is subject to a final inflation-based adjustment, it is currently projected to remain at $16.00 per hour.

Based on this, the calculation for the 2025 minimum exempt salary is:

- Hourly equivalent: $16.00/hour x 2 = $32.00/hour

- Weekly salary: $32.00 x 40 hours = $1,280/week

- Annual salary: $1,280 x 52 weeks = $66,560/year

Therefore, to classify an employee as exempt in 2025, an employer must pay them a salary of at least $66,560 per year, in addition to the employee satisfying the duties test.

Important Exceptions: Certain professions, like computer software professionals and physicians, have their own higher minimum salary thresholds for exemption, which are adjusted annually for inflation by the California Department of Industrial Relations.

Key Factors That Influence Your *Actual* Salary (Above the Minimum)

The $66,560 figure is the legal starting line, not the finish line. Your actual compensation as a professional in California will be determined by a combination of factors that reflect your value in the job market.

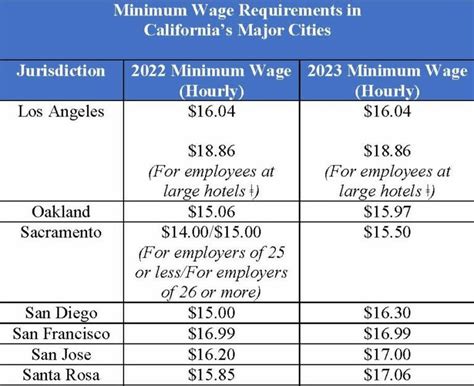

### Geographic Location

Where you work in California has a massive impact on your earnings. Major metropolitan areas with high costs of living and concentrated industries command significantly higher salaries.

- Top-Tier Markets (San Francisco Bay Area, Los Angeles, San Diego): Professionals in these regions often earn 20-40% above the state average for the same role due to intense competition for talent and high living expenses.

- Mid-Tier Markets (Sacramento, Orange County): These areas offer strong salaries that are typically above the state average but are more moderate than the Bay Area.

- Developing Markets (Central Valley, Inland Empire): While salaries here are lower, the cost of living is also significantly less, providing a different kind of financial advantage.

For example, according to 2024 data from Salary.com, the average salary for a Marketing Manager in Los Angeles is around $135,000, while the same role in Fresno averages closer to $118,000.

### Years of Experience

Experience is one of the most reliable predictors of salary growth. Companies pay a premium for seasoned professionals who can solve complex problems, mentor junior staff, and operate with minimal supervision.

- Entry-Level (0-2 years): Salaries will be closer to the market base rate for that specific role, but still well above the state exempt minimum.

- Mid-Career (3-8 years): Professionals can expect substantial salary increases as they prove their value and take on more responsibility.

- Senior/Lead (8+ years): Senior-level experts and managers command the highest salaries, often exceeding $200,000 in high-demand fields.

### Area of Specialization (Job Role)

This is perhaps the single most important factor. The "exempt" classification covers a vast range of professions, each with its own unique market value. High-demand fields like technology, engineering, and specialized finance will always have higher average salaries.

Here are a few examples of typical exempt roles in California and their average salary ranges (Source: Glassdoor & BLS, 2024 data for California):

- Software Engineer: $110,000 (entry-level) to $220,000+ (senior/staff)

- Human Resources Manager: $95,000 to $165,000

- Financial Analyst: $80,000 to $140,000

- Project Manager (Construction): $100,000 to $175,000

- Registered Nurse (often exempt in administrative/management roles): $115,000 to $180,000+

### Level of Education

While experience often trumps education later in a career, your academic background plays a crucial role, especially early on. Advanced degrees can unlock specialized, higher-paying roles. A Master of Business Administration (MBA), a Ph.D. in a technical field, or a professional certification (like a PMP for project managers or a CPA for accountants) can significantly increase your earning potential.

### Company Type and Industry

The type of company you work for and its industry shape compensation philosophies.

- Industry: A software engineer at a major tech firm in Silicon Valley will almost certainly earn more than a software engineer at a non-profit organization or a small retail company.

- Company Size: Large, publicly traded corporations generally have more structured (and often higher) pay scales than early-stage startups or small businesses.

Job Outlook for Exempt Professional Roles in California

The job outlook for the types of roles typically classified as exempt—namely, professional, administrative, and executive positions—is very strong in California. According to the U.S. Bureau of Labor Statistics (BLS), employment in Management Occupations and Business and Financial Operations Occupations is projected to grow faster than the average for all occupations through the next decade.

Key growth sectors in California that heavily employ exempt professionals include:

- Technology and Information Services

- Healthcare and Social Assistance

- Professional, Scientific, and Technical Services

- Logistics and Transportation Management

This sustained demand for high-skilled labor ensures that compensation for these roles will remain competitive and continue to rise, far outpacing the state-mandated minimums.

Conclusion: Your Path Forward

As you plan your career in California for 2025 and beyond, remember these key takeaways:

1. The $66,560 Threshold is a Legal Minimum: It is a compliance requirement for employers, not a benchmark for what a skilled professional should earn.

2. Your Value is Multi-Faceted: Your actual salary is a reflection of your specific role, experience, skills, location, and the industry you work in.

3. Know Your Rights: Understand the duties test to ensure you are classified correctly. If your job doesn't involve significant independent judgment and discretion, you may be entitled to overtime pay, regardless of your salary.

4. Focus on Growth: The path to a higher salary lies in gaining valuable experience, pursuing continuous education, specializing in a high-demand field, and strategically choosing your location and industry.

California's dynamic economy offers immense opportunities for dedicated professionals. By understanding the legal landscape and focusing on the factors that truly drive value, you can build a rewarding and financially prosperous career in the Golden State.