A manager position at PricewaterhouseCoopers (PwC), one of the prestigious "Big Four" accounting and professional services firms, represents a significant milestone in any finance, accounting, or consulting career. It’s a role that signifies leadership, deep expertise, and the responsibility of driving client success. But beyond the prestige, what is the tangible financial reward?

This article provides a data-driven look into the salary of a PwC Manager in the United States. While individual compensation can vary, a Manager at PwC can expect an average total compensation package ranging from $130,000 to over $190,000 annually, with significant potential for growth based on performance, location, and specialization.

What Does a PwC Manager Do?

Before diving into the numbers, it's essential to understand the role. A PwC Manager is far more than just an experienced accountant or consultant. They are the linchpin of client engagements, responsible for managing projects, leading teams of associates and senior associates, and serving as the primary point of contact for clients.

Key responsibilities include:

- Project Management: Overseeing the planning, execution, and completion of client engagements, ensuring they are delivered on time and within budget.

- Team Leadership: Mentoring, coaching, and developing junior staff, fostering a collaborative and high-performance team environment.

- Client Relationship Management: Building and maintaining strong relationships with clients, understanding their needs, and ensuring their expectations are met and exceeded.

- Technical Expertise: Applying deep subject matter knowledge in areas like audit, tax compliance, M&A strategy, or cybersecurity to solve complex client problems.

- Business Development: Assisting senior leaders in identifying new business opportunities and contributing to proposals and practice development.

The specific duties vary significantly depending on the Manager's line of service—Assurance, Tax, or Advisory.

Average PwC Manager Salary

Salary data from multiple authoritative sources indicates a highly competitive compensation structure for PwC Managers. It's important to consider both base salary and total compensation, which includes bonuses and other incentives.

- According to Glassdoor, the estimated total pay for a Manager at PwC in the United States is approximately $168,000 per year, with an average base salary of around $147,000. The likely total pay range spans from $136,000 to $210,000 annually.

- Payscale reports a slightly lower average base salary for a Management Consultant Manager at around $141,000 per year, but this doesn't always capture the full scope of roles and bonuses across all service lines.

- Data on professional forums and communities like Fishbowl and Levels.fyi, which offer user-reported figures, often show total compensation packages for first-year managers (M1) starting in the $150,000 - $175,000 range, climbing toward $200,000+ for more experienced managers (M2/M3) in high-demand fields.

This data paints a clear picture: a Manager role at PwC is a lucrative position. However, this is just the average. Several key factors can significantly influence your specific earnings.

Key Factors That Influence Salary

Your final compensation package isn't a single number; it's a dynamic figure shaped by a combination of your background, expertise, and where you work.

### Level of Education

While a bachelor's degree in accounting, finance, or a related field is the standard entry requirement, advanced education can provide a competitive edge. A Master of Business Administration (MBA), Master of Accountancy (MAcc), or Master of Taxation can lead to a higher starting salary. More importantly, professional certifications are often prerequisites for promotion to the manager level. The Certified Public Accountant (CPA) license is virtually mandatory for managers in the Assurance and Tax practices. Other valuable certifications include the CFA (Chartered Financial Analyst) for deals advisory or a CISA (Certified Information Systems Auditor) for risk assurance.

### Years of Experience

PwC has a well-defined career progression. Professionals are typically promoted to Manager after demonstrating consistent high performance for 5-6 years, usually after serving 2-3 years as an Associate and another 2-3 years as a Senior Associate. Within the Manager level itself, there is a hierarchy (often referred to internally as M1, M2, and M3) where compensation increases with each year of experience in the role, reflecting growing expertise and responsibility.

### Geographic Location

Location is one of the most significant drivers of salary variance. PwC adjusts compensation based on the local cost of living and market demand. Managers in high-cost-of-living (HCOL) metropolitan areas like New York City, San Francisco, and Boston will earn substantially more than their counterparts in lower-cost-of-living (LCOL) cities. This "cost-of-living adjustment" can amount to a difference of 15-25% or more in base salary alone. For example, a Manager role that pays $150,000 in a mid-sized city might command $175,000 or more in NYC.

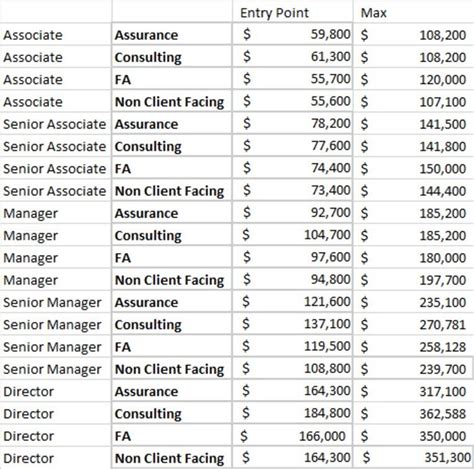

### Line of Service

This is arguably the most critical factor after location. PwC's primary lines of service offer different salary bands based on the market value of their skills and the margins on the work they perform.

- Assurance (Audit): As the firm's traditional and largest practice, Assurance offers highly competitive and stable salaries. This is often considered the baseline for compensation.

- Tax: Due to its specialized nature, the Tax practice often offers salaries slightly higher than Assurance. Specialists in high-demand areas like International Tax or M&A Tax can command a premium.

- Advisory (Consulting): This is typically the highest-paying service line. Advisory managers, who may work in Deals, Strategy, Cybersecurity, or Technology Consulting, command top dollar because they compete for talent with management consulting firms (like McKinsey, BCG) and technology companies. It is not uncommon for an Advisory Manager's total compensation to be 10-20% higher than that of a Manager in Assurance.

### Area of Specialization

Within each service line, further specialization can boost earning potential. A manager in the core audit practice will earn a strong salary, but a manager in a niche group like Capital Markets and Accounting Advisory Services (CMAAS) may earn more. Similarly, in the Advisory practice, a manager specializing in a high-growth area like cloud transformation or cybersecurity strategy will likely have a higher market value and, therefore, a higher salary than one in a more traditional advisory role.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track data for "PwC Manager" specifically, we can look at related professions to gauge the career outlook. The future for professionals in this field is exceptionally bright.

- For Accountants and Auditors, the BLS projects employment growth of 4 percent from 2022 to 2032, which is about as fast as the average for all occupations. This translates to about 126,500 new job openings each year.

- For Management Analysts (a strong proxy for consulting roles), the outlook is even better. The BLS projects a robust growth rate of 10 percent from 2022 to 2032, much faster than the average.

As a global leader, PwC is perfectly positioned to capture this growing demand for accounting, tax, and advisory services, ensuring strong job security and continued opportunities for career advancement for its managers.

Conclusion

Becoming a Manager at PwC is a rewarding and financially lucrative career goal. It reflects years of hard work, a commitment to excellence, and the ability to lead both people and projects effectively.

Here are the key takeaways for anyone aspiring to this role:

- Expect High Compensation: Total compensation packages for PwC Managers are well into the six figures, often ranging from $130,000 to over $190,000.

- Your Path Matters: The line of service you choose is critical. Advisory roles typically offer the highest compensation, followed by Tax and then Assurance.

- Location is Key: Salaries are significantly higher in major metropolitan areas to account for the cost of living and market competition.

- Invest in Yourself: Advanced degrees and, most importantly, professional certifications like the CPA are essential for reaching and excelling at the manager level.

For ambitious professionals in finance and consulting, the Manager track at PwC offers a clear path to leadership, professional fulfillment, and outstanding earning potential.