For ambitious professionals in California, the term "exempt employee" represents more than just a payroll classification; it's a significant milestone. It signifies a transition from hourly wages to a fixed salary, a shift from tracking minutes to managing outcomes, and entry into a class of careers defined by autonomy, responsibility, and substantially higher earning potential. The key that unlocks this door is the California exempt salary threshold—a specific, legally mandated figure that is set to rise again in 2025. Understanding this threshold is not just a matter of compliance for employers; for you, the aspiring professional, it is the financial benchmark you must surpass to secure a high-level, salaried role in the Golden State.

This guide is designed to be your definitive resource for navigating this critical aspect of California's professional landscape. We will demystify the 2025 exempt salary threshold, explore the lucrative careers that fall within this category, and provide a strategic roadmap for achieving one. The average salary for exempt professional roles in California can range from approximately $85,000 for emerging professionals to well over $200,000 for senior experts and executives, making this a goal worth pursuing. I remember the exact moment my own career shifted from non-exempt to exempt. It wasn't just the relief of no longer needing to clock in and out; it was the implicit trust from my employer that I was now being paid for my judgment and the results I could deliver, not just the hours I was present. That shift in mindset is the true heart of an exempt career. This article will show you how to get there.

### Table of Contents

- [Understanding Exempt Status: What It Means for Your Career](#understanding-exempt-status-what-it-means-for-your-career)

- [Salary Benchmarks for Exempt Professionals in California](#salary-benchmarks-for-exempt-professionals-in-california)

- [Key Factors That Influence Your Professional Salary](#key-factors-that-influence-your-professional-salary)

- [Job Outlook and Career Growth for Exempt Roles](#job-outlook-and-career-growth-for-exempt-roles)

- [How to Attain an Exempt-Level Professional Role](#how-to-attain-an-exempt-level-professional-role)

- [Conclusion: Charting Your Path to an Exempt Career](#conclusion-charting-your-path-to-an-exempt-career)

Understanding Exempt Status: What It Means for Your Career

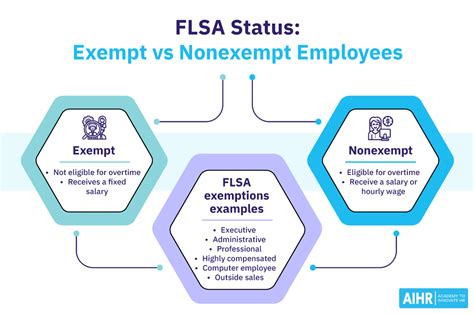

At its core, the "California exempt salary threshold" is not a job title but a legal and financial cornerstone of the state's labor law. It dictates the minimum annual salary an employee must receive to be considered "exempt" from overtime pay, meal and rest break requirements, and other protections afforded to non-exempt (typically hourly) workers.

To be properly classified as exempt in California, an employee must meet both a Salary Basis Test and a Duties Test.

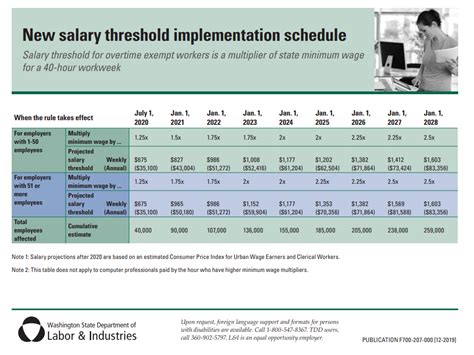

1. The Salary Basis Test: This is the quantitative part of the equation. As of January 1, 2024, the California minimum salary for exempt employees is $66,560 per year. This figure is calculated as no less than two times the state minimum wage for full-time employment (State Minimum Wage x 2 x 2080 hours).

What is the California Exempt Salary Threshold for 2025?

The California minimum wage is tied to inflation. While the official 2025 figure is typically announced in the late summer of the preceding year (around August 2024), we can create a strong projection. The state minimum wage is set to increase based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Assuming a conservative inflation-based increase, professionals and employers should anticipate and budget for a rise. If, for example, the minimum wage were to increase to $16.50/hour, the 2025 exempt salary threshold would be:

$16.50 (per hour) x 2 x 2080 (hours per year) = $68,640 per year

*Disclaimer:* *This is a projection. The official 2025 threshold will be determined by the California Department of Industrial Relations based on inflation data released in mid-2024.*

2. The Duties Test: This is the qualitative and more complex part. Simply earning above the salary threshold is not enough. The employee's primary duties must fall into one of the specific "white-collar" exemption categories defined by law. The main categories are:

- Executive Exemption: The employee’s primary duties involve managing the enterprise or a recognized department. They must customarily direct the work of at least two other full-time employees and have the authority to hire, fire, or make influential recommendations on these matters. (e.g., CEO, Department Director, Store Manager).

- Administrative Exemption: The employee’s primary duties involve performing office or non-manual work directly related to the management policies or general business operations of the employer. This work requires the regular exercise of discretion and independent judgment. (e.g., Human Resources Manager, Financial Analyst, Marketing Strategist, Executive Assistant handling significant projects).

- Professional Exemption: This is the broadest category and is split into two types:

- Learned Professional: Primary duties require advanced knowledge in a field of science or learning, typically acquired through a prolonged course of specialized instruction. (e.g., Lawyers, Doctors, Accountants, Engineers, Scientists).

- Creative Professional: Primary duties involve work that is original and creative in a recognized field of artistic endeavor. (e.g., Graphic Designer, Writer, Musician, Actor).

- Computer Software Professional Exemption: A specialized category for highly skilled computer professionals. As of 2024, these employees are exempt if their primary duties are in software/hardware design and development and they are paid at least $55.58 per hour (or an equivalent annual salary of $115,763.35). This hourly rate is adjusted annually for inflation and is separate from the standard salary threshold.

- Outside Salesperson Exemption: Primary duties involve making sales or obtaining orders, and they must spend more than 50% of their working time away from the employer's place of business.

### A Day in the Life: Exempt vs. Non-Exempt

To make this tangible, let's contrast two marketing professionals working at the same company.

- A Non-Exempt Marketing Coordinator (Paid Hourly): Their day is structured. They clock in at 9:00 AM. Their tasks are often directed by a manager: schedule 10 social media posts, pull a weekly analytics report using a pre-made template, coordinate with vendors for an upcoming event, and answer customer inquiries from the company's social media inbox. They take a mandated 30-minute unpaid lunch and two 10-minute paid breaks. If a last-minute task requires them to stay past 5:00 PM, they must get approval for overtime and are paid time-and-a-half. Their focus is on completing assigned tasks within a set timeframe.

- An Exempt Marketing Manager (Paid a Salary above the Threshold): Their day is driven by objectives. They arrive around 9:15 AM after taking a call with an international partner. Their morning is spent reviewing the performance of a major advertising campaign they designed, analyzing data to determine ROI, and making strategic decisions on where to reallocate the budget. In the afternoon, they meet with the sales team to align on Q3 goals, then mentor the Marketing Coordinator on developing a new content strategy. They might work through lunch to finalize a presentation for the company's executives. They leave around 6:00 PM, but later that evening, they log on from home to respond to urgent emails from the creative agency. They are not paid extra for these hours; their compensation is based on their overall responsibility for the success of the company's marketing function. Their focus is on achieving strategic goals, regardless of the hours it takes.

This "Day in the Life" illustrates the fundamental trade-off: non-exempt roles offer protection for your time, while exempt roles offer autonomy and are compensated for your judgment and impact.

Salary Benchmarks for Exempt Professionals in California

While the state's exempt threshold provides the legal *floor*, the actual salaries for professional roles in California are significantly higher, driven by a competitive market, high cost of living, and a concentration of high-value industries. These are the careers that aspiring professionals target when they aim for "exempt status."

Below is a deep dive into the typical salary ranges for common exempt-level occupations in California. It's crucial to remember that these are statewide averages; salaries can be 20-30% higher in a major metropolitan area like the San Francisco Bay Area compared to the Central Valley.

*Data is aggregated and synthesized from the U.S. Bureau of Labor Statistics (BLS) Occupational Employment and Wage Statistics (OEWS) for California (May 2023 data, released in April 2024), Salary.com, Glassdoor, and Payscale, reflecting late 2023 and early 2024 figures.*

### California Exempt Salary Ranges by Experience Level

This table showcases the typical salary progression (excluding bonuses and equity) for prominent exempt roles in California.

| Career Path | Entry-Level (0-2 Years) | Mid-Career (3-8 Years) | Senior/Lead (8+ Years) |

| :--- | :--- | :--- | :--- |

| Software Engineer | $110,000 - $145,000 | $150,000 - $200,000 | $200,000 - $300,000+ |

| Marketing Manager | $80,000 - $110,000 | $115,000 - $150,000 | $155,000 - $220,000+ |

| Financial Analyst | $75,000 - $95,000 | $100,000 - $135,000 | $140,000 - $190,000+ |

| Human Resources Manager | $85,000 - $115,000 | $120,000 - $160,000 | $165,000 - $230,000+ |

| Project Manager (Tech) | $90,000 - $120,000 | $125,000 - $170,000 | $175,000 - $250,000+ |

| Accountant (CPA) | $75,000 - $95,000 | $100,000 - $140,000 | $145,000 - $200,000+ |

*(Sources: BLS OEWS, Salary.com, Glassdoor. Ranges are illustrative and can vary widely based on the factors discussed in the next section.)*

According to the BLS OEWS, the mean annual wage for "Management Occupations" in California is $160,340, and for "Computer and Mathematical Occupations," it is $144,530. These broad categories are almost entirely composed of exempt positions and highlight the substantial earning potential in the state.

### Deconstructing Your Compensation Package

For exempt professionals, the base salary is just one piece of the puzzle. Total compensation is a much more important metric, especially in competitive industries like tech and finance.

- Base Salary: This is the fixed, guaranteed amount you earn, paid bi-weekly or semi-monthly. It's the number that must exceed the California exempt salary threshold.

- Annual Bonus: This is a variable cash payment tied to performance—either your individual performance, your team's, or the company's overall profitability. For a mid-level manager, a typical bonus might range from 10-20% of their base salary. For senior executives, bonuses can be 50-100% or more of their base.

- Equity/Stock Options: Particularly prevalent in startups and publicly traded tech companies, equity gives you ownership in the company. This can come in the form of Restricted Stock Units (RSUs) that vest over time or stock options that allow you to purchase company stock at a predetermined price. Equity compensation can be the most lucrative part of a package, potentially worth hundreds of thousands or even millions of dollars over a multi-year period, though it also carries the most risk.

- Profit Sharing: Some companies, especially established professional services firms (law, accounting) and some traditional corporations, distribute a portion of their annual profits to employees. This is often contributed directly to a retirement account.

- Commissions: For roles in sales, business development, and some marketing functions, commissions are a direct percentage of the revenue you generate. While outside sales roles have their own exemption, many inside sales and account management roles are classified under the administrative exemption, with a compensation structure of base + commission.

- Benefits and Perks: Don't underestimate the value of a strong benefits package. This includes:

- Health Insurance: Premium coverage for medical, dental, and vision can be worth $10,000-$25,000 annually.

- Retirement Savings: A 401(k) plan with a generous company match (e.g., a 100% match on the first 6% of your contributions) is essentially a 6% raise.

- Paid Time Off (PTO): Generous vacation, sick leave, and holiday policies.

- Other Perks: Wellness stipends, remote work budgets, commuter benefits, and paid parental leave all contribute to your total compensation and well-being.

When evaluating a job offer for an exempt role in California, it's essential to look beyond the base salary and calculate the total potential value of the compensation package. A role with a $130,000 base salary plus a 15% bonus and strong benefits could be more valuable than a role with a flat $145,000 salary and minimal perks.

Key Factors That Influence Your Professional Salary

Achieving a six-figure salary in an exempt role is not just about crossing a threshold; it's about strategically positioning yourself to maximize your value in the marketplace. Your salary is not a fixed number for a given job title but a dynamic figure influenced by a confluence of factors. Understanding these levers is critical to negotiating effectively and accelerating your career trajectory.

###

Level of Education

Your educational background is the foundation upon which your professional career is built. While a bachelor's degree is the standard entry ticket for most exempt roles, advanced degrees and certifications can create significant salary differentiation.

- Bachelor's Degree: This is the de facto minimum requirement for roles in management, finance, marketing, and tech. The field of study matters greatly—a Bachelor of Science in Computer Science or Engineering will command a higher starting salary than a Bachelor of Arts in a less technical field.

- Master's Degree (MBA, MS): A Master of Business Administration (MBA) remains a powerful tool for career acceleration, particularly for those transitioning into management or strategy roles. According to a 2023 report from the Graduate Management Admission Council (GMAC), the median starting salary for MBA graduates was $125,000 nationally, a figure that is often higher in California. A specialized Master of Science (MS) in a field like Data Science, Finance, or Computer Science can also lead to a substantial salary premium, as it signals deep domain expertise. For example, a Software Engineer with an MS in Artificial Intelligence will be far more competitive for high-paying AI/ML roles.

- Professional Certifications: Certifications act as a third-party validation of your skills and can directly impact your earning potential. They are often more flexible and less time-consuming than a full degree program.

- Project Management Professional (PMP): Project managers with a PMP certification can earn up to 16% more than their non-certified peers, according to the Project Management Institute (PMI). In California, this can translate to a $20,000-$30,000 salary bump.

- Certified Public Accountant (CPA): For accountants, the CPA license is the gold standard. It not only increases salary but is a prerequisite for many senior and managerial roles in accounting and finance.

- SHRM-CP / SHRM-SCP: The Society for Human Resource Management certifications are essential for HR professionals looking to move into strategic HR Business Partner or management roles.

- Cloud & Tech Certifications (AWS, Google Cloud, Azure): In the tech world, certifications from major cloud providers are extremely valuable, often leading to salary premiums of 5-15% for roles like Cloud Engineer or Solutions Architect.

###

Years of Experience

Experience is arguably the single most powerful driver of salary growth. Companies pay for proven results and the wisdom that comes from navigating complex challenges over time. Your career can be viewed in three distinct salary stages:

- Entry-Level (0-2 years): In this stage, your salary is based on your potential. You've met the educational requirements and are being paid to learn and execute assigned tasks. Salaries typically start just above the exempt threshold and climb as you demonstrate competence. For example, an entry-level Financial Analyst in Los Angeles might earn $80,000.

- Mid-Career (3-8 years): You are now a proven contributor. You've moved from just executing tasks to managing small projects, mentoring junior staff, and contributing to strategy. Your value is in your reliability and growing expertise. This is often where professionals see the most significant percentage-based salary growth, often through a combination of annual raises and job changes. That Financial Analyst, after 5 years and a promotion to Senior Analyst, could now be earning $120,000.

- Senior/Expert Level (8+ years): At this stage, you are paid for your strategic oversight, leadership, and deep institutional or industry knowledge. You are no longer just doing the work; you are directing the work of others, setting departmental or company-wide strategy, and are responsible for major business outcomes. Your salary reflects the scope of your responsibility. That same professional, now a Finance Manager overseeing a team, might command a salary of $175,000+ plus a significant bonus.

###

Geographic Location

In a state as large and economically diverse as California, where you work matters immensely. The cost of living and concentration of high-paying industries create vast salary disparities between regions.

- Tier 1: San Francisco Bay Area (San Francisco, Silicon Valley, Oakland): This is the epicenter of the global tech industry and venture capital. The intense competition for talent and the world's highest cost of living drive salaries to their peak. A senior software engineer who might earn $180,000 in another state could easily command $250,000+ in base salary alone in Mountain View or Palo Alto.

- Tier 2: Southern California (Los Angeles, Orange County, San Diego): This region has a more diversified economy, with major hubs for entertainment, aerospace, biotech, and a growing tech scene ("Silicon Beach"). Salaries are very strong but generally 10-15% lower than the Bay Area. A marketing director might earn $190,000 in Los Angeles compared to $220,000 in San Francisco.

- Tier 3: Major Inland & Secondary Coastal Cities (Sacramento, Irvine, Santa Barbara): These areas offer a blend of strong job markets and a slightly lower cost of living. Government jobs are prevalent in Sacramento, while Irvine is a hub for tech and medical device companies. Salaries here are competitive but are often another 5-10% below the Los Angeles metro area.

- Tier 4: Central Valley and Rural Areas (Fresno, Bakersfield, Redding): The cost of living is significantly lower in these regions, and so are the salaries. While exempt roles exist, particularly in healthcare, agriculture management, and logistics, the pay scales are much closer to the national average. An HR Manager might earn $110,000 in Fresno, a salary that would be considered low for a similar role in the Bay Area.

The Impact of Remote Work: The rise of remote work has introduced a new dynamic. Some Bay Area companies have adopted location-based pay, adjusting salaries downward if an employee moves to a lower-cost area like Sacramento. However, many are still competing for talent on a national level, meaning a skilled professional living in Fresno could potentially land a remote role with a Bay Area salary—a powerful strategy for maximizing real income.

###

Company Type & Size

The type and size of your employer create different cultures, opportunities, and compensation structures.

- Early-Stage Startups (Seed or Series A): Cash is tight. Base salaries will often be lower than the market average. The trade-off is a significant grant of stock options, which holds the potential for a massive payout if the company succeeds. The work environment is fast-paced, with broad responsibilities.

- Late-Stage Startups / "Unicorns" (Pre-IPO): These companies have significant funding and are in a high-growth phase. They often pay competitive base salaries *and* offer valuable equity (often RSUs) to attract top talent from established players. This can be a sweet spot for high total compensation.

- Large Public Corporations (e.g., Apple, Google, Disney, Wells Fargo): These companies offer some of the highest and most stable base salaries and bonus structures. Their compensation packages are well-defined, with clear salary bands for each level. While the life-changing equity upside of a startup is less likely, they provide robust benefits, job security, and clear career ladders.

- Non-Profits and Government: Mission-driven work in these sectors is critically important but generally comes with lower pay scales than the private sector. A Director of Finance at a large non-profit might earn $150,000, while a counterpart at a for-profit tech company could earn double that. The trade-off is often better work-life balance, strong benefits (like pensions in government roles), and the satisfaction of contributing to a social cause.

###

Area of Specialization

Within any given profession, specialization can create significant value. Becoming an expert in a high-demand niche is one of the fastest ways to increase your salary.

- In Tech: A generalist Software Engineer is valuable, but an engineer specializing in AI/Machine Learning, Cybersecurity, or Blockchain Development is in a different league. These specialists can command a 20-40% salary premium due to a severe talent shortage.

- In Marketing: A general Marketing Manager is common. A Marketing Manager who is a specialist in Marketing Automation (e.g., Marketo, HubSpot expert) or Performance Marketing (managing multi-million dollar ad spends) has a much more quantifiable and in-demand skillset.

- In Finance: A corporate Financial Analyst is a standard role. An analyst specializing in Mergers & Acquisitions (M&A) or International Financial Reporting Standards (IFRS) possesses knowledge that is critical for specific, high-stakes business operations, justifying a higher salary.

- In HR: An HR Generalist handles a bit of everything. An HR professional specializing in Compensation & Benefits design or HR Information Systems (HRIS) implementation can command a higher salary because their work has a direct, measurable impact on the entire organization's structure and efficiency.

###

In-Demand Skills

Beyond job titles and specializations, a set of transferable, high-value skills will make you a more attractive and highly compensated candidate, regardless of your field.

- Leadership and People Management: The ability to hire, mentor, and lead a high-performing team is the primary skill that separates individual contributors from managers. This is the gateway to the highest salary bands.

- Data Analysis and Interpretation: In every field, the ability to work with data—whether it's financial models, marketing analytics, or user behavior data—to derive insights and make evidence-based decisions is paramount. Skills in tools like Excel, SQL, Tableau, or Python are highly sought after.

- Strategic Thinking: This is the ability to see the big picture, understand how your work fits into the company's broader goals, and make decisions that have a positive long-term impact. It’s the difference between managing a project and owning a business outcome.

- Complex Problem-Solving: Companies pay top dollar for people who can untangle complex, ambiguous problems without a clear roadmap. This involves critical thinking, creativity, and resilience.

- Communication and Influence: Having a great idea is only half the battle. The ability to articulate that idea clearly, persuade stakeholders (including executives), and build consensus is a force multiplier for your career.

By strategically developing these skills and aligning your career choices with these influencing factors, you can proactively steer your compensation from simply meeting the exempt threshold to reaching the top tier of earners in your profession.

Job Outlook and Career Growth for Exempt Roles

Investing your time and resources into building a professional career requires a forward-looking perspective. Fortunately, the job outlook for the types of roles that qualify for exempt status in California is overwhelmingly positive. These positions, rooted in knowledge work, management, and technical expertise, are central to the growth of California's high-value industries.

According to the U.S. Bureau of Labor Statistics' (BLS) long-term occupational projections (2022-2032), many of the core exempt professions are set to grow much faster than the average for all occupations.

- Management Occupations: The BLS projects this category to grow by 8% nationally, adding about 882,000 jobs. In California, with its concentration of corporate headquarters and new business formation, this growth is expected to be even more robust. Roles like Financial Managers (16% growth) and Medical and Health Services Managers (28% growth) are projected to be in particularly high demand.

- Computer and Mathematical Occupations: This is the fastest-growing major occupational group, with a projected growth rate of 23%. This translates