For many professionals, hearing the term "salaried" or "exempt" is a milestone, often associated with career progression and stability. However, this classification is more than just a title—it's a specific legal designation under the Fair Labor Standards Act (FLSA) that has significant implications for your pay, hours, and eligibility for overtime. Understanding the minimum salary required for this status is crucial for both employees seeking to verify their classification and employers ensuring compliance.

This article breaks down the legal salary thresholds, the factors that influence your actual earnings far beyond that minimum, and the future outlook for this critical component of employee compensation.

What is an "Exempt Employee"? A Quick Overview

Before diving into the numbers, it's essential to understand what being an "exempt employee" means. In the United States, the FLSA requires employers to pay most employees at least the federal minimum wage for all hours worked and overtime pay at one and a half times their regular rate of pay for all hours worked over 40 in a workweek.

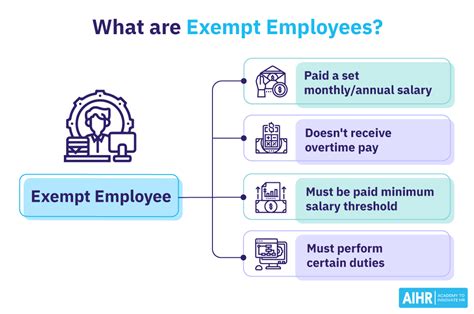

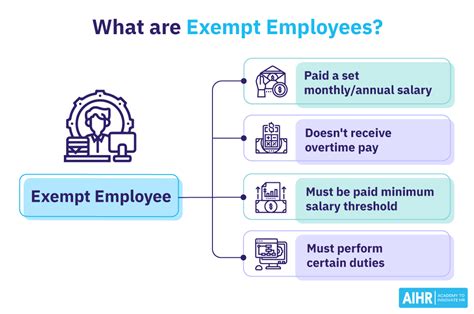

However, some employees are exempt from these overtime provisions. To qualify for exemption, an employee must generally meet three tests:

1. Salary Basis Test: The employee must be paid a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

2. Salary Level Test: The employee must be paid a salary that meets a specified minimum amount. This is the primary focus of this article.

3. Duties Test: The employee's primary job duties must involve executive, administrative, or professional (EAP) tasks as defined by the Department of Labor (DOL). There are also exemptions for certain outside sales and computer employees.

If an employee does not meet *all three* of these criteria, they are considered "non-exempt" and are eligible for overtime pay, regardless of whether they are paid a salary or an hourly wage.

The Federal and State Salary Thresholds for Exempt Employees

The "minimum salary for exempt employees" is a legal threshold, not an average salary for a particular job. This threshold is set by the U.S. Department of Labor and is subject to change. Furthermore, many states have implemented their own, often higher, salary thresholds.

Major upcoming changes to the federal threshold are set to take effect in 2024 and 2025.

### Federal Salary Threshold

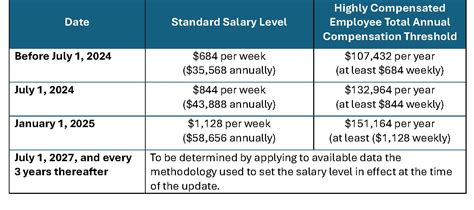

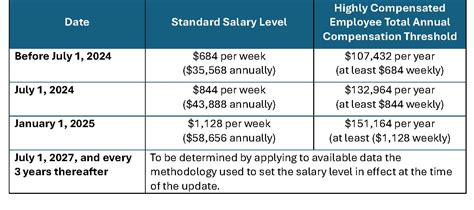

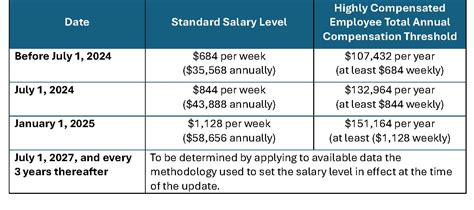

As of early 2024, the federal salary threshold for the executive, administrative, and professional (EAP) exemptions is $684 per week ($35,568 per year). However, a new Final Rule from the DOL has scheduled significant increases:

- Effective July 1, 2024: The threshold will increase to $844 per week ($43,888 per year).

- Effective January 1, 2025: The threshold will increase again to $1,128 per week ($58,656 per year).

For "highly compensated employees" (HCEs), who are subject to a more lenient duties test, the total annual compensation threshold is also rising:

- Current: $107,432 per year

- Effective July 1, 2024: $132,964 per year

- Effective January 1, 2025: $151,164 per year

*(Source: U.S. Department of Labor, "Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees; Final Rule," 2024)*

### State-Specific Salary Thresholds

It is critical to note that if a state's law provides a higher salary threshold than the federal law, employers in that state must comply with the higher standard. Several states have already surpassed the federal minimum.

- California: As of January 1, 2024, the minimum salary for exempt employees is $66,560 per year, regardless of the size of the employer. *(Source: California Department of Industrial Relations)*

- New York: The 2024 minimum salary threshold varies by location, with the highest rate in New York City, Westchester, and Long Island at $1,200 per week ($62,400 per year). The rate for the rest of the state is $1,124.20 per week ($58,458.40 per year). *(Source: New York State Department of Labor)*

- Washington: As of 2024, the state's minimum salary threshold is 2 times the state minimum wage, resulting in a minimum salary of $67,724.80 per year. *(Source: Washington State Department of Labor & Industries)*

Key Factors That Influence Your Actual Salary (Beyond the Minimum)

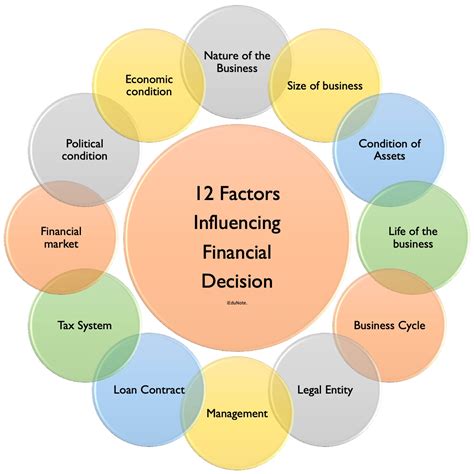

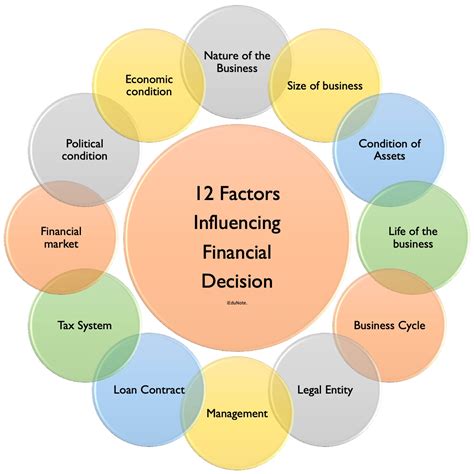

While the salary threshold is a legal floor, an employee's actual compensation is determined by a range of factors that push earnings well above this minimum. The following factors dictate your earning potential in any professional, exempt-level role.

###

Level of Education

While a specific degree doesn't change the legal minimum, it's a primary driver of access to high-paying exempt positions. Roles that fall under the "professional" exemption, such as doctors, lawyers, architects, and scientists, require advanced degrees. This educational attainment directly correlates with higher salaries. For instance, according to Salary.com, a Financial Analyst with a bachelor's degree might earn an average of $68,000, while one with an MBA could command a salary closer to $95,000 or more, both well above the exempt threshold.

###

Years of Experience

Experience is one of the most significant determinants of salary. An entry-level exempt employee, such as a junior project coordinator, will earn a salary closer to the legal minimum. In contrast, a senior-level Director of Operations with 15+ years of experience will command a salary deep into the six figures. Data from Payscale shows that a Human Resources Manager's salary can range from around $55,000 at the entry-level to over $105,000 for experienced professionals, showcasing a clear and rewarding path for growth.

###

Geographic Location

As seen with the state-level thresholds, location matters immensely. A high cost of living directly translates to higher prevailing wages. An exempt Marketing Manager in San Francisco, CA, will earn a substantially higher salary than a counterpart with the exact same responsibilities in Des Moines, IA. According to Glassdoor data, the average base pay for a Software Engineer in San Francisco is approximately $150,000, whereas in a lower-cost city, it might be closer to $90,000. Employers must offer competitive wages for the local market to attract talent, pushing salaries far past the federal minimum.

###

Company Type and Industry

The size, profitability, and industry of a company heavily impact its compensation structure. A large, multinational technology firm or a Wall Street investment bank will typically offer much higher salaries and more robust benefits packages than a small non-profit organization or a local retail business. Industries like finance, technology, and pharmaceuticals are known for high compensation, making the federal salary minimum largely a formality for their professional staff.

###

Area of Specialization

The "duties test" is intrinsically linked to specialization. The skills you bring to the table in an executive, administrative, or professional capacity determine your value. A general office manager's salary will differ greatly from that of a specialized Cybersecurity Analyst, even if both are classified as exempt. The more specialized and in-demand your skills are, the higher your earning potential. The median annual wage for Information Security Analysts, a highly specialized and typically exempt role, was $120,360 in May 2023, according to the U.S. Bureau of Labor Statistics (BLS).

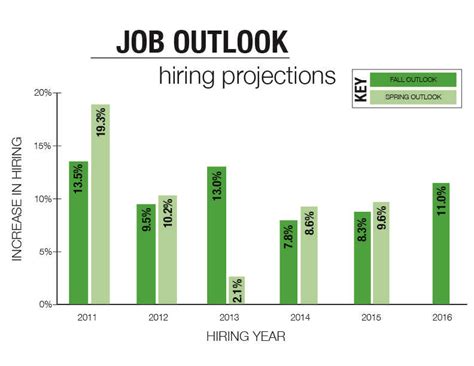

Job Outlook and the Future of Salary Thresholds

The concept of an "exempt employee" is not a career in itself, but the outlook for the types of jobs that are typically exempt—namely, management, professional, and technical roles—is very strong. The BLS projects that employment in management occupations will grow much faster than the average for all occupations, adding about 883,900 new jobs from 2022 to 2032.

The key trend to watch is the continued adjustment of the salary thresholds. The DOL's 2024 Final Rule includes a provision to automatically update the thresholds every three years to reflect changes in earnings data. This, combined with the trend of states proactively setting their own higher minimums, suggests that the legal salary floor for exempt status will continue to rise, protecting more workers from being misclassified and ensuring their pay keeps pace with the economy.

Conclusion: Know Your Worth and Your Rights

Understanding the minimum salary for exempt employees is a matter of knowing your rights and ensuring fair compensation. Here are the key takeaways:

- It's a Legal Standard: The "minimum salary" is a legal floor, not an average wage for a job.

- The Bar is Rising: Federal salary thresholds are increasing significantly on July 1, 2024, and again on January 1, 2025.

- State Laws Matter: Your state may have a higher salary requirement that supersedes the federal rule.

- Your Value is More Than the Minimum: Your actual salary is determined by your experience, education, location, and the specific value you bring to an employer.

For professionals building their careers, being classified as exempt is a common step. By staying informed about these legal standards, you can better advocate for yourself and ensure you are being compensated fairly for your valuable contributions to the workplace.