In the complex world of modern business, few roles are as critical and impactful as that of the Compensation Analyst. These financial and human resources strategists are the architects behind a company's most vital asset: its pay structure. They ensure that compensation is not only competitive and fair but also legally compliant, a task that has become increasingly intricate, especially in trailblazing states like California. If you are a detail-oriented, analytical individual with a passion for creating equitable and motivational workplace environments, a career as a Compensation Analyst offers a pathway to significant influence and financial reward.

This guide is designed to be your definitive resource, exploring every facet of this dynamic profession. We will delve into the national average salary for a Compensation Analyst, which typically ranges from $65,000 for entry-level positions to over $125,000 for senior experts, with top earners in high-demand markets pushing even higher. [Source: Salary.com, 2024]. The role's importance is underscored by the ever-evolving landscape of labor legislation, such as the landmark California salary laws of 2024, which have fundamentally reshaped pay transparency and equity. I was once brought in to consult for a mid-sized tech company struggling to align its national pay bands with California's stringent new requirements; untangling that web and building a compliant, transparent system not only averted legal disaster but tangibly boosted employee morale, demonstrating the profound, real-world impact of this specialized expertise.

This article will serve as your roadmap, whether you're just starting to consider this career or are looking to advance within it. We will cover the day-to-day responsibilities, dissect the factors that drive salary, examine the robust job outlook, and provide a step-by-step plan to launch your journey.

### Table of Contents

- [What Does a Compensation Analyst Do?](#what-does-a-compensation-analyst-do)

- [Average Compensation Analyst Salary: A Deep Dive](#average-compensation-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Compensation Analyst Do?

At its core, a Compensation Analyst is a strategic partner within an organization responsible for designing, implementing, and managing an organization's entire compensation framework. This goes far beyond simply processing payroll. They are the guardians of pay equity and the strategists who ensure a company can attract, retain, and motivate top talent through a compelling total rewards package. Their work is a sophisticated blend of data analysis, market research, financial modeling, and legal compliance.

The role requires a dual focus: an internal one on the company's structure and an external one on market trends and legal mandates. Internally, they conduct job evaluations to determine the relative value of each position within the company. This involves creating detailed job descriptions, defining levels of responsibility (e.g., Analyst I, II, Senior, Principal), and then slotting these roles into a logical, hierarchical pay structure. They build salary bands—the minimum, midpoint, and maximum pay for each job grade—that guide hiring managers and ensure internal equity.

Externally, Compensation Analysts are market detectives. They subscribe to and analyze massive salary survey datasets from consulting firms like Radford and Willis Towers Watson to benchmark their company's pay against competitors. Is the company paying enough to attract top software engineers in the Bay Area? Is their pay for marketing managers competitive in the Midwest? The analyst’s research provides the data-driven answers to these critical business questions.

Furthermore, a massive part of their responsibility is ensuring strict adherence to a complex web of labor laws. This is particularly crucial in states like California, where regulations are stringent and constantly evolving. For instance, under California's 2024 salary laws (specifically SB 1162), analysts must manage the requirement to include pay scales in all job postings and provide pay data reports to the state, analyzing metrics for potential race or gender-based pay disparities.

#### A Day in the Life of a Compensation Analyst

To make this more tangible, let's walk through a typical day for a Senior Compensation Analyst named Alex, who works at a large tech company in California.

- 9:00 AM - 9:30 AM: Morning Sync & Review. Alex starts the day by reviewing overnight emails and urgent requests in the HR information system (HRIS) like Workday. A hiring manager has submitted an offer for a new hire that is above the established salary band. Alex flags this for immediate investigation.

- 9:30 AM - 11:00 AM: Market Pricing for a New Role. The product team is creating a new "AI Ethics Specialist" position. Alex's task is to determine the correct salary grade. They access the company's salary survey database, searching for matches or comparable roles in the tech industry. They pull data for the San Francisco, Austin, and New York metro areas, adjusting for geographic differentials, and begin modeling a competitive salary range for the new role.

- 11:00 AM - 12:00 PM: Consultation with an HR Business Partner. Alex meets with an HRBP to discuss the offer request that was flagged earlier. The hiring manager is adamant that the candidate's unique experience warrants the higher salary. Alex provides data showing internal equity comparators—how this offer would stack up against current employees in similar roles. Together, they strategize a solution: a one-time sign-on bonus instead of an inflated base salary to reward the candidate's experience without disrupting the internal pay structure.

- 12:00 PM - 1:00 PM: Lunch.

- 1:00 PM - 3:30 PM: Annual Salary Planning & Compliance Analysis. It's that time of year. Alex is deep in a project to model the financial impact of the upcoming annual merit increase cycle. They export large datasets from the HRIS into Excel and begin running pivot tables and VLOOKUPs to analyze performance ratings against current salaries. Crucially, as part of this process, Alex also runs a preliminary pay equity analysis, checking for any statistically significant pay gaps between male and female employees or across different ethnic groups, a core requirement for the upcoming California pay data reporting deadline.

- 3:30 PM - 4:30 PM: Research & Professional Development. Alex spends an hour reading industry news and legal updates. They review a detailed analysis from a law firm on the latest interpretations of California's pay transparency laws to ensure their company's job posting templates are fully compliant.

- 4:30 PM - 5:00 PM: Wrap-Up. Alex documents their findings for the "AI Ethics Specialist" role, sends the recommended salary band to the hiring manager and HRBP, and prepares their agenda for tomorrow's compensation committee meeting.

This "day in the life" illustrates the multifaceted nature of the role—it's analytical, strategic, collaborative, and deeply rooted in a foundation of data and legal principles.

Average Compensation Analyst Salary: A Deep Dive

The salary for a Compensation Analyst is a direct reflection of the immense value they bring to an organization. Their ability to control labor costs, mitigate legal risk, and enhance employee motivation places them in a high-demand, well-remunerated category of professionals. Compensation is competitive and grows substantially with experience and specialization.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Compensation, Benefits, and Job Analysis Specialists was $74,540 in May 2023. However, this figure represents the national median for a broad category that includes benefits and job analysis roles, which can sometimes pay less. For a dedicated Compensation Analyst, especially one with a few years of experience, the figures are often higher.

More focused salary aggregators provide a clearer picture. For example, Salary.com reports the median salary for a Compensation Analyst II (a mid-career professional) in the United States to be around $83,682, with a typical range falling between $75,595 and $92,430 as of early 2024. Payscale.com shows a similar average base salary of around $73,280, with the total pay package (including bonuses) reaching upwards of $90,000 for experienced professionals. [Sources: BLS, Salary.com, Payscale, 2024].

It is essential to understand that these figures are just a starting point. Your actual earnings will be a composite of your experience, skills, location, and the type of company you work for.

#### Salary Brackets by Experience Level

Salary progression in this career is clear and rewarding. As you gain more sophisticated skills in data modeling, market analysis, and executive compensation, your value—and your paycheck—will increase significantly.

| Experience Level | Typical Title(s) | National Average Salary Range | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level

(0-2 years) | Compensation Analyst I, HR Analyst (Comp Focus) | $60,000 - $75,000 | Assisting with salary surveys, running basic reports, maintaining job descriptions, conducting entry-level job evaluations. |

| Mid-Career

(3-6 years) | Compensation Analyst II, Senior Compensation Analyst | $75,000 - $100,000 | Managing annual salary review cycles, independently pricing new and existing jobs, participating in complex projects like pay equity audits, mentoring junior analysts. |

| Senior/Lead

(7-10+ years) | Principal Compensation Analyst, Compensation Manager | $100,000 - $140,000+ | Designing new compensation programs (e.g., sales incentive plans), managing executive compensation, leading major compliance projects, presenting to senior leadership. |

| Executive

(10-15+ years) | Director/VP of Compensation, Director/VP of Total Rewards | $150,000 - $250,000++ | Setting the overall compensation and total rewards strategy for the entire organization, managing a team of analysts, reporting to the C-suite and Board of Directors. |

*Source: Data compiled and synthesized from BLS, Salary.com, Glassdoor, and Payscale for 2023-2024.*

#### Beyond the Base Salary: Understanding Total Compensation

A Compensation Analyst's pay isn't just their base salary. As experts in total rewards, they are often the beneficiaries of well-structured compensation packages themselves. Here are the other key components that make up their total earnings:

- Annual Bonuses/Short-Term Incentives (STI): This is the most common form of variable pay. Based on individual and company performance, analysts can expect an annual bonus ranging from 5% of their base salary at the entry-level to 15-25% or more at the manager and director levels.

- Profit Sharing: Some companies, particularly in the private sector, offer a portion of their annual profits back to employees. This can add a significant, though variable, amount to total cash compensation.

- Long-Term Incentives (LTI): Especially prevalent in publicly traded companies and tech startups, LTIs are designed to retain key talent. These often come in the form of Restricted Stock Units (RSUs) or stock options, which vest over several years and can be incredibly lucrative if the company's stock performs well. A senior analyst at a successful tech firm might receive an LTI grant worth $20,000 - $50,000 or more, vesting over four years.

- Comprehensive Benefits: This includes high-quality health, dental, and vision insurance; a strong 401(k) or 403(b) retirement plan with a generous company match; paid time off (PTO); parental leave; and educational assistance or tuition reimbursement for pursuing relevant certifications.

When evaluating a job offer, it is crucial to look at the entire "total rewards" statement, not just the base salary. An offer with a slightly lower base but a substantial annual bonus and excellent LTI potential could be far more valuable in the long run.

Key Factors That Influence Salary

While the national averages provide a useful baseline, a Compensation Analyst's salary is highly variable and influenced by a confluence of specific, identifiable factors. Mastering these areas is the key to maximizing your earning potential throughout your career. This section provides an in-depth analysis of the six primary drivers of compensation in this field.

###

Level of Education and Certification

Your educational foundation is the launching pad for your career and has a direct impact on your starting salary and long-term trajectory.

- Bachelor's Degree: A bachelor's degree is the standard requirement for entry-level Compensation Analyst roles. Degrees in Human Resources, Business Administration, Finance, Economics, or Statistics are most common and highly valued. They provide the necessary groundwork in business principles, quantitative analysis, and HR fundamentals.

- Master's Degree: While not typically required for entry-level positions, a Master's in Human Resources (MHR), a Master's in Business Administration (MBA) with an HR concentration, or a specialized Master's in Industrial and Labor Relations can accelerate your career path. Graduates with a master's degree often command a starting salary that is 10-15% higher and may be fast-tracked into Analyst II or senior roles.

- Professional Certifications: In the world of compensation, certifications are the gold standard for demonstrating specialized expertise and a commitment to the profession. They are a powerful salary booster. The most recognized and respected certifications are offered by WorldatWork, the leading professional association for total rewards professionals:

- Certified Compensation Professional (CCP®): This is the premier certification for compensation practitioners. Achieving the CCP requires passing a series of rigorous exams covering topics like base pay administration, market pricing, variable pay, and quantitative principles. Holding a CCP can increase an analyst's salary by 5-15%, as it signals a high level of proven competence.

- Advanced Certified Compensation Professional (ACCP™): For those looking to move into strategy and leadership, the ACCP builds on the CCP with a focus on advanced concepts.

- Global Remuneration Professional (GRP®): For analysts working in multinational corporations, the GRP demonstrates expertise in managing compensation across different countries and regulatory environments.

- Other valuable certifications include the SHRM-CP/SHRM-SCP from the Society for Human Resource Management and the PHR/SPHR from HRCI, which show broader HR knowledge that complements compensation expertise.

###

Years of Experience

Experience is arguably the most significant driver of salary growth for a Compensation Analyst. The field rewards a deep understanding of nuance and a proven track record of handling complex scenarios. The progression is steep and consistent.

- 0-2 Years (Analyst I): At this stage, you are learning the fundamentals. Your salary will be in the entry-level range ($60k - $75k). Your focus is on execution and support: pulling survey data, running pre-built reports, and learning the company's job architecture.

- 3-6 Years (Analyst II / Senior Analyst): You have moved from learner to practitioner. You can now work independently, manage the annual salary review process for a business unit, accurately price new jobs with minimal supervision, and begin to contribute to program design. Your salary moves firmly into the mid-career range ($75k - $100k). This is often the point where analysts begin to specialize.

- 7-10+ Years (Principal Analyst / Manager): You are now a subject matter expert and potentially a people leader. You are not just executing programs; you are designing them. You might be the go-to expert for executive compensation, sales incentive plan design, or international pay. You present complex analyses to VPs and Directors. At this level, salaries regularly cross the six-figure mark, often landing in the $110,000 to $140,000 range, with manager titles earning even more.

- 10-15+ Years (Director / VP): At the executive level, you are setting the strategic direction for the entire company's rewards philosophy. Your work directly impacts the company's ability to achieve its business goals. Compensation at this level is a comprehensive package, with base salaries often starting at $150,000 and soaring well above $250,000 when significant bonus and equity components are included.

###

Geographic Location

Where you work matters immensely. Salaries are adjusted based on the local cost of labor and cost of living. A Compensation Analyst in a high-cost metropolitan area will earn significantly more than one in a lower-cost rural area, even if their responsibilities are identical.

- Top-Tier Metropolitan Areas: Cities with a high concentration of large corporate headquarters, particularly in the tech and finance industries, offer the highest salaries. These include the San Francisco Bay Area (San Jose, San Francisco, Oakland), New York City, Boston, and Seattle. In these locations, a mid-career Compensation Analyst can easily command a salary of $110,000 or more, a premium of 20-40% over the national average.

- Second-Tier Metropolitan Areas: Large cities like Los Angeles, San Diego, Chicago, Washington D.C., and Austin also offer strong salaries that are well above the national average, typically with a 10-20% premium.

- Average-Cost Areas: Most other mid-sized cities and suburban areas will have salaries that cluster around the national average.

- The California Effect & The Impact of Local Laws: California stands out not just for its high cost of living but also for its pioneering role in labor legislation. The California salary laws of 2024 have created a unique and demanding environment that increases the value of skilled Compensation Analysts.

- Pay Transparency (SB 1162): This law mandates that all California employers (with 15+ employees) must include a pay scale in every job posting. This requires analysts to perform rigorous, proactive market pricing for every open role *before* it's posted. It's no longer a background task; it's a public-facing compliance requirement.

- Pay Data Reporting: The law also requires employers (with 100+ employees) to submit detailed annual reports to the state, breaking down pay by gender, race, and ethnicity within specific job categories. This has turned pay equity analysis from a best-practice recommendation into a mandatory, high-stakes project. Analysts who are experts in conducting these audits and interpreting the results are in extremely high demand.

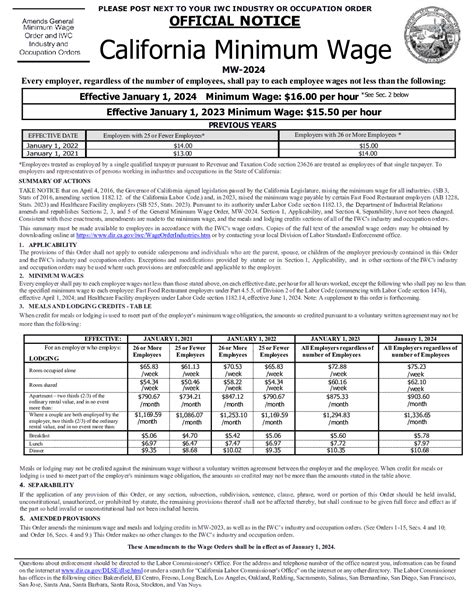

- High Minimum Wage: California's state minimum wage is among the highest in the nation, with several cities (like West Hollywood and Mountain View) having even higher local minimums. Analysts must constantly monitor and adjust the lowest-paid roles to ensure compliance, which has ripple effects on the entire pay structure (a phenomenon known as wage compression).

Because of this complex regulatory burden, companies in California are willing to pay a premium for Compensation Analysts who are not just good with numbers, but are also bona fide compliance experts. An analyst with deep experience navigating the California legal landscape is a more valuable asset and can command a higher salary than a peer in a less-regulated state. A Senior Compensation Analyst in San Francisco or Los Angeles can expect to earn $120,000 to $150,000 or more, placing them at the very top of the pay scale for this profession nationally. [Source: Glassdoor, Geographic Salary Data, 2024].

###

Company Type & Size

The type and scale of the organization you work for will have a profound effect on both your salary and the nature of your work.

- Large Corporations (Fortune 500): These companies have the deepest pockets and the most complex compensation structures. They typically pay at or above the market rate and offer robust bonus programs and benefits. Working here means dealing with thousands of employees, multiple business units, and often international pay issues. The roles are often more specialized.

- Tech Companies & Startups: The tech industry is famous for its high-paying and equity-driven compensation philosophies. A pre-IPO startup might offer a more modest base salary but compensate with potentially lucrative stock options. A large, established tech giant (like Google, Meta, or Apple) will offer both a high base salary and generous RSU grants, leading to some of the highest total compensation packages in the profession.

- Non-Profits & Higher Education: These organizations typically have tighter budgets and, as a result, tend to pay less than their for-profit counterparts. The trade-off can be a better work-life balance, a mission-driven culture, and sometimes very generous benefits (like tuition waivers at a university).

- Government (Federal, State, Local): Government compensation roles offer excellent job security and strong benefits, particularly pensions. Salaries are often determined by rigid General Schedule (GS) pay scales. While the base pay may lag behind the top-tier private sector, the value of the benefits and job stability can make it an attractive option.

###

Area of Specialization

As you advance in your career, specializing can make you a more valuable and higher-paid expert.

- Executive Compensation: This is one of the most complex and lucrative specializations. These analysts deal with compensation for C-suite executives, which includes base salary, short- and long-term incentives, deferred compensation, and complex perks. It requires discretion and a deep understanding of SEC regulations and corporate governance.

- Sales Compensation: Designing incentive plans that motivate sales teams without encouraging the wrong behaviors is a fine art. Analysts specializing in this area are always in demand and can significantly impact a company's revenue.

- International/Global Compensation: For multinational corporations, managing pay across different countries with varying currencies, laws, and cultural norms is a huge challenge. GRP-certified analysts with this expertise are highly sought after.

- Compliance & Pay Equity: With the rise of laws like those in California, Colorado, and New York, analysts who specialize purely in pay equity auditing and regulatory compliance have become indispensable. This is a rapidly growing and critically important niche.

###

In-Demand Skills

Beyond your formal credentials, a specific set of technical and soft skills can dramatically increase your marketability and salary.

- Advanced Microsoft Excel: This is non-negotiable. You must be a power user, proficient with pivot tables, complex formulas (VLOOKUP, INDEX/MATCH, SUMIFS), and data modeling.

- HRIS Proficiency: Experience with major Human Resource Information Systems is critical. Expertise in the compensation modules of platforms like Workday, SAP SuccessFactors, or Oracle HCM is a huge resume booster.

- Data Analysis & Visualization Tools: Increasingly, companies are looking for analysts who can go beyond Excel. Skills in SQL for pulling data directly from databases, and tools like Tableau or Power BI for creating compelling data visualizations for leadership, can set you apart. Knowledge of statistical programming languages like Python or R is becoming a major differentiator for top-paying roles.

- Quantitative and Statistical Acumen: You need a strong grasp of statistics to perform meaningful analysis, including understanding concepts like regressions, standard deviations, and bell curves to build and validate compensation models.

- Legal Expertise: As emphasized, a deep and up-to-date knowledge of labor law, especially wage and hour laws and the latest pay transparency and equity regulations (FLSA, Equal Pay Act, and state-specific laws like California's SB 1162), is paramount. This skill, more than many others, directly translates to higher pay in today's market.

Job Outlook and Career Growth

The future for Compensation Analysts is bright and stable. In an economic climate where attracting and retaining talent is a top priority for nearly every business, the expertise of compensation professionals is more valuable than ever. The increasing complexity of legal regulations further solidifies the necessity and security of this career path.

The U.S. Bureau of Labor Statistics (BLS) projects that employment for Compensation, Benefits, and Job Analysis Specialists will grow by 7 percent from 2022 to 2032, which is faster than the average for all occupations. The BLS anticipates about 9,100 openings for these specialists each year, on average, over the decade. Much of this demand stems from the need to replace workers who are retiring or transitioning to different occupations, but a significant portion is driven by new growth. [Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook].

The drivers behind this positive outlook are clear and sustainable, indicating long-term career viability.

#### Emerging Trends Shaping the Future of Compensation

The role of a Compensation Analyst is not static; it is constantly evolving. Staying ahead of these trends is crucial for career advancement and continued relevance.

1. The Pay Transparency Movement: This is the single most significant trend shaping the profession today. Spearheaded by states like California, Colorado, Washington, and New York City, laws requiring pay ranges in job postings are becoming the norm. This trend is shifting the work of analysts from reactive (pricing a role for a specific candidate) to proactive (building and maintaining a fully transparent and defensible pay structure for the entire organization). Analysts who can build communication strategies and train managers on how to talk about pay in this new transparent world are exceptionally valuable.

2. Focus on Pay Equity: Driven by legislation and social pressure, organizations are under intense scrutiny to ensure fair pay across gender, race, and other demographics. Pay equity audits, once a niche practice, are now a standard annual project at most large companies. Analysts skilled in the statistical methods required for these audits and capable of recommending remediation strategies are in high demand. Expertise in navigating the reporting requirements of laws like California's SB 1162 is a mission-critical skill.

3. The Impact of Remote and Hybrid Work: The rise of remote work has thrown a wrench into traditional geographic-based pay strategies. Companies now grapple with complex questions: Should an employee who moves from San Francisco to Boise receive a pay cut? Should a role be paid based on the employee's location or the company's headquarters? Compensation Analysts are on the front lines, developing new, sophisticated pay models (e.g., national pay bands with location-based multipliers) to address this new reality.

4. Data-Driven Decision Making: "Gut feelings" about pay are a relic of the past. Today's compensation decisions must be backed by robust data. This means analysts are increasingly expected to have stronger technical skills. The ability to not only use survey data but also to leverage internal company data—combining performance metrics, tenure, and demographic data with pay—to uncover insights is becoming a key competency.

5. Holistic "Total Rewards" Approach: Companies are increasingly competing for talent based on more than just salary. The concept of "Total Rewards" encompasses everything of value an employee receives, including benefits, wellness programs, career development opportunities, and workplace flexibility. Compensation Analysts are evolving into Total Rewards Strategists, working to integrate all these elements into a single, cohesive, and compelling employee value proposition.

#### How to Stay Relevant and Advance

Advancement in this field comes from a commitment to continuous learning and strategic skill development.

- Become a Legal Eagle: Dedicate time each week to reading updates from law firms and HR publications about emerging labor laws. Become the go-to expert on the regulations in the states where your company operates, especially complex ones like California.

- Embrace Technology: Don't just be an Excel user