Considering a career that rewards analytical thinking, meticulous attention to detail, and sound judgment? The role of an insurance underwriter might be the perfect fit. This financially stable and intellectually stimulating profession is the backbone of the insurance industry. But what can you expect to earn?

An insurance underwriter's salary isn't just a single number; it's a spectrum influenced by a range of factors. While entry-level professionals can expect a solid starting salary, experienced and specialized underwriters can command impressive six-figure incomes. This guide will break down everything you need to know about your potential earnings in this critical field.

What Does an Insurance Underwriter Do?

In short, insurance underwriters are the risk-assessment experts of the insurance world. Their primary job is to act as the gatekeeper for the insurance company. They meticulously review applications for insurance coverage and use a combination of sophisticated software and professional judgment to determine whether to provide that coverage and, if so, under what terms and at what price (the premium).

Key responsibilities include:

- Analyzing applications and background information to evaluate risk.

- Utilizing underwriting software and actuarial data to determine risk levels.

- Deciding whether to accept, modify, or decline an application.

- Calculating appropriate premiums and defining the terms and conditions of the insurance policy.

- Collaborating with insurance agents and brokers to gather information.

By accurately pricing risk, underwriters ensure the insurance company remains profitable while providing essential coverage to individuals and businesses.

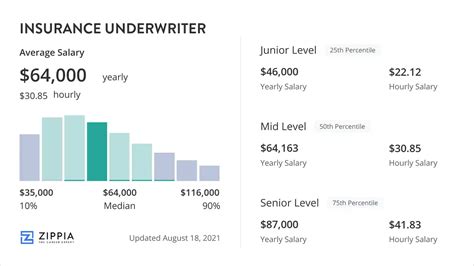

Average Insurance Underwriter Salary

To understand your earning potential, it's best to look at a combination of national averages and typical salary ranges that account for experience.

According to the most recent data from the U.S. Bureau of Labor Statistics (BLS), the median annual wage for insurance underwriters was $83,810 in May 2023. The "median" means that half of all underwriters earned more than this amount, and half earned less.

However, this single figure doesn't tell the whole story. Salary aggregators provide a more detailed look at the typical range:

- Salary.com reports that the salary range for an Insurance Underwriter in the United States typically falls between $72,300 and $98,100.

- Payscale notes a similar base salary range, from approximately $57,000 for entry-level roles to over $96,000 for senior underwriters.

This data shows a clear path for salary growth. An entry-level underwriter might start in the $60,000s, but with experience, specialization, and proven performance, earning over $100,000 is a very achievable goal.

Key Factors That Influence Salary

Your specific salary as an underwriter will depend heavily on several key variables. Understanding these factors can help you strategize your career path for maximum earning potential.

### Level of Education

A bachelor's degree is the standard entry-level requirement for most underwriting positions. Degrees in business, finance, economics, or mathematics are particularly relevant. While an undergraduate degree will get you in the door, pursuing advanced certifications can significantly boost your salary and career trajectory.

The most respected designation in the industry is the Chartered Property Casualty Underwriter (CPCU). Earning a CPCU demonstrates a high level of expertise and commitment to the profession and is often a prerequisite for senior and management-level positions. Other valuable certifications include the Associate in Commercial Underwriting (AU) and Associate in General Insurance (AINS).

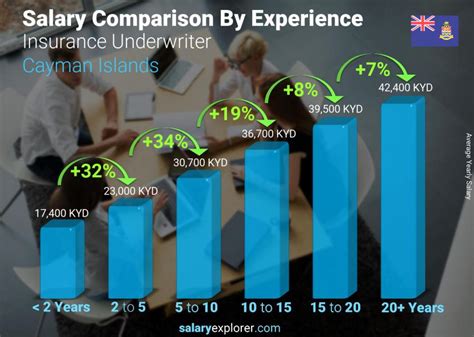

### Years of Experience

Experience is arguably the most significant driver of salary growth in underwriting. As you gain experience, you are trusted with larger, more complex cases, which translates directly to higher compensation.

- Underwriter Trainee / Junior Underwriter (0-2 years): In this phase, you are learning the fundamentals and working under close supervision. Salaries typically range from $55,000 to $70,000.

- Mid-Level Underwriter (2-5 years): With a few years of experience, you have more autonomy and handle a full caseload. Salaries often move into the $70,000 to $90,000 range.

- Senior Underwriter (5+ years): Senior underwriters are experts who handle the most complex and high-value accounts. They may also mentor junior staff. Their earnings frequently exceed $95,000, with many earning well over $110,000.

- Underwriting Manager / Director: Those who move into management roles are responsible for leading a team of underwriters and setting departmental strategy. These positions command the highest salaries, often ranging from $120,000 to $170,000+.

### Geographic Location

Where you work matters. Salaries for underwriters are higher in major metropolitan areas with a high cost of living and a large concentration of insurance company headquarters.

According to the BLS, the top-paying states for insurance underwriters include:

1. Connecticut: A historic hub for the insurance industry.

2. New York: A major financial and insurance center.

3. New Jersey: Benefitting from its proximity to New York City.

4. California: Home to a massive market and major corporate offices.

5. Illinois: Anchored by the major insurance market in Chicago.

Working in cities like New York, NY, Hartford, CT, or San Francisco, CA, will likely result in a higher salary than working in a smaller, more rural market, though the cost of living will also be higher.

### Company Type

The type of company you work for plays a crucial role in your compensation. The primary employers of underwriters are direct insurance carriers (companies like Travelers, Progressive, or Allstate). These companies hold the risk and directly employ underwriting teams to manage it.

Another major employer type is a reinsurance company—essentially, "insurance for insurance companies." Underwriting for a reinsurer is highly complex, involves massive financial risk, and is one of the most lucrative paths in the field.

Generally, larger national carriers and reinsurance firms offer higher salaries and more robust benefits packages than smaller, regional insurance companies or agencies.

### Area of Specialization

Not all underwriting is the same. The complexity of the product you underwrite has a direct impact on your salary.

- Personal Lines: This includes auto and homeowner's insurance. While essential, this area is becoming more automated and is generally the entry point for many underwriters, with salaries on the lower end of the spectrum.

- Commercial Lines: This involves underwriting businesses and is far more complex. It can include everything from general liability and commercial property to workers' compensation. Commercial underwriters are in high demand and earn significantly more than their personal lines counterparts.

- Life & Health Insurance: These underwriters assess mortality (life) and morbidity (health) risks. This is a specialized field with strong earning potential.

- Surety & Bonds: This is a highly specialized niche of underwriting that guarantees a party's performance of an obligation. It is one of the most challenging and highest-paying areas of the profession.

Specializing in complex commercial lines, reinsurance, or surety bonds is a proven strategy for maximizing your income as an underwriter.

Job Outlook

The future of underwriting is evolving with technology. The U.S. Bureau of Labor Statistics projects a 3 percent decline in employment for insurance underwriters from 2022 to 2032.

However, this statistic requires context. The decline is primarily expected in more routine areas, like personal lines, where automated software can handle simple applications. The demand for skilled underwriters who can analyze complex, unique, and high-value risks—especially in commercial, specialty, and reinsurance lines—is expected to remain strong. The role is not disappearing; it is becoming more specialized and focused on risks that algorithms cannot assess alone.

Conclusion

A career as an insurance underwriter offers a clear and promising path to a stable and lucrative professional life. While the national median salary hovers in the low $80,000s, your individual potential is much higher.

Key Takeaways:

- Strong Foundation: A bachelor's degree is your entry ticket, with typical starting salaries in the $60,000 range.

- Growth is Key: Experience is the primary driver of salary growth, with senior professionals and managers earning well into the six figures.

- Invest in Yourself: Earning prestigious certifications like the CPCU is a direct investment in your earning potential.

- Specialize for Success: Focusing on complex areas like commercial lines, reinsurance, or surety bonds will put you in the highest salary brackets.

For individuals who are analytical, detail-oriented, and ready for a rewarding challenge, the field of insurance underwriting provides a durable career path with excellent financial prospects.