Introduction

In the intricate ecosystem of the modern workplace, compensation is often the most sensitive, confidential, and emotionally charged topic. You work hard, negotiate for your worth, and trust that your financial details are a private matter between you and your employer. But what happens when that trust is broken? You hear whispers in the hallway, notice a change in how colleagues interact with you, and a sinking feeling tells you something is wrong: you suspect your salary has been shared without your consent. This single act can erode morale, breed resentment, and create a toxic work environment. The question, "Can my employer disclose my salary to other employees?" isn't just a matter of workplace etiquette; it strikes at the heart of your legal rights, professional standing, and financial privacy.

The answer is complex, layered with federal law, varying state statutes, and specific workplace contexts. While employers generally do not have the right to broadcast your salary details indiscriminately, the legality of such a disclosure is not a simple "yes" or "no." The legal landscape is shifting rapidly, driven by a powerful movement toward pay transparency aimed at closing persistent wage gaps. Navigating this landscape is crucial for protecting your rights and career. The potential financial and professional consequences are significant; an unlawful disclosure could be grounds for legal action, while understanding your right to discuss your own pay can be a powerful tool for ensuring you are compensated fairly.

I once worked with a mid-level manager at a tech firm who discovered her director had revealed her salary to a junior team member during a "mentoring" session, using it as an example of a "goal to aspire to." While perhaps well-intentioned, this act completely undermined her authority and created a wave of resentment that took months to repair. It highlighted for me, in stark terms, how critical it is for every employee to understand the explicit and implicit rules governing pay confidentiality. This guide is designed to be your definitive resource, empowering you with the knowledge to protect your privacy, understand your rights, and take decisive action if those rights are violated.

### Table of Contents

- [Understanding Salary Disclosure: The Core Concepts](#understanding-salary-disclosure-the-core-concepts)

- [The Legal Landscape of Salary Disclosure in the U.S.](#the-legal-landscape-of-salary-disclosure-in-the-us)

- [Key Factors That Determine if a Disclosure is Lawful](#key-factors-that-determine-if-a-disclosure-is-lawful)

- [Trends and the Future of Pay Transparency](#trends-and-the-future-of-pay-transparency)

- [What to Do If Your Salary Has Been Disclosed](#what-to-do-if-your-salary-has-been-disclosed)

- [Conclusion: Taking Control of the Conversation](#conclusion-taking-control-of-the-conversation)

Understanding Salary Disclosure: The Core Concepts

Before delving into the dense legalities, it’s essential to establish a clear understanding of what "salary disclosure" truly means in a professional context. The term can encompass a wide range of scenarios, each with different implications. It is not a monolithic event but a nuanced action defined by who is sharing, what is being shared, and why. At its core, salary disclosure refers to the act of making an individual's compensation details known to others. However, the practical and legal analysis of such an act depends heavily on the specifics.

The most critical distinction is between employee-led discussion and employer-led disclosure. You and your colleagues discussing your wages over lunch is fundamentally different from your manager revealing your bonus amount in a team meeting. The former is a protected right for most employees, while the latter is a potential legal violation by the employer.

Let's break down the common forms of salary disclosure:

- Formal, Intentional Disclosure by an Employer: This occurs when a manager, HR representative, or executive knowingly and purposefully shares an employee's specific pay information with other employees who do not have a legitimate business need to know. For example, a supervisor telling Employee B that Employee A earns $75,000 per year. This is the most legally precarious type of disclosure for an employer.

- Accidental or Negligent Disclosure by an Employer: This happens through carelessness. An HR manager might accidentally email a payroll spreadsheet to the wrong distribution list, or a supervisor might leave a document with salary information visible on their desk or a shared printer. While unintentional, this can still create significant liability for the company and harm for the employee.

- Employee-to-Employee Discussion (Pay Transparency): This is when employees voluntarily share their own salary information with one another. This can happen in one-on-one conversations, group chats, or even shared spreadsheets. As we will explore, this activity is legally protected for most private-sector employees under federal law.

- Disclosure Required by Law or for Business Operations: In some contexts, salary information must be shared. HR and payroll departments inherently have access to this data to perform their jobs. A manager may need to know the salary ranges of their direct reports to conduct performance reviews and make budget decisions. Furthermore, the salaries of most public-sector and government employees are a matter of public record and can be accessed through Freedom of Information Act (FOIA) requests.

To make this tangible, let's consider a real-world scenario that illustrates these distinctions.

### A Scenario in Practice: The Case of the Team "Benchmark"

Imagine a marketing team with three specialists: Alex, Ben, and Carla.

1. Employee-Led Discussion: Alex and Ben are having coffee and start discussing career growth. Alex mentions he's making $80,000 and is wondering if that's competitive. Ben shares that he’s at $84,000 but received a higher signing bonus. This conversation is a form of salary disclosure, but it is initiated by the employees themselves. Under federal law, this discussion is protected, and their employer cannot retaliate against them for having it.

2. Employer-Led Disclosure: The following week, their manager, David, holds a performance review with Carla. Carla expresses frustration that she feels underpaid. To motivate her, David says, "Look, I know you're at $76,000 right now, but Alex is our benchmark for this role, and he's at $80,000. If you can lead the next campaign successfully, we can get you closer to that." David has now disclosed Alex's salary to Carla without Alex's consent and without a legitimate, overriding business necessity. This action is not protected and is likely illegal.

3. Accidental Disclosure: Later that day, David is working on salary projections for the next fiscal year. He prints the spreadsheet, which includes the names and current salaries of everyone on his team, and then leaves for a meeting, forgetting the document on the shared office printer. Ben finds it while retrieving his own printout. This is an accidental disclosure. While not malicious, it represents a data breach and exposes the company to potential liability for failing to properly safeguard sensitive employee information.

This scenario highlights the critical difference: agency and purpose. When employees share, it's typically for mutual benefit and is legally protected. When an employer shares an individual's pay with others without a compelling business reason, it crosses a line from transparency into a potential violation of privacy and labor law.

The Legal Landscape of Salary Disclosure in the U.S.

The question of whether an employer can legally disclose your salary is primarily governed by a combination of federal and state laws. While there is no single federal statute that explicitly says, "An employer shall not disclose an employee's salary," the legal framework creates a powerful set of protections for employees and significant restrictions on employers. The cornerstone of this framework is the National Labor Relations Act (NLRA).

### Federal Protection: The National Labor Relations Act (NLRA)

Enacted in 1935, the NLRA is a foundational piece of U.S. labor law. While many associate it with unions and collective bargaining, its protections extend to most non-supervisory employees in the private sector, regardless of whether they are in a union.

Section 7 of the NLRA is the key provision. It grants employees the right to engage in "concerted activities for the purpose of collective bargaining or other mutual aid or protection." The National Labor Relations Board (NLRB), the federal agency that enforces the NLRA, has long interpreted "mutual aid or protection" to include the discussion of wages and working conditions among colleagues.

What does this mean for you?

- You have the right to discuss your salary: You can talk about your pay, bonuses, and benefits with your coworkers.

- You cannot be punished for discussing your salary: An employer cannot fire, demote, discipline, threaten, or otherwise retaliate against you for engaging in these conversations.

- "Pay Secrecy" policies are generally illegal: Any formal or informal company policy that prohibits employees from discussing their wages is a violation of the NLRA. This includes handbook rules, non-disclosure agreements signed upon hiring, or verbal warnings from managers telling you not to talk about pay.

According to the NLRB, "When you and another employee have a conversation about your pay, it is unlawful for your employer to punish or retaliate against you in any way for having that conversation. It is also unlawful for your employer to have a work rule, policy, or hiring agreement that prohibits employees from discussing their wages with each other or that requires you to get the employer’s permission to have such conversations."

So, if employees CAN discuss their pay, does that mean employers CAN'T?

Precisely. The NLRB’s interpretation creates a one-way street. The right belongs to the employees to voluntarily share their own information for their mutual benefit. It is *not* a right for the employer to take that private information and disseminate it. In fact, an employer disclosing one employee's salary to another could be seen as an unfair labor practice designed to interfere with, restrain, or coerce employees in the exercise of their Section 7 rights. For example, a manager revealing a high earner's salary could be interpreted as an attempt to discourage other employees from asking for raises, thereby chilling protected concerted activity.

Exceptions to NLRA Protections:

It's crucial to note that the NLRA does not cover all workers. The following groups are generally not protected by the NLRA's right to discuss wages:

- Supervisors and Managers: The law defines a "supervisor" as someone who has the authority to hire, fire, discipline, or direct other employees. These individuals are considered agents of the employer and do not have the same protected rights to discuss wages among themselves.

- Public-Sector Employees: Federal, state, and municipal government workers are not covered by the NLRA. However, they may have similar rights under other federal or state civil service laws. (As noted earlier, their salaries are often public record anyway).

- Agricultural Laborers, Independent Contractors, and Domestic Service Workers: These classifications are also explicitly excluded from NLRA coverage.

### The Rise of State-Level Pay Transparency Laws

While the NLRA provides a strong federal floor, a growing number of states and cities have enacted their own, often more explicit, pay transparency laws. These laws supplement the NLRA and can provide even broader protections or impose new obligations on employers.

These state laws generally fall into two categories:

1. Laws Protecting Employee Wage Discussion: These laws mirror or strengthen the NLRA's protections, explicitly stating that employers cannot forbid employees from discussing, inquiring about, or disclosing their wages. Some of these laws extend protections to applicants as well as current employees.

2. Laws Requiring Proactive Pay Disclosure (Pay Scale Transparency): This is a more recent and powerful trend. These laws require employers to proactively disclose salary ranges for open positions, either directly in the job posting or upon request by an applicant.

Here is a comparison of how federal and state laws interact, with examples from prominent states (as of late 2023/early 2024):

| Jurisdiction | Key Provisions Regarding Salary Disclosure | Who is Covered? | Source/Reference |

| ----------------- | --------------------------------------------------------------------------------------------------------------------------------------------------------------------- | --------------------------------------------------------------------------------------------------------------------- | ---------------------------------------------------------------------------------------------- |

| Federal (NLRA) | Protects non-supervisory employees' right to discuss wages. Prohibits employer retaliation and "pay secrecy" policies. | Most private-sector, non-supervisory employees. | National Labor Relations Board (NLRB) |

| California | Protects employee right to discuss wages. Requires employers with 15+ employees to include pay scales in job postings. Requires providing pay scale to current employees upon request. | All employees. Pay scale provisions apply to employers with 15+ employees. | California Labor Code §432.3 |

| Colorado | The first state to mandate pay scales in all job postings. Protects employee right to discuss wages. Prohibits employers from seeking wage history. | All employers and employees in the state. | Colorado Equal Pay for Equal Work Act |

| New York State| Requires employers with 4+ employees to list good-faith salary ranges in all advertisements for jobs, promotions, or transfer opportunities. | All employers with 4+ employees. | New York State Labor Law §194-b |

| Washington | Requires employers with 15+ employees to disclose wage scales in job postings. Employers of all sizes must provide the range to an applicant or current employee upon request. | All employers and employees. Posting requirements apply to employers with 15+ employees. | Washington's Equal Pay and Opportunities Act |

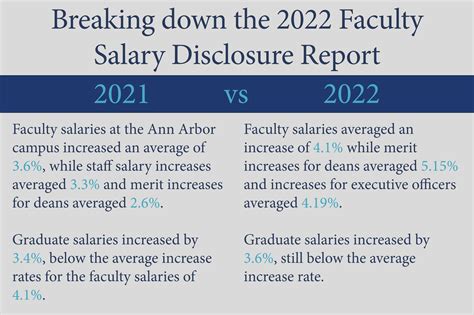

This table illustrates a critical point: while federal law sets a baseline, your specific rights can be even stronger depending on where you work. These state laws are a direct response to the persistence of gender and racial wage gaps, which, according to the U.S. Bureau of Labor Statistics (BLS), remain significant. In 2022, women's median weekly earnings were 83.1% of men's. The transparency movement aims to close these gaps by empowering employees with more information.

In summary, the legal framework is heavily weighted in favor of an employee's right to discuss their own pay and against an employer's right to disclose it. An employer who discloses an employee's salary to others without a legitimate business justification is treading on very thin ice, potentially violating the NLRA, state law, and common law principles of privacy.

Key Factors That Determine if a Disclosure is Lawful

The legality of a specific instance of salary disclosure is not black and white. It is a nuanced issue where context is everything. An action that is permissible in one scenario can be a serious legal violation in another. When an employee's salary is revealed, several key factors must be analyzed to determine whether the disclosure was lawful or if it created a cause for action. Think of these factors as a checklist that a lawyer or a government agency like the NLRB would use to evaluate a complaint.

### `

`Who is Disclosing the Information? (The Source) `

`This is the single most important factor. The legal rights and restrictions are completely different for an employee versus an employer.

- Disclosure by an Employee: As established by the NLRA, a non-supervisory employee discussing their *own* pay with a colleague is engaging in protected concerted activity. This is legal and cannot be grounds for retaliation. The same goes for an employee who discloses a coworker's pay that they learned through normal workplace conversation (e.g., "I heard from Sarah that she makes $X"). While this can create workplace drama, it's generally still part of the protected conversation around wages and working conditions.

- Disclosure by the Employer (or its Agents): This is where the legal risk lies. When a manager, director, HR professional, or any other agent of the company discloses an employee's salary, the act is scrutinized heavily. The employer holds the employee's data in a position of trust. Disseminating it without a legitimate reason can be seen as an attempt to interfere with employees' rights (e.g., to sow discord or discourage wage negotiations), a breach of confidentiality, or an invasion of privacy. A company cannot claim the same "mutual aid and protection" right that its employees have.

### `

`Who is the Employee in Question? (The Subject's Status)`

`The role and status of the employee whose salary is being disclosed can change the legal analysis significantly.

- Non-Supervisory Employees: These individuals have the full protection of the NLRA. A disclosure of their salary by management is highly problematic and likely unlawful unless there's a compelling, narrowly defined business reason.

- Supervisors and Managers: Since supervisors are not protected by Section 7 of the NLRA, the rules are murkier. An employer has more latitude in discussing a manager's salary with other members of the management team, especially for purposes of budgeting, succession planning, or compensation calibration. However, broadcasting a manager's salary to their non-supervisory subordinates is still highly inappropriate and could create other legal issues, such as claims of creating a hostile work environment or undermining the manager's authority.

- HR, Payroll, and Finance Professionals: These employees have access to confidential salary information as a core function of their job. This access comes with an extremely high duty of confidentiality. If an HR manager discloses an employee's salary for any reason outside the absolute necessities of their job, it is a severe breach of professional ethics and company policy, and it could lead to immediate termination and potential legal action against both the HR manager and the company. The "need to know" principle is paramount here.

### `

`What is the Context of the Disclosure? (The Purpose and Method)`

`The "why" and "how" of the disclosure are critical. Intent matters.

- Accidental Disclosure (Data Breach): If salary information is disclosed accidentally (e.g., a misdirected email, a lost document), the legal issue shifts from a labor law violation to one of data privacy and negligence. The employer could be liable for failing to implement reasonable safeguards to protect sensitive employee data. The harm to the employee is real, regardless of intent. Many states have data breach notification laws that might be triggered by such an incident.

- Intentional Disclosure to Suppress Wages: This is a worst-case scenario and a clear violation of the NLRA. If a manager tells a group of employees, "Don't bother asking for a raise, our top performer Sarah only makes $90,000," they are using private salary data to illegally discourage employees from exercising their right to seek better compensation.

- Intentional Disclosure for Legitimate Business Needs: There are rare situations where disclosure might be permissible. For instance, in a legal proceeding, salary information would be discoverable. When creating departmental budgets, a department head must work with finance using specific salary data. A senior executive might discuss a direct report's compensation with HR during a calibration session. The key is that the disclosure is limited to only those with a direct "need to know" to perform a legitimate business function, and it is not shared more broadly. Using someone's pay as a "motivational example" for another employee, as in the earlier scenario, does not meet this standard.

### `

`Geographic Location (State and Local Laws)`

`As detailed previously, your location is a massive factor. An employer in Colorado or New York City is operating under a different set of rules than one in a state with no specific pay transparency laws.

- States with Strong Pay Transparency Laws (e.g., CA, CO, WA, NY): In these states, the culture and legal expectation is one of openness. While this doesn't give employers the right to disclose *individual* salaries, it strengthens the argument that salary information should not be secret. A legal challenge against an employer for a disclosure might be viewed even more seriously in these jurisdictions because the employer is expected to be highly aware of the sensitivity and legal framework surrounding pay.

- States with No Specific Pay Transparency Laws: In these states, the federal NLRA is the primary source of protection. The case rests entirely on the "concerted activity" argument. While still strong, it lacks the extra weight of a specific state statute explicitly protecting wage discussions.

### `

`Type of Employer (Public vs. Private Sector)`

`The nature of the employer fundamentally changes the expectation of privacy.

- Private-Sector Employers: Most of this guide focuses on private companies. Here, salary information is considered confidential business information and sensitive personal data. The legal protections of the NLRA and state laws are in full force.

- Public-Sector Employers (Government Agencies): For most federal, state, and local government employees, there is little to no expectation of salary privacy. Salaries are often funded by taxpayers, and as a result, they are considered public records. Websites like `FederalPay.org` or state-specific public employee salary databases publish this information for anyone to see. In this context, an employer "disclosing" a salary is often just pointing to information that is already publicly available by law.

### `

`Company Policies (Pay Secrecy Policies)`

`Finally, the employer's own written policies are a factor, though often not in the way they intend.

- Illegal "Pay Secrecy" Policy: If a company has a policy in its employee handbook that states, "Employees are prohibited from discussing their compensation with one another," that policy is unlawful and unenforceable under the NLRA. The existence of such a policy can be used as evidence against the employer in an NLRB complaint, showing a pattern of attempting to chill employees' rights.

- Confidentiality Policy: A company can have a valid policy that prohibits *managers* and *HR staff* from disclosing confidential pay information they access as part of their jobs. This is a legitimate and necessary policy to protect employee data. If a manager violates this specific, well-defined policy, it strengthens the employee's case against the company, as it shows the employer knew the conduct was wrong but failed to prevent it.

By walking through these factors, an employee can move from the initial shock of a disclosure to a clear-eyed assessment of their legal standing and the potential severity of the violation.

Trends and the Future of Pay Transparency

The conversation around salary disclosure is not static. It's at the forefront of a major societal and legislative shift away from the historic norm of pay secrecy and toward a future defined by greater transparency. This evolution is driven by a confluence of factors, including social justice movements, new legislation, and a generational change in workplace expectations. Understanding these trends is crucial for navigating your career, as they are actively reshaping how employers handle compensation and how employees advocate for themselves.

### The Legislative Momentum is Unmistakable

The primary engine of change is legislation. What began with a few pioneering states has become a national movement. According to the National Conference of State Legislatures, as of early 2024, more than 20 states have enacted laws that either protect an employee's right to discuss pay or require some form of pay scale disclosure from employers. This trend shows no signs of slowing down.

- The Domino Effect: The success of laws in states like Colorado and California has created a template for other states to follow. As more states adopt these measures, it creates pressure on others to keep up, both to protect their own workers and to create a predictable legal environment for multi-state employers.

- From Posting to Reporting: The next frontier in transparency legislation is pay data reporting. States like California and Illinois now require large employers to submit detailed reports on employee pay, broken down by race, ethnicity, and gender. This data is used by enforcement agencies to proactively identify and combat systemic pay discrimination. This trend moves beyond empowering individual applicants and toward holding companies accountable at a structural level.

- Federal Interest: While a comprehensive federal pay transparency law has yet to pass, the issue is on the national agenda. The proposed Paycheck Fairness Act, which has been introduced in Congress multiple times, includes provisions similar to the more robust state laws. The continued push at the state level may eventually create the momentum needed for a federal standard.

### The Impact on Corporate Culture and HR Practices

This legal groundswell is forcing companies to fundamentally rethink their compensation strategies. The era of keeping pay decisions shrouded in mystery is ending.

- Proactive Compensation Analysis: Companies can no longer afford to be reactive. The risk of being "exposed" by new transparency laws for having inequitable pay structures is too great. This is leading to a surge in internal pay equity audits. HR departments and consulting firms like Payscale and Salary.com report a significant increase in businesses conducting comprehensive analyses to identify and remediate unexplained pay gaps before they become public liabilities.

- Formalizing Compensation Structures: To create defensible and transparent pay ranges, companies must build more formal structures. This means defining job levels, creating clear career ladders, and establishing salary bands for each role based on market data, skills, and experience. The "ad-hoc" approach to setting salaries is becoming untenable.

- Training for Managers: A major challenge is preparing managers to have these conversations. For decades, managers were often trained to deflect or shut down any talk about pay. Now, they must be equipped with the language and data to explain the company's compensation philosophy and an individual employee's position within a specific pay band. This is a significant training and development need for organizations nationwide.

### Future Challenges and Emerging Issues

While the trend toward transparency is overwhelmingly positive for employee equity, it also presents new challenges that will define the next phase of this evolution.

- The "Context" Challenge: A salary range in a job posting is a starting point, but it lacks context. Two people in the same role with the same title might be paid differently for valid reasons—one has a niche, high-demand skill; the other has more years of relevant experience. The future of transparency will involve companies getting better at communicating the "why" behind their pay decisions, not just the "what."

- Data Privacy Concerns: As more pay data is collected and reported, concerns about data privacy and security will grow. How is this sensitive data stored? Who has access to it? How is it anonymized to protect individual employees while still being useful for analysis? These are complex questions that companies and regulators will need to address.

- The Backlash to Remote Work Transparency: Pay transparency laws are colliding with the rise of remote work. Companies that once set salaries based on an employee's location in a high-cost area (like San Francisco or New York) now have to post those high salary ranges for remote jobs that can be performed anywhere. This has led to some companies creating separate job postings for different regions or trying to find loopholes, creating a new layer of complexity.

- Beyond Base Salary: True transparency isn't just about salary. It's about the entire compensation package: bonuses, equity (stock options/RSUs), commissions, and benefits. The next wave of transparency advocacy will likely focus on requiring employers to be more open about the total rewards package, which can vary dramatically even among employees with the same base pay.

To stay relevant and advance, professionals must embrace this new paradigm. This means actively researching market rates using tools from Glassdoor, Payscale, and the BLS Occupational Outlook Handbook. It means becoming comfortable having data-driven conversations about your value. And it means understanding that your right to discuss pay is not just a legal protection—it's one of the most powerful tools you have for building a fair and equitable career.