Can Salaried Workers Get Overtime? A Guide to Your Rights and Pay

It’s one of the most persistent myths in the workplace: if you earn a salary, you’re not eligible for overtime pay. Many professionals work long hours assuming it's simply part of the "salaried" package. However, the reality is far more nuanced. The ability to earn overtime isn't about being paid a salary versus an hourly wage; it’s about your specific job classification under federal and state law.

Understanding your rights can be the difference between being fairly compensated for your extra work and leaving significant money on the table. This guide will demystify the rules, explain who is eligible, and empower you to ensure you’re being paid correctly.

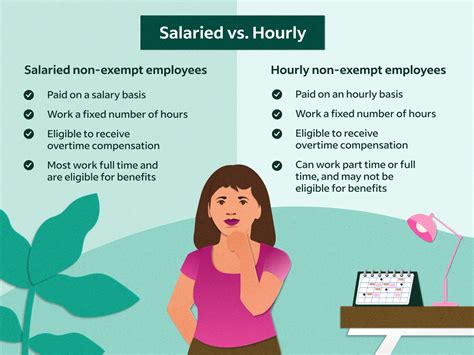

The Salaried vs. Hourly Myth: Understanding Exempt vs. Non-Exempt Status

The core of the overtime issue lies not in how you are paid (salary or hourly) but in how your role is classified by your employer under the Fair Labor Standards Act (FLSA). This federal law establishes minimum wage, recordkeeping, and overtime pay standards. The FLSA divides employees into two categories:

- Non-Exempt: These employees are "not exempt" from the FLSA's overtime rules. They are entitled to overtime pay, typically calculated at 1.5 times their regular rate of pay for all hours worked over 40 in a workweek. Most hourly workers fall into this category, but so do many salaried employees.

- Exempt: These employees are "exempt" from the FLSA's overtime rules, meaning their employer is not required to pay them overtime. To be classified as exempt, an employee must meet specific criteria related to their salary level and job duties.

The key takeaway is this: You can be a salaried employee and still be classified as non-exempt, making you eligible for overtime pay.

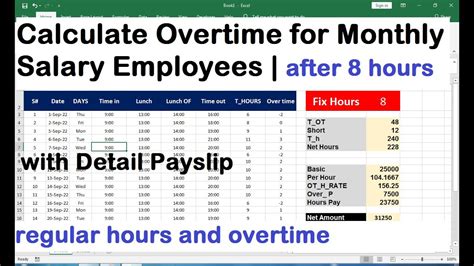

Calculating Overtime for a Non-Exempt Salaried Employee

If you are a salaried, non-exempt employee, you might wonder how overtime is calculated. Since you don't have a set "hourly rate," one must be determined first.

The process is straightforward:

1. Calculate the Regular Rate: Divide your weekly salary by the number of hours that salary is intended to cover. If your salary is for a 40-hour workweek, you divide by 40.

- *Example:* Your salary is $1,000 per week for a 40-hour workweek. Your regular rate is $1,000 / 40 = $25 per hour.

2. Calculate the Overtime Rate: Multiply your regular rate by 1.5.

- *Example:* $25/hour x 1.5 = $37.50 per hour.

3. Calculate Total Overtime Pay: Multiply your overtime rate by the number of overtime hours worked.

- *Example:* You worked 45 hours one week (5 overtime hours). Your overtime pay is 5 hours x $37.50 = $187.50.

4. Calculate Total Weekly Pay: Add your regular weekly salary and your overtime pay.

- *Example:* $1,000 (salary) + $187.50 (overtime) = $1,187.50 total pay for that week.

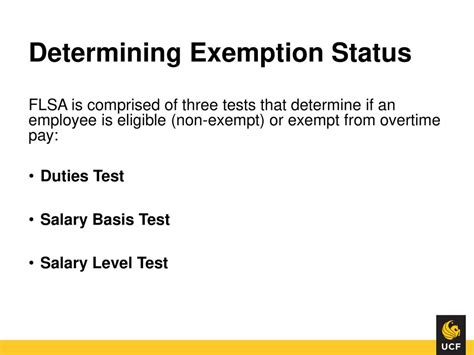

Key Factors That Determine Overtime Eligibility (The Exemption Tests)

For an employer to legally classify a salaried employee as exempt from overtime, the employee’s role must pass both a Salary Basis Test and a Duties Test.

###

The Salary Threshold Test

First, the employee must be paid a salary at or above a specific amount set by the U.S. Department of Labor (DOL).

- Current Federal Threshold: As of 2024, the federal salary threshold for exemption is $684 per week, which amounts to $35,568 per year. If you are a salaried employee earning less than this amount, you are automatically considered non-exempt and are eligible for overtime, regardless of your job duties. (Source: U.S. Department of Labor).

It's important to note that the DOL has proposed new rules to significantly increase this threshold. Always check the current DOL regulations for the most up-to-date figures.

###

The Job Duties Test

If you meet the salary threshold, your specific job responsibilities must then fall into one of the DOL's exemption categories. Simply having an impressive job title is not enough; the actual work you perform is what matters. The primary categories include:

- Executive Exemption: Your primary duty must be managing the enterprise or a recognized department. You must regularly direct the work of at least two other full-time employees and have the authority to hire or fire (or your recommendations on these matters must be given significant weight).

- Administrative Exemption: Your primary duty must be performing office or non-manual work directly related to the management or general business operations of the employer or its customers. Your role must also include the exercise of discretion and independent judgment on significant matters. This is often the most complex and litigated exemption.

- Professional Exemption: This applies to roles requiring advanced knowledge in a field of science or learning (Learned Professional, e.g., doctors, lawyers, engineers) or roles requiring invention, imagination, or talent in a recognized artistic or creative field (Creative Professional, e.g., writers, actors, musicians).

###

Geographic Location (State Laws)

While the FLSA sets the federal standard, many states have their own, more employee-friendly overtime laws. If state law provides greater protection, the state law applies.

For example, states like California, New York, and Washington have significantly higher salary thresholds for an employee to be considered exempt.

- In California, the 2024 salary threshold for exempt employees is $66,560 per year, substantially higher than the federal minimum (Source: California Department of Industrial Relations).

- In New York, the threshold varies by region, with the highest requirement in New York City, Long Island, and Westchester County at $1,200 per week ($62,400 annually) as of 2024 (Source: New York State Department of Labor).

Always check your specific state's labor department website, as its laws may grant you overtime rights even if you are considered exempt under federal law.

###

Highly Compensated Employees (HCE)

There is a separate, streamlined test for "highly compensated employees." Under federal law, an employee who earns a total annual compensation of $107,432 or more is considered exempt if they customarily and regularly perform at least one of the duties of an exempt executive, administrative, or professional employee. (Source: U.S. Department of Labor).

This makes it easier for employers to classify high-earning individuals as exempt. However, like the standard salary threshold, this figure is also subject to change and state laws may differ.

###

Specialized Professions (e.g., Computer Professionals)

Certain professions have unique rules. For example, the FLSA has specific criteria for computer employees (such as systems analysts, programmers, and software engineers). They can be classified as exempt if they are paid a salary of at least $684 per week *or* an hourly rate of at least $27.63 per hour, and their primary duties fit specific high-level tech-related tasks.

Navigating Your Overtime Rights

If you believe you are being improperly classified as exempt and are owed overtime, knowledge is your first tool.

1. Review Your Job Description and Actual Duties: Compare what you do every day against the DOL's duties tests. Does your job truly involve management or the exercise of independent judgment on significant business matters?

2. Check Your Pay Stubs: Confirm your annual salary and see how it compares to both federal and your state's salary thresholds.

3. Consult Your HR Department: You can start by having a professional, informed conversation with your HR representative. Frame it as a request for clarification on your FLSA classification.

4. Contact the Department of Labor: If you are not satisfied with the response, you can file a complaint with the U.S. Department of Labor's Wage and Hour Division (WHD) or your state's labor agency. They can investigate on your behalf.

Conclusion: Empower Yourself with Knowledge

The question, "Can salaried workers get overtime?" has a clear answer: yes, absolutely. Eligibility hinges entirely on whether your role qualifies as exempt or non-exempt under federal and state law. For any professional, understanding these rules is a critical part of managing your career and ensuring you are fairly compensated for your time and effort.

Don't assume a salary automatically disqualifies you from overtime. By understanding the salary and duties tests and being aware of your state's specific laws, you can protect your rights and ensure your hard work beyond the 40-hour week is properly valued.