It's one of the most persistent myths in the modern workplace: if you earn a salary, you’re not eligible for overtime pay. Many professionals work long hours assuming it’s simply part of the package. However, the reality is far more nuanced and is governed by specific federal and state laws. Simply being paid a salary does not automatically disqualify you from earning overtime.

The key lies in whether your specific role is classified as "exempt" or "non-exempt" under the Fair Labor Standards Act (FLSA). This guide will break down what these terms mean, how to determine your status, and what factors influence your right to overtime pay.

The Core Distinction: Exempt vs. Non-Exempt Employees

Understanding your eligibility for overtime begins and ends with two classifications defined by the U.S. Department of Labor (DOL).

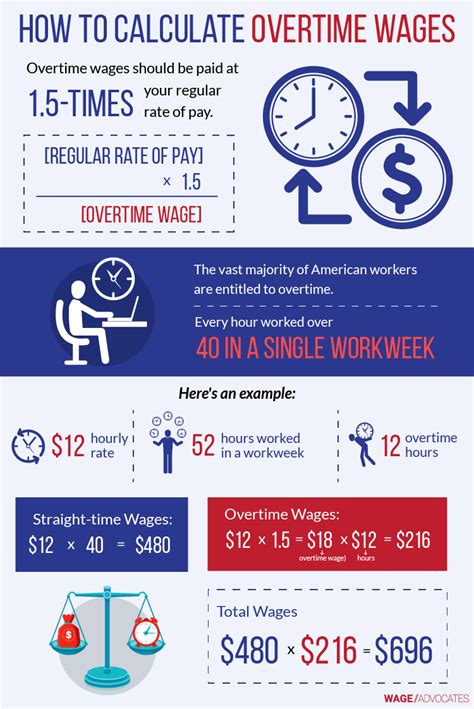

- Non-Exempt Employees: These employees are covered by the Fair Labor Standards Act and are *entitled* to overtime pay. Overtime is calculated at a rate of at least one-and-a-half times their regular rate of pay for all hours worked over 40 in a workweek. Both hourly and salaried employees can be classified as non-exempt.

- Exempt Employees: These employees are *not* entitled to overtime pay under the FLSA. To be considered exempt, an employee must meet specific criteria related to their salary level and job duties. This is where most of the confusion arises.

Are You Eligible for Overtime? The Key Exemption Tests

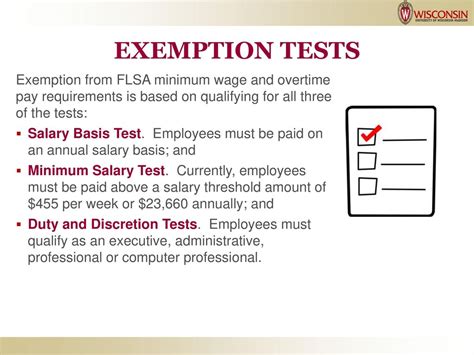

For an employer to legally classify you as exempt from overtime, you must meet all three of the following tests:

1. The Salary Basis Test: You must be paid on a salary basis, meaning you receive a predetermined amount of compensation each pay period that is not reduced based on the quality or quantity of work.

2. The Salary Level Test: Your salary must meet a minimum threshold set by the DOL.

3. The Duties Test: Your primary job duties must involve tasks that are considered executive, administrative, or professional in nature.

If your role does not meet all three of these criteria, you are likely a non-exempt employee and should be paid for overtime, regardless of whether you receive a salary.

Key Factors That Determine Overtime Eligibility

This is the most critical section for understanding your status. Your title alone means very little; it's the combination of your pay and your actual responsibilities that matters.

### The Salary Threshold: How Much You Earn Matters

This is the first and most straightforward hurdle for an exemption. As of the latest federal guidelines, to be considered exempt, you must earn a salary of at least $684 per week, which amounts to $35,568 per year (Source: U.S. Department of Labor). If you earn less than this amount, you are automatically non-exempt and eligible for overtime, even if your duties are executive or professional.

Important Note: Geographic location plays a huge role here. Several states have their own, higher salary thresholds. For example:

- California: The 2024 salary threshold for exemption is $66,560 per year for all employers.

- New York: The threshold varies by region, with New York City, Long Island, and Westchester having a threshold of $1,200 per week ($62,400 annually) in 2024.

State law always supersedes federal law when it provides greater protection or benefit to the employee.

### Your Job Duties: The "Duties Test"

This is where classification becomes complex. Even if you meet the salary threshold, your primary job responsibilities must fit into one of the following categories defined by the FLSA:

- Executive Exemption: Your primary duty is managing the enterprise or a recognized department. You must customarily direct the work of at least two full-time employees and have the authority to hire, fire, or make influential recommendations on these matters. (e.g., Department Head, Shift Supervisor).

- Administrative Exemption: Your primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers. This role must include the exercise of discretion and independent judgment with respect to matters of significance. (e.g., Human Resources Manager, Financial Analyst, Executive Assistant who manages schedules and operations independently).

- Professional Exemption: This is split into two types:

- Learned Professional: Your primary duty requires knowledge of an advanced type in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction. (e.g., Doctors, Lawyers, Engineers, Accountants, Scientists).

- Creative Professional: Your primary duty is work requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor. (e.g., Actors, Musicians, Graphic Artists, Writers).

- Computer Employee Exemption: You must be employed as a computer systems analyst, computer programmer, software engineer, or other similarly skilled worker in the computer field.

If your job duties do not clearly fit one of these descriptions, you may be a non-exempt employee.

### Company Policy and "Salaried Non-Exempt" Roles

Some confusion arises from a hybrid classification: the salaried non-exempt employee. This is an employee who is paid a fixed salary each week but *is still eligible for overtime*. Companies may do this for various reasons, including simplifying payroll for roles with consistent schedules or for positions that don't meet the FLSA duties test.

For example, a company might pay an administrative assistant a salary of $45,000 per year. Because this role typically does not involve the level of independent judgment required for the administrative exemption, they would be classified as salaried non-exempt. If they work 45 hours in one week, they are owed 5 hours of overtime pay.

### Industry and Role Specifics

Certain industries and roles are more likely to be exempt than others due to high salaries and the nature of the work.

- Typically Exempt: Senior executives, physicians, attorneys, and certified public accountants earning well above the salary threshold are almost always exempt. A Senior Software Engineer with a median salary of $132,630 (Source: Salary.com, 2024) whose primary duty is designing complex systems would be exempt.

- Often Non-Exempt (Even if Salaried): Roles that are highly skilled but production-oriented or lack managerial/discretionary duties are often non-exempt. This can include paralegals, bookkeepers, lab technicians, and many sales representatives who do not work "outside" the office. An Administrative Assistant with a median salary of $47,780 (Source: U.S. Bureau of Labor Statistics, 2023) is a classic example of a role that is often salaried but non-exempt.

What to Do If You Believe You're Owed Overtime

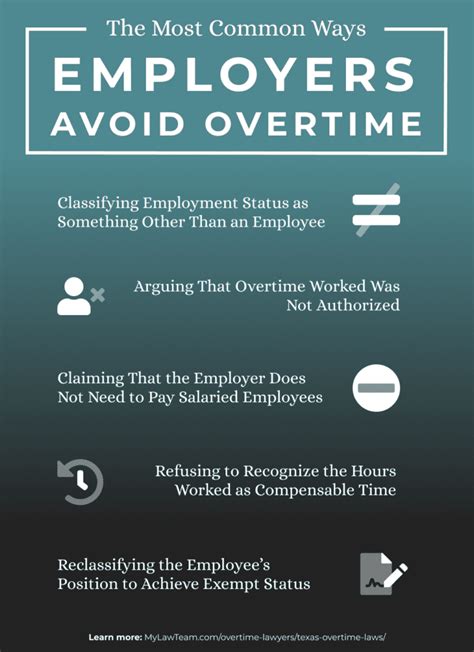

The job outlook for all professionals includes understanding your rights. Misclassification is a common issue, and it's often unintentional. If you believe you are a non-exempt employee who is not receiving overtime, take these professional steps:

1. Review Your Job Description: Compare your actual day-to-day duties with the FLSA exemption tests.

2. Track Your Hours: Keep a detailed, private log of all the hours you work for several weeks.

3. Consult HR: Politely inquire with your Human Resources department about how your role is classified and why. Frame it as a request for clarification.

4. Seek External Advice: If you are not satisfied with the answer, you can contact your state's labor department or the U.S. Department of Labor’s Wage and Hour Division for a confidential consultation.

Conclusion: Know Your Rights and Your Role

The ability to earn overtime on a salary is not a simple yes or no question—it's a legal determination based on a combination of your pay, your specific job duties, and state law.

Key Takeaways:

- Your job title is irrelevant; your actual duties and salary determine your overtime eligibility.

- To be exempt from overtime, you must meet both a salary threshold and a duties test.

- If you earn less than the federal or your state's minimum salary threshold (whichever is higher), you are automatically entitled to overtime.

- Understanding your classification as exempt or non-exempt is a crucial part of managing your career and ensuring you are compensated fairly for your time and expertise.

By being informed, you can better advocate for yourself and ensure your compensation accurately reflects not just the work you do, but all the hours you put in to do it.