For many professionals, a sudden salary reduction is a significant source of anxiety and uncertainty. The news from HR or a manager that your pay is being cut can feel personal, unfair, and even illegal. This raises a critical question that every employee should understand: Can my company actually do this?

The short answer is often yes, but this power is not absolute. An employer's ability to reduce your salary is governed by a complex mix of employment law, contract obligations, and company policy. Understanding these rules is the first step in protecting your financial well-being and making informed decisions about your career. This guide will break down the legality of pay cuts, outline your rights, and provide actionable steps to take if you find yourself in this challenging situation.

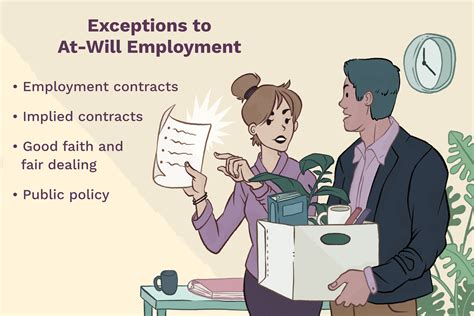

The Legal Framework: At-Will Employment

To understand salary reductions, we must first understand the primary employment doctrine in the United States (all states except Montana): at-will employment. This principle means that an employer can terminate an employee for any reason, at any time, as long as the reason isn't illegal (e.g., discriminatory or retaliatory).

This doctrine also gives employers the right to change the terms of employment—including job title, responsibilities, and, yes, salary—on a going-forward basis. The most critical rule is that a pay cut cannot be retroactive. An employer must inform you of the salary reduction *before* you perform the work at the new, lower rate. They cannot pay you less for work you have already completed at the previously agreed-upon higher rate.

When a Salary Reduction is Generally Legal

While unsettling, there are several common scenarios where a company can legally reduce an employee's pay.

For Future Work in an At-Will Arrangement

This is the most common situation. If you do not have an employment contract guaranteeing a specific salary, your employer can implement a pay cut for all future work. By continuing to work after being notified of the change, you are generally considered to have accepted the new terms of employment.

To Avoid Layoffs or During Economic Hardship

Companies facing financial distress may implement organization-wide pay cuts as an alternative to laying off staff. During economic downturns, this is a frequent strategy to preserve cash flow and retain talent. According to a 2023 report by Payscale, while salary increase budgets were high, some companies still considered pay reductions for cost-saving measures, a trend more visible during recessions. In these cases, the reduction is often presented as a shared sacrifice to keep the business afloat.

Change in Role, Responsibilities, or Hours

If your job changes significantly, a salary adjustment may be legally justifiable. Common examples include:

- Demotion: Moving to a lower-level role with fewer responsibilities.

- Change in Status: Shifting from a full-time to a part-time schedule.

- Restructuring: Your role is redefined with a reduced scope or impact on the business.

Performance-Based Reductions

Some companies have pay-for-performance structures where compensation is directly tied to meeting specific targets. If you are moved off a commission-based plan or fail to meet the performance criteria for a certain pay level, your overall compensation may decrease. However, your base salary cannot be reduced retroactively.

When a Salary Reduction is Illegal

An employer's right to reduce pay is not unlimited. There are crucial situations where a pay cut is illegal and can be challenged.

Breach of Contract

This is the most powerful protection for an employee. If you have a signed employment contract that specifies your salary for a certain period, your employer cannot reduce it without breaching that contract. This also applies to:

- Collective Bargaining Agreements (CBAs): If you are a member of a union, your CBA dictates wages, and your employer cannot unilaterally change them.

- Offer Letters: In some cases, a detailed offer letter that guarantees a salary for a specific duration can be interpreted as a binding contract.

Discrimination

A pay cut is illegal if it is motivated by discrimination. Federal law, including Title VII of the Civil Rights Act, the Age Discrimination in Employment Act (ADEA), and the Americans with Disabilities Act (ADA), prohibits employers from making compensation decisions based on an employee's:

- Race or color

- Religion

- Gender (including pregnancy)

- National origin

- Age (40 and over)

- Disability

If you can prove that you were singled out for a pay cut because you belong to a protected class, or that a policy disproportionately affects a protected group, you may have a legal claim.

Retaliation

It is illegal for an employer to reduce your salary as a form of punishment for engaging in a legally protected activity. This includes:

- Filing a harassment or discrimination claim.

- Acting as a whistleblower.

- Requesting or taking FMLA leave.

- Filing a workers' compensation claim.

- Reporting workplace safety violations (OSHA).

Falling Below Minimum Wage

An employer cannot reduce your salary below the federal, state, or local minimum wage. According to the Fair Labor Standards Act (FLSA), non-exempt (hourly) employees must be paid for all hours worked at the prevailing minimum wage. For salaried, exempt employees, there is a federal salary threshold they must meet to remain exempt from overtime pay. As of the latest updates, this is a critical legal floor that cannot be breached.

What to Do If Your Salary is Being Reduced

Finding out your pay is being cut is stressful. How you respond can have a major impact on your career and finances.

1. Stay Calm and Gather Information: Avoid an immediate emotional reaction. Your first goal is to understand the situation fully.

2. Review Your Documents: Locate your employment contract or offer letter. Read the terms carefully to see if a specific salary is guaranteed for any duration.

3. Request a Meeting: Schedule a professional conversation with your manager or HR. Ask for a clear explanation of why the reduction is happening. Is it company-wide? Is it specific to your role? Is it temporary or permanent?

4. Get It in Writing: Ask for the new terms of your employment—including your new salary and its effective date—to be documented in writing. This creates a clear record and prevents future misunderstandings.

5. Assess Your Options and Negotiate: Once you have the facts, you can decide how to proceed.

- Accept the Change: If the reasoning is fair (e.g., avoiding layoffs) and you value the job, you might choose to accept.

- Negotiate Alternatives: Could you take on different responsibilities to maintain your salary? Could a bonus structure be implemented to make up the difference upon recovery?

- Begin a Job Search: A significant pay cut may be a signal that it's time to look for opportunities elsewhere. Data from salary aggregators like Glassdoor and Salary.com can help you determine your market value and find roles that meet your salary expectations.

- Consider "Constructive Dismissal": In some states, a drastic and unilateral pay cut can be considered "constructive dismissal" or "constructive discharge." This means the employer has made working conditions so intolerable that a reasonable person would feel forced to quit. If this is proven, you may be eligible for unemployment benefits.

6. Seek Legal Counsel: If you believe the pay cut is a breach of contract, discriminatory, or retaliatory, it is wise to consult with an employment lawyer to understand your legal options.

Conclusion: Know Your Rights and Your Value

While companies often have the legal right to reduce an employee's salary for future work, this power is limited by contracts, anti-discrimination laws, and wage regulations. The key takeaway for any professional is to be proactive. Understand the terms of your employment, know your legal protections, and be prepared to have a professional conversation if faced with a pay cut. A salary reduction is a significant event, but by handling it with a clear, informed, and strategic approach, you can navigate the challenge and make the best decision for your long-term career success.