Navigating the world of job classifications can be complex, but understanding your pay structure is fundamental to career success. While "Salary Non-Exempt" might sound like a specific job title, it’s actually a crucial employment classification under U.S. labor law that directly impacts your earnings, particularly your right to overtime pay. Understanding this classification is key to ensuring you are compensated fairly for every hour you work.

This guide will break down what it means to be a salaried, non-exempt employee, explore the types of roles that fall into this category, and analyze the factors that influence your total earning potential.

What Does "Salary Non-Exempt" Mean?

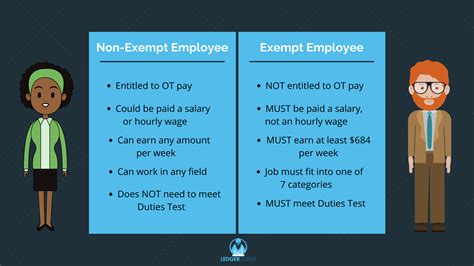

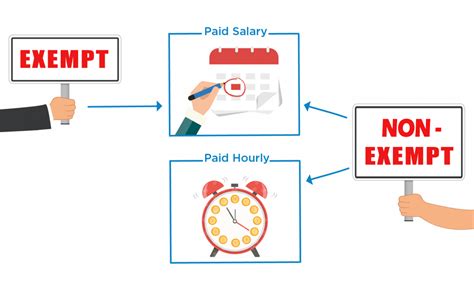

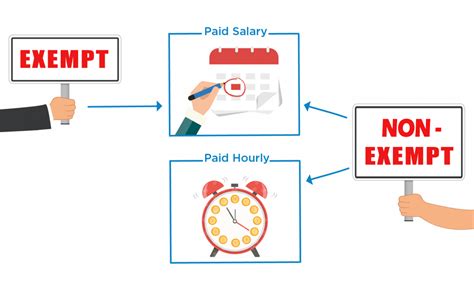

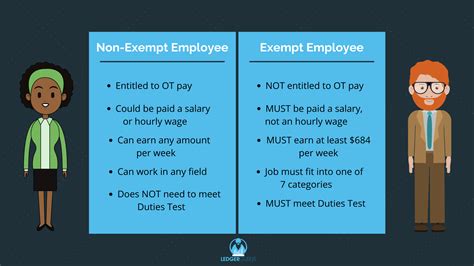

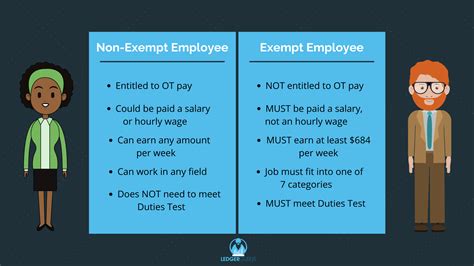

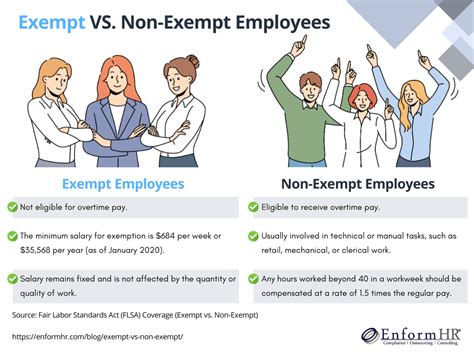

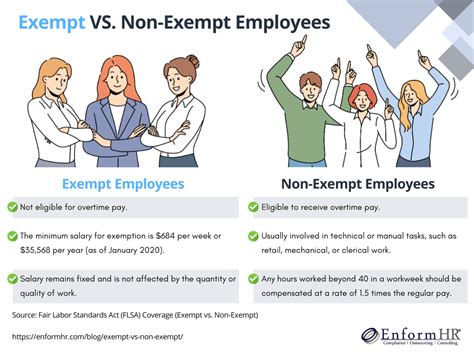

The term "Salary Non-Exempt" is a hybrid classification defined by the Fair Labor Standards Act (FLSA). Let's break it down:

- Salary: This means you receive a fixed, regular payment (e.g., $900 per week) regardless of the specific hours you work in that week. This provides predictable income.

- Non-Exempt: This is the critical part. It means you are *not exempt* from the FLSA's overtime provisions. Therefore, you are legally entitled to overtime pay—typically calculated at 1.5 times your regular hourly rate—for any hours worked beyond 40 in a workweek.

In short, a salary non-exempt employee gets the stability of a salary with the legal protection of overtime pay. This classification typically applies to roles that may require work beyond a standard 40-hour week but don't meet the specific "duties tests" for executive, administrative, or professional exemption under the FLSA. To calculate the overtime rate for a salaried non-exempt employee, the salary is converted to an equivalent hourly rate.

Average Salary for Common Non-Exempt Roles

Because "salary non-exempt" is a classification and not a single job, there is no single average salary. The salary depends entirely on the specific role, industry, and location. However, we can examine the salary ranges for professions that are frequently classified as salary non-exempt.

Here are a few examples of common non-exempt roles and their typical salary ranges in the United States:

- Administrative and Executive Assistants: These professionals are often salaried and non-exempt. According to Salary.com, as of early 2024, the median salary for an Executive Assistant in the U.S. is $73,205, with a typical range falling between $65,022 and $82,883.

- Paralegals and Legal Assistants: This is a skilled profession that is often non-exempt. The Bureau of Labor Statistics (BLS) reports the median annual wage for paralegals and legal assistants was $59,200 in May 2022.

- IT Support Specialists / Help Desk Technicians: Many entry-to-mid-level tech support roles are non-exempt. Glassdoor reports a national average base pay of approximately $59,700 per year as of early 2024 for IT Help Desk Technicians.

- Customer Service Supervisors or Team Leads: While entry-level representatives are often hourly, their supervisors may be salaried non-exempt. Payscale data from early 2024 shows the average salary for a Customer Service Supervisor is around $55,300 per year, with total pay (including potential overtime and bonuses) reaching higher.

*Note: These figures represent the base salary and do not include potential overtime earnings, which can significantly increase total compensation.*

Key Factors That Influence Salary

For any non-exempt role, several key factors will determine your base salary, which in turn dictates your overtime rate.

Level of Education

While many non-exempt roles do not require a bachelor's degree, higher education or specialized certifications can significantly increase earning potential. For instance, a paralegal with an associate's degree may start at a lower salary than one with a bachelor's degree and a paralegal certification from an ABA-approved program. Similarly, an IT Support Specialist with CompTIA A+ or Network+ certifications will command a higher salary than one without.

Years of Experience

Experience is one of the most significant drivers of salary growth in non-exempt positions. An entry-level Administrative Assistant might earn around $40,000, while a Senior Executive Assistant with over 10 years of experience supporting C-suite executives can earn upwards of $85,000 or more, according to 2024 data from sites like Salary.com. More experience not only justifies a higher base salary but also increases your hourly overtime rate, making those extra hours more lucrative.

Geographic Location

Where you work matters immensely. Salaries are adjusted for the local cost of living and labor market demand. A non-exempt Office Manager role in a high-cost-of-living area will pay substantially more than the same role in a more affordable region.

- Example: According to Salary.com's calculator in early 2024, an Office Manager earning the national average of $66,500 could expect to make approximately $83,000 in San Francisco, CA (a 25% increase), but around $62,500 in Orlando, FL (a 6% decrease).

Company Type and Industry

The size, profitability, and industry of a company heavily influence its compensation structure. A non-exempt project coordinator at a large tech firm in Silicon Valley will almost certainly earn a higher salary than a project coordinator at a small non-profit organization. Industries like technology, finance, and biotechnology tend to offer higher base salaries for their support and administrative staff compared to retail or hospitality.

Job Function and Specialization

Within a job category, specialization pays a premium. A general administrative assistant performs a wide range of tasks, but one with specialized knowledge can earn more.

- Legal Administrative Assistant: Requires knowledge of legal terminology, court filings, and document management.

- Medical Administrative Assistant: Requires understanding of patient records, medical coding (HIPAA), and scheduling.

- Marketing Coordinator: A non-exempt role requiring skills in social media, CRM software, and campaign tracking.

These specialized roles command higher salaries due to the specific skills and knowledge required to perform them effectively.

Job Outlook for Common Non-Exempt Professions

The job outlook for non-exempt roles is as varied as the jobs themselves. It's best to look at the forecast for specific professions that are often classified this way.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook (2022-2032 projections):

- Paralegals and Legal Assistants: This field is projected to grow by 14%, much faster than the average for all occupations. The demand for legal services creates a strong need for these skilled professionals.

- Computer Support Specialists: Employment is projected to grow by 5%, about as fast as average. As organizations continue to upgrade their computer equipment and software, support specialists will be needed.

- Secretaries and Administrative Assistants: Overall employment is projected to decline by 7%. However, the outlook is much better for specialized roles like Medical Secretaries (+8%) and for Executive Assistants who can adapt to new technologies and take on project management responsibilities.

This data shows that focusing on specialized, in-demand non-exempt careers is a strategic move for long-term job security and growth.

Conclusion: Empower Your Career by Understanding Your Pay

While "salary non-exempt" is not a career path in itself, understanding what it means is a powerful act of professional self-advocacy.

Here are the key takeaways:

- Know Your Classification: It’s a hybrid model offering a stable salary and the right to overtime pay.

- Overtime is Key: Your total compensation is a combination of your base salary and any overtime worked, making it a crucial part of your earning potential.

- Growth is Tied to Value: Your salary is influenced by the same factors as any other role: your experience, education, location, and the specific value you bring to an organization.

- Focus on In-Demand Fields: To maximize security and earnings, pursue non-exempt roles in growing sectors like healthcare, legal services, and technology.

By understanding the mechanics of your pay, you can better negotiate your salary, track your hours accurately, and ensure you are being compensated fairly for your hard work. This knowledge is not just an administrative detail—it is a cornerstone of building a successful and sustainable career.