Introduction

Have you ever looked at the leaders of major corporations—the titans of industry who grace the covers of business magazines—and wondered not just what they do, but what they *earn*? The role of a Chief Executive Officer (CEO) represents the pinnacle of the corporate ladder, a position of immense responsibility, strategic vision, and, yes, substantial financial reward. For many ambitious professionals, understanding the compensation structure of a CEO isn't just about curiosity; it's about setting the ultimate career goal and understanding the value placed on top-tier leadership. The question of a "CEO United States salary" is complex, with an answer that spans from modest non-profit figures to astronomical sums in the hundreds of millions.

The spectrum of CEO compensation is vast. While the U.S. Bureau of Labor Statistics reports a median annual wage for top executives at $191,480, this figure barely scratches the surface. The reality is that a CEO's salary at a small, regional company can be in the low six figures, while the CEO of a Fortune 500 giant like United Airlines can earn a compensation package valued in the tens of millions of dollars. In 2023, for instance, the median total compensation for an S&P 500 CEO soared to a record $16.3 million.

I recall a conversation with a first-time CEO of a burgeoning tech startup. She confessed that the weight of the company's fate—and the livelihoods of her 50 employees—was a constant, heavy presence. Her base salary was less than her top engineers, with the vast majority of her potential earnings tied up in stock options that might one day be worth a fortune, or nothing at all. This conversation crystallized for me that a CEO's salary is never just a number; it's a story about risk, value, and the immense pressure to deliver results.

This comprehensive guide will demystify the world of CEO compensation in the United States. We will dissect every component of a CEO's pay, explore the myriad factors that influence it, and provide a realistic roadmap for those aspiring to reach this coveted position.

### Table of Contents

- [What Does a CEO Do?](#what-does-a-ceo-do)

- [Average CEO Salary: A Deep Dive](#average-ceo-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

---

What Does a CEO Do?

Before we can understand *what* a CEO earns, we must first appreciate *what* a CEO does. The role is far more than that of a simple manager; a CEO is the ultimate custodian of a company's vision, culture, and long-term success. They are the primary link between the company's internal operations and its external stakeholders, including the board of directors, investors, employees, and the public.

The responsibilities of a CEO are multifaceted and carry immense weight. They can be broadly categorized into four key pillars:

1. Setting the Vision and Strategy: The CEO is the chief architect of the company's future. They are responsible for defining the organization's mission, vision, and long-term strategic goals. This involves analyzing market trends, identifying opportunities for growth, navigating competitive threats, and making high-stakes decisions about where to allocate the company's precious resources—be it capital, talent, or time.

2. Building and Leading the Senior Executive Team: A CEO cannot succeed alone. One of their most critical functions is to recruit, develop, and lead a high-performing C-suite (e.g., Chief Financial Officer, Chief Operating Officer, Chief Technology Officer). They set the performance bar for this team, ensure alignment across departments, and hold them accountable for executing the company's strategy.

3. Managing Capital Allocation and Financial Performance: Ultimately, a CEO is judged by their ability to create value for shareholders and stakeholders. This requires astute capital allocation—deciding on major investments, acquisitions, divestitures, and budget priorities. They have final oversight of the company's financial health and are responsible for communicating performance to the board and investors.

4. Shaping Culture and Acting as the Public Face: The CEO is the embodiment of the company's culture and values. Their behavior, communication style, and priorities set the tone for the entire organization. Externally, they are the company's chief ambassador, representing it to customers, partners, regulators, and the media. This public-facing role is crucial for building brand reputation and navigating crises.

### A Day in the Life of a CEO

To make this tangible, let's imagine a typical day for the CEO of a mid-sized, publicly-traded manufacturing company.

- 6:00 AM - 7:30 AM: Wake up, exercise, and consume a steady diet of news—The Wall Street Journal, Financial Times, and key industry publications. Review overnight market performance and any urgent emails from international teams.

- 8:00 AM - 9:00 AM: Executive leadership team meeting. The CEO, CFO, COO, and Head of Sales review the previous day's performance metrics, discuss immediate challenges (e.g., a supply chain disruption), and align on priorities for the day.

- 9:30 AM - 11:00 AM: Strategic deep dive with the product development team. Review the roadmap for a next-generation product, challenge assumptions, and make a key decision on a multi-million dollar R&D investment.

- 11:30 AM - 1:00 PM: Lunch with a major institutional investor. The CEO provides an update on quarterly progress, answers tough questions about competitive pressures, and reinforces the company's long-term growth story.

- 1:30 PM - 2:30 PM: One-on-one coaching session with the new Vice President of Marketing. Discuss leadership development, performance goals, and strategies for a major upcoming brand campaign.

- 3:00 PM - 4:30 PM: All-hands town hall meeting (virtual and in-person). The CEO shares recent wins, transparently addresses a recent business challenge, and answers unfiltered questions from employees to foster trust and engagement.

- 5:00 PM - 6:00 PM: Call with the company's general counsel to discuss pending litigation and a new regulatory proposal that could impact the industry.

- 7:00 PM onwards: Attend an industry awards dinner to network with peers, followed by two more hours of email and preparing for the next day's board committee meeting.

This grueling schedule highlights that the CEO role is not a 9-to-5 job; it's a 24/7 commitment where every decision can have significant, far-reaching consequences.

---

Average CEO Salary: A Deep Dive

Analyzing the "average CEO salary" is like analyzing the average price of a vehicle; a used sedan and a new Ferrari are both "vehicles," but their prices are worlds apart. The same principle applies to CEO compensation. However, by examining data from reputable sources, we can paint a detailed picture of the compensation landscape.

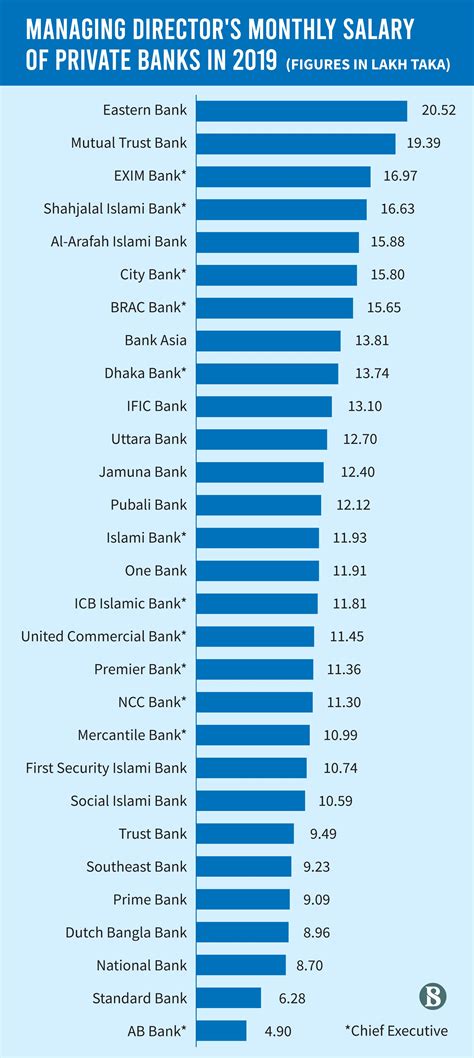

The U.S. Bureau of Labor Statistics (BLS) groups CEOs under the category of "Top Executives." According to its latest data (May 2023), the national salary profile for this group is as follows:

- Median Annual Wage: $191,480

- Lowest 10% Earned: Less than $77,500

- Highest 10% Earned: More than $239,200

*Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Top Executives.*

It's crucial to understand that the BLS data includes a very broad range of senior leaders across companies of all sizes and types (including non-profits and smaller businesses) and typically focuses on base salary, not the total compensation package. The "more than $239,200" figure is an open-ended top bracket that doesn't capture the multi-million dollar packages of major corporate CEOs.

To get a more realistic view, we must turn to salary aggregators and corporate governance data firms that analyze total compensation.

- Salary.com reports that the median total compensation for a Chief Executive Officer in the United States, as of late 2023, is $843,893. The typical range falls between $636,893 and $1,102,642.

- Payscale.com shows a slightly different picture, with a median base salary of around $175,000, but a total pay range that stretches from $79,000 to over $496,000 when bonuses and profit sharing are included. This likely reflects a dataset with more small-to-medium-sized businesses (SMBs).

The most dramatic numbers come from analyzing large, publicly traded companies. A 2023 report by Equilar, which studies executive compensation, found that for S&P 500 companies, the median CEO total compensation reached a record $16.3 million.

### Compensation Brackets by Experience Level

Salary grows exponentially with experience and a proven track record of success. While there's no single formula, we can outline a general trajectory based on synthesized data from various sources.

| Experience Level | Typical Title / Role | Estimated Total Compensation Range | Notes |

| :--- | :--- | :--- | :--- |

| Emerging Leader (5-10 years) | Director / Senior Manager | $150,000 - $300,000 | Focused on functional expertise. Compensation is mostly base salary + annual bonus. |

| Mid-Career Executive (10-15 years) | Vice President | $250,000 - $600,000+ | P&L responsibility begins. Long-term incentives (stock) become a more significant part of the package. |

| Senior Executive (15-20+ years) | C-Suite (COO, CFO), Division President | $500,000 - $2,000,000+ | Directly reporting to the CEO. Total compensation is heavily weighted towards performance-based stock and bonuses. |

| CEO (Small/Mid-Sized Co.) | CEO of a company with <$50M revenue | $200,000 - $1,000,000 | Compensation highly dependent on profitability and ownership structure (private vs. public). |

| CEO (Large Public Co.) | CEO of a company with >$1B revenue | $2,000,000 - $50,000,000+ | Base salary is a small fraction of total pay. The vast majority comes from stock awards and performance bonuses. |

### The Four Pillars of CEO Compensation

A CEO's "salary" is a misnomer. Their *compensation* is a complex package with four main components. Let's use the publicly disclosed 2023 compensation for Scott Kirby, CEO of United Airlines, as a high-profile example to illustrate this.

1. Base Salary: This is the fixed, guaranteed cash payment an executive receives. It's often a relatively small portion of the total package for a large-company CEO, intended to provide a stable income. For 2023, Scott Kirby's base salary was $1.3 million.

2. Annual Bonus / Short-Term Incentive Plan (STIP): This is a variable cash payment tied to the company's (and sometimes the individual's) performance over the past year. Metrics often include revenue growth, profitability targets (like EBIT), and operational goals (like on-time performance for an airline). Mr. Kirby's non-equity incentive plan compensation for 2023 was $5.85 million.

3. Long-Term Incentive Plan (LTIP): This is the largest component for most major CEOs and is designed to align their interests with those of shareholders over a multi-year horizon. It typically comes in the form of:

- Stock Options: The right to buy company stock at a predetermined price in the future. They only have value if the stock price increases.

- Restricted Stock Units (RSUs): A promise of a certain number of shares that "vest" (become the executive's property) over a set period of time, as long as they remain with the company.

- Performance Share Units (PSUs): Stock units where the final number of shares awarded depends on the company achieving specific long-term performance goals (e.g., total shareholder return relative to a peer group).

For 2023, the value of stock awards for United's CEO was approximately $11.3 million.

4. Perquisites ("Perks") and Other Compensation: This is a smaller bucket that includes all other benefits, such as a personal use of the company aircraft, car allowance, 401(k) matching, and enhanced security services. For Mr. Kirby, this amounted to several hundred thousand dollars.

Total Compensation for United's CEO in 2023: By adding these components, Scott Kirby's total reported compensation was approximately $18.6 million. This example powerfully illustrates how the "CEO United salary" conversation must extend far beyond the base salary to capture the full picture of executive pay.

---

Key Factors That Influence Salary

The difference between a CEO earning $200,000 and one earning $20 million is not random. It is driven by a predictable, albeit complex, set of factors. Understanding these variables is essential for any professional aiming for the C-suite.

###

Level of Education

While experience is paramount, education provides the foundation and can act as a powerful accelerator.

- Bachelor's Degree: A bachelor's degree is a non-negotiable prerequisite for almost any path to the C-suite. Common fields of study include Business Administration, Finance, Economics, and Engineering. This degree provides the fundamental knowledge of how organizations work.

- Master of Business Administration (MBA): The MBA is the most common and impactful advanced degree for aspiring CEOs. According to a study by *U.S. News*, over 40% of Fortune 100 CEOs hold an MBA. An MBA from a top-tier business school (e.g., Harvard, Stanford, Wharton) does more than just impart advanced knowledge in strategy, finance, and marketing. Its true value lies in:

1. Pedigree and Signaling: It signals a high level of ambition and intellectual horsepower to boards and investors.

2. The Network: It provides access to an elite network of alumni who become future colleagues, investors, and board members.

3. Career Acceleration: It often serves as a pivot point, allowing a mid-career professional to switch industries or jump to a role with greater leadership responsibility.

A CEO with an MBA from a top program, particularly in industries like finance or consulting, can command a higher initial compensation package than one without.

- Other Advanced Degrees (JD, PhD): Other degrees can be highly valuable depending on the industry. A Juris Doctor (JD) is common for CEOs in highly regulated industries or those who rise through the legal department. A PhD or MD can be essential for leading biotechnology, pharmaceutical, or deep-tech companies where scientific credibility is key to strategy and investor confidence.

###

Years of Experience

This is arguably the single most important factor. A CEO is not an entry-level job; it is the culmination of decades of proven leadership and demonstrated results. The salary growth trajectory is a steep pyramid.

- Early Career (0-7 years): At this stage, individuals are building functional expertise as individual contributors or junior managers. Compensation is standard for their role and industry. The focus is on mastering a craft (e.g., software engineering, accounting, brand management).

- Mid-Career / First Leadership Roles (8-15 years): This is the critical transition to leading teams and then departments (e.g., Director level). Here, a professional must prove they can deliver results *through others*. A major milestone is gaining Profit & Loss (P&L) responsibility—managing a business unit with its own budget, revenue targets, and costs. Executives who successfully manage a P&L are seen as "general managers" and are placed on the CEO track. Salary jumps significantly, and performance bonuses become more substantial. A Director at a large corporation might earn a total compensation of $200,000 - $350,000.

- Senior Executive / VP Level (15-25 years): As a Vice President or Senior Vice President, the scope of responsibility expands to entire functions or large business divisions. They are part of the senior leadership team and are deeply involved in corporate strategy. Compensation structure shifts dramatically, with long-term incentives (stock) often exceeding base salary. Total compensation can range from $400,000 to over $1,000,000.

- The CEO Appointment: The board of directors appoints a CEO based on their proven ability to lead complex organizations and create shareholder value. A first-time CEO's compensation is based on their track record as a senior executive, the company's specific situation, and benchmarks against peer companies. There is no "typical" salary, as it is a bespoke negotiation.

###

Geographic Location

Where a company is headquartered has a significant impact on CEO compensation, driven by the cost of living, the concentration of talent, and the prevalence of high-growth industries.

High-paying metropolitan areas are typically major hubs for technology, finance, and large corporate headquarters.

Top-Paying Metropolitan Areas for Top Executives (based on BLS data):

1. San Jose-Sunnyvale-Santa Clara, CA: The heart of Silicon Valley, with an annual mean wage of $476,330 for top executives.

2. San Francisco-Oakland-Hayward, CA: Another tech and finance hub, with a mean wage of $369,270.

3. New York-Newark-Jersey City, NY-NJ-PA: The center of global finance and corporate HQs, with a mean wage of $329,480.

4. Boston-Cambridge-Nashua, MA-NH: A nexus for biotech, technology, and asset management.

5. Seattle-Tacoma-Bellevue, WA: Home to giants like Amazon and Microsoft and a thriving startup scene.

Conversely, CEO salaries in rural areas or states with a lower cost of living and fewer large corporations will be substantially lower. A CEO of a family-owned manufacturing business in the Midwest might have a total compensation package closer to $250,000, which still provides an excellent quality of life in that region.

###

Company Type & Size

This is a massive differentiator, arguably as important as experience.

- Startups: A startup CEO's compensation is a story of high risk and potentially high reward.

- Base Salary: Often very low, sometimes under $100,000, to conserve precious cash. The CEO is often the last to get a market-rate salary.

- Equity: This is the real prize. The CEO receives a significant chunk of founder's stock or stock options, which could be worth tens of millions if the company has a successful exit (IPO or acquisition), but is worthless if it fails.

- Small to Medium-Sized Businesses (SMBs): For private companies with established revenue streams ($5M - $100M), CEO pay is more stable.

- Total Compensation: Typically in the $200,000 to $750,000 range.

- Structure: Comprises a solid base salary plus a significant profit-sharing or bonus component tied directly to the year's net income. Equity is less common unless it's a family-owned business succession plan.

- Large Private Companies: In very large private firms (e.g., Cargill, Koch Industries), CEO pay can rival that of public companies, but it's not publicly disclosed. It often includes "phantom stock" or other long-term cash incentive plans that mimic stock performance.

- Large Public Corporations (e.g., S&P 500): This is where compensation reaches stratospheric levels, as seen with the United Airlines example.

- Total Compensation: Routinely $10 million to $30 million, with some outliers exceeding $100 million.

- Structure: Heavily performance-based. A base salary of $1-1.5 million is just the starting point. The vast majority is linked to stock price appreciation and achieving multi-year financial targets, as determined by the board's compensation committee.

- Non-Profits: Leading a non-profit is driven by mission, not money. While the CEO of a major non-profit like the Red Cross or a large university system can earn a substantial salary (sometimes over $1 million), it is a fraction of their for-profit counterparts. The CEO of a small community non-profit might earn less than $100,000.

###

Area of Specialization / Industry

The industry a company operates in dictates its growth potential, profitability margins, and the skills required of its leader, all of which influence pay.

- Top-Paying Industries:

- Financial Services & Private Equity: The highest-paying sector. CEOs of major banks, asset management firms, and private equity funds often have compensation packages tied directly to assets under management or deal profits, leading to enormous payouts.

- Technology & Software: High-growth, high-margin software and internet companies reward CEOs for innovation and market disruption. Stock options have created immense wealth for tech CEOs.

- Biotechnology & Pharmaceuticals: A high-risk, high-reward industry where a successful drug can generate billions in revenue. CEOs with scientific and commercialization expertise are compensated handsomely.

- Media & Entertainment: Top media CEOs who oversee vast content empires and navigate digital transformation command huge pay packages.

- Mid-Tier Industries:

- Energy, Consumer Goods, Aerospace & Defense (like United Airlines): These are mature, capital-intensive industries. CEO pay is excellent but generally more measured and tied to operational efficiency, market share, and steady shareholder returns.

- Lower-Paying Industries:

- Retail, Hospitality, Education, and Non-Profit: These sectors typically have lower profit margins, are more sensitive to economic downturns, and, in the case of non-profits, are mission-driven. CEO compensation is accordingly more modest.

###

In-Demand Skills

Beyond a track record, boards look for specific, high-value skills when selecting and compensating a CEO. Cultivating these can directly lead to a higher salary and more significant opportunities.

- Strategic & Visionary Thinking: The ability to see beyond the next quarter and articulate a compelling vision for the future of the company in a changing world.

- Financial Acumen: Deep understanding of financial statements, capital markets, and M&A. The ability to speak the language of Wall Street and investors is non-negotiable.

- Transformational Leadership: Proven experience leading a company through significant change, such as a digital transformation, a major turnaround, or a post-merger integration.

- Global Experience: For multinational corporations, experience managing teams and operations across different cultures and regulatory environments is critical.

- ESG Expertise: A rapidly growing demand. Boards want leaders who can navigate the complex landscape of Environmental, Social, and Governance issues, which are increasingly important to investors, customers, and employees.

- Exceptional Communication: The ability to inspire employees, build trust with investors, and act as a polished public representative for the brand, especially during a crisis.

---

Job Outlook and Career Growth

The path to the C-suite is exceptionally competitive, and the number of available positions is inherently limited. However, for those with the talent, drive, and strategic career plan, the outlook remains strong.

According to the U.S. Bureau of Labor Statistics, employment of top executives is projected to grow 3 percent from 2022 to 2032, which is about as fast as the average for all occupations. The BLS projects about 228,700 openings for top executives each year, on average, over the decade. It's important to note that most of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire, rather than from new job creation.

While the overall number of CEO positions doesn't grow rapidly (as it's tied to the number of organizations), the nature of the role and the demands placed upon it are constantly evolving.

### Emerging Trends and Future Challenges

The CEO of 2030 will face a different set of challenges than the CEO of 2010. Aspiring leaders must be prepared to navigate:

1. The Acceleration of AI and Digital Transformation: CEOs no longer need to be coders, but they must possess a deep, strategic understanding of how artificial intelligence, data analytics, and automation can reshape their business models, operations, and competitive landscape. Leaders who can drive a successful AI integration will be in high demand.

2. The Primacy of ESG and Stakeholder Capitalism: The long-held doctrine of "shareholder primacy" (where the only goal is to maximize shareholder profit) is being challenged by "stakeholder capitalism." Modern CEOs are expected to create value for *all* stakeholders: employees, customers, suppliers, the community, and the environment, in addition to shareholders. This requires a delicate balancing act and a new set of leadership skills focused on sustainability and social responsibility.

3. Geopolitical Instability and Supply Chain Resilience: The era of stable, global