The global economy is a colossal, intricate machine, powered by the constant flow of goods across international borders. Every car, smartphone, piece of clothing, or medical device that crosses a frontier is subject to a complex web of regulations, tariffs, and documentation. Standing at the very center of this complex dance is the Certified Customs Specialist (CCS)—a highly skilled professional ensuring that this flow is legal, efficient, and compliant. If you are a detail-oriented individual with a passion for international business and a knack for navigating complex rules, this career might be your perfect fit, offering not just intellectual stimulation but also a highly competitive salary and robust job security.

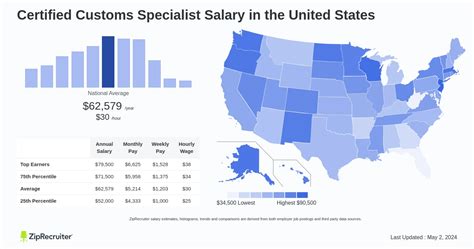

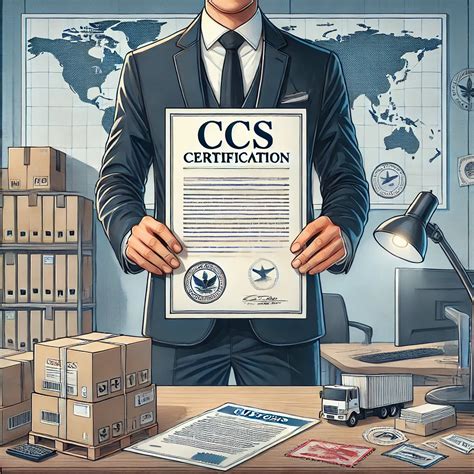

For those willing to master the Harmonized Tariff Schedule and the nuances of international trade law, the rewards are substantial. A certified customs specialist salary typically ranges from $55,000 for entry-level professionals to well over $120,000 for experienced specialists and managers in high-demand locations. This guide will serve as your definitive roadmap, exploring every facet of the profession, from the daily responsibilities and salary expectations to the precise steps you need to take to launch and advance your career in this vital field.

Years ago, while working on a logistics project, I stood at the Port of Los Angeles watching thousands of shipping containers being offloaded like giant Lego blocks. It struck me that my project's success didn't just depend on the ship arriving on time, but on an unseen expert who knew exactly what was in each container, how to classify it for customs, and how to clear it without delay. That unseen expert was a customs specialist, the linchpin holding a multi-billion dollar supply chain together. Their expertise is the invisible engine of global commerce, and this guide will show you how to become one.

### Table of Contents

- [What Does a Certified Customs Specialist Do?](#what-does-a-certified-customs-specialist-do)

- [Average Certified Customs Specialist Salary: A Deep Dive](#average-certified-customs-specialist-salary-a-deep-dive)

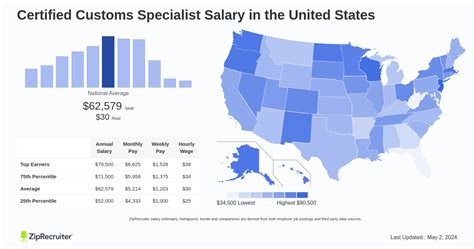

- [Key Factors That Influence a Certified Customs Specialist's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Customs Specialists](#job-outlook-and-career-growth)

- [How to Become a Certified Customs Specialist: Your Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career as a Certified Customs Specialist Right for You?](#conclusion)

---

What Does a Certified Customs Specialist Do?

A Certified Customs Specialist (CCS) is a professional gatekeeper and facilitator of international trade. Their primary mandate is to ensure that imported and exported goods comply with all applicable laws and regulations of the countries involved. They are masters of detail, navigating the labyrinthine world of customs procedures to ensure shipments are not delayed, fined, or seized.

This role is a critical blend of legal interpretation, data analysis, and client service. Specialists work for a variety of entities, including customs brokerage firms, freight forwarders, large multinational corporations with in-house logistics departments (importers/exporters), and consulting firms. Their work directly impacts a company's bottom line by minimizing duties, avoiding costly penalties, and maintaining a smooth supply chain.

The core responsibilities of a Certified Customs Specialist can be broken down into several key areas:

- Tariff Classification: This is arguably the most fundamental and challenging aspect of the job. Specialists use the Harmonized Tariff Schedule (HTS) of the United States—a massive, detailed codebook—to assign a specific 10-digit classification number to every single product being imported. The correct classification determines the duty rate (the tax paid on the item), so a mistake here can cost a company thousands or even millions of dollars.

- Valuation: They determine the correct "customs value" of imported goods. This isn't always as simple as the price on the invoice; it can involve complex calculations including freight costs, insurance, assists (e.g., providing molds or tooling to an overseas manufacturer), and royalties.

- Country of Origin Determination: Specialists determine the legal country of origin for goods, which is crucial for applying preferential duty rates under Free Trade Agreements (FTAs) like the USMCA (United States-Mexico-Canada Agreement) or for complying with trade sanctions and embargoes.

- Documentation and Entry Filing: They prepare and file the necessary legal documents with U.S. Customs and Border Protection (CBP) and other Partner Government Agencies (PGAs) like the FDA (Food and Drug Administration) or USDA (Department of Agriculture). This is typically done electronically through the Automated Commercial Environment (ACE) system.

- Compliance and Risk Management: A huge part of the role is proactive compliance. They conduct internal audits of past import records, advise clients on structuring their import programs to be compliant, and stay up-to-date on the constantly changing landscape of trade regulations, sanctions, and anti-dumping duties.

- Client/Stakeholder Communication: They are the primary point of contact for clients (importers) regarding the status of their shipments. They also communicate directly with CBP officers to resolve issues, answer questions, and respond to formal inquiries (CF-28s) or actions (CF-29s).

---

#### A Day in the Life of a Certified Customs Specialist

To make this more concrete, let's imagine a day for "Alex," a CCS at a mid-sized customs brokerage firm.

- 8:30 AM - 9:30 AM: Morning Triage. Alex arrives and immediately scans the ACE system for any customs holds or rejections on shipments that were filed overnight. One shipment of medical devices is being held for an FDA review. Alex immediately contacts the importer to request the specific device listing numbers and sends a message to the FDA liaison at the port to provide the information proactively. He also triages his inbox, flagging urgent requests from clients and freight forwarders.

- 9:30 AM - 12:00 PM: Classification and Entry Processing. Alex’s main task for the morning is to process a new shipment for a major apparel client. The commercial invoice lists 25 different styles of jackets and pants. He can't just classify them all as "clothing." He must meticulously examine the material composition (e.g., 60% cotton, 40% polyester), fabric type (woven vs. knit), gender, and specific features (e.g., water-resistant lining, down filling) for each style to assign the correct HTS code. He spends two hours carefully researching the tariff schedule, ensuring each classification is correct and defensible. He then calculates the duties owed and prepares the customs entry for filing.

- 12:00 PM - 1:00 PM: Lunch & Learn. During lunch, Alex tunes into a webinar hosted by the National Customs Brokers & Forwarders Association of America (NCBFAA) about recent changes to Section 301 tariffs on goods from China. Staying current is non-negotiable in this field.

- 1:00 PM - 3:30 PM: Client Consultation and Problem Solving. A long-term client who imports furniture is considering sourcing a new line of wooden tables from Vietnam. They schedule a call with Alex to discuss the potential compliance risks. Alex advises them on the documentation needed to prove the wood is not subject to anti-dumping duties (which are often applied to Chinese-origin wooden furniture) and the specific requirements for Lacey Act declarations to ensure the wood was legally harvested. This proactive advice saves the client from potential future seizures and fines.

- 3:30 PM - 5:00 PM: Auditing and Reporting. Alex spends the last part of his day conducting a post-entry audit on a batch of entries he filed last month. He double-checks the classifications and values to ensure no errors were made. He discovers a minor error where the freight cost was mis-keyed on one entry. He immediately prepares a Post Summary Correction (PSC) to amend the entry with CBP, demonstrating due diligence and mitigating any potential penalty.

This "day in the life" illustrates that the role is far from monotonous. It is a dynamic, problem-solving position that requires immense attention to detail, strong analytical skills, and the ability to communicate complex information clearly.