Considering a career in management accounting? The Certified Management Accountant (CMA) certification is a globally recognized credential that signals expertise in financial planning, analysis, control, and decision support. But beyond the prestige, what does it mean for your bottom line? In short, a CMA certification is one of the most direct ways to increase your earning potential and accelerate your career in finance and accounting.

On average, a Certified Management Accountant in the United States can expect to earn a salary ranging from $75,000 to over $160,000, with a median salary often comfortably exceeding the six-figure mark. This article breaks down exactly what you can expect to earn and the key factors that will shape your salary throughout your career.

What Does a Certified Management Accountant Do?

Unlike traditional accounting roles that focus on historical data, taxes, and audits, a CMA is a forward-looking strategic partner within an organization. They bridge the gap between accounting and management, using financial data to drive business decisions.

Key responsibilities include:

- Financial Planning & Analysis (FP&A): Budgeting, forecasting, and analyzing financial performance.

- Cost Management: Identifying inefficiencies and opportunities for cost savings.

- Performance Management: Developing and monitoring key performance indicators (KPIs).

- Internal Controls & Risk Management: Ensuring financial integrity and mitigating business risks.

- Strategic Decision Support: Providing data-driven insights to senior leadership for long-term planning.

CMAs are the financial storytellers who help a company understand where it's been, where it is, and where it's going.

Average Certified Management Accountant Salary

According to data from leading salary aggregators, the average base salary for a Certified Management Accountant in the United States typically falls between $105,000 and $125,000 per year.

However, an "average" salary only tells part of the story. A more realistic view includes the full compensation range:

- Entry-Level CMA (0-2 years): $70,000 - $90,000

- Mid-Career CMA (3-9 years): $95,000 - $130,000

- Senior/Managerial CMA (10+ years): $130,000 - $160,000+

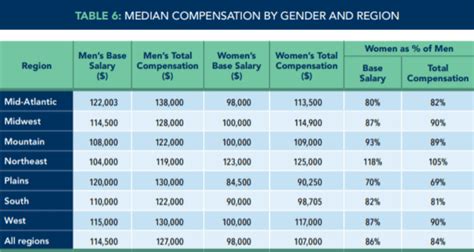

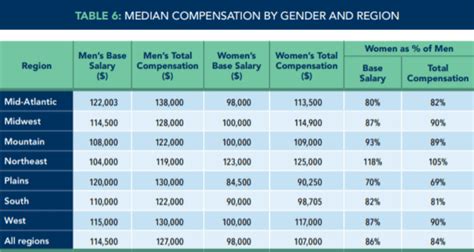

The most compelling data comes directly from the Institute of Management Accountants (IMA), the issuing body for the CMA certification. The IMA's 2023 Global Salary Survey reveals a significant "CMA premium." Globally, CMAs earn 58% more in median total compensation than their non-certified peers. This powerful statistic underscores the tangible return on investment the certification provides.

*(Sources: Salary.com, Payscale, IMA's 2023 Global Salary Survey)*

Key Factors That Influence Salary

Your specific salary as a CMA is not a single number but a range determined by several critical factors. Understanding these will help you maximize your earning potential.

### Level of Education

While a bachelor's degree in accounting, finance, or a related field is a prerequisite for the CMA exam, pursuing an advanced degree can significantly boost your income. According to the IMA, CMAs holding a master's degree or MBA report higher median compensation than those with only a bachelor's degree. An advanced degree signals a deeper commitment to the field and often qualifies you for higher-level leadership positions right from the start.

### Years of Experience

Experience is arguably the most significant driver of salary growth for a CMA. Your earnings will follow a clear upward trajectory as you move through your career.

- Early Career (0-3 years): In roles like Staff Accountant or Junior Financial Analyst, your focus is on applying your technical skills. Your salary will be competitive but at the lower end of the CMA range.

- Mid-Career (4-9 years): As a Senior Financial Analyst or Accounting Manager, you take on more responsibility, manage small teams, and contribute to strategic projects. This is where salaries often cross the $100,000 threshold.

- Senior/Executive Level (10+ years): In high-level roles like Controller, Director of Finance, or Chief Financial Officer (CFO), your value lies in strategic leadership. At this stage, total compensation can soar well above $160,000, often including substantial bonuses and equity.

### Geographic Location

Where you work matters. Major metropolitan areas with a high cost of living and a high concentration of corporate headquarters typically offer the highest salaries. According to data from salary aggregators, states like California, New York, Texas, New Jersey, and Massachusetts often lead the nation in compensation for finance professionals. However, a higher salary in these locations is often balanced by a higher cost of living. Conversely, a lower salary in a city like Des Moines, Iowa, may offer more purchasing power than a higher salary in New York City.

### Company Type and Industry

The size and type of your employer play a major role in your compensation.

- Company Size: Large, multinational corporations ($500M+ in revenue) generally offer the highest salaries, benefits, and bonus potential.

- Public vs. Private: Publicly traded companies often have more complex reporting requirements and larger budgets, which can translate to higher pay for CMAs.

- Industry: Industries with high-growth or high-margin models tend to pay more. Top-paying sectors for CMAs include manufacturing, technology, financial services, pharmaceuticals, and consulting.

### Area of Specialization

The CMA certification opens doors to a variety of roles, each with its own salary band. As you progress, your title and responsibilities will directly impact your earnings.

- Financial Analyst: An excellent entry point for CMAs.

- Cost Accountant/Manager: A core role that leverages CMA skills directly.

- Controller: A high-level position responsible for overseeing all accounting operations. This role often commands a salary well into the six-figure range.

- Director of Finance: A strategic role focused on long-term financial planning and team leadership.

- Chief Financial Officer (CFO): The pinnacle of a corporate finance career, with compensation often including significant equity and bonuses, reaching into the high hundreds of thousands or more.

Job Outlook

The career outlook for accountants and financial managers is stable and promising. According to the U.S. Bureau of Labor Statistics (BLS), employment for "Accountants and Auditors" is projected to grow 4 percent from 2022 to 2032, which is as fast as the average for all occupations.

The BLS projects about 126,500 openings for accountants and auditors each year, on average, over the decade. This steady demand is driven by economic growth, regulatory changes, and the increasing need for organizations to have strong financial oversight and strategic guidance—the exact skills a CMA provides. In an increasingly data-driven world, the ability to analyze information and inform strategy makes CMAs indispensable.

*(Source: U.S. Bureau of Labor Statistics Occupational Outlook Handbook, Accountants and Auditors)*

Conclusion

For aspiring and current finance professionals, the path to becoming a Certified Management Accountant is a strategic career move with a clear and significant financial payoff. While factors like experience, location, and industry will influence your exact salary, the evidence is undeniable: the CMA certification is a powerful tool for unlocking higher earnings and accessing senior leadership roles.

Key Takeaways:

- Significant Salary Premium: CMAs earn substantially more than their non-certified counterparts.

- High Growth Potential: Your salary will grow significantly as you gain experience and take on roles with greater responsibility, such as Controller or Director of Finance.

- Strong Job Security: The skills of a CMA are in constant demand, providing a stable and rewarding career path.

Investing in the CMA certification is a direct investment in your future earning potential and professional trajectory. It equips you with the forward-looking skills modern businesses need to thrive, making you an invaluable asset to any organization.