Embarking on a career in the financial services industry can be a rewarding journey, and for many, the first step is a customer-facing role at a renowned institution. A Bank Teller position at a powerhouse like JPMorgan Chase is a popular and accessible entry point, offering valuable experience and a clear path for career growth. But what can you realistically expect to earn?

This guide will provide a data-driven look at the salary of a Chase Bank Teller. While the national average provides a baseline, your actual earnings can vary significantly. We'll explore the key factors that influence your pay, from your location to your experience, and look at the long-term career outlook for this foundational role.

What Does a Chase Bank Teller Do?

Before diving into the numbers, it's essential to understand the role. A Chase Bank Teller is the face of the bank, the first point of contact for customers visiting a branch. Their responsibilities are a blend of customer service, operational accuracy, and sales acumen.

Key duties include:

- Processing Transactions: Accurately handling deposits, withdrawals, loan payments, and money transfers.

- Cash Management: Managing and balancing a cash drawer, ensuring meticulous accuracy in all transactions.

- Customer Service: Answering account inquiries, resolving issues, and providing a positive and professional banking experience.

- Product Awareness: Identifying customer needs and introducing them to other bank products and services, such as new accounts, credit cards, or referring them to a personal banker for mortgage or investment discussions.

This role is far more than just counting cash; it's about building relationships and serving as a trusted financial guide for the community.

Average Chase Bank Teller Salary

When evaluating compensation for a Chase Bank Teller, it's important to look at both the company's stated starting wage and data from salary aggregators, which reflect a wider range of experience levels.

In a move to attract and retain top talent, JPMorgan Chase announced it would raise its minimum starting wage to between $22 and $25 per hour, depending on the geographic location. On a full-time basis, this translates to an annual starting salary of approximately $45,760 to $52,000.

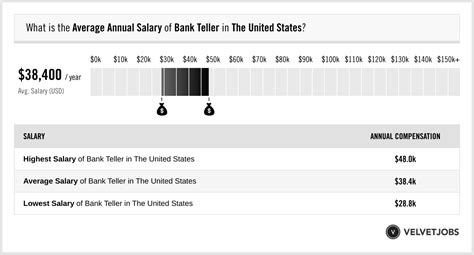

Salary aggregation websites, which collect self-reported data from current and former employees, provide a broader view of the average earnings:

- Glassdoor reports the average total pay for a Chase Bank Teller is approximately $42,100 per year, with a likely range between $36,000 and $49,000.

- Payscale estimates the average hourly wage for a Chase Teller at $18.55 per hour, with a range typically falling between $16 and $22 per hour.

- Salary.com places the median salary for a "Teller I" in the U.S. at around $38,277 per year, though this is a general figure for the role and not specific to Chase.

Key Takeaway: While entry-level tellers can expect to start at Chase's competitive minimum wage, the overall average hovers in the low $40,000s, with experienced and high-performing tellers earning closer to $50,000 or more, especially when considering potential bonuses.

Key Factors That Influence Salary

Your salary is not a single, fixed number. It's influenced by a combination of personal qualifications and market forces. Here are the most significant factors that will determine your pay as a Chase Bank Teller.

### Level of Education

For a Bank Teller position, a high school diploma or GED is typically the minimum educational requirement. While a college degree is not necessary for an entry-level role, possessing a bachelor's degree in a relevant field like finance, business, or economics can significantly impact your career trajectory. It won't necessarily increase your starting teller salary, but it will make you a much stronger candidate for promotions to higher-paying roles like Lead Teller, Relationship Banker, or Branch Manager.

### Years of Experience

Experience is one of the most direct drivers of salary growth. An entry-level teller is still learning the ropes, while a seasoned professional with several years of experience is more efficient, accurate, and adept at handling complex customer issues. Banks reward this expertise. An experienced teller may be promoted to a Lead Teller or Senior Teller, roles that come with supervisory responsibilities and a notable pay increase, often pushing their salary into the $50,000+ range.

### Geographic Location

Where you work matters immensely. Due to significant variations in the cost of living, a teller in a major metropolitan area will earn substantially more than one in a rural community. Chase's own policy of a sliding starting wage ($22-$25/hour) reflects this. For example, you can expect a higher salary in high-cost-of-living (HCOL) areas like New York City, San Francisco, or Boston compared to lower-cost regions in the Midwest or South. Always research the average salary for your specific city or state to get the most accurate picture.

### Company Type

Working for a large, national bank like Chase often comes with advantages. Due to their scale and resources, they can often offer a higher starting wage and more structured benefits packages than smaller community banks or credit unions. Their corporate structure also provides a more defined path for career advancement into different departments, from wealth management to corporate banking.

### Area of Specialization

The "teller" role is often a gateway to more specialized and lucrative positions within the bank. This is where the real earning potential lies. After gaining foundational experience, an employee can specialize in several ways:

- Lead Teller: Takes on operational leadership and training duties.

- Relationship Banker/Personal Banker: A salaried, often commissioned role focused on building deeper customer relationships, opening accounts, and handling more complex financial needs. Salaries for these roles often start in the $50,000s and can go much higher with sales commissions.

- Business Banking Specialist: Focuses on the needs of small business clients.

- Licensed Bankers: Those who obtain financial licenses (like the SIE, Series 6, or Series 63) can discuss and sell investment products, leading to a significant increase in compensation.

Job Outlook

It's important to approach this career with a clear understanding of its future. The U.S. Bureau of Labor Statistics (BLS) projects that overall employment for tellers will decline by 12% from 2022 to 2032. This decline is largely driven by the rise of automation, mobile banking, and online services that handle routine transactions.

However, this statistic doesn't tell the whole story. While the number of traditional "transaction-focused" teller roles may decrease, the need for skilled, in-person financial professionals is evolving, not disappearing. The modern teller role is becoming more focused on relationship-building, problem-solving, and sales support—skills that cannot be automated.

Therefore, you should view the Chase Bank Teller position not as a final destination, but as a crucial springboard. The skills you gain—in customer service, cash management, financial products, and regulatory compliance—are the bedrock for a successful and long-lasting career in the financial industry.

Conclusion

A career as a Chase Bank Teller offers a competitive starting salary, with most new hires earning between $45,760 and $52,000 per year depending on location. Your earning potential is directly influenced by your experience, your performance in cross-selling, and your ambition to move into specialized roles.

While the broader "teller" profession is undergoing a transformation due to technology, the position at a major institution like Chase remains an outstanding entry point. It provides invaluable training, a pathway to higher-paying roles like Personal Banker or Loan Officer, and a stable foundation for building a rewarding career in the dynamic world of finance. For those with strong people skills and a head for numbers, it is a role filled with opportunity.