Decoding Your Earning Potential: A Deep Dive into Bank Teller Salaries

A career as a bank teller is a foundational role in the financial services industry. It’s a position that combines critical customer service skills with a high degree of trust and accuracy. But what can you expect to earn? While the job is an excellent entry point, the salary can vary significantly.

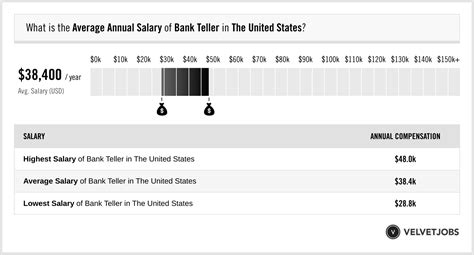

This article provides a data-driven look at bank teller salaries, exploring the national average and the key factors that can impact your paycheck. For those considering this career, you can expect a national median salary of approximately $37,000 to $38,000 per year, with a typical range falling between $32,000 and $44,000 annually. Let's break down what influences that number and how you can maximize your earning potential.

What Does a Bank Teller Do?

Before we talk numbers, it's important to understand the role. A bank teller is the primary point of contact for most bank customers—they are the face of the institution. Their responsibilities go far beyond simply handling cash. A modern bank teller is a versatile professional who:

- Processes Transactions: Accurately manages deposits, withdrawals, loan payments, and money orders.

- Provides Customer Service: Answers questions about accounts, helps customers resolve issues, and provides a positive banking experience.

- Manages Cash: Balances a cash drawer daily, ensuring all funds are accounted for with precision.

- Identifies Customer Needs: Listens to customers to understand their financial goals and recommends other bank products or services, such as new accounts, credit cards, or loans.

- Ensures Security and Compliance: Follows strict security protocols to protect customer information and prevent fraud.

Average Bank Teller Salary

When determining the average salary, we look at data from several authoritative sources to get a complete picture.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for tellers was $37,840 in May 2023. This means that half of all tellers earned more than this amount, and half earned less. The BLS also reports that the lowest 10 percent earned less than $29,670, and the highest 10 percent earned more than $48,010.

Reputable salary aggregators provide a similar outlook:

- Salary.com reports that the average Bank Teller I salary in the United States is around $37,131 as of 2024, with a typical range between $33,088 and $41,833.

- Glassdoor estimates the average total pay for a bank teller is approximately $40,500 per year in the U.S., which includes a base salary of around $38,000 and additional pay like cash bonuses or commissions.

This data shows a consistent range, but what pushes a teller's salary toward the higher end of that spectrum?

Key Factors That Influence Salary

Your specific salary as a bank teller is not a fixed number. It is influenced by a combination of your background, where you work, and the specific skills you bring to the table.

### Level of Education

A high school diploma or its equivalent is the standard educational requirement for most entry-level bank teller positions. However, further education can be a significant advantage. An associate's or bachelor's degree in fields like finance, business, or accounting can make you a more competitive candidate and, more importantly, pave the way for advancement. Banks often prefer candidates with some college education for promotions into roles like head teller, personal banker, or assistant branch manager, all of which come with higher salaries.

### Years of Experience

Experience is one of the most direct drivers of salary growth for a bank teller. As you gain experience, you become more efficient, knowledgeable, and trusted. This progression is often formalized in titles and pay grades:

- Entry-Level Teller (0-2 years): Typically earns at the lower end of the salary range, focusing on mastering basic transactions and customer service.

- Experienced Teller (2-5 years): Has a strong command of all procedures, can handle more complex transactions, and may begin training new hires. Their salary moves toward the national median.

- Senior or Head Teller (5+ years): This is a leadership role. A Head Teller supervises other tellers, manages the vault, handles scheduling, and resolves escalated customer issues. According to Salary.com, a Head Teller can earn an average salary closer to $46,950, with some earning well over $50,000.

### Geographic Location

Where you live and work plays a massive role in your salary due to varying costs of living and regional demand for financial services. Tellers in major metropolitan areas and states with a higher cost of living generally earn more.

According to BLS data, the top-paying states for bank tellers include:

- District of Columbia

- Washington

- Massachusetts

- California

- New York

In contrast, tellers in rural areas or states with a lower cost of living can expect to earn salaries closer to the lower end of the national range.

### Company Type

The type of financial institution you work for can also impact your earnings and benefits package.

- Large National Banks (e.g., Chase, Bank of America): These institutions often have highly structured, standardized pay scales. They may offer competitive benefits packages and clear, albeit sometimes competitive, pathways for career advancement into corporate roles.

- Community Banks and Credit Unions: These smaller institutions may offer salaries that are competitive with larger banks to attract talent. They often pride themselves on a strong work-life balance and a close-knit company culture. Bonuses and benefits can vary widely but are often quite generous.

### Area of Specialization

While "specialization" may not seem obvious for a teller role, developing niche skills can directly increase your value and earning potential. This can include:

- Sales and Cross-Selling: Tellers who excel at identifying customer needs and successfully referring them to other banking services (like mortgages or investment advice) are often eligible for performance bonuses and commissions. This can add thousands of dollars to your annual income.

- Business Banking: Becoming the go-to teller for handling complex transactions for small business clients can make you an indispensable team member.

- Notary Public Certification: Some banks will pay for you to become a notary. This added skill provides another valuable service to customers and can sometimes come with a small pay bump or bonus.

Job Outlook

The career outlook for bank tellers is undergoing a significant transformation. The U.S. Bureau of Labor Statistics (BLS) projects a 12% decline in employment for tellers from 2022 to 2032.

While this statistic may seem discouraging, it's crucial to understand the context. The decline is largely driven by automation and the rise of online and mobile banking. However, it does not mean the role is disappearing. Instead, it's evolving. The tellers who will be most in-demand are those who can provide a high level of personalized customer service, solve complex problems, and build relationships—skills a machine cannot replicate.

Furthermore, the bank teller position remains an exceptional launching pad for a long-term career in finance. Many personal bankers, loan officers, branch managers, and even corporate executives started their careers as tellers.

Conclusion

A bank teller salary is influenced by a blend of experience, location, education, and the specific institution you work for. While the median salary hovers around $37,000 to $38,000, you have considerable power to increase your earnings. By focusing on professional development, gaining experience, developing specialized skills in sales and customer relations, and seeking opportunities for advancement, you can move toward the higher end of the pay scale.

For individuals with strong attention to detail, excellent people skills, and a trustworthy character, the bank teller role is more than just a job—it's the first step on a promising and stable career path in the financial world.