For professionals passionate about finance, leadership, and community impact, a career as a Branch Manager at a major financial institution like JPMorgan Chase is a highly sought-after goal. It’s a role that blends sales acumen, operational excellence, and people development. But beyond the responsibilities, what is the earning potential? This in-depth analysis will explore the salary of a Chase Branch Manager, the factors that shape it, and the overall career outlook.

A career as a Chase Branch Manager offers significant financial rewards, with average total compensation often ranging from $90,000 to over $135,000 annually when factoring in bonuses and incentives. Let's dive into the details.

What Does a Chase Branch Manager Do?

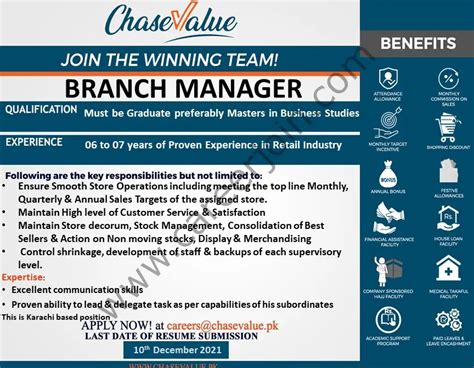

A Chase Branch Manager is the leader of a local banking center, acting as the face of the company in the community. They are not just managing operations; they are running a small business. Their core responsibilities are multifaceted and dynamic, including:

- Team Leadership & Development: Recruiting, training, coaching, and managing a team of bankers, tellers, and specialists. They are responsible for fostering a positive work environment and helping their team members achieve their career goals.

- Sales and Business Growth: Driving branch performance by meeting and exceeding goals for loans, deposits, investments, and new client acquisition. They develop strategies to grow the branch's portfolio and deepen client relationships.

- Operational Excellence & Compliance: Ensuring the branch operates smoothly, efficiently, and in strict accordance with all banking regulations and internal policies. This includes managing risk, overseeing audits, and ensuring top-tier security.

- Client Relationship Management: Serving as the primary point of contact for high-value clients and handling escalated customer service issues. They work to build lasting relationships that foster loyalty and trust.

In essence, they are tasked with ensuring their branch is profitable, compliant, and a cornerstone of the local community's financial well-being.

Average Chase Branch Manager Salary

When analyzing the salary for a Chase Branch Manager, it's crucial to look beyond the base salary and consider total compensation, which includes performance-based bonuses and incentives.

Based on an aggregation of recent data, the figures are as follows:

- Average Base Salary: Most sources place the average base salary for a Chase Branch Manager in the range of $80,000 to $95,000 per year.

- Total Compensation: This is where the earning potential truly shines. With bonuses, commissions, and potential profit-sharing, the total compensation package is significantly higher. Data from reputable aggregators like Glassdoor and Salary.com indicates that the average total pay for a Chase Branch Manager typically falls between $95,000 and $135,000. Top performers in high-value markets can exceed this range.

For context, the U.S. Bureau of Labor Statistics (BLS) classifies Branch Managers under the broader category of "Financial Managers." The median annual wage for all Financial Managers was $156,100 in May 2023. While this category includes higher-paying corporate roles like CFOs and treasurers, it confirms that management positions in the financial sector are among the most lucrative in the nation.

Key Factors That Influence Salary

Averages provide a useful benchmark, but an individual's actual earnings can vary widely. Several key factors determine where a Chase Branch Manager will fall on the salary spectrum.

###

Level of Education

A bachelor’s degree in finance, business administration, economics, or a related field is the standard educational requirement for this role. While a degree is a prerequisite, it's typically experience and performance that have a more direct impact on salary. However, an advanced degree, such as a Master of Business Administration (MBA), can make a candidate more competitive for positions in larger, more complex branches or accelerate their path toward regional management roles, which come with substantially higher compensation.

###

Years of Experience

Experience is one of the most significant drivers of salary. The career path to a Branch Manager role is a journey of progressive responsibility, and compensation reflects that.

- Early Career (1-4 years): Professionals often start as Personal Bankers or Assistant Branch Managers. In these roles, they build foundational skills and a track record of success.

- Mid-Career (5-9 years): A professional with a solid performance history and around five years of experience is a prime candidate for a Branch Manager position, typically earning a salary within the average range.

- Experienced (10+ years): Managers with a decade or more of experience, particularly those with a history of leading successful teams, can command salaries at the higher end of the scale. They are also prime candidates for promotion to roles overseeing multiple branches or entire markets.

###

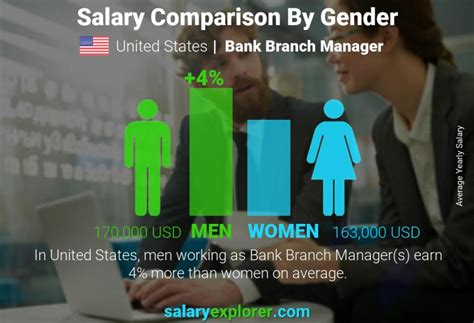

Geographic Location

Where you work matters immensely. Salaries are adjusted based on the cost of living and the concentration of wealth in a specific market. A Branch Manager in a high-cost-of-living area like New York City, San Francisco, or Boston will earn a significantly higher salary than a manager in a smaller, rural market. For example, salary data consistently shows that financial management roles in major metropolitan hubs can pay 20-30% more than the national average to compensate for higher living expenses and greater market opportunity.

###

Branch Size and Market Complexity

Not all branches are created equal. This factor is closely tied to location but deserves its own distinction. A manager overseeing a high-traffic flagship branch in a downtown financial district with a large team and a focus on high-net-worth "Private Client" services will have greater responsibilities and higher performance targets. Consequently, their compensation potential, especially bonuses, will be much greater than that of a manager at a smaller, suburban branch with lower deposit volumes and a smaller staff.

###

Performance, Licensing, and Specialization

A substantial portion of a Branch Manager's income is variable and tied directly to performance. Key Performance Indicators (KPIs) often include:

- Loan and mortgage origination volume

- New deposit growth

- Referrals to financial advisors and mortgage bankers

- Customer satisfaction scores (NPS)

Furthermore, holding specific FINRA licenses, such as the Series 6, 63, and 26, allows a manager to discuss and oversee the sale of investment products. These licenses make a manager more versatile and valuable, often leading to higher compensation as they can support a wider range of client needs.

Job Outlook

The career outlook for financial managers is exceptionally strong. According to the U.S. Bureau of Labor Statistics (BLS), employment for Financial Managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations.

While the rise of digital and mobile banking is changing the landscape, the role of the physical branch is evolving, not disappearing. Branches are becoming centers for advice, complex problem-solving, and relationship-building—tasks that require skilled human leadership. This transition makes the role of the modern Branch Manager more critical than ever, securing their place as essential leaders in the financial services industry.

Conclusion

A career as a Chase Branch Manager is a challenging yet highly rewarding path for ambitious financial professionals. It offers a powerful combination of leadership responsibility, community impact, and significant earning potential.

Key Takeaways:

- Strong Earning Potential: Expect a total compensation package ranging from $90,000 to over $135,000, with top performers earning even more.

- Performance is Paramount: Your ability to drive sales, manage your team effectively, and grow your branch's business is directly tied to your income.

- Experience and Location are Key: Your years in the industry and the market you work in are the two largest factors influencing your base salary.

- Excellent Career Outlook: With projected industry growth far exceeding the national average, the demand for skilled financial leaders remains high.

For anyone looking to build a leadership career in banking, the role of a Chase Branch Manager represents a pinnacle of achievement with financial rewards to match.