For ambitious professionals at the intersection of sales, marketing, and strategy, the role of Chief Revenue Officer (CRO) represents a career pinnacle. It's a demanding, high-impact position that commands a significant compensation package. But what does a Chief Revenue Officer's salary actually look like? The answer is more than just a single number; it's a complex equation influenced by experience, location, company performance, and more.

A CRO's earnings often soar well into the six figures, with total compensation packages frequently exceeding $400,000 to $500,000 annually. This article will provide a comprehensive breakdown of the CRO salary, explore the key factors that drive earning potential, and offer a look into the future of this critical executive role.

What Does a Chief Revenue Officer Do?

Before diving into the numbers, it's essential to understand the immense responsibility a CRO holds. This isn't just a glorified Head of Sales. A Chief Revenue Officer is a C-suite executive who orchestrates the company's entire revenue generation engine.

Their primary mandate is to align and optimize all revenue-related functions, including:

- Marketing: Ensuring lead generation and brand strategy are directly tied to revenue goals.

- Sales: Driving sales team performance, strategy, and execution.

- Customer Success/Account Management: Focusing on retention, upselling, and reducing customer churn.

- Revenue Operations (RevOps): Building the technology stack, processes, and analytics framework that supports the entire revenue lifecycle.

In essence, the CRO breaks down traditional silos to create a single, accountable strategy for driving predictable and sustainable growth.

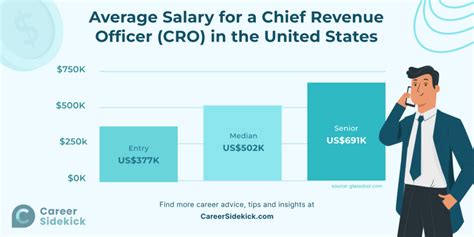

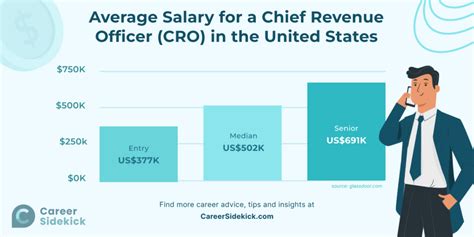

Average Chief Revenue Officer Salary

The compensation for a Chief Revenue Officer is substantial, reflecting the role's strategic importance and direct impact on a company's bottom line. It's crucial to distinguish between base salary and total compensation, as a significant portion of a CRO's earnings comes from performance-based incentives.

- Average Base Salary: According to data from Salary.com, the median base salary for a Chief Revenue Officer in the United States is approximately $291,500 as of early 2024. However, this is just the midpoint. The typical base salary range usually falls between $231,900 and $366,400.

- Total Compensation (Salary + Incentives): The real story is in total compensation. When you include bonuses, commissions, and equity (stock options), the numbers increase dramatically. Glassdoor reports a total pay average of around $401,000 per year, with a likely range between $254,000 and $654,000. Top performers at high-growth tech firms or large public companies can see total compensation packages that exceed $700,000.

These figures represent a national average. To understand what you could potentially earn, we need to examine the factors that influence these numbers.

Key Factors That Influence Salary

Several key variables determine where a CRO's salary will fall within the wide range of possibilities.

### Level of Education

While experience is paramount for a C-suite role, education lays the foundational groundwork. A Bachelor's degree in business administration, finance, marketing, or a related field is considered a minimum requirement. However, many top-tier candidates hold a Master of Business Administration (MBA). An MBA is highly valued because it equips leaders with advanced strategic planning, financial modeling, and executive leadership skills, often leading to higher salary offers and more significant opportunities.

### Years of Experience

This is arguably the most critical factor. A CRO role is not an entry-level position. Most executives have 15 to 20+ years of progressive experience. A typical career path involves moving up through leadership roles like Director of Sales, VP of Marketing, or VP of Sales. A proven track record of hitting and exceeding revenue targets, managing large teams, and successfully scaling a business is non-negotiable and directly correlates with higher compensation.

### Geographic Location

Where you work matters. Salaries for CROs are significantly higher in major metropolitan areas with a high cost of living and a dense concentration of large corporations and tech hubs.

According to data analysis from Salary.com, cities that pay a premium over the national average include:

- San Francisco, CA

- San Jose, CA

- New York, NY

- Boston, MA

- Seattle, WA

Working in one of these hubs can increase your base salary by 20-30% or more compared to the national median.

### Company Type

The type of company you work for has a massive impact on your compensation structure.

- Industry: The technology sector, particularly Software-as-a-Service (SaaS), is known for offering some of the highest CRO salaries. The high-growth, scalable nature of SaaS business models makes the CRO role exceptionally valuable. Other high-paying industries include financial services, healthcare technology, and professional services.

- Company Size and Stage:

- Startups/Early-Stage Companies: May offer a lower base salary but compensate with a significant equity stake. The potential for a massive payout if the company is acquired or goes public is the primary draw.

- Mid-Sized/Growth-Stage Companies: Often offer a competitive blend of a strong base salary, performance bonuses, and meaningful equity.

- Large, Public Corporations: Typically provide the highest base salaries and most stable, structured bonus plans. Equity may be in the form of Restricted Stock Units (RSUs) rather than options, offering more predictable value.

### Area of Specialization

While the CRO is a generalist role overseeing multiple functions, a deep background in a specific area can make a candidate more valuable to a particular company. For example:

- A CRO with a background in enterprise B2B sales will be highly sought after by companies that rely on large, complex deal cycles.

- An executive with expertise in SaaS subscription models and RevOps is a perfect fit for a high-growth tech company.

- A leader with a proven track record in direct-to-consumer (DTC) e-commerce would be invaluable to a retail or consumer goods brand.

This specialized expertise allows a company to de-risk its growth plans and often translates into a premium compensation package for the right candidate.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track data for the "Chief Revenue Officer" title specifically, it provides projections for the umbrella category of "Top Executives."

According to the BLS, employment for top executives is projected to grow about as fast as the average for all occupations. However, the *need* for the CRO role is growing much faster conceptually. As businesses face increasing market complexity and the need for digital transformation, the strategic imperative to unify revenue-generating departments under a single leader is becoming more critical. This trend suggests that demand for skilled, experienced CROs will remain strong and competitive for the foreseeable future.

Conclusion

The path to becoming a Chief Revenue Officer is long and demanding, but the rewards are substantial. It is a career defined by high stakes, strategic leadership, and a direct, measurable impact on business success.

For professionals considering this trajectory, the key takeaways are clear:

- Aim High: The earning potential is exceptional, with total compensation packages often reaching well into the high six figures.

- Build Your Foundation: A strong educational background, especially an MBA, can open doors.

- Experience is King: Focus on gaining 15+ years of progressive leadership experience across sales, marketing, and customer-facing roles.

- Be Strategic: Your industry, location, and the type of company you join will significantly influence your salary and overall compensation structure.

For those who can master the art and science of revenue generation, the role of Chief Revenue Officer offers not just a lucrative salary, but a premier seat at the leadership table.