Considering a career as a commercial banker? It's a dynamic and influential profession that serves as the financial backbone for businesses of all sizes. But beyond the professional satisfaction, a key question for many is: what is the earning potential?

A career in commercial banking offers a highly competitive compensation package, with experienced professionals in major financial hubs often earning well into the six-figure range. While the national average base salary hovers around $100,000, total compensation—including significant performance-based bonuses—can push that figure substantially higher, often reaching $200,000 or more for senior-level roles.

This guide will break down everything you need to know about a commercial banker's salary, from average earnings to the critical factors that will shape your financial future in this rewarding field.

What Does a Commercial Banker Do?

Before we dive into the numbers, it's essential to understand the role. A commercial banker is a financial professional who manages the relationship between a bank and its business clients. They are the primary point of contact for companies seeking loans, lines of credit, treasury management services, and other financial products.

Key responsibilities include:

- Business Development: Identifying and building relationships with new business clients.

- Financial Analysis: Analyzing a company's financial statements, cash flow, and overall creditworthiness to assess risk.

- Loan Structuring: Designing loan packages and credit solutions that meet the client's needs while protecting the bank's interests.

- Portfolio Management: Overseeing a portfolio of existing business loans, monitoring their performance, and ensuring compliance with loan agreements.

In essence, commercial bankers help businesses get the capital they need to grow, operate, and thrive.

Average Commercial Banker Salary

Compensation in commercial banking is typically composed of two main parts: a base salary and a variable bonus or commission, which is often tied to individual and bank performance.

When analyzing salary data, it's crucial to look at both base pay and total compensation.

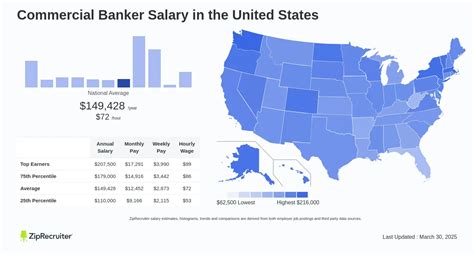

- Median Base Salary: According to Salary.com, the median base salary for a Commercial Banker in the United States is approximately $105,170 as of early 2024. The typical range falls between $91,480 and $121,550.

- Total Compensation (including bonuses): Glassdoor reports a higher average "total pay" of around $148,500 per year, with a likely range between $111,000 and $209,000. This figure highlights the significant impact of bonuses and profit-sharing.

- Salary Range: Data from Payscale shows a broad salary spectrum, with base salaries ranging from $63,000 at the entry-level to over $150,000 for senior and leadership roles, before accounting for bonuses that can add another $10,000 to $75,000+ to annual earnings.

It's important to note that the U.S. Bureau of Labor Statistics (BLS) groups commercial bankers under the broader category of "Loan Officers." The BLS reports a median annual wage for all loan officers of $72,370 in May 2023. This lower figure includes consumer, mortgage, and other types of loan officers, who typically have different compensation structures than those specializing in commercial banking.

Key Factors That Influence Salary

Your specific salary as a commercial banker will depend on a combination of critical factors. Understanding these will help you maximize your earning potential throughout your career.

### Level of Education

A bachelor's degree is the standard entry requirement for a commercial banking role. Degrees in Finance, Accounting, Economics, or Business Administration are highly preferred as they provide a strong foundational knowledge of financial principles. For those looking to accelerate their career and earning potential, an advanced degree or certification can be a significant differentiator. A Master of Business Administration (MBA), especially from a top-tier business school, can open doors to higher-level positions and significantly boost starting salaries. Likewise, earning the Chartered Financial Analyst (CFA) designation is highly respected and can enhance credibility and compensation.

### Years of Experience

Experience is arguably the most significant driver of salary growth in commercial banking. The career path is well-defined, with compensation increasing at each level.

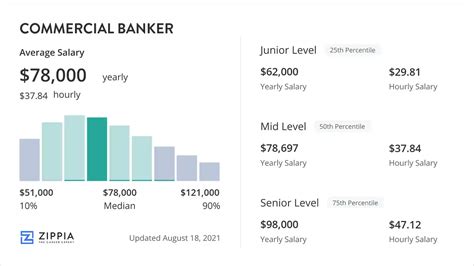

- Entry-Level (Analyst/Junior Relationship Manager, 0-3 years): Professionals starting their careers can expect a base salary in the $65,000 to $85,000 range, with smaller initial bonuses. The focus at this stage is on learning credit analysis and supporting senior bankers.

- Mid-Career (Relationship Manager/AVP/VP, 4-9 years): With a proven track record, bankers move into direct client-facing roles. Base salaries typically increase to $90,000 to $130,000, and performance bonuses become a much larger component of total pay, often adding 20-50% to the base salary.

- Senior-Level (Senior Vice President/Team Lead, 10+ years): Top performers with extensive experience and a large book of business command the highest salaries. Base pay can exceed $150,000 - $180,000+, with bonuses that can match or even exceed their base salary, pushing total compensation well over $250,000.

### Geographic Location

Where you work matters immensely. Banks in major financial centers with a high cost of living and a heavy concentration of large businesses offer significantly higher salaries to attract top talent.

Top-paying metropolitan areas for commercial bankers include:

- New York, NY: Often 20-30% above the national average.

- San Francisco, CA: Similar to New York, with very high compensation levels.

- Charlotte, NC: A major banking hub, offering salaries well above the national average.

- Chicago, IL: A key financial center for the Midwest with competitive pay scales.

- Boston, MA: Another high-cost, high-salary market.

Working in a smaller city or rural area will generally result in a lower base salary, though this is often offset by a lower cost of living.

### Company Type

The size and type of the bank you work for directly impact your compensation structure.

- Large Money-Center Banks (e.g., JPMorgan Chase, Bank of America, Citigroup): These global institutions handle the most complex deals and largest clients. They typically offer the highest base salaries and the largest bonus potential, but also come with a high-pressure environment.

- Regional Banks (e.g., Truist, U.S. Bank, PNC): These large, established banks offer very competitive compensation packages that are often close to money-center banks, particularly for strong performers. They may offer a slightly better work-life balance.

- Community Banks and Credit Unions: These smaller institutions focus on local businesses. While their base salaries and bonuses are generally lower than their larger counterparts, they often provide excellent work-life balance, strong community ties, and a direct impact on local economic growth.

### Area of Specialization

Within commercial banking, certain specializations can lead to higher pay due to the complexity and risk involved.

- Commercial & Industrial (C&I) Lending: This is the traditional form of commercial banking, providing working capital loans and lines of credit to a wide range of industries. It forms the benchmark for compensation.

- Commercial Real Estate (CRE): Financing large property developments and acquisitions can be very lucrative, with compensation often tied directly to market cycles and deal size.

- Asset-Based Lending (ABL): This highly specialized field involves lending against a company's assets (like accounts receivable and inventory). It requires deep expertise and often comes with higher compensation.

- Small Business Administration (SBA) Lending: While vital, these government-backed loans are often more process-driven and may have a slightly different and sometimes lower compensation structure compared to conventional commercial lending.

Job Outlook

The future for commercial bankers looks stable. According to the U.S. Bureau of Labor Statistics, employment for Loan Officers is projected to show little or no change from 2022 to 2032. However, the BLS also projects about 25,700 openings for loan officers each year, on average, over the decade.

While technology and automation may streamline some of the analytical tasks, the core of commercial banking—relationship management, complex deal structuring, and risk assessment—will continue to require skilled human professionals. As the economy grows, businesses will always need capital, ensuring a consistent demand for talented commercial bankers.

Conclusion

A career as a commercial banker is a challenging yet financially and professionally rewarding path. While entry-level salaries are competitive, the long-term earning potential is exceptional for those who are driven, analytical, and skilled at building relationships.

Your earnings will be a direct reflection of your experience, performance, location, and specialization. By focusing on gaining valuable experience, considering advanced certifications like an MBA or CFA, and strategically positioning yourself in a high-growth market or specialization, you can build a highly successful and lucrative career in commercial banking. For those with a passion for finance and a drive to help businesses succeed, it remains one of the premier careers in the financial services industry.