For ambitious professionals with a flair for negotiation, market analysis, and building relationships, a career as a commercial real estate (CRE) broker offers one of the highest earning potentials in the sales industry. Unlike many traditional salaried roles, a broker's income is often directly tied to their performance, creating an environment where the sky is truly the limit. While a six-figure income is common, top performers in major markets regularly earn well into the high six or even seven figures.

This guide will break down what you can expect to earn as a commercial real estate broker, exploring the key factors that drive compensation and the overall outlook for this dynamic profession.

What Does a Commercial Real Estate Broker Do?

A commercial real estate broker is a licensed professional who acts as an intermediary between buyers, sellers, landlords, and tenants in transactions involving commercial properties. These properties are used for business purposes and include office buildings, industrial warehouses, retail centers, apartment complexes, and raw land.

Their core responsibilities include:

- Representing Clients: Advocating for the best interests of their clients, whether they are a company looking for office space (tenant representation) or a building owner looking to fill vacancies (landlord representation).

- Market Analysis: Conducting in-depth research on market trends, property values, and comparable sales to advise clients effectively.

- Financial Modeling: Analyzing the financial viability of potential investments and lease deals.

- Negotiation: Skillfully negotiating deal terms, from purchase price and lease rates to tenant improvement allowances.

- Transaction Management: Guiding the deal through every stage, from initial contact and property tours to closing the final paperwork.

Average Commercial Real Estate Broker Salary

A commercial real estate broker’s salary is almost universally commission-based, meaning their income is a percentage of the total lease value or sale price of the properties they transact. This makes defining an "average salary" complex, as it fluctuates dramatically based on performance.

While some junior brokers may start with a modest base salary or a draw (an advance against future commissions), established brokers work on a commission-only model.

Here’s a look at what the data says:

- The U.S. Bureau of Labor Statistics (BLS) reports the median annual wage for all real estate brokers and sales agents was $55,000 in May 2023. It's crucial to note that this figure includes residential agents and part-time professionals, which skews the average significantly lower than what a full-time, successful commercial broker earns.

- More specialized sources provide a clearer picture. Salary.com reports that the median salary for a Commercial Real Estate Broker in the United States is approximately $96,550 as of early 2024, but this often represents base pay or a conservative estimate. The typical total cash compensation, including commissions and bonuses, often falls between $150,000 and $250,000.

- Glassdoor shows an average total pay of around $162,000 per year for commercial real estate brokers, combining a base salary with significant additional pay from commissions.

The takeaway is clear: while entry-level earnings may be modest, the potential for growth is immense. It's common for mid-career brokers to earn $150,000 - $300,000+, with top-tier, senior brokers in major markets exceeding $500,000 or even $1 million in a strong year.

Key Factors That Influence Salary

Your earnings as a CRE broker are not determined by a single number. They are a direct result of several interconnected factors. Understanding these variables is key to charting a high-earning career path.

###

Level of Education

While a specific degree is not always required, a bachelor’s degree in finance, business administration, economics, or real estate is highly preferred by top brokerage firms. This foundational knowledge is critical for understanding complex financial models, investment analysis, and market dynamics. An MBA can further enhance earning potential, opening doors to leadership roles or positions focused on high-stakes investment sales.

Furthermore, professional certifications like the Certified Commercial Investment Member (CCIM) designation are highly respected and can directly lead to higher earnings by signaling a deep level of expertise in financial and market analysis.

###

Years of Experience

Experience is arguably the single most important factor in determining a broker's income. The career path typically follows a clear progression:

- Entry-Level (0-3 years): Often an "Associate" or "Junior Broker," this period is focused on learning the market, building a network, and supporting senior brokers. Compensation may be a base salary ($50,000 - $70,000) or a draw-against-commission. Total earnings are typically under $100,000.

- Mid-Career (4-10 years): By this stage, brokers have developed a specialization, a solid client list, and a strong personal brand. They operate primarily on commission and can consistently earn $150,000 to $300,000+ annually as they close larger and more frequent deals.

- Senior-Level (10+ years): Senior brokers, often with titles like "Senior Vice President," "Managing Director," or "Principal," are industry leaders. They handle the largest, most complex transactions and often manage a team of junior brokers. Their income is highly variable but can easily reach $500,000 and beyond.

###

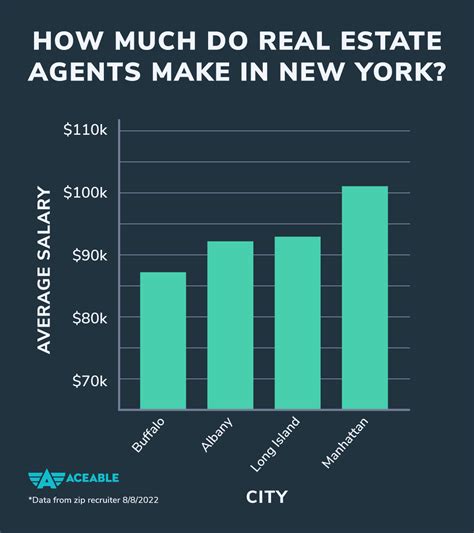

Geographic Location

Location, location, location isn't just a real estate mantra—it's a salary driver. Brokers in major metropolitan hubs with high property values and significant business activity earn substantially more because their commission checks are tied to larger deal sizes.

- Tier 1 Markets: Cities like New York, San Francisco, Los Angeles, and Chicago offer the highest earning potential due to the sheer volume and value of transactions.

- Tier 2 Markets: Strong, growing cities like Austin, Denver, Miami, and Atlanta also provide excellent opportunities and can offer a better work-life balance.

- Rural/Suburban Markets: While earnings are lower, brokers in these areas can build a dominant local presence with less competition.

###

Company Type

The type of brokerage firm you work for influences your training, resources, and commission structure.

- Large National/Global Firms (e.g., CBRE, JLL, Cushman & Wakefield): These giants offer unparalleled training programs, cutting-edge technology, and access to a global network of clients. While their brand name can open doors, they often have more structured commission splits that may be less favorable for junior brokers.

- Boutique/Local Firms: Smaller, specialized firms may offer a more entrepreneurial culture and higher commission splits. Success here often depends on the firm's local reputation and a broker's ability to self-generate leads, but the financial rewards can be greater.

###

Area of Specialization

Just as doctors specialize, so do CRE brokers. Developing deep expertise in a specific property type can make you the go-to expert in your market, leading to more referrals and higher earnings. Common specializations include:

- Multifamily: Brokering the sale of apartment buildings. This is often a very lucrative and stable sector.

- Industrial: Focusing on warehouses, distribution centers, and manufacturing facilities, a sector that has boomed with the rise of e-commerce.

- Office Leasing: Representing either tenants looking for space or landlords looking to lease it.

- Retail: Working with shopping centers, storefronts, and restaurants.

- Investment Sales: Specializing in the sale of high-value, income-producing properties to institutional investors. This is often considered the highest-earning specialization.

Job Outlook

The career outlook for commercial real estate brokers is closely tied to the health of the overall economy. According to the U.S. Bureau of Labor Statistics, employment for real estate brokers and sales agents is projected to grow 3 percent from 2022 to 2032, which is about as fast as the average for all occupations.

While factors like rising interest rates can temporarily slow transaction volume, the long-term need for businesses to lease, buy, and sell property remains constant. As businesses expand, relocate, or adapt to new models (like hybrid work), they will continue to rely on the expertise of skilled brokers.

Conclusion

A career as a commercial real estate broker is not a get-rich-quick scheme; it's a demanding, performance-driven profession that requires patience, resilience, and a deep commitment to mastering your market. The initial years can be a grind with a steep learning curve and uncertain income.

However, for those who persevere, the rewards are exceptional. By focusing on continuous learning, building a strong professional network, developing a niche specialization, and aligning with the right firm, you can build a career with unparalleled financial freedom and professional satisfaction. The data is clear: if you have the drive to succeed, the commercial real estate broker salary has a ceiling that you get to build yourself.