Becoming a Certified Public Accountant (CPA) is one of the most respected and stable career paths in the world of finance. For those pursuing this designation in the Golden State, the rewards are particularly significant. California's dynamic and massive economy creates exceptional demand for skilled financial professionals, making a cpa salary california a highly competitive and lucrative figure. On average, CPAs in California can expect to earn over $100,000, with top-level professionals in high-demand areas commanding salaries well over $200,000.

This guide will break down what you can expect to earn as a CPA in California, the key factors that influence your salary, and the promising outlook for this career.

What Does a CPA in California Do?

A CPA is more than just a tax preparer; they are licensed and trusted financial advisors to individuals, businesses, and government agencies. As guardians of financial integrity, CPAs perform a wide range of critical functions. Their responsibilities often include:

- Assurance and Auditing: Reviewing company financial records to ensure accuracy and compliance with laws and regulations.

- Taxation: Preparing federal, state, and local tax returns, as well as providing strategic advice on tax planning and reduction.

- Advisory Services: Offering consulting on everything from personal financial planning and mergers & acquisitions (M&A) to risk management and IT security.

- Forensic Accounting: Investigating financial discrepancies and fraud.

- Corporate Finance: Managing a company's financial health, including budgeting, reporting, and strategic planning in roles like Controller or Chief Financial Officer (CFO).

In essence, CPAs provide the clarity and strategy necessary for sound financial decision-making in a complex economic landscape.

Average CPA Salary in California

Salary data reveals a promising financial picture for CPAs in California. While exact figures vary based on several factors, we can establish a strong baseline by looking at authoritative data sources.

The U.S. Bureau of Labor Statistics (BLS) groups CPAs under the broader category of "Accountants and Auditors." According to the May 2023 BLS data, accountants and auditors in California earn an annual mean wage of $105,430. The salary range is extensive, highlighting the potential for growth:

- 10th Percentile (Entry-Level): $64,310

- 50th Percentile (Median): $98,420

- 90th Percentile (Senior/Specialist): $159,380

It's important to note that the CPA designation typically places professionals in the upper half of this range. Data from salary aggregators that specifically track "CPA" roles reinforces this. For example:

- Salary.com reports the average CPA salary in California is around $118,500, with a typical range falling between $107,400 and $130,800.

- Glassdoor places the average total pay (including base salary and additional compensation like bonuses) for a CPA in California at $123,000 per year.

These figures confirm that earning your CPA license is a direct path to a six-figure income in California.

Key Factors That Influence Salary

Your salary as a CPA is not a single, static number. It's influenced by a combination of your background, choices, and professional environment. Understanding these factors is key to maximizing your earning potential.

### Level of Education

To become a CPA in California, you must complete 150 semester units of education—30 units beyond a typical bachelor's degree. While a bachelor's in accounting is the standard foundation, pursuing a master's degree can significantly impact your starting salary and career trajectory. A Master of Accountancy (MAcc), Master of Science in Taxation (MST), or a Master of Business Administration (MBA) with an accounting concentration makes you a more competitive candidate and can lead to higher-level entry positions and faster promotions.

### Years of Experience

Experience is arguably the most significant driver of salary growth. Your earning potential increases substantially as you move from a junior associate to a senior leadership role.

- Entry-Level (0-2 years): As a Staff Accountant or Audit Associate, you can expect a salary in the $70,000 to $95,000 range, especially if starting at a major public accounting firm.

- Mid-Career (3-5 years): As a Senior Accountant or Senior Auditor, your responsibilities grow, and so does your paycheck. Salaries typically rise to $95,000 to $130,000. This is often the stage where professionals move from public accounting into industry roles.

- Senior/Managerial (5-10+ years): In roles like Accounting Manager, Controller, or Senior Tax Manager, compensation moves firmly into the $130,000 to $180,000+ range.

- Executive Level (15+ years): At the top of the profession, CPAs serving as CFOs, VPs of Finance, or Partners in public accounting firms can earn $200,000 to $500,000+, including bonuses and equity.

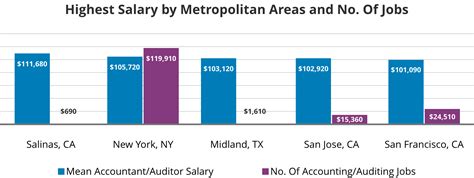

### Geographic Location

In a state as large and economically diverse as California, where you work matters. Major metropolitan areas with a high cost of living and a concentration of large corporations offer the highest salaries.

According to BLS data from May 2023, the mean salaries for accountants and auditors in key California metro areas are:

- San Jose-Sunnyvale-Santa Clara (Silicon Valley): $128,150

- San Francisco-Oakland-Hayward: $116,840

- Los Angeles-Long Beach-Anaheim: $102,680

- San Diego-Carlsbad: $99,190

- Sacramento-Roseville-Arden-Arcade: $95,830

Professionals in the Bay Area and Silicon Valley command a premium due to the concentration of high-growth tech companies and a higher cost of living.

### Company Type

The type of organization you work for has a profound impact on your salary and work-life balance.

- Public Accounting (The "Big Four"): The four largest accounting firms (PwC, Deloitte, EY, KPMG) are known for offering the highest starting salaries, excellent training, and prestigious resume-building experience. However, they are also known for demanding long hours.

- Public Accounting (Mid-Size & Regional): These firms offer competitive salaries—often slightly less than the Big Four—but typically provide a better work-life balance and a direct path to partnership.

- Corporate/Industry Accounting: Moving into an industry role (e.g., at a tech, entertainment, or manufacturing company) can be very lucrative. Salaries are highly dependent on the industry and company size, with sectors like technology, biotech, and entertainment often paying a premium.

- Government and Non-Profit: While these sectors generally offer lower base salaries, they compensate with exceptional job security, excellent benefits, and a predictable work schedule.

### Area of Specialization

General accounting skills are valuable, but specialized expertise commands the highest salaries. High-demand, high-paying specializations include:

- Advisory and Consulting: Services related to M&A, IT risk assurance, and business strategy are highly profitable and pay top dollar.

- International Tax: With so many multinational corporations based in California, CPAs who can navigate complex international tax laws are in constant demand.

- Forensic Accounting: This niche field, focused on uncovering financial fraud, requires a unique skill set and is compensated accordingly.

- Information Technology (IT) Audit: As business becomes more digitized, CPAs with expertise in information systems and cybersecurity (often holding a CISA certification) are critically valuable.

Job Outlook

The future for CPAs in California is bright. The BLS Occupational Outlook Handbook projects that employment for accountants and auditors nationwide will grow by 4% from 2022 to 2032, resulting in about 126,500 openings each year.

This demand is driven by several factors relevant to California's economy: tightening financial regulations, increasing globalization of business, a complex tax code, and the growing need for professionals who can analyze financial data to guide corporate strategy. In a state that serves as the fifth-largest economy in the world, the need for skilled, certified financial experts will remain consistently strong.

Conclusion

Pursuing a CPA license in California is a significant investment of time and effort, but the return is undeniable. It unlocks a career path defined by financial security, professional respect, and continuous opportunity for growth.

Key Takeaways:

- High Earning Potential: The average CPA salary in California comfortably exceeds six figures, with senior professionals earning well over $150,000.

- Growth is Guaranteed with Experience: Your salary will increase significantly as you gain experience and take on more responsibility.

- Location and Specialization are Key: Working in a major metro area like the Bay Area and developing expertise in a high-demand niche like advisory or international tax will maximize your earnings.

- Strong Job Security: Demand for CPAs is stable and projected to grow, ensuring robust career opportunities for years to come.

For anyone considering a career in finance, becoming a CPA in California offers not just a job, but a pathway to becoming an influential leader in the business world.