Pursuing a career as a Certified Public Accountant (CPA) in New York City places you at the epicenter of global finance, offering unparalleled opportunities for growth and substantial earning potential. If you're considering this demanding yet rewarding path, one of your primary questions is likely about compensation. In a city known for its high cost of living, how much can a CPA truly expect to make?

The answer is compelling. While starting salaries are competitive, the long-term earning potential for a CPA in NYC is exceptionally high. Entry-level CPAs can expect to earn upwards of $80,000, while experienced senior managers and specialized experts can command salaries well over $200,000, not including significant bonuses.

This guide will break down the salary you can expect as a CPA in NYC, the key factors that drive your earnings, and the bright future this career holds.

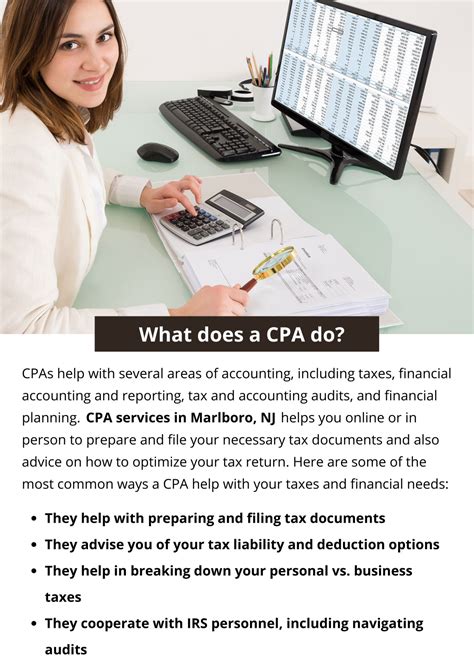

What Does a CPA Do?

Before diving into the numbers, it's essential to understand the role. A CPA is more than just a tax preparer; they are a licensed and trusted financial advisor to individuals, corporations, and governments. Their responsibilities are diverse and critical to financial integrity and strategic planning.

Key duties often include:

- Assurance and Auditing: Verifying the accuracy of financial records and providing an opinion on financial statements.

- Tax Compliance and Planning: Preparing tax returns and developing strategies to minimize tax liability legally.

- Consulting and Advisory: Offering strategic business advice, from mergers and acquisitions to risk management.

- Forensic Accounting: Investigating financial discrepancies and fraud.

- Financial Planning and Analysis: Managing budgets, forecasting financial performance, and guiding investment decisions.

In a hub like NYC, CPAs are the backbone of Wall Street, Fortune 500 companies, and innovative startups, making their role both vital and dynamic.

Average CPA Salary in NYC

New York City is one of the highest-paying markets for CPAs in the United States, reflecting the concentration of top-tier firms and the high cost of living.

According to recent data from several authoritative sources:

- Salary.com reports that the average salary for a Certified Public Accountant in New York, NY, is $135,591 as of November 2023, with a typical range falling between $122,236 and $150,535.

- Glassdoor estimates a total average pay of $128,000 per year for a CPA in the NYC area, combining a base salary of around $104,000 with additional pay like bonuses and profit-sharing.

- Payscale notes that the average base salary for a CPA in New York is approximately $102,000 per year, with figures varying significantly based on the factors discussed below.

It's important to remember that these are averages. An entry-level associate will earn less, while a partner at a firm or a CFO with a CPA designation will earn substantially more.

Key Factors That Influence Salary

Your salary as a CPA in NYC isn't a single, fixed number. It's a dynamic figure influenced by a combination of crucial factors. Understanding these drivers is key to maximizing your earning potential.

### Level of Education

To become a CPA, you must meet the "150-hour rule," which means completing 150 semester hours of education—30 hours beyond a standard bachelor's degree. Many candidates fulfill this requirement by earning a Master of Science in Accounting (MSA), a Master of Taxation (MTax), or an MBA with a concentration in accounting. While not strictly required for licensure, a master's degree can provide a competitive advantage, potentially lead to a higher starting salary, and open doors to more specialized, higher-paying roles sooner in your career.

### Years of Experience

Experience is arguably the single most significant factor in determining a CPA's salary. The career path typically involves a steep and rewarding salary progression.

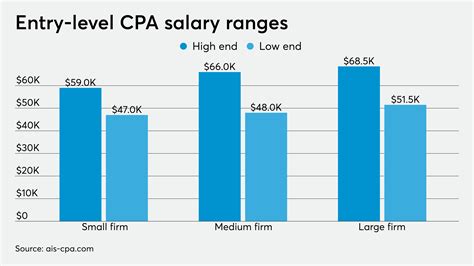

- Entry-Level (0-3 Years): A first-year associate at a public accounting firm in NYC can expect a starting salary in the range of $80,000 to $105,000. This period is focused on learning the fundamentals of audit or tax.

- Mid-Career (4-8 Years): After earning the CPA license and gaining a few years of experience, professionals are promoted to senior and manager roles. Salaries in this bracket typically range from $110,000 to $160,000. This is also a common point for CPAs to transition from public accounting to lucrative roles in private industry.

- Senior/Experienced (8+ Years): With extensive experience, CPAs in senior manager, director, or partner roles can see their compensation climb dramatically. Salaries can range from $160,000 to over $250,000, with partners at major firms earning significantly more.

### Geographic Location

This article focuses on NYC for a reason. Location is a major determinant of salary. According to the U.S. Bureau of Labor Statistics (BLS), the mean annual wage for "Accountants and Auditors" in the New York-Newark-Jersey City metropolitan area was $110,660 in May 2022. This is significantly higher than the national average of $86,740.

This "NYC premium" exists to offset the high cost of living and reflects the intense demand for top financial talent from the world's leading companies headquartered there.

### Company Type

Where you work matters immensely. The type and size of your employer have a direct impact on your paycheck.

- Big Four and Large National Firms (PwC, Deloitte, EY, KPMG): These firms typically offer the highest starting salaries and most structured career progression. They are known for demanding workloads but provide prestigious experience that leads to excellent "exit opportunities."

- Mid-Size and Regional Firms: These firms offer competitive salaries that may be slightly lower than the Big Four but often provide a better work-life balance. They are an excellent option for those who want to serve a diverse client base without the intense pressure of a global firm.

- Private Industry (Corporate Accounting): Moving from public accounting to a role within a corporation (e.g., as a Senior Accountant, Controller, or Internal Auditor) can be very lucrative. Experienced CPAs are highly sought after by banks, investment funds, media conglomerates, and tech companies in NYC, with compensation packages often exceeding those in public accounting, especially when bonuses are considered.

- Government and Non-Profit: While these sectors typically offer lower base salaries than the private sector, they provide exceptional job security, robust benefits, and a predictable work-life balance.

### Area of Specialization

All CPAs are not created equal in terms of pay. Highly specialized knowledge can unlock top-tier salaries. While core audit and tax services are the foundation of the profession, certain specialties are in higher demand and command a premium.

- Transaction Advisory Services (TAS) / Mergers & Acquisitions (M&A): CPAs who advise on the financial aspects of deals, conduct due diligence, and work on valuation are among the highest earners.

- International Tax: In a global hub like NYC, experts who can navigate the complex web of international tax laws are invaluable.

- Forensic Accounting: These financial detectives are highly paid for their specialized skills in litigation support and fraud investigation.

- IT Audit and Cybersecurity: As financial systems become more complex, CPAs with expertise in technology, data analytics, and cybersecurity are in extremely high demand.

Job Outlook

The future for CPAs is bright and stable. According to the U.S. Bureau of Labor Statistics, employment of accountants and auditors is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

The BLS projects about 126,500 openings for accountants and auditors each year, on average, over the decade. This steady demand is fueled by economic growth, changing financial laws and regulations, and the increasing need for financial transparency and accountability. In a complex financial ecosystem like New York City, the need for skilled, certified professionals is constant and non-negotiable.

Conclusion

A career as a Certified Public Accountant in New York City is a challenging but immensely rewarding endeavor. The financial compensation is among the best in the nation, with a clear and attainable path to a six-figure salary and beyond.

Your earning potential is directly in your hands, driven by your commitment to continuous learning, the experience you accumulate, the company you work for, and any specializations you pursue. For those with the ambition to thrive in a fast-paced environment, the CPA designation serves as a powerful key, unlocking doors to leadership, influence, and financial success in the business capital of the world.