The question "What is the Darren Taylor Tidel CEO salary?" is more than just a search for a number. It's a query driven by aspiration, curiosity, and a desire to understand the pinnacle of corporate achievement. It represents a fascination with the individuals who steer multi-million or billion-dollar enterprises, making strategic decisions that affect thousands of employees and shape entire industries. You're not just asking about a salary; you're asking about the value of leadership, the reward for a lifetime of dedication, and the blueprint for reaching the highest echelons of the professional world.

While the exact compensation of any single executive at a privately held company like Tidel is confidential, we can do something far more valuable. We can deconstruct the question and use it as a powerful case study to build the ultimate guide to a CEO-level career. We will explore the compensation structures, responsibilities, and career trajectory for Chief Executive Officers in specialized technology and manufacturing sectors, giving you a comprehensive, data-backed roadmap to understand and potentially pursue this path.

In my years as a career analyst, I've seen countless professionals climb the ladder, but the journey to the C-suite is unique. Early in my career, I had the opportunity to sit in on a quarterly town hall led by a new CEO. The clarity and conviction with which she laid out her vision for the company, turning abstract financial goals into a tangible mission for every employee, was a masterclass in leadership. It taught me that the true value of a top executive isn't just in the numbers they produce, but in the purpose they inspire. This guide is designed to take you beyond the numbers and into the very essence of what it takes to become a chief executive.

We will analyze the national salary averages for CEOs, the critical factors that can dramatically increase your earning potential, and the strategic steps you need to take over a decades-long career to position yourself for a role at the top. This is your comprehensive manual for understanding the summit of the corporate world.

### Table of Contents

- [What Does a Chief Executive Officer (CEO) Do?](#what-does-a-ceo-do)

- [Average CEO Salary: A Deep Dive into Executive Compensation](#average-ceo-salary)

- [Key Factors That Influence a CEO's Salary](#key-factors-that-influence-salary)

- [The CEO Job Outlook and Future Career Growth](#job-outlook-and-career-growth)

- [How to Get Started on the Path to CEO](#how-to-get-started-in-this-career)

- [Is the Path to CEO Right for You?](#conclusion)

---

What Does a Chief Executive Officer (CEO) Do?

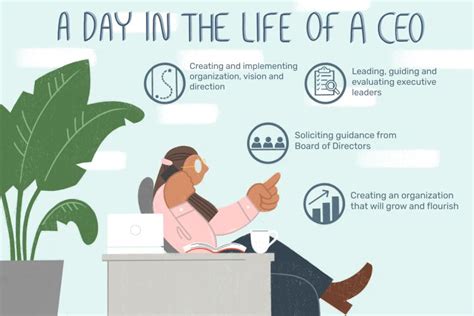

At its core, the Chief Executive Officer is the highest-ranking executive in a company, ultimately responsible for its overall success or failure. The title is not merely ceremonial; it signifies the final point of accountability for every aspect of the organization's performance. While the board of directors provides oversight and guidance, the CEO is the individual charged with executing the company's vision and strategy on a day-to-day basis.

The role of a CEO can be broken down into four primary pillars of responsibility:

1. Strategy and Vision: The CEO is the chief architect of the company's long-term strategy. This involves setting the overarching vision (the "Why"), defining the mission (the "What"), and establishing the strategic goals (the "How"). They must constantly analyze market trends, competitive landscapes, technological shifts, and economic indicators to ensure the company is positioned for sustainable growth. This isn't a one-time task; it's a continuous process of refinement and adaptation.

2. Capital Allocation and Financial Performance: A CEO is the ultimate steward of the company's resources. This includes deciding how to allocate capital—whether to invest in research and development, pursue an acquisition, expand into new markets, or return capital to shareholders. They are accountable for the company's financial health, including revenue growth, profitability, cash flow, and return on investment. They work closely with the Chief Financial Officer (CFO) to manage budgets and deliver financial results that meet or exceed stakeholder expectations.

3. Leadership and Culture: A CEO's most profound impact is often on the company's culture. They set the tone, values, and standards of behavior for the entire organization. By hiring and developing the senior leadership team (the C-suite), they cascade this culture throughout the company. A great CEO builds a high-performing team, fosters an environment of innovation and accountability, and inspires employees to be committed to the company's mission.

4. Stakeholder Management: The CEO is the public face of the company. They must manage relationships with a wide array of stakeholders, including the board of directors, investors, employees, customers, partners, government regulators, and the media. This requires exceptional communication, negotiation, and public relations skills.

### A "Day in the Life" of a CEO (Fictional Example)

To make this tangible, let's imagine a day in the life of "Alex," the CEO of a mid-sized technology manufacturing company similar to Tidel.

- 7:00 AM - 8:30 AM: Alex starts the day reviewing key performance indicator (KPI) dashboards: last night's production numbers, daily sales figures, and critical customer support metrics. This is followed by a scan of industry news and a pre-read of materials for the day's meetings.

- 8:30 AM - 9:00 AM: Daily check-in with the senior leadership team (COO, CFO, CTO). They cover urgent issues, review progress against quarterly goals, and align on priorities for the day.

- 9:00 AM - 11:00 AM: A deep-dive strategic session with the Head of Product and the CTO. They are reviewing the 18-month product roadmap, debating a significant investment in an AI-driven security feature for their next-generation product line. Alex's role is to challenge assumptions, ensure the investment aligns with the overall company strategy, and make the final go/no-go decision.

- 11:00 AM - 12:00 PM: Call with a major institutional investor. Alex provides an update on quarterly performance, answers tough questions about competitive threats, and reaffirms the company's long-term growth story.

- 12:00 PM - 1:00 PM: "Lunch and Learn" with a group of high-potential junior managers. This is a critical culture-building activity. Alex shares leadership lessons and listens to their ideas and concerns, making them feel seen and valued.

- 1:00 PM - 3:00 PM: Board of Directors committee call. Alex and the CFO present a proposal for a potential strategic acquisition of a smaller competitor. This requires detailed financial models, synergy analysis, and a clear strategic rationale.

- 3:00 PM - 4:00 PM: Tour of the manufacturing floor with the COO. Alex talks to line workers, asks about process improvements, and visibly demonstrates that leadership is connected to the core operations of the business.

- 4:00 PM - 5:30 PM: One-on-one coaching session with the new VP of Sales, helping them troubleshoot a challenge with a key international market. This is part of Alex's role as the "chief developer" of talent.

- 5:30 PM onwards: The "second shift" begins. This time is often reserved for clearing emails, reading detailed reports, preparing for the next day's meetings, and strategic thinking without interruption. It might also include an evening industry dinner or a call with an international team.

This schedule illustrates that the CEO role is not one of passive oversight. It is an intensely demanding, hands-on position that requires a unique blend of strategic thinking, financial acumen, operational knowledge, and interpersonal skill.

---

Average CEO Salary: A Deep Dive into Executive Compensation

Executive compensation is a complex subject that extends far beyond a simple annual salary. For a role like a CEO, total compensation is a carefully constructed package designed to align the executive's incentives with the long-term success of the company and its shareholders. While a specific figure for the CEO of a private company like Tidel isn't public, we can use authoritative data sources to paint a very clear picture of the earning potential for CEOs in similar roles.

According to Salary.com, as of late 2023, the median total compensation for a Chief Executive Officer in the United States is $842,590. However, the typical range is vast, generally falling between $638,490 and $1,104,190. It's crucial to understand that this is just the median; the full spectrum is even wider, with CEOs of smaller companies earning less and those at the helm of Fortune 500 giants earning tens of millions.

The U.S. Bureau of Labor Statistics (BLS) groups CEOs under the category of "Top Executives." In its latest data (May 2022), the BLS reports a median annual wage of $246,440 for Chief Executives. It's important to note the discrepancy between BLS and salary aggregator data. The BLS data often focuses more heavily on base salary and may not fully capture the extensive variable compensation (bonuses, stock awards) that constitutes the majority of a CEO's earnings, especially at larger companies. For a comprehensive view, it's best to consider both sources.

### Compensation Breakdown by Experience Level

A CEO's compensation package evolves dramatically with their experience and the scale of their responsibilities. The path to the CEO chair is long, and compensation reflects this journey.

| Experience Level | Description | Typical Total Compensation Range (Annual) | Primary Compensation Mix |

| ----------------------- | --------------------------------------------------------------------------------------------------------------------------------------------------------------------------- | ------------------------------------------------------------------------------------------------------------------------------------- | ------------------------------------------------------------------------------------- |

| Emerging Executive | A senior leader on the path to CEO, such as a General Manager, Divisional President, or COO of a smaller company. They have significant P&L responsibility. | $250,000 - $500,000+ | High base salary + significant annual performance bonus. Equity may be present but smaller. |

| Mid-Career CEO | CEO of a small-to-mid-sized enterprise (SME), perhaps with revenues between $50 million and $500 million. This is a good proxy for many private company CEO roles. | $500,000 - $1,500,000+ | Balanced mix of base salary, large annual bonus, and substantial long-term incentives (equity, stock options). |

| Senior/Large-Cap CEO | CEO of a large, often publicly traded corporation (e.g., Fortune 1000). These are the most highly compensated and visible executive roles. | $2,000,000 - $20,000,000+ | Base salary is a smaller portion. The vast majority comes from performance-based bonuses and massive long-term equity awards. |

*Sources: Analysis based on data from Salary.com, Payscale, and reports from executive compensation consulting firms like Equilar.*

### The Components of a CEO Compensation Package

To truly understand a CEO's salary, you must look beyond the base pay. The total package is typically comprised of several key components:

1. Base Salary: This is the fixed, guaranteed portion of their pay. For a CEO, this often represents a surprisingly small fraction of their total potential earnings. Its primary purpose is to provide a stable income, but the real motivation lies in the variable components. For a mid-sized company CEO, this might be in the $350,000 to $600,000 range.

2. Short-Term Incentives (STI) / Annual Bonus: This is a cash payment awarded for achieving specific performance goals over a one-year period. These goals are typically tied to financial metrics like revenue growth, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), net income, or operational KPIs. A target bonus is often expressed as a percentage of base salary, and for a CEO, this can be substantial—frequently 100% to 200% of their base salary, or even more for exceptional performance.

3. Long-Term Incentives (LTI): This is the most significant component of a CEO's pay and the one that truly aligns their interests with shareholders. LTIs are designed to reward performance over a multi-year horizon (typically 3-5 years). They come in several forms:

- Stock Options: The right to buy company stock at a predetermined price in the future. They only have value if the stock price increases, directly rewarding the CEO for creating shareholder value.

- Restricted Stock Units (RSUs): An award of company stock that vests (becomes the executive's property) over a set period. This encourages retention.

- Performance Shares: A grant of stock that only vests if specific, long-term performance goals (e.g., total shareholder return vs. a peer group, multi-year earnings per share growth) are met. This is considered the most performance-sensitive form of LTI.

4. Perquisites and Benefits: While less significant in value, this is still part of the package. It includes comprehensive health insurance, a generous 401(k) or deferred compensation plan, life and disability insurance, and often "perks" like a car allowance, club memberships, and personal security services, particularly for CEOs of high-profile public companies.

In summary, when analyzing a "CEO salary," it is a misnomer. One must analyze *total compensation*. For a CEO of a company the size and type of Tidel, it's reasonable to estimate a total compensation package that is well into the seven figures, with the majority of that compensation being "at-risk" and tied directly to the performance and growth of the company.

---

Key Factors That Influence a CEO's Salary

The vast range in CEO compensation isn't random. It's the result of a complex interplay of factors that a company's board of directors (and its compensation committee) meticulously evaluates. Understanding these levers is critical for anyone aspiring to the C-suite, as they dictate not only earning potential but also the strategic career choices one must make along the way.

###

1. Company Size and Revenue

This is, by far, the most dominant factor in determining CEO pay. The complexity, risk, and scope of responsibility increase exponentially with the size of the organization. A larger company means more employees, more complex operations, greater financial stakes, and more intense public and investor scrutiny.

- Small Businesses (<$50M Revenue): CEOs in this category, often founders or early hires, may have a total compensation package in the $200,000 to $450,000 range. A significant portion of their potential wealth is tied up in their own equity in the company.

- Mid-Sized Enterprises ($50M - $1B Revenue): This is the sweet spot where CEO compensation rapidly professionalizes and grows. A company like Tidel, a leader in its niche, likely falls into this broad category. Here, total compensation packages frequently range from $750,000 to $2.5 million, as detailed by compensation survey data from firms like Payscale and Salary.com. The mix shifts towards a higher proportion of performance-based cash bonuses and long-term incentives.

- Large Corporations (>$1B Revenue): Once a company enters the S&P 500 or Fortune 1000, CEO pay enters another stratosphere. According to a 2023 report from Equilar, the median total compensation for CEOs at S&P 500 companies was $14.5 million. Here, the base salary is almost an afterthought, with the vast majority of pay delivered through performance shares and stock options tied to multi-year goals.

###

2. Public vs. Private Company Status

The ownership structure of the company profoundly impacts compensation philosophy.

- Public Companies: CEO pay is public information, disclosed in detail in annual proxy statements filed with the SEC. Compensation is heavily scrutinized by shareholders, proxy advisory firms (like ISS and Glass Lewis), and the media. This leads to highly structured pay packages with a heavy emphasis on performance shares tied to Total Shareholder Return (TSR) to demonstrate a clear link between pay and performance.

- Private Companies: Compensation is confidential. While the overall numbers may sometimes be lower than at a comparable public company, there can be more flexibility.

- Privately Held / Family-Owned: Pay might be more conservative, with a focus on long-term stability and cash flow preservation.

- Private Equity (PE) Owned: This is a distinct and highly lucrative category. A company like Tidel is backed by a private equity firm. PE firms hire CEOs to execute a specific investment thesis over a 3-5 year period, typically focused on rapid growth, operational efficiency, and a profitable exit (sale or IPO). PE-backed CEO compensation is famously aggressive. It often includes a solid base and bonus, but the real prize is a significant equity stake (e.g., 1-5% of the company). If the CEO successfully grows the company and orchestrates a successful exit, this equity can be worth tens of millions of dollars, dwarfing the annual cash compensation.

###

3. Geographic Location

While the CEO role is less sensitive to geographic salary differences than junior roles, location still plays a part, primarily driven by the cost of living and the concentration of corporate headquarters.

Salary.com provides excellent tools to compare CEO salaries by location. For example, a CEO role with a national median total compensation of $840,000 would see adjustments like:

- High-Cost Metropolitan Areas:

- San Francisco, CA: +28% (approx. $1,075,200)

- New York, NY: +21% (approx. $1,016,400)

- Mid-to-High Cost Areas:

- Boston, MA: +11% (approx. $932,400)

- Dallas, TX: +3% (approx. $865,200) - *Note: Tidel's headquarters is in the Dallas-Fort Worth area, making this a particularly relevant data point.*

- Lower-Cost Metropolitan Areas:

- Tampa, FL: -2% (approx. $823,200)

- St. Louis, MO: -4% (approx. $806,400)

This data shows that while a role in Texas is compensated above the national median, it doesn't command the same premium as coastal tech and finance hubs. Boards consider local market data when setting pay to ensure they are competitive enough to attract top talent to their specific location.

###

4. Level of Education and Pedigree

For the CEO role, a baseline of high-level education is assumed. A bachelor's degree is a minimum requirement. However, advanced degrees significantly correlate with C-suite positions.

- MBA (Master of Business Administration): This is the most common advanced degree among CEOs. An MBA, particularly from a top-tier program (e.g., Harvard, Stanford, Wharton, Kellogg), provides a rigorous foundation in finance, strategy, and operations. More importantly, it provides an unparalleled professional network that can be invaluable throughout a career. While having an MBA doesn't guarantee a CEO spot, a large percentage of Fortune 500 CEOs hold one. It signals a high level of ambition and analytical capability to boards.

- Other Advanced Degrees: Law degrees (JD), technical Master's degrees, or PhDs can also be a path to the CEO role, especially in industries where that specific expertise is paramount (e.g., a PhD in biotechnology for a pharma CEO, a JD for a CEO in a highly regulated industry).

- Undergraduate Institution: The prestige of one's undergraduate institution can play a role, particularly in opening doors early in a career. However, by the time a candidate is being considered for a CEO position, their track record of professional accomplishments far outweighs the name on their diploma.

###

5. Industry and Area of Specialization

The industry a company operates in dictates its margins, growth potential, and the specific skill set required of its leader, all of which influence pay.

- Financial Services & Private Equity: Traditionally the highest-paying sectors. The direct management of massive capital flows and the potential for huge returns lead to some of the highest executive compensation packages.

- Technology & Software: A high-paying sector driven by rapid growth, innovation, and intense competition for talent. CEO pay is often heavily weighted towards stock options, as value creation is tied to scaling the company and increasing its market valuation.

- Healthcare & Pharmaceuticals: High salaries driven by the complex regulatory environment, long R&D cycles, and high-profit margins of successful drugs and medical devices.

- Manufacturing & Industrials: This is the sector Tidel belongs to. Compensation is generally very strong but can be more conservative than in pure tech or finance. Pay is often tied to operational efficiency metrics like margin improvement, supply chain optimization, and market share growth, in addition to top-line revenue and profit.

- Retail & Consumer Goods: Can have a wider variance. CEOs of large, successful retail brands can be compensated exceptionally well, but the industry's typically lower margins can mean slightly lower median pay compared to tech or finance.

- Non-Profit: CEOs in the non-profit sector are driven more by mission than by monetary maximization. While the leaders of very large non-profits (like major hospital systems or foundations) can earn salaries well into the six or even seven figures, it is generally significantly lower than in the for-profit world.

###

6. In-Demand Skills and Proven Track Record

Ultimately, a CEO is hired to do a job. The candidate with the most relevant skills and a proven track record of success will command the highest salary. For a modern CEO, especially in a technology-focused manufacturing company, the most valuable skills include:

- P&L Ownership: The single most important prerequisite. A candidate must have a history of running a business unit or division and being directly responsible for its profit and loss.

- Strategic Transformation: Experience leading a company through a significant change—a digital transformation, a market repositioning, or a post-merger integration.

- Capital Markets Experience: For public company CEOs or those on an IPO track, experience with investor relations, raising capital, and M&A is non-negotiable.

- Operational Excellence: A deep understanding of the mechanics of the business. For a company like Tidel, this means expertise in supply chain management, lean manufacturing, and quality control.

- Global Leadership: Experience managing teams and operations across different cultures and regulatory environments.

- Digital Acumen: Not just understanding technology, but understanding how to leverage AI, data analytics, and digital platforms to create a competitive advantage.

A candidate who can point to specific, quantifiable achievements in these areas—"Grew revenue by 30%," "Improved EBITDA margins by 500 basis points," "Successfully integrated a $100M acquisition"—is in the strongest possible negotiating position.

---

Job Outlook and Career Growth

The path to the C-suite is not a typical career ladder; it's a pyramid, with progressively fewer positions available at each ascending level. The role of Chief Executive Officer represents the absolute apex. As such, competition is extraordinarily intense, and the number of available positions is inherently limited.

### Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) provides projections for the "Top Executives" occupational group, which is the best available proxy for the CEO role. According to the latest BLS Occupational Outlook Handbook, employment of top executives is projected to grow 3 percent from 2022 to 2032. This growth rate is about as fast as the average for all occupations.

The BLS projects about 210,100 openings for top executives each year, on average, over the decade. It's crucial to understand what this number means. Most of these openings are not newly created jobs but are the result of the need to replace executives who are retiring or transitioning to different organizations. The pyramid's peak doesn't get much wider; rather, there is constant turnover at the top, creating opportunities for those who are prepared.

The formation of new organizations is a key driver of demand. As the economy grows, new companies are created, each requiring a leadership team. Conversely, mergers and acquisitions can sometimes lead to the consolidation of executive roles, acting as a slight headwind to overall growth.

### Emerging Trends and Future Challenges for CEOs

The role of the CEO is not static. It is constantly evolving to meet the demands of a rapidly changing world. Aspiring leaders must be students of these trends to remain relevant and effective.

1. The Rise of AI and Digital Transformation: The most significant trend of our time. CEOs no longer need to be just "tech-savvy"; they must be digital strategists. They are now expected to lead their companies in leveraging artificial intelligence for everything from operational efficiency and product innovation to customer engagement. A CEO who cannot speak the language of data and AI will be at a severe disadvantage.

2. ESG (Environmental, Social, and Governance) as a Core Mandate: Twenty years ago, ESG was a niche concern. Today, it is a board-level priority. Investors, customers, and employees increasingly demand that companies operate sustainably, ethically, and with strong governance. The CEO is now the chief spokesperson for the company's ESG strategy, and their performance (and compensation) is often tied to achieving specific ESG goals.

3. Geopolitical and Supply Chain Volatility: The era of stable, globalized supply chains has been challenged by the pandemic, trade disputes, and geopolitical conflicts. CEOs must now be adept at risk management and building resilient, agile supply chains. This requires a deeper understanding of global politics and economics than ever before.

4. The War for Talent and the Future of Work: The post-pandemic world has permanently altered employee expectations around remote/hybrid work, flexibility, and company culture. The CEO is responsible for setting the strategy for attracting and retaining top talent in this new environment. They must champion a culture that is inclusive, purpose-driven, and adaptable to new ways of working.

5. Intensified Stakeholder Scrutiny: With the rise of social media and activist investors, CEOs operate under an unprecedented level of public scrutiny. Every decision, statement, and action can be instantly broadcast and analyzed globally. This requires exceptional communication skills, emotional intelligence, and a thick skin.

### How to Stay Relevant and Advance

Advancement on the long road to CEO requires a deliberate, multi-decade strategy. It's not about doing one job well; it's about building a portfolio of experiences.

- **Seek P&