In the world of professional development, understanding the fine print of an employment offer is just as crucial as negotiating the headline salary. One of the most important—and often misunderstood—terms you'll encounter is "salary non-exempt." This classification can significantly impact your weekly pay, your work-life balance, and your overall compensation.

While not a job title itself, being classified as salaried non-exempt can offer a unique blend of predictability and earning potential. It applies to a vast range of roles, from administrative professionals and paralegals to certain sales and technical positions. Understanding what it means is the first step to maximizing your career and financial well-being.

What Does "Salary Non-Exempt" Actually Mean?

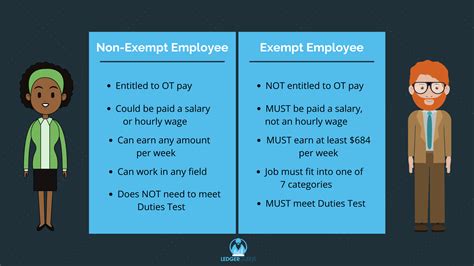

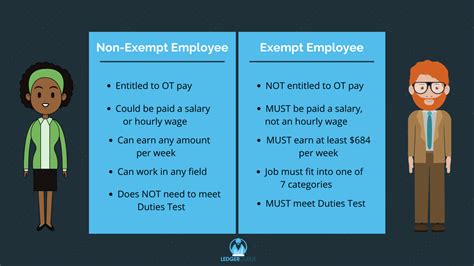

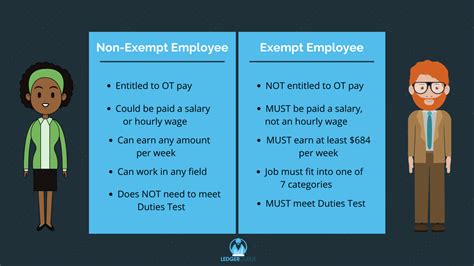

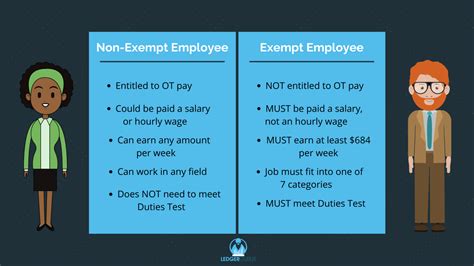

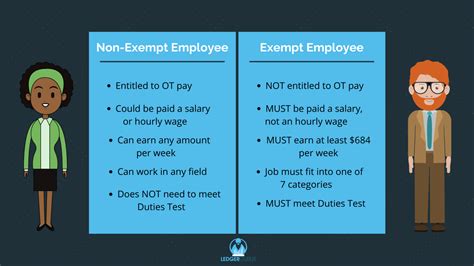

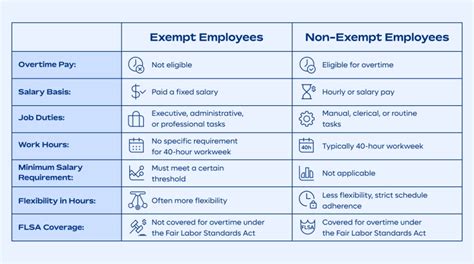

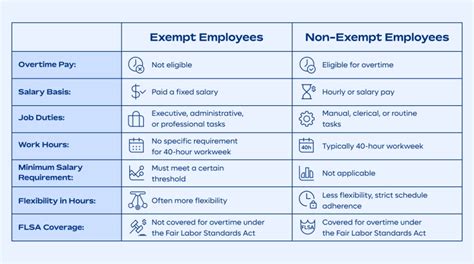

At its core, "salary non-exempt" is a payroll classification under the U.S. Fair Labor Standards Act (FLSA). It’s a hybrid status that combines the stability of a fixed salary with the legal right to overtime pay. Let's break down the two parts:

- Salaried: This means you are paid a fixed, predetermined amount of money each pay period (e.g., weekly, bi-weekly). Your base pay doesn't fluctuate based on the quality or quantity of your work in a given week. This provides predictable income.

- Non-Exempt: This is the critical part. "Non-exempt" means you are *not exempt* from the FLSA's overtime rules. By law, your employer must pay you overtime, typically calculated at 1.5 times your regular rate of pay, for any hours you work beyond 40 in a single workweek.

In short, a salaried non-exempt employee receives a consistent base salary but also earns extra pay for working extra hours. This status is often applied to roles that don't meet the specific "duties tests" for executive, administrative, or professional exemptions outlined by the Department of Labor.

How Salary Non-Exempt Classification Affects Your Pay

There isn't an "average salary" for a non-exempt employee because the classification spans countless industries and roles. The salary is determined by the specific job, not the classification itself. However, the key financial components are the base salary and the potential for overtime.

To illustrate, consider these common salaried non-exempt roles and their typical salary ranges:

- Administrative Assistants: The median pay for administrative assistants was $45,170 per year as of May 2023, according to the U.S. Bureau of Labor Statistics (BLS). Salary.com reports a typical range between $45,793 and $56,926.

- Paralegals and Legal Assistants: The BLS reports a median annual wage of $60,970 for paralegals as of May 2023. Top earners in senior roles can command much higher salaries.

- Inside Sales Representatives: Payscale notes the average base salary for an Inside Sales Representative is around $52,654 per year, but this can be heavily supplemented by commissions and overtime during busy seasons.

The most significant impact on your total earnings is overtime. To calculate it, your employer must first determine your "regular rate of pay." For a salaried employee, this is typically your weekly salary divided by 40 hours.

Example:

An employee has a base salary of $52,000 per year.

- Weekly Salary: $52,000 / 52 weeks = $1,000 per week.

- Regular Rate of Pay: $1,000 / 40 hours = $25 per hour.

- Overtime Rate: $25 x 1.5 = $37.50 per hour.

If this employee works 45 hours in one week, their pay for that week would be:

(40 hours x $25) + (5 hours x $37.50) = $1,000 + $187.50 = $1,187.50

Key Factors That Influence Salary in Non-Exempt Roles

While the classification itself doesn't set your pay, several factors determine the base salary for a position that falls under the salaried non-exempt category.

###

Level of Education

For many non-exempt professional roles, a higher level of education can directly impact your starting salary and advancement potential. For example, a paralegal with a bachelor's degree and a formal paralegal certificate will almost always command a higher salary than one with only an associate's degree. Likewise, specialized certifications in software (like Salesforce for a sales role) or project management can increase your value.

###

Years of Experience

Experience is a primary driver of salary growth. An entry-level non-exempt employee is typically paid at the lower end of the market range for their role. As you accumulate years of experience, master your responsibilities, and take on more complex tasks, your value to the company increases. A senior administrative assistant who can manage an executive's entire workflow is far more valuable than a junior assistant handling basic scheduling, and their salary will reflect that. According to Salary.com, a senior-level Paralegal (Paralegal III) can earn 20-30% more than an entry-level one.

###

Geographic Location

Where you work matters immensely. Salaries are adjusted to reflect the local cost of living and labor market demand. A position in a major metropolitan area like New York City or San Francisco will have a significantly higher base salary than the exact same role in a smaller city like Omaha, Nebraska.

For example, data from Salary.com shows that the salary range for an Administrative Assistant in New York, NY, is about 20% higher than the national average, while in a lower-cost area, it might be 5-10% below the average.

###

Company Type and Industry

The size, type, and industry of your employer play a huge role. A large, multinational tech corporation or a prestigious law firm will generally offer higher base salaries, more robust benefits, and greater potential for overtime pay than a small non-profit or a local startup. Industries like finance, technology, and legal services often pay higher baseline salaries for their support and operational roles compared to retail or hospitality.

###

Area of Specialization

Within a broad job category, specialization can lead to higher earnings. For instance:

- A litigation paralegal with experience in e-discovery may earn more than a generalist.

- An executive assistant supporting a C-suite executive will earn more than one supporting a mid-level manager.

- An inside sales representative specializing in high-value B2B software will likely have a higher base salary than one in general consumer goods.

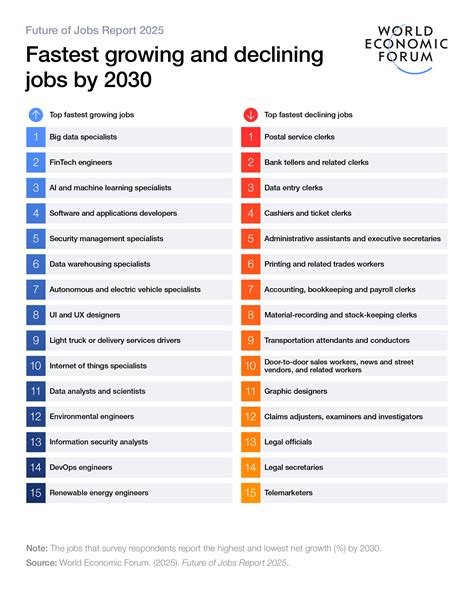

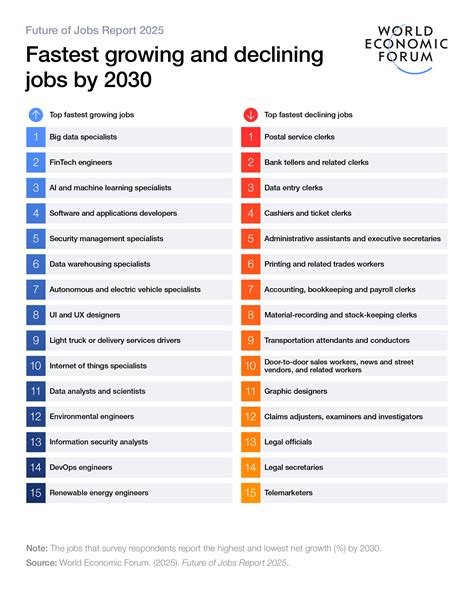

Job Outlook and the Future of Work Classification

The job outlook for salaried non-exempt positions is tied to the outlook of the specific roles themselves. For example, the BLS projects that employment for paralegals and legal assistants will grow by 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

More broadly, the rules surrounding employment classifications are a topic of ongoing discussion. The Department of Labor periodically updates the salary threshold required for an employee to be considered "exempt." As of 2024, proposed changes aim to raise this threshold, which would make millions more workers eligible for overtime pay—effectively shifting them from "exempt" to "non-exempt" status. Staying aware of these legislative changes is crucial for any professional to understand their rights and earning potential.

Conclusion: Empowering Your Career Path

Understanding your employment classification is a fundamental part of managing your career. Being "salary non-exempt" is not a step down; in many cases, it's a significant advantage.

Here are the key takeaways for any professional:

- Know Your Status: Always confirm your classification (exempt vs. non-exempt) when you receive a job offer.

- Embrace the Hybrid Model: The salary non-exempt status provides the financial security of a predictable salary combined with the legal right to be paid for all the hours you work.

- Track Your Hours: Diligently and accurately track your time. This ensures you are compensated fairly for any work performed beyond the standard 40-hour week.

- Focus on the Role: Your career growth and salary potential are tied to your skills, experience, and performance in your specific job—the non-exempt classification is simply the mechanism that governs how you're paid for it.

By decoding terms like "salary non-exempt," you empower yourself to make informed career decisions, protect your rights, and ensure you are being compensated fairly for your valuable time and effort.