Table of Contents

- [Introduction: The Power Behind the Paycheck](#introduction-the-power-behind-the-paycheck)

- [What Does a Compensation and Benefits Manager Do?](#what-does-a-compensation-and-benefits-manager-do)

- [Average Compensation and Benefits Manager Salary: A Deep Dive](#average-compensation-and-benefits-manager-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and the Future of Compensation Careers](#job-outlook-and-the-future-of-compensation-careers)

- [How to Become a Compensation and Benefits Manager: Your Step-by-Step Guide](#how-to-become-a-compensation-and-benefits-manager-your-step-by-step-guide)

- [Conclusion: Is a Career in Compensation Right for You?](#conclusion-is-a-career-in-compensation-right-for-you)

Introduction: The Power Behind the Paycheck

For most people, a paycheck is a simple transaction: work performed in exchange for money. But behind that seemingly simple number lies a universe of complex strategy, legal nuance, and profound human psychology. How much is a role worth? How do you ensure fairness across an organization of thousands? How do you structure pay to motivate a sales team, retain a brilliant engineer, or reward a long-serving executive? And, most fundamentally, who should be paid a fixed salary and who should be paid an hourly wage?

These are not just administrative questions; they are among the most critical strategic decisions a company can make. The professionals who answer them are Compensation and Benefits Managers, the architects of an organization's financial relationship with its people. This is a career for the analytical mind that understands human motivation, for the strategist who can see the big picture, and for the ethical leader who believes in fairness and equity. The earning potential reflects this high-level responsibility; according to the U.S. Bureau of Labor Statistics (BLS), the median pay for Compensation and Benefits Managers was $136,480 per year in May 2023.

I once consulted for a fast-growing tech startup where the founders, in a move to create a sense of egalitarianism, put all employees on a salary. This backfired spectacularly when junior support staff, who were legally entitled to overtime, were working 60-hour weeks without extra pay. The subsequent Department of Labor audit and back-pay settlement almost sank the company. This experience cemented my belief that understanding the intricate difference between wages and salary isn't just an HR technicality—it's a cornerstone of a stable, ethical, and successful business.

This guide will illuminate the path to becoming a leader in this vital field. We will dissect the role, explore its lucrative salary potential in granular detail, analyze the future job outlook, and provide a clear, actionable roadmap for you to get started. If you are ready to move beyond the "what" of a paycheck and into the "why" and "how," you've come to the right place.

What Does a Compensation and Benefits Manager Do?

A Compensation and Benefits (C&B) Manager is far more than a "numbers person." They are strategic partners to executive leadership, tasked with designing and managing a company's "Total Rewards" program. This program is the entire package of what an employee receives in return for their work, encompassing not just pay but also benefits, recognition, and development opportunities. Their ultimate goal is to create a system that attracts top talent, retains high-performers, and motivates the entire workforce, all while keeping the company competitive and financially sound.

At the heart of their responsibilities lies the critical task of structuring compensation itself. This involves a deep understanding of market data, internal job roles, and complex legal frameworks.

Core Responsibilities and Daily Tasks:

- Job Analysis and Evaluation: C&B managers don't just guess what a job is worth. They use systematic methods to analyze the duties, responsibilities, and requirements of every role in the organization. They then use established job evaluation techniques (like point-factor or market-pricing systems) to assign each job a level or grade within the company's hierarchy.

- Salary Structure Development: Based on job evaluations and external market data from salary surveys, they build the company's entire pay structure. This includes defining pay grades, setting salary ranges (minimum, midpoint, and maximum) for each grade, and establishing guidelines for pay increases.

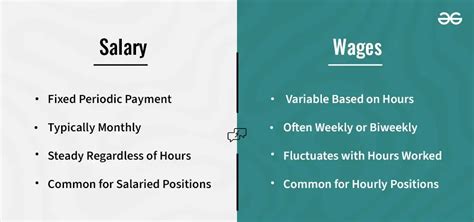

- Wage and Salary Administration: This is where the crucial distinction between "wages" and "salary" comes into play. A core duty is to correctly classify employees according to the Fair Labor Standards Act (FLSA) in the United States, or similar laws globally.

- Wages: Typically paid to "non-exempt" employees on an hourly basis. These employees are eligible for overtime pay (usually 1.5 times their regular rate) for any hours worked over 40 in a week. C&B managers set these hourly rates based on market data and internal equity.

- Salary: A fixed amount paid to "exempt" employees, regardless of the number of hours worked. These employees are "exempt" from overtime pay because they meet certain tests related to job duties (typically professional, administrative, or executive) and are paid above a specific salary threshold set by law. The C&B Manager is responsible for ensuring these classifications are legally defensible.

- Benefits Administration: They oversee the entire suite of employee benefits, including health insurance, retirement plans (like 401(k)s), paid time off, life insurance, and disability coverage. This involves selecting vendors, negotiating contracts, managing open enrollment, and ensuring compliance with laws like ERISA and ACA.

- Incentive Pay and Bonus Plans: They design and administer variable pay programs. This could be anything from annual performance bonuses for office staff to complex commission plans for salespeople or long-term equity awards (stock options) for executives.

- Market Analysis and Benchmarking: The market for talent is constantly shifting. C&B managers are perpetually analyzing salary survey data from sources like Radford, Willis Towers Watson, and Mercer to ensure their company's pay and benefits remain competitive within their industry and geographic location.

- Compliance and Reporting: They are the guardians of legal compliance in all matters of pay. This includes ensuring adherence to FLSA, Equal Pay Act, and new, emerging pay transparency laws. They prepare reports for management and, in some cases, government agencies.

### A Day in the Life of a Compensation Manager

To make this more concrete, let's imagine a typical Tuesday for Sarah, a Compensation Manager at a mid-sized software company.

- 9:00 AM - 9:30 AM: Sarah starts her day by reviewing an urgent request from the Head of Engineering. They want to create a new "Lead Machine Learning Engineer" position and need a competitive salary range immediately to make an offer to a top candidate.

- 9:30 AM - 11:00 AM: Sarah dives into her salary survey databases (Radford and Payscale). She pulls data for similar roles in the tech industry in their specific metropolitan area, filtering by company size and revenue. She analyzes the 25th, 50th, and 75th percentile data to propose a competitive salary band. She also models the potential impact of a high signing bonus versus a stronger base salary.

- 11:00 AM - 12:00 PM: She meets with the engineering leader and an HR Business Partner. She presents her data, explains her rationale for the proposed salary range ($180k - $240k), and advises them on where the candidate's specific experience should place them within that range. They agree on a strategy.

- 12:00 PM - 1:00 PM: Lunch while reading industry news about new pay transparency laws being passed in Colorado and Washington, considering the implications for her company's remote hiring policy.

- 1:00 PM - 3:00 PM: Time for a major project: the annual salary review cycle. Sarah exports employee data from the HRIS (Workday) into Excel. She runs analyses to check for "comp-a-ratios" (how an employee's pay compares to the midpoint of their salary range) and identify potential pay equity issues between genders or ethnic groups.

- 3:00 PM - 4:00 PM: Sarah joins a call with the company's benefits broker to discuss the renewal rates for their health insurance plan for the upcoming year. They are facing a 9% increase, and she strategizes with the broker on plan design changes to mitigate the cost impact on both the company and employees.

- 4:00 PM - 5:00 PM: She finalizes a communication plan to roll out a new bonus structure for the customer success team. She needs to create a clear, simple document that explains how the new plan works to ensure everyone understands how their performance will be rewarded.

This role is a dynamic mix of deep analysis, strategic consultation, and careful communication, making a tangible impact on every single employee in the organization.

Average Compensation and Benefits Manager Salary: A Deep Dive

A career in compensation and benefits is not only intellectually rewarding but also financially lucrative, reflecting the critical strategic importance of the role. Compensation professionals are highly valued for their ability to balance market competitiveness, internal equity, and fiscal responsibility. The data consistently shows a strong earnings potential that grows significantly with experience and expertise.

### National Averages and Salary Ranges

According to the most recent data from the U.S. Bureau of Labor Statistics (BLS) Occupational Employment and Wages survey (May 2023), the national salary landscape for Compensation and Benefits Managers is robust:

- Median Annual Salary: $136,480 (This means 50% of C&B managers earned more than this amount, and 50% earned less).

- Mean Annual Salary: $146,730

- Bottom 10% Earned: Less than $83,230 (typical for entry-level analysts or roles in very low-cost-of-living areas).

- Top 10% Earned: More than $231,160 (representing senior directors, VPs, or specialists in high-paying industries like tech and finance).

It's important to look beyond just the BLS data, as salary aggregators provide a real-time pulse on the market, often incorporating bonuses and other compensation.

- Salary.com reports that as of late 2023, the median base salary for a Compensation and Benefits Manager in the U.S. is $129,576, with a typical range falling between $114,942 and $145,595.

- Glassdoor, which incorporates user-submitted data, shows an average total pay (including bonuses and additional compensation) of $148,446 per year for a Compensation Manager in the United States.

- Payscale.com places the average base salary at $101,570, but highlights a total pay range from $73k to $146k when bonuses and profit sharing are included.

The slight variations between sources reflect different data sets and methodologies, but the overall picture is clear: this is a six-figure profession with significant upside potential.

### Salary Progression by Experience Level

Your earnings will not be static. A key feature of a C&B career is a clear and rewarding growth trajectory. As you gain experience, move from analyst to manager to director, and deepen your expertise, your compensation will rise accordingly.

Here is a typical salary progression, combining data from the BLS, Salary.com, and industry observations:

| Career Stage | Typical Job Title(s) | Typical Years of Experience | Typical Base Salary Range | Description of Role |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Compensation Analyst, Benefits Coordinator, HR Analyst | 0 - 3 years | $60,000 - $85,000 | Focuses on data entry, running reports, participating in salary surveys, answering employee benefit questions, and assisting senior team members with analysis. |

| Mid-Career | Senior Compensation Analyst, Compensation/Benefits Specialist | 3 - 7 years | $85,000 - $115,000 | Manages key processes like salary survey submissions and market pricing for new roles. Begins to lead smaller projects, analyze data independently, and make recommendations. |

| Manager-Level | Compensation Manager, Benefits Manager | 5 - 10+ years | $115,000 - $160,000 | Manages a team of analysts, oversees major programs (annual reviews, open enrollment), develops salary structures, and acts as a key advisor to HR business partners and business leaders. |

| Senior/Director-Level| Senior C&B Manager, Director of Compensation, Director of Total Rewards | 10 - 15+ years | $160,000 - $220,000+ | Sets the strategic direction for the entire Total Rewards function. Manages a larger team, designs executive compensation plans, presents to the board's compensation committee, and manages large vendor contracts. |

| Executive-Level | VP of Total Rewards, Chief Human Resources Officer (CHRO) | 15+ years | $220,000 - $500,000+ | Leads the entire HR function or the global Total Rewards organization for a large corporation. The role is deeply strategic, tied directly to the company's financial performance and long-term goals. Compensation at this level is heavily weighted towards stock and long-term incentives. |

### Beyond the Base: Understanding Total Compensation

Base salary is only one piece of the puzzle. A significant portion of a C&B professional's earnings, especially at the manager level and above, comes from variable pay and other benefits.

- Annual Bonuses/Short-Term Incentives (STI): This is the most common form of variable pay. It is typically a percentage of base salary, tied to both individual and company performance. For a Manager, a target bonus might be 10-20% of their base salary. For a Director, this could increase to 20-40%.

- Profit Sharing: Some companies distribute a portion of their profits to employees. This can add a significant, though variable, amount to annual income.

- Long-Term Incentives (LTI): Particularly common in publicly traded companies or late-stage startups, LTI is designed to retain key talent. This often comes in the form of:

- Stock Options: The right to buy company stock at a predetermined price in the future.

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period of time (e.g., 4 years).

- Performance Shares: Stock grants that only vest if the company meets certain performance targets (e.g., revenue growth or stock price appreciation).

LTI can dramatically increase total compensation, often adding tens or even hundreds of thousands of dollars to a senior leader's annual earnings.

- Comprehensive Benefits: As the managers of these programs, C&B professionals typically enjoy excellent benefits packages themselves. This includes top-tier health, dental, and vision insurance; generous 401(k) matching contributions (often 4-6% of salary); ample paid time off; and robust life and disability insurance. While not direct cash, the value of these benefits can be equivalent to an additional 25-35% of base salary.

In summary, when evaluating a career in compensation and benefits, it's essential to think in terms of "Total Rewards." The combination of a strong base salary, significant bonus potential, potential for equity, and excellent benefits makes this one of the most financially secure and rewarding paths within the field of human resources.

Key Factors That Influence Your Salary

While the national averages provide a great starting point, your individual earning potential as a Compensation and Benefits professional will be determined by a combination of several key factors. Understanding these levers is crucial for negotiating your salary, planning your career trajectory, and maximizing your long-term income. This is the most detailed and critical section for anyone serious about this career path.

### 1. Level of Education and Professional Certifications

Your educational foundation sets the stage for your career, while certifications act as powerful accelerators.

- Bachelor's Degree: This is the standard entry requirement. Degrees in Human Resources, Business Administration, Finance, or Economics are most common and highly relevant. They provide the foundational knowledge in business operations, statistics, and HR principles. A candidate with a bachelor's degree can expect to start in an analyst role.

- Master's Degree: An advanced degree, such as a Master of Business Administration (MBA) or a specialized Master's in Human Resources (MHRM), can significantly boost earning potential and accelerate your path to leadership. An MBA, particularly from a top-tier program, provides deep financial acumen and strategic thinking skills that are highly valued for Director and VP-level roles. Companies often pay a premium of 10-20% for candidates with a relevant master's degree, and it may be a prerequisite for senior leadership positions in Fortune 500 companies.

- Professional Certifications: In the world of compensation, certifications are not just resume-builders; they are industry-recognized credentials that prove a specific level of expertise. They are arguably more impactful on salary than a master's degree for mid-career roles. The gold standard provider is WorldatWork, a global association for Total Rewards professionals.

- Certified Compensation Professional (CCP®): This is the most recognized and respected certification for compensation practitioners. It requires passing a series of exams covering topics like base pay administration, market pricing, variable pay, and job analysis. Earning your CCP can lead to a salary increase of 5-15% and unlocks opportunities for manager-level roles. It signals to employers that you have mastered the core technical skills of the profession.

- Global Remuneration Professional (GRP®): For those working in multinational corporations, the GRP is essential. It builds on the CCP and covers the complexities of international compensation, including expatriate pay, currency fluctuations, and varying global regulations. This niche expertise is highly sought after and can command a significant salary premium.

- Certified Benefits Professional (CBP®): This certification focuses on the other side of the Total Rewards coin, covering health and welfare plans, retirement plans, and benefits compliance. Professionals who hold both the CCP and CBP are incredibly versatile and valuable.

- Other valuable certifications include the SHRM-CP/SHRM-SCP (from the Society for Human Resource Management) and PHR/SPHR (from HRCI), which provide a broader HR context.

Actionable Advice: Prioritize getting your CCP as soon as you have 2-3 years of experience. Your employer will often pay for the courses and exams, as it directly benefits their organization.

### 2. Years of Experience and Career Trajectory

As demonstrated in the salary table above, experience is the single most significant driver of salary growth in this field. This isn't just about time served; it's about the accumulation of expertise, strategic insight, and a track record of success.

- Analyst (0-3 years): In this stage, you are learning the ropes and building your technical skills. Your value is in your ability to accurately gather and process data. Salary growth comes from mastering the tools (Excel, HRIS) and demonstrating reliability.

- Senior Analyst / Specialist (3-7 years): You are now an independent contributor. You don't just process data; you interpret it. You can price jobs with minimal supervision, manage key annual processes, and start to advise HR partners. Your salary increases as you prove you can handle complexity and ambiguity.

- Manager (5-10+ years): This is a major leap in responsibility and pay. You are now responsible for the work of others and for managing major programs. Your value shifts from technical execution to program management, stakeholder influence, and team leadership. You begin to have a direct impact on company-wide compensation strategy.

- Director / VP (10+ years): At this level, you are a strategic leader. You are no longer just managing programs; you are *designing* them. You work with the C-suite and the Board of Directors, and your decisions have multi-million dollar implications. Your compensation reflects this, with a much heavier emphasis on long-term incentives tied to the company's overall success.

### 3. Geographic Location

Where you work has a massive impact on your paycheck. This is driven by the local cost of labor and cost of living. Companies in high-cost metropolitan areas must pay more to attract talent. The rise of remote work has complicated this, with some companies adopting location-based pay Tiers, but major tech and finance hubs still command the highest salaries.

Here is a comparison of mean salaries for Compensation and Benefits Managers in various metropolitan areas, based on BLS May 2023 data:

| High-Paying Metropolitan Area | Mean Annual Salary |

| :--- | :--- |

| San Jose-Sunnyvale-Santa Clara, CA | $206,170 |

| San Francisco-Oakland-Hayward, CA | $189,320 |

| Bridgeport-Stamford-Norwalk, CT | $180,680 |

| New York-Newark-Jersey City, NY-NJ-PA | $176,140 |

| Boston-Cambridge-Nashua, MA-NH | $166,970 |

| Lower-Paying Metropolitan Area (Examples) | Mean Annual Salary |

| :--- | :--- |

| Little Rock-North Little Rock-Conway, AR | $112,020 |

| Omaha-Council Bluffs, NE-IA | $116,920 |

| Oklahoma City, OK | $118,500 |

| Louisville/Jefferson County, KY-IN | $120,830 |

| Kansas City, MO-KS | $126,200 |

*Source: BLS Occupational Employment Statistics, Compensation and Benefits Managers (Code 11-3111), May 2023.*

It's crucial to note that while the salaries in cities like San Jose are significantly higher, so is the cost of living. A $180,000 salary in San Francisco may have similar purchasing power to a $120,000 salary in Kansas City. However, for wealth accumulation and retirement savings, the higher absolute numbers in major hubs are a distinct advantage.

### 4. Company Type, Size, and Industry

The context in which you work is a powerful determinant of pay.

- Industry: The industry you work in is a massive factor.

- Technology and Financial Services: These sectors consistently pay the most. They compete for highly specialized talent and often use lucrative stock options and bonuses to attract and retain employees. A C&B Director in a pre-IPO tech firm or on Wall Street can easily earn well over $300,000 in total compensation.

- Professional, Scientific, and Technical Services: This BLS category, which includes consulting firms, is the highest-paying industry sector for C&B managers, with a mean salary of $170,120.

- Manufacturing and Healthcare: These are large, stable sectors with competitive pay, but they typically lag behind tech and finance.

- Non-Profit and Government: These sectors typically pay the least in terms of base salary and bonuses. However, they often compensate with excellent benefits, strong job security, and better work-life balance. A C&B manager in local government might earn $90,000, compared to their **$150,