If you're searching for the "Gary Cohen salary," you're likely curious about the earning potential at the highest echelons of the financial world. While the astronomical compensation of figures like Gary Cohn (the former President of Goldman Sachs and White House economic advisor) is the result of a decades-long, high-profile career, it points toward a lucrative and dynamic field: financial analysis.

For most aspiring professionals, the relevant question isn't about one individual's earnings, but about the career path that makes such compensation possible. A career as a Financial Analyst offers significant earning potential, with the U.S. Bureau of Labor Statistics (BLS) reporting a median annual salary of $95,570. Top earners in the field, however, can command salaries well into the six figures, especially when factoring in bonuses and specializations.

This article will break down the salary you can expect as a Financial Analyst, the key factors that drive your earnings, and the overall outlook for this rewarding profession.

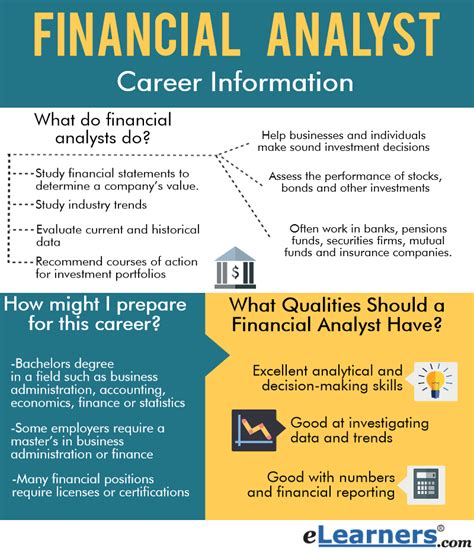

What Does a Financial Analyst Do?

At its core, a Financial Analyst evaluates financial data to help businesses and individuals make strategic investment decisions. They are the analytical engine behind financial operations. Their day-to-day responsibilities often include:

- Analyzing Financial Statements: Scrutinizing balance sheets, income statements, and cash flow statements to assess a company's health.

- Building Financial Models: Creating complex spreadsheets to forecast future earnings, revenue, and economic trends.

- Recommending Actions: Advising management or clients to buy or sell company stocks, make investments, or launch new projects based on their analysis.

- Staying Current: Monitoring industry trends, economic news, and market movements to inform their recommendations.

Whether working for an investment bank, a corporation, or an insurance company, their goal is the same: to provide data-driven insights that guide financial strategy and maximize value.

Average Financial Analyst Salary

While the national median provides a solid benchmark, actual salaries for Financial Analysts can vary widely based on experience, location, and other factors.

According to the most recent data from the U.S. Bureau of Labor Statistics (May 2022), the median annual wage for financial analysts was $95,570.

Here’s a more detailed breakdown of the typical salary range:

- Lowest 10%: Earned less than $59,330 (often representing entry-level positions in lower-cost areas).

- Median (Middle 50%): Earned $95,570.

- Highest 10%: Earned more than $169,370 (typically senior analysts in high-paying sectors).

Reputable salary aggregators provide a similar picture. For instance, Salary.com reports the average Financial Analyst I (entry-level) salary in the U.S. is around $68,000, while a Financial Analyst III (senior) averages around $105,000, with top roles reaching much higher. It's important to remember these figures often represent base salary, and in many financial roles, annual bonuses can significantly increase total compensation.

Key Factors That Influence Salary

Your earning potential is not static. Several key factors directly influence how much you can earn as a Financial Analyst.

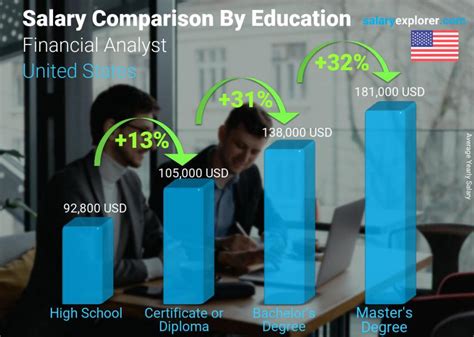

### Level of Education

A bachelor's degree in finance, economics, accounting, or a related field is the standard entry requirement. However, advanced credentials can unlock higher-level roles and salaries.

- Master of Business Administration (MBA): An MBA, particularly from a top-tier business school, can dramatically increase earning potential and open doors to leadership positions in investment banking and corporate finance.

- Professional Certifications: The Chartered Financial Analyst (CFA) designation is the gold standard in the investment management profession. Earning the CFA charter demonstrates a mastery of complex financial and investment principles and is highly correlated with higher salaries and more senior roles.

### Years of Experience

Experience is a primary driver of salary growth in this field. As you gain expertise and a proven track record, your value to an employer increases substantially.

- Entry-Level (0-2 years): Analysts focus on data gathering, spreadsheet maintenance, and supporting senior staff. Salaries typically fall in the $65,000 to $80,000 range.

- Mid-Career (3-8 years): Professionals take on more complex modeling, manage projects, and may begin mentoring junior analysts. Salaries often climb to the $85,000 to $120,000+ range.

- Senior/Lead (8+ years): Senior analysts are responsible for high-stakes analysis, presenting to executives, and shaping financial strategy. Their base salaries can easily exceed $130,000, with bonuses pushing total compensation much higher.

### Geographic Location

Where you work matters immensely in finance. Major financial hubs offer the highest salaries due to a concentration of top-tier firms and a higher cost of living. According to BLS data, the metropolitan areas with the highest annual mean wages for financial analysts include:

- New York-Newark-Jersey City, NY-NJ-PA: $140,840

- San Francisco-Oakland-Hayward, CA: $132,190

- Boston-Cambridge-Nashua, MA-NH: $120,460

- Bridgeport-Stamford-Norwalk, CT: $124,560

Working in cities like New York or San Francisco can result in a salary that is 30-40% higher than the national average.

### Company Type

The type of company you work for is one of the most significant factors determining your total compensation.

- Investment Banks & Hedge Funds: These are the top-paying employers. This is the world of figures like Gary Cohn. While the base salaries are high, the performance-based bonuses can be enormous, often exceeding the base salary. However, these roles are extremely competitive and demand very long hours.

- Corporate Finance (FP&A): Financial analysts working within a large (non-financial) corporation, in a Financial Planning & Analysis (FP&A) role, earn competitive salaries with better work-life balance.

- Insurance and Commercial Banks: These institutions offer stable careers and solid compensation, though typically less than what is offered at premier investment banks.

- Government: Federal and state agencies employ financial analysts, offering job security and excellent benefits, but with generally lower base salaries compared to the private sector.

### Area of Specialization

"Financial Analyst" is a broad title. Specializing in a high-demand area can lead to higher pay.

- Investment Banking (M&A, Capital Markets): Analysts focused on mergers and acquisitions or raising capital tend to be among the highest earners.

- Equity Research: These analysts follow a portfolio of stocks and make buy/sell/hold recommendations. "Buy-side" analysts (working for hedge funds, mutual funds) often earn more than "sell-side" analysts (working for brokerages).

- Corporate Development: These professionals work within a corporation to identify and execute mergers, acquisitions, and other strategic opportunities.

- Private Equity & Venture Capital: These highly sought-after roles involve analyzing private companies for potential investment and offer some of the highest long-term earning potentials in finance.

Job Outlook

The future for Financial Analysts is bright. The U.S. Bureau of Labor Statistics projects that employment for financial analysts will grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations.

This growth is driven by the increasing complexity of financial products and a greater need for in-depth, data-driven analysis to guide investment decisions in a global economy.

Conclusion

While reaching the compensation level of a figure like Gary Cohn is exceptionally rare, the career path he represents—financial analysis—is both intellectually stimulating and financially rewarding. A career as a Financial Analyst offers a clear path for advancement and significant salary growth.

Key takeaways for anyone considering this career:

- Strong Foundation: A bachelor's degree is a must, but an MBA or a CFA charter can significantly accelerate your career and earnings.

- Location is Key: Aim for major financial centers like New York or San Francisco to maximize your salary potential.

- Specialize for Success: High-paying specializations like investment banking, private equity, or buy-side research offer the greatest financial upside.

- Gain Experience: Your value—and your salary—will grow substantially as you build a track record of successful analysis and strategic insight.

With a strong job outlook and a high median salary, becoming a Financial Analyst is an excellent choice for analytical minds eager to make an impact in the world of business and finance.