Understanding the DOL Salary Threshold in 2025: A Guide for U.S. Professionals

The landscape of professional compensation in the United States is undergoing a significant transformation. The U.S. Department of Labor (DOL) has finalized a new rule that dramatically increases the salary threshold for overtime pay eligibility. This change, rolling out in 2024 and 2025, will impact millions of salaried workers, potentially increasing their earnings or reshaping their job responsibilities. Understanding this rule is no longer just for HR departments; it's essential for any professional planning their career path.

What is the DOL Overtime Salary Threshold?

At its core, the DOL salary threshold is a key component of the Fair Labor Standards Act (FLSA). The FLSA establishes federal minimum wage, overtime pay, recordkeeping, and youth employment standards. One of its most crucial functions is to determine which employees are eligible for overtime pay (at 1.5 times their regular rate) for any hours worked over 40 in a workweek.

Employees are generally classified as either "non-exempt" (eligible for overtime) or "exempt" (not eligible for overtime).

To be considered "exempt" from overtime, an employee must typically meet three criteria:

1. Salary Basis Test: The employee must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

2. Duties Test: The employee's primary job duties must involve executive, administrative, or professional (EAP) tasks as defined by the DOL.

3. Salary Level Test: The employee must earn more than a specific salary amount per year. This is the salary threshold.

If a salaried employee meets the duties test but their annual salary falls *below* the DOL's threshold, their employer must pay them overtime for any hours worked beyond 40 per week.

The new rule, finalized in April 2024, significantly raises this salary threshold.

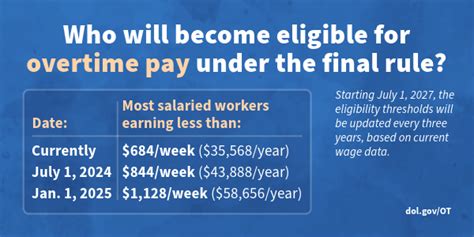

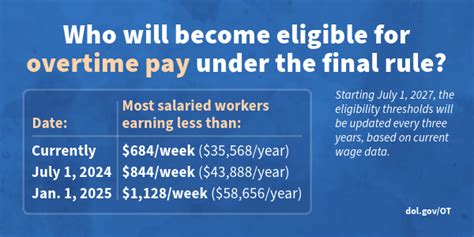

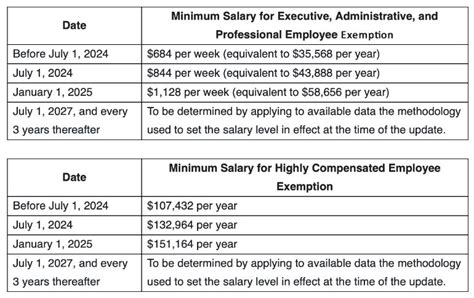

The New DOL Salary Thresholds for 2024 and 2025

The Department of Labor has implemented a phased approach to increase the threshold, giving employers time to adapt. It's critical to know these dates and figures.

- Effective July 1, 2024: The annual salary threshold will increase from $35,568 ($684/week) to $43,888 ($844/week).

- Effective January 1, 2025: The threshold will increase again to $58,656 ($1,128/week).

Furthermore, the rule also adjusts the threshold for Highly Compensated Employees (HCEs), who are subject to a more relaxed duties test.

- Effective July 1, 2024: The HCE threshold increases from $107,432 to $132,964 per year.

- Effective January 1, 2025: The HCE threshold increases again to $151,164 per year.

A major feature of this new rule is a mechanism for automatic updates to these thresholds every three years, starting July 1, 2027, to ensure they keep pace with wage data.

*(Source: U.S. Department of Labor, "Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees; Final Rule," 2024.)*

Key Factors: How the New Thresholds Will Impact Careers and Compensation

This regulatory change will have far-reaching effects on how employees are compensated and how companies structure their teams. Here’s how it breaks down.

### Employee Reclassification and Overtime Pay

The most direct impact is that millions of salaried employees earning between the old threshold ($35,568) and the new 2025 threshold ($58,656) will be reclassified from exempt to non-exempt.

- What this means for you: If your salary is, for example, $55,000, and your job duties are administrative or professional, you may have been exempt from overtime. As of January 1, 2025, your employer will have two primary choices:

1. Increase your salary to at least $58,656 to maintain your exempt status.

2. Keep your salary the same and begin paying you overtime (1.5x your hourly equivalent) for any hours you work over 40 in a week.

### Changes to Work-Life Balance and Flexibility

While the potential for overtime pay is a significant benefit, a shift to non-exempt status can change the nature of your work.

- Flexibility: Exempt employees often enjoy more flexibility, working longer hours during a busy week and perhaps shorter hours during a slow one without a change in pay.

- Time Tracking: Non-exempt employees must meticulously track all hours worked. This means you will likely be required to "clock in" and "clock out," and activities like checking email after hours could now count as paid work time. This can lead to more rigid schedules and less autonomy.

### Employer Strategies and Company Structure

Companies will need to conduct internal audits and make strategic decisions. Their responses will vary based on their size, industry, and financial health.

- Salary Increases: Many companies, particularly for essential roles, will opt to raise salaries above the threshold to avoid the administrative complexity of tracking overtime and to maintain the prestige and flexibility associated with exempt positions.

- Paying Overtime: Other companies may choose to reclassify employees and pay overtime as needed. This could be coupled with stricter policies to limit overtime work to control costs.

- Workload Redistribution: Some employers might restructure roles or hire additional part-time staff to ensure no single employee consistently works more than 40 hours per week. This could affect opportunities for taking on extra projects or responsibilities that often lead to career growth.

### Geographic and Industry Variations

The impact will be felt differently across the country and in various industries.

- Geographic Location: In high-cost-of-living areas like New York City or San Francisco, many professional salaries are already well above the new $58,656 threshold. The impact will be felt more acutely in regions with lower average wages, where a larger percentage of the salaried workforce falls within the affected range.

- Industry Impact: Non-profits, higher education, and retail management are sectors where many junior- to mid-level salaried professionals earn wages within the new threshold zone. According to Salary.com, a Retail Department Manager in a low-cost area might earn an average of $52,000, placing them squarely in the reclassification zone. These industries will face significant budgetary and operational adjustments.

Job Market Outlook: Navigating the New Environment

This rule doesn't change the overall job outlook for specific professions as defined by the Bureau of Labor Statistics (BLS), but it will change the compensation structure and potentially the hiring strategy for certain roles.

- Wage Compression: As employers raise salaries for those at the bottom of the exempt scale, there could be "wage compression," where the pay gap narrows between junior employees and their direct supervisors.

- Hiring and Promotion: Companies may become more strategic about creating new salaried positions or promoting employees into managerial roles, as these actions will now have a higher minimum salary cost attached. An "Assistant Manager" title might now require a salary of nearly $60,000, changing the calculus for creating such roles.

Conclusion: Key Takeaways for Your Career

The DOL's 2025 salary threshold is more than a number; it's a catalyst for change in the American workplace. For professionals, it's a critical time to be informed and proactive.

Key Takeaways for Employees:

- Know Your Status: Understand whether you are currently classified as exempt or non-exempt.

- Assess Your Salary: Determine where your current salary sits in relation to the new thresholds of $43,888 (July 2024) and $58,656 (Jan 2025).

- Anticipate Conversations: Be prepared for discussions with your manager or HR about potential changes to your compensation, job duties, or work schedule.

- See the Opportunity: Whether it's through a salary raise or the potential for overtime pay, this rule is designed to ensure you are compensated fairly for your time.

Ultimately, this new rule empowers millions of workers. By understanding its mechanics, you can better navigate the evolving professional landscape and advocate for your value in the workplace.