Are you ambitious, analytical, and driven to solve complex business problems? Do you envision yourself working at the heart of the global economy, advising top-tier clients and building a career with immense growth potential? If so, a path within a major professional services firm—a world where an EY company salary represents a benchmark for excellence—may be your calling. This isn't just a job; it's a launchpad. While the hours can be long and the work demanding, the rewards, both in terms of compensation and career trajectory, are substantial. The average salary for a professional at a firm like EY can range from a strong starting base of over $70,000 for an entry-level associate to well over $200,000 for experienced managers, with partners earning significantly more.

I once mentored a recent graduate who was preparing for his first-round interview at a "Big Four" firm. The sheer level of preparation and intellectual horsepower required was staggering, but what struck me most was his vision: he saw the firm not just as a job, but as an accelerated learning program for a future in business leadership. That perspective is the key to thriving in this environment and unlocking the significant earning potential it offers.

This guide will demystify the entire ecosystem of a career in professional services. We will dissect the salary structures, explore the factors that dictate your earning power, and provide a clear, actionable roadmap to help you land a coveted position at a firm like EY.

### Table of Contents

- [What Does a Professional at a Firm Like EY Do?](#what-does-a-professional-do)

- [Average EY Company Salary: A Deep Dive](#average-salary-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth in Professional Services](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started)

- [Conclusion: Is a Career in Professional Services Right for You?](#conclusion)

What Does a Professional at a Firm Like EY Do?

Ernst & Young (EY) is one of the "Big Four" accounting and professional services firms, alongside Deloitte, PwC, and KPMG. These global behemoths are intricate ecosystems offering a wide range of services to a diverse client base, from Fortune 500 corporations to government agencies and fast-growing startups. While the term "accountant" might first come to mind, the roles within are incredibly varied.

A professional's job at a firm like EY revolves around providing expertise, assurance, and advisory services to clients. The work is project-based, client-facing, and deadline-driven. Your specific responsibilities will depend entirely on your service line, but the core function is to act as a trusted external expert.

Core Service Lines and Responsibilities:

- Assurance (Audit): This is the bedrock of the Big Four. As an Assurance Associate, your primary role is to audit the financial statements of companies to ensure they are accurate and comply with regulations (like GAAP or IFRS). This involves examining financial records, testing internal controls, and interacting directly with client finance teams. The goal is to provide an independent opinion on the fairness of the financial statements, which is crucial for investors, regulators, and the public.

- Tax: Tax professionals help clients navigate the labyrinthine complexity of local, national, and international tax laws. This isn't just about filing tax returns. It involves strategic tax planning, advising on the tax implications of major business decisions (like mergers and acquisitions), handling transfer pricing between international entities, and ensuring compliance to minimize risk.

- Consulting (Advisory): This is a broad and dynamic field. Consultants are problem-solvers who help clients improve their performance. This can span technology implementation (e.g., deploying a new SAP system), business transformation (restructuring a department for efficiency), risk management (identifying and mitigating cybersecurity threats), or strategy (analyzing market entry opportunities).

- Strategy and Transactions (SaT): Formerly known as Transaction Advisory Services (TAS), this group advises clients on managing their capital agenda. Professionals here work on mergers, acquisitions, divestitures, and capital raising. They perform due diligence, conduct company valuations, and help structure deals to maximize value for their clients.

### A Day in the Life: "Sarah," a Second-Year Tech Consultant

To make this tangible, let's follow a hypothetical day for "Sarah," a second-year Technology Consultant working on a digital transformation project for a large retail client.

- 8:30 AM: Sarah arrives at the client's office. She starts her day by checking emails and reviewing her calendar. She has a team huddle at 9:00 AM to align on the day's priorities for their project: implementing a new customer relationship management (CRM) platform.

- 9:00 AM - 10:30 AM: During the team huddle, the project manager outlines the key tasks. Sarah's responsibility today is to finalize the requirements for the marketing automation module of the CRM. She'll need to facilitate a workshop with the client's marketing team.

- 10:30 AM - 12:30 PM: Sarah co-leads the workshop. She uses a prepared slide deck to guide the discussion, asks probing questions to understand the client's "as-is" processes, and documents their "to-be" needs on a virtual whiteboard. The goal is to get specific, actionable requirements.

- 12:30 PM - 1:15 PM: Lunch with her team. This is an informal chance to decompress, discuss project challenges, and build camaraderie.

- 1:15 PM - 4:00 PM: Back at her desk, Sarah synthesizes the notes from the workshop. She translates the business needs into formal user stories and technical requirements in a shared document. This requires meticulous attention to detail, as developers will use this document to build the software. She messages a senior technical architect on her team to clarify a complex integration point.

- 4:00 PM - 5:00 PM: Sarah joins a call with the offshore development team to walk them through the requirements she has just documented, answering their questions to ensure a clear understanding.

- 5:00 PM - 6:30 PM: Sarah spends the last part of her day updating the project management software (like Jira) with her progress, responding to outstanding emails, and preparing a brief status update for her manager. Before she leaves, she plans her key tasks for the next day.

This example illustrates the blend of analytical work, client interaction, teamwork, and communication that defines life at a top professional services firm.

Average EY Company Salary: A Deep Dive

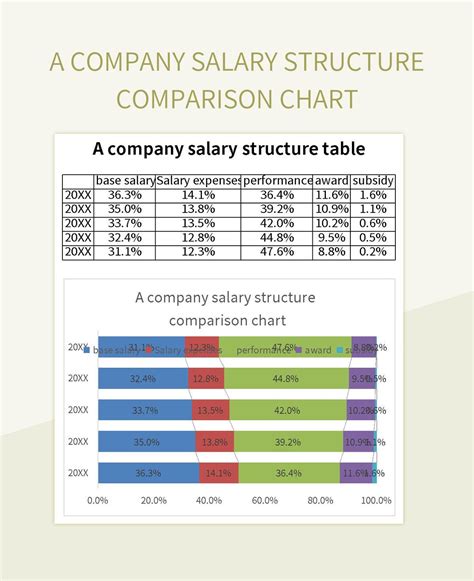

Compensation at a firm like EY is a significant draw for top talent. It's structured to be highly competitive and is composed of more than just a base salary. Understanding the complete package is crucial when evaluating a career offer. The data presented here is aggregated from reputable sources like Glassdoor, Payscale, and industry reports, reflecting recent market conditions. Note that figures can vary based on the numerous factors we'll discuss in the next section.

For a broad perspective, the U.S. Bureau of Labor Statistics (BLS) reports that the median annual wage for Accountants and Auditors was $78,000 in May 2022. For Management Analysts (a category that includes many consultants), the median annual wage was $95,290. Professionals at elite firms like EY typically earn at the higher end of these ranges and beyond.

### Salary Brackets by Experience Level (Big Four Professional Services)

Salaries at firms like EY follow a very structured and predictable progression, especially in the early years. The titles may vary slightly between service lines (e.g., Associate, Staff, Consultant), but the hierarchy is consistent.

| Level / Role | Years of Experience | Typical Base Salary Range (USD) | Notes |

| :--- | :--- | :--- | :--- |

| Intern/Co-op | 0 | ~$30 - $45 per hour | Often includes a housing stipend if relocation is required. A crucial feeder for full-time roles. |

| Associate / Staff Level 1 | 0 - 2 | $70,000 - $95,000 | Entry-level position after graduation. Consulting roles typically start higher than Assurance/Tax. |

| Senior Associate / Staff Level 2 | 2 - 5 | $90,000 - $130,000 | Promoted after 2-3 years. Takes on more responsibility, leading small teams and managing parts of an engagement. |

| Manager | 5 - 8 | $130,000 - $185,000 | Manages entire project teams, client relationships, and project budgets. Significant increase in responsibility and bonus potential. |

| Senior Manager | 8 - 12 | $175,000 - $250,000+ | Oversees multiple projects and managers. Deep subject matter expert and begins focusing on business development. |

| Director / Principal / Partner | 12+ | $300,000 - $1,000,000+ | Equity partners share in the firm's profits. Responsible for bringing in new business and leading entire service lines. |

*Sources: Data compiled and synthesized from Glassdoor, Payscale, and observed industry reports (2023-2024). Ranges are for major U.S. markets and can vary significantly.*

### Deconstructing the Full Compensation Package

Your total compensation is much more than your base salary. Big Four firms use a comprehensive rewards strategy to attract and retain talent.

1. Base Salary: This is your fixed, predictable income and forms the largest part of your compensation, especially in your early career. It's determined by your role, location, and experience.

2. Bonuses:

- Signing Bonus: Often offered to new campus hires and experienced hires to make an offer more attractive. This can range from $2,000 for an intern conversion to $10,000 - $20,000+ for MBA or experienced hires.

- Performance Bonus: This is an annual bonus tied to both individual performance (your ratings) and the firm's overall performance. At the Associate level, this might be 5-10% of your base salary. As you become more senior, the bonus becomes a much larger percentage of your total compensation, often exceeding 20-30% at the Manager and Senior Manager levels.

- CPA/Certification Bonus: Firms heavily incentivize getting your Certified Public Accountant (CPA) license. They often pay for review materials and exam fees, and offer a one-time bonus upon completion, typically in the range of $5,000. Similar bonuses may exist for other prestigious certifications like the CFA or PMP.

3. Retirement and Health Benefits:

- 401(k) Plan: These are standard, with firms typically offering a generous match. For example, a firm might match 100% of your contribution up to 6% of your salary. This is a powerful wealth-building tool.

- Health and Wellness: Comprehensive health, dental, and vision insurance is a given. What sets these firms apart are their wellness programs. This can include wellness stipends (e.g., $1,000 per year to spend on gym memberships, fitness classes, or meditation apps), extensive mental health resources, and telehealth services.

4. Other Perks and Benefits:

- Paid Time Off (PTO): Generous PTO policies are common, often starting around 3-4 weeks and increasing with seniority, in addition to firm-wide holidays and winter/summer shutdowns.

- Parental Leave: Industry-leading paid parental leave policies (for all parents) are a major competitive advantage, often offering 16 weeks or more.

- Professional Development: The firm invests heavily in your growth, paying for training, conferences, and certifications that are relevant to your career path.

- Flexible Work Arrangements: Post-pandemic, most firms have adopted hybrid work models, allowing for a mix of in-office and remote work.

- Travel and Expense Accounts: If your role involves travel, all related expenses (flights, hotels, meals) are covered. Many employees also accrue significant airline and hotel loyalty points for personal use.

When considering an EY company salary, you must look at this complete picture. A slightly lower base salary at one firm might be more than offset by a superior bonus structure, 401(k) match, or wellness benefits.

Key Factors That Influence Your Salary

While the salary bands provide a general framework, your specific compensation within that framework is determined by a confluence of critical factors. Mastering these levers is the key to maximizing your earning potential throughout your career in professional services. This section is the most important for understanding how to actively shape your financial future in this field.

### `

` Level of Education

Your educational background is the foundation of your entry into a firm like EY and sets your initial salary baseline.

- Bachelor's Degree: This is the standard requirement. For Assurance and Tax roles, a Bachelor's in Accounting or a related field is almost mandatory. For Consulting, firms are more open to a variety of majors, including Finance, Economics, Computer Science, and Engineering, as they value diverse problem-solving approaches. Your starting salary with a Bachelor's degree will be at the entry-level band (e.g., $70k - $95k). The prestige of your university can also play a role; firms have "target schools" where they recruit heavily, and offers from these schools may be slightly more competitive.

- Master's Degree: A Master of Accountancy (MAcc) or Master's in Taxation (MTax) is highly common. It's often pursued to meet the 150-credit-hour requirement to sit for the CPA exam. Possessing a Master's degree can lead to a starting salary that is $5,000 - $10,000 higher than that of a candidate with only a Bachelor's.

- Master of Business Administration (MBA): An MBA from a top-tier business school is the primary entry point for experienced professionals transitioning into consulting roles at the post-MBA level (often called "Senior Consultant" or "Associate"). The salary jump is significant. A pre-MBA consultant might make $110,000, but upon returning with an MBA from a top program, their starting base salary could be in the $165,000 - $185,000 range, plus a substantial signing bonus.

- Professional Certifications: This is arguably more impactful than a Master's degree for long-term salary growth in many service lines.

- CPA (Certified Public Accountant): Essential for Assurance and Tax. Passing the CPA exam is a prerequisite for promotion to Manager in these fields. As mentioned, firms offer a bonus (e.g., $5,000) for passing and it unlocks higher salary bands.

- CFA (Chartered Financial Analyst): Highly valued in the Strategy and Transactions (SaT) and valuation practices. It demonstrates a deep expertise in investment analysis and can add a significant premium to your salary.

- PMP (Project Management Professional): Valuable for Consultants, especially in technology and business transformation, as it proves your ability to manage large-scale projects effectively.

- Technical Certifications: For technology consultants, certifications in specific platforms like AWS, Azure, Salesforce, or SAP are career accelerators that directly translate to higher pay and more specialized, high-demand project opportunities.

### `

` Years of Experience

Professional services careers are built on a clear, lock-step progression model, particularly for the first decade. Your salary growth is directly tied to this "up or out" promotion cycle.

- Associate/Consultant (0-2 years): Your focus is on learning, executing assigned tasks, and proving your competence. You will receive annual raises (typically 5-15% depending on performance rating) but the most significant jump comes with promotion.

- Senior Associate/Senior Consultant (2-5 years): Salary Range: $90,000 - $130,000. This is your first major promotion. You are now responsible for coaching junior staff, managing smaller workstreams, and having more direct client contact. The salary increase upon promotion to Senior is substantial, often 15-25%. You are considered a reliable practitioner.

- Manager (5-8 years): Salary Range: $130,000 - $185,000. This is a pivotal role. You are now the primary manager of client engagements, responsible for project delivery, budgets, and team management. Your bonus becomes a much more significant part of your compensation. Moving from Senior to Manager is one of the largest pay bumps in your career, often exceeding 25-30%.

- Senior Manager (8-12 years): Salary Range: $175,000 - $250,000+. At this stage, you are a deep subject matter expert and are transitioning from just *managing* work to *selling* work. You develop client relationships, contribute to proposals, and manage multiple projects simultaneously. Your compensation is heavily tied to performance and the firm's business success.

- Partner/Principal/Director: This is the pinnacle. Compensation is no longer just a salary; it's a share of the firm's profits. Earning potential is extremely high but so is the pressure to generate revenue and lead a significant part of the business.

### `

` Geographic Location

Where you work is one of the biggest determinants of your salary. Firms use a cost-of-living adjustment (COLA) model, which means the same job will pay significantly more in an expensive city than in a less expensive one.

High-Paying Metropolitan Areas:

These cities have the highest concentration of large corporate clients and the highest cost of living, commanding the highest salaries.

- New York City, NY

- San Francisco Bay Area, CA (including San Jose and Silicon Valley)

- Boston, MA

- Los Angeles, CA

- Chicago, IL

- Washington, D.C.

An entry-level Associate in San Francisco might start at $90,000, while the same role in Kansas City might start at $72,000. This differential is designed to provide a similar quality of life across locations.

Mid-Tier Metropolitan Areas:

These cities offer a good balance of strong salaries and a more manageable cost of living.

- Dallas/Fort Worth, TX

- Atlanta, GA

- Denver, CO

- Charlotte, NC

- Seattle, WA

Lower-Paying Areas:

Salaries will be lower in smaller cities or regions with a lower cost of living and less demand for high-end professional services. However, your disposable income might be comparable to that in a high-cost city.

### `

` Company Type & Size

While we're focusing on an EY company salary as a benchmark, the professional services landscape is diverse.

- Big Four (EY, Deloitte, PwC, KPMG): These firms generally set the market rate and are at the top of the pay scale, especially for Assurance and Tax. They offer unparalleled training, brand prestige, and access to the largest clients.

- Mid-Tier Firms (e.g., Grant Thornton, BDO, RSM): These national firms are also major players. Their salaries are very competitive with the Big Four, sometimes just slightly below. They may offer a better work-life balance and a more direct path to partner for some.

- Boutique Consulting Firms: These are smaller, highly specialized firms that focus on a specific industry (e.g., healthcare strategy) or function (e.g., pricing optimization). The most elite strategy boutiques (like McKinsey, Bain, BCG) pay *more* than the Big Four, especially at the post-MBA level. Other boutiques may pay similarly or slightly less but offer deep expertise and a different culture.

- Industry/Corporate Roles: A very common career path is to work at a Big Four firm for 2-5 years and then transition to an "industry" role at a client company. For example, an Audit Senior might become a Senior Financial Analyst at a Fortune 500 company. This move often comes with a 15-25% salary increase and a significant improvement in work-life balance. The Big Four experience is seen as a "golden ticket" that makes you highly valuable in the corporate world.

### `

` Area of Specialization

Within a firm like EY, not all service lines are created equal in terms of pay. Compensation is directly related to the perceived value and margin of the services being sold.

- Consulting (Advisory): Generally the highest-paying service line. Consultants are seen as direct revenue-generators and problem-solvers for a client's most pressing issues. Technology and Strategy consulting, in particular, command the highest salaries due to the specialized skills and high project fees involved.

- Strategy and Transactions (SaT): This is also a top-paying area. Working on high-stakes M&A deals is a high-pressure, high-reward environment. The skills required (valuation, financial modeling, due diligence) are highly specialized and command a premium.

- Tax: Tax sits in a very strong position. It's a complex, regulation-driven field where expertise is essential. Specialized areas like International Tax or M&A Tax are particularly lucrative. Pay is generally very competitive, often slightly below consulting but higher than assurance.

- Assurance (Audit): While being the largest and most stable service line, audit is often the lowest paying of the four major areas. This is partly due to the commoditization of audit services and intense fee pressure from clients. However, it provides incredible foundational training and is the most common and reliable path to securing the CPA license.

### `

` In-Demand Skills

Beyond your title and service line, the specific skills you cultivate can create salary leverage. Professionals who are just "good at their job" follow the standard pay scale; those who develop high-value, niche skills can accelerate their compensation.

- Data Analytics & Visualization: Proficiency in tools like Alteryx, Tableau, and Power BI is no longer a "nice-to-have"; it's a core competency. The ability to analyze large datasets to find insights, identify anomalies in an audit, or create compelling client dashboards is a massive differentiator.

- Advanced Excel & Financial Modeling: While basic Excel is a given, the ability to build complex, dynamic, and error-free financial models is a superpower, especially in SaT and Consulting.

- Programming & Automation: Knowledge of languages like Python or SQL to automate data cleaning, analysis, and repetitive tasks is highly sought after. An auditor who can write a script to analyze 100% of a company's journal entries is far more efficient and valuable than one who can only perform manual sampling.

- ESG (Environmental, Social, and Governance): This is one of the fastest-growing areas in professional services. Companies need help with sustainability reporting, climate risk assessment, and social impact strategy. Expertise in ESG frameworks and regulations is a new and highly valuable specialization.

- Client Management and Business Development: As you become more senior, your technical skills matter less than your ability to manage client relationships, understand their needs, write compelling proposals, and ultimately, sell new business. This is the key skill that separates a Senior Manager from a Partner.

Job Outlook and Career Growth in Professional Services

A career launched at a firm like EY offers not just a competitive salary, but also a robust and promising long-term outlook. The demand for skilled accountants, auditors, and consultants is intrinsically linked to the health and complexity of the global economy. As businesses grow, enter new markets, and face evolving regulations, the need for expert advice and assurance grows in tandem.

### A Profession in Demand

The U.S. Bureau of Labor Statistics (BLS) provides strong, data-backed evidence for the stability and growth in this sector.

- For Accountants and Auditors, the BLS projects employment growth of 4 percent from 2022 to 2032, which is about as fast as the average for all occupations. This will result in approximately 126,500 openings each year, on average, over the decade. Much of this demand comes from the need to replace workers who transfer to different occupations or exit the labor force.

- For Management Analysts (consultants), the outlook is even more promising. The BLS projects employment to grow 10 percent from 2022 to 2032, much faster than the average for all occupations. This translates to about 103,500 openings each year, on average. The BLS attributes this growth to the increasing need for organizations to improve efficiency and control costs.

What these statistics mean for you is that the core skills you develop in professional services are not a fleeting trend; they are a durable asset. Globalization, an increasingly complex tax and regulatory environment, and the constant threat of financial fraud all but guarantee a steady demand for assurance and tax professionals. The relentless pace of technological change and competitive pressure ensures a strong market for consultants who can guide companies through transformation.

### Emerging Trends and Future Challenges

While the outlook is positive, the profession is not static. Thriving in the next decade will require adapting to significant shifts in the industry.

1. The Rise of AI and Automation: Routine, manual tasks in both audit and consulting are being rapidly automated. AI can now perform data entry, reconciliation, and basic analysis far more quickly and accurately than a human. This is not a threat, but a shift. The future professional will spend less time on "what" happened and more time on "why" it happened and "what" should be done next. Your value will come from