Earning $40 an hour is a significant financial milestone for many professionals. This wage translates to an annual salary of approximately $83,200 per year, placing you comfortably above the U.S. median household income. Achieving this level of pay signifies a strong command of valuable skills and represents a gateway to greater financial stability and career growth.

But what does it take to earn this salary? Which jobs pay in this range, and what factors can help you reach this goal? This comprehensive guide will break down the numbers, explore relevant careers, and outline the key steps you can take to secure a position that pays $40 an hour or more.

What Does a $40/Hour Job Look Like?

A wage of $40 an hour is not tied to a single role but rather represents a pay grade common across numerous skilled professions in thriving industries. These roles typically require a blend of formal education, specialized training, and several years of practical experience.

Professionals earning this wage are often responsible for complex problem-solving, project management, technical implementation, or providing critical care and services. They are trusted experts in their fields, capable of working independently and contributing significant value to their organizations. From registered nurses managing patient care to software developers building complex applications, these jobs form the backbone of our modern economy.

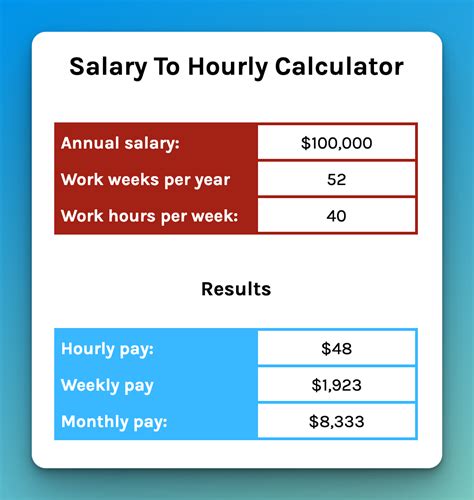

Breaking Down a $40 Hourly Salary

To understand the full picture, let's look at the numbers. Assuming a standard 40-hour workweek and 52 weeks a year, the calculation is straightforward:

- Annual Salary: $40/hour × 2,080 hours/year = $83,200 per year (before taxes)

- Monthly Income: $83,200 / 12 months ≈ $6,933 per month (before taxes)

- Weekly Income: $40/hour × 40 hours/week = $1,600 per week (before taxes)

For context, the U.S. Census Bureau reported a median household income of $74,580 in 2022. Earning $83,200 a year positions you well above this national midpoint, enabling a more comfortable lifestyle in most parts of the country.

Key Factors That Influence Your Earning Potential

Reaching the $40-per-hour mark rarely happens by chance. It is the result of a strategic combination of factors. Understanding these elements can help you map out your own career path toward higher earnings.

### Level of Education

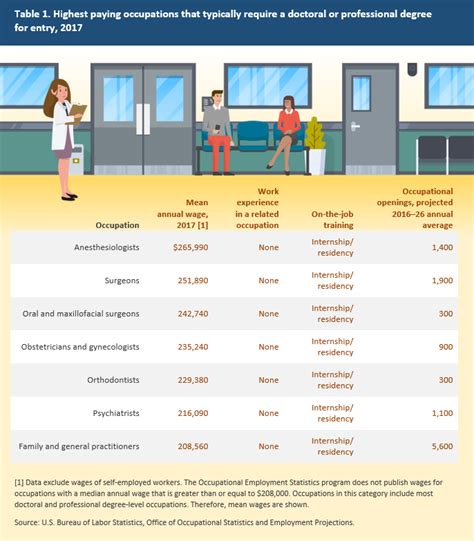

Formal education is often the foundation for high-paying careers. While a high school diploma can lead to well-paying skilled trade jobs, a bachelor's or master's degree can significantly broaden your opportunities.

- Bachelor's Degree: Many jobs in the $40/hr range require a four-year degree. According to the U.S. Bureau of Labor Statistics (BLS), roles like Financial Analyst (median pay $46.26/hour) and Marketing Manager (median pay $68.74/hour) typically require a bachelor's degree.

- Master's Degree: An advanced degree can unlock more specialized and higher-paying roles, such as Nurse Practitioner (median pay $60.07/hour) or Data Scientist, where salaries reported on Glassdoor often exceed $120,000 annually ($57+/hour).

- Certifications: Industry-specific certifications (e.g., PMP for project management, CISSP for cybersecurity) can validate your skills and provide a significant salary boost, often pushing experienced professionals into the $40+/hour bracket.

### Years of Experience

Experience is one of the most powerful drivers of salary growth. While entry-level positions in a field might start closer to $25-$30 per hour, gaining experience allows you to take on more responsibility and command a higher wage.

- Entry-Level (0-2 years): Focus is on learning and applying foundational skills.

- Mid-Career (3-8 years): Professionals in this stage often reach the $40/hour milestone. They can manage projects, mentor junior staff, and operate with greater autonomy.

- Senior-Level (8+ years): Senior and principal roles often pay well above $50 or $60 per hour, as these individuals lead strategic initiatives and are considered experts in their domain.

### Geographic Location

Where you work matters immensely. A $40/hour salary in a low-cost-of-living (LCOL) area like Omaha, Nebraska, provides significantly more purchasing power than the same salary in a high-cost-of-living (HCOL) city like San Francisco or New York. Salary aggregator Payscale notes that wages in San Francisco are, on average, 31% higher than the national average to compensate for this. Consequently, employers in HCOL areas must offer higher wages to attract talent for the same job. Use tools on sites like Salary.com to compare how your target salary stacks up in different metropolitan areas.

### Company Type and Industry

The type of company you work for and the industry it operates in can dramatically affect your pay.

- Industry: Industries with high demand and revenue, like Technology, Pharmaceuticals, and Finance, typically offer higher salaries than sectors like non-profit or retail.

- Company Size: Large, multinational corporations often have more structured (and higher) pay bands than small businesses or startups. However, a successful startup may offer equity, which can lead to a substantial long-term payout.

- Public vs. Private Sector: Private sector jobs generally offer higher base salaries, while public sector (government) jobs may offer more robust benefits, job security, and pensions.

### Area of Specialization

Within any given profession, specialists often out-earn generalists. By developing a deep expertise in a high-demand niche, you become more valuable and can command a premium wage.

- Healthcare: A general Registered Nurse earns a strong wage, but an RN specializing in the cardiac catheterization lab or a Certified Registered Nurse Anesthetist (CRNA) can earn significantly more.

- Technology: A general Software Developer is well-compensated, but one who specializes in high-demand fields like Artificial Intelligence (AI), Machine Learning, or Cybersecurity can command salaries well over the $40/hour mark, even early in their careers.

Job Outlook for High-Wage Professions

The future is bright for skilled professionals. The BLS projects that total employment will grow by 3 percent from 2022 to 2032, adding 4.7 million new jobs. Many of the fields that pay $40 an hour are projected to grow much faster than this average.

For example, the BLS projects the following growth rates for 2022-2032:

- Software Developers: 25% (Much faster than average)

- Registered Nurses: 6% (Faster than average)

- Financial Managers: 16% (Much faster than average)

- Construction Managers: 5% (Faster than average)

This strong demand indicates that investing in the skills and education required for these roles is a sound long-term career strategy.

Conclusion: Charting Your Path to $40 an Hour

Earning a $40 hourly wage, or an $83,200 annual salary, is an ambitious and highly achievable career goal. It is a benchmark that reflects skill, experience, and significant professional value.

To summarize the key takeaways:

1. It's an Excellent Target: A $40/hour salary places you well above the national median income and provides for a comfortable lifestyle.

2. Focus on In-Demand Fields: Careers in technology, healthcare, finance, and specialized skilled trades consistently offer wages in this range.

3. Invest in Yourself: A combination of education, certifications, and continuous skill development is crucial.

4. Strategy is Key: Your earnings are influenced not just by your role, but by your experience level, geographic location, industry, and area of specialization.

Whether you are a student planning your future or a professional looking to advance, use these insights to build a clear roadmap. By making strategic decisions and committing to professional growth, you can successfully position yourself to reach—and exceed—this impressive earning milestone.