Table of Contents

- [Introduction: More Than Just a Job, A Career of Impact](#introduction)

- [What Does an Employee Benefits Specialist Do? The Core of the Role](#what-they-do)

- [Average Employee Benefits Specialist Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence Your Salary: The Ultimate Breakdown](#key-factors)

- [Job Outlook and Career Growth: The Future of Benefits](#job-outlook)

- [How to Become an Employee Benefits Specialist: Your Step-by-Step Roadmap](#how-to-start)

- [Conclusion: Is a Career as a Benefits Specialist Right for You?](#conclusion)

---

Introduction: More Than Just a Job, A Career of Impact

Are you searching for a career that blends analytical rigor with a tangible, positive impact on people's lives? Do you want a role that is both financially rewarding and professionally challenging, placing you at the very heart of a company's most valuable asset—its employees? If so, the path of an Employee Benefits Specialist might be your calling. This critical Human Resources function is more than administrative; it's a strategic role that directly influences employee well-being, satisfaction, and a company’s ability to attract and retain top talent.

Financially, this career offers a stable and promising trajectory. While the title might sound specific, the earning potential is significant. According to a composite of data from sources like the U.S. Bureau of Labor Statistics (BLS), Salary.com, and Payscale, the median employee benefits specialist salary in the United States hovers around $70,000 per year, with a typical range falling between $60,000 and $85,000. However, with experience, specialization, and strategic career moves, top earners in senior or managerial roles can command salaries well into the six figures.

I remember early in my career analysis work, I interviewed a Director of Total Rewards who shared a poignant story. She had spent a week helping a frantic employee navigate the complex short-term disability process after a sudden, life-altering accident. She didn't just process paperwork; she coordinated with the insurance carrier, explained every step to the terrified family, and ensured the employee's pay and benefits continued without interruption. "That," she told me, "is what this job is about. You’re a lifeline when people need it most." That blend of compassion and technical expertise is what makes this field so unique and vital.

This guide is designed to be your definitive resource for understanding the employee benefits specialist career path. We will dissect salary expectations, explore the factors that drive compensation, analyze the long-term job outlook, and provide a clear, actionable roadmap to help you launch or advance your career in this rewarding field.

---

What Does an Employee Benefits Specialist Do? The Core of the Role

At its core, an Employee Benefits Specialist is the architect and administrator of an organization's employee benefits programs. This goes far beyond simply handing out forms during open enrollment. They are strategic partners to the business, ensuring the benefits package is competitive, compliant with a labyrinth of regulations, and aligned with the company's financial goals and culture.

These professionals are the go-to experts on everything from health insurance and retirement plans to wellness initiatives and leave policies. They serve as a crucial bridge between employees, the company, and third-party vendors like insurance carriers and investment firms. Their work requires a unique combination of skills: the empathy of a counselor, the analytical mind of a financial analyst, the precision of a compliance officer, and the communication skills of a marketing professional.

Common Responsibilities and Daily Tasks:

- Benefits Administration: Managing the day-to-day operations of all benefits plans, including enrollments, status changes (e.g., marriage, birth of a child), and terminations. This includes meticulous record-keeping and ensuring data integrity within the Human Resources Information System (HRIS).

- Employee Communication and Education: Acting as the primary point of contact for employee inquiries about benefits. They develop and lead new hire orientations, create educational materials, and guide employees through the complexities of their options during the annual open enrollment period.

- Vendor Management: Liaising with insurance brokers, retirement plan administrators, and other benefits vendors. This can involve resolving claim disputes, reviewing service level agreements, and participating in negotiations for plan renewals.

- Compliance and Reporting: Ensuring all benefits programs adhere to federal, state, and local regulations, such as the Affordable Care Act (ACA), ERISA (Employee Retirement Income Security Act), COBRA, HIPAA, and FMLA. This includes preparing and filing required government reports.

- Analysis and Strategy: Assisting in the analysis of benefits program effectiveness and cost. They may benchmark the company's offerings against competitors, survey employees for feedback, and help senior management make strategic decisions about which benefits to offer.

- Wellness Program Management: Increasingly, benefits specialists are involved in designing and promoting wellness initiatives, such as fitness challenges, mental health support programs, and financial literacy workshops.

### A Day in the Life of an Employee Benefits Specialist

To make this more concrete, let's walk through a typical day:

- 8:30 AM: Start the day by reviewing emails. There's an urgent query from an employee whose prescription wasn't covered, a request from a manager about the parental leave policy, and an automated alert from the HRIS about a new hire's enrollment deadline.

- 9:00 AM: Tackle the prescription issue first. This involves calling the insurance carrier's representative to investigate the claim denial. After a 20-minute call, you discover it was a simple coding error, which you then communicate back to the relieved employee.

- 10:00 AM: Participate in a weekly check-in call with the company’s 401(k) plan administrator. You review participation rates, discuss upcoming educational webinars for employees, and address a compliance testing question.

- 11:30 AM: Work on a communication plan for the upcoming open enrollment period. You draft an email timeline, outline the key changes to the medical plans for next year, and start designing a one-page summary to make the information easily digestible for all employees.

- 1:00 PM: Lunch, followed by a quick walk—practicing the wellness you preach!

- 1:30 PM: A meeting with the HR Director and a benefits broker to review renewal options for the dental and vision plans. You come prepared with data on current plan utilization and costs, helping to inform the strategic discussion.

- 3:00 PM: Process benefits paperwork for new hires and employees with qualifying life events. This requires careful data entry into the HRIS and submitting enrollment information to the various insurance carriers.

- 4:00 PM: Run a monthly report on benefits costs to be reviewed by the finance department. You use your Excel skills to create charts that visualize spending trends.

- 5:00 PM: One last check of emails before logging off, responding to the manager's question about parental leave by sending them the official policy document and a helpful summary.

This example illustrates the dynamic nature of the role—a constant mix of reactive problem-solving, proactive planning, and detailed administrative work that has a real-world effect on every employee in the organization.

---

Average Employee Benefits Specialist Salary: A Deep Dive

Understanding the compensation structure is a critical step in evaluating any career path. For an Employee Benefits Specialist, salary is not a single number but a spectrum influenced by a host of factors we will explore in the next section. Here, we establish a baseline by examining national averages, typical salary ranges, and the different components that make up a total compensation package.

### National Averages and Salary Ranges

To provide a comprehensive picture, it's best to consult multiple authoritative sources. The U.S. Bureau of Labor Statistics (BLS) groups this role under the broader category of "Compensation, Benefits, and Job Analysis Specialists."

- According to the most recent BLS data (May 2023), the median annual wage for Compensation, Benefits, and Job Analysis Specialists was $75,250. This means half of the professionals in this field earned more than this amount, and half earned less.

- The BLS also provides a range: the lowest 10 percent earned less than $48,600, and the highest 10 percent earned more than $119,420. This demonstrates significant upward mobility within the field.

Reputable salary aggregators offer a slightly different, but corroborating, view, often with more real-time data from user-submitted profiles:

- Salary.com (as of late 2023) reports the median salary for a Benefits Specialist II (a mid-level role) in the U.S. to be around $73,200, with a typical range between $65,500 and $81,300.

- Payscale.com shows the average base salary for an Employee Benefits Specialist at approximately $64,000, with a total pay range (including bonuses and profit sharing) extending from $49,000 to $86,000.

- Glassdoor, which aggregates self-reported salaries, places the "most likely" total pay for a Benefits Specialist at around $77,000 per year in the United States.

Consensus: Taking these sources together, a realistic expectation for a mid-career Employee Benefits Specialist in the U.S. is a base salary in the $65,000 to $80,000 range. Entry-level positions will start lower, while senior, lead, and managerial roles will command significantly higher figures.

### Salary by Experience Level

Your experience is arguably the single most powerful driver of your salary. As you accumulate skills, demonstrate success, and take on more responsibility, your value—and your paycheck—will grow accordingly.

Here is a typical salary progression, with data synthesized from sources like Payscale and Salary.com:

| Career Stage | Years of Experience | Typical Salary Range | Key Responsibilities & Titles |

| :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 years | $50,000 - $65,000 | Benefits Coordinator / Assistant: Primarily administrative tasks, data entry, answering basic employee questions, assisting with open enrollment logistics. |

| Mid-Career | 3-8 years | $65,000 - $85,000 | Benefits Specialist / Analyst: Manages daily administration, handles complex employee issues, assists with compliance reporting, contributes to renewal analysis, may lead small projects. |

| Senior-Level | 9-15 years | $85,000 - $115,000+ | Senior Benefits Specialist / Lead Benefits Analyst: Manages complex projects, handles vendor relationships, performs in-depth financial analysis, mentors junior staff, may specialize in areas like retirement or wellness. |

| Managerial / Strategic | 15+ years | $110,000 - $175,000+ | Benefits Manager / Director of Total Rewards: Sets benefits strategy, manages department budget, negotiates with brokers and carriers, ensures enterprise-wide compliance, presents to executive leadership. |

*Note: These ranges are national averages and can be significantly higher in major metropolitan areas or for highly specialized roles.*

### Beyond the Base Salary: Understanding Total Compensation

A smart career analyst looks beyond the base salary to the total compensation package. For a Benefits Specialist, this is particularly relevant, as they are intimately familiar with the value of these non-salary components.

- Annual Bonuses: These are common, especially in for-profit companies. Bonuses are typically tied to a combination of company performance and individual performance. For a mid-level specialist, a bonus might range from 5% to 10% of their base salary. For managers and directors, this can increase to 15-25% or more.

- Profit Sharing: Some companies offer a profit-sharing plan where a portion of the company's profits is distributed among employees. This can be a significant addition to annual earnings, though it is variable by nature.

- Stock Options / Equity: More common in publicly traded companies or pre-IPO startups, equity can be a powerful long-term wealth-building tool. A Benefits Specialist might receive Restricted Stock Units (RSUs) or stock options as part of their compensation.

- The Benefits Package Itself: This is a key, and often undervalued, part of compensation. A robust benefits package can be worth tens of thousands of dollars per year. This includes:

- Health Insurance Premiums: The amount the company pays toward your medical, dental, and vision insurance. A low-premium, high-quality plan is a huge financial benefit.

- Retirement Plan Matching: Company matching contributions to a 401(k) or 403(b) plan are essentially free money. A common match is 50% of the first 6% of your salary you contribute—that's a guaranteed 3% annual return on your investment.

- Paid Time Off (PTO): Generous vacation, sick leave, and holiday policies have a direct monetary value.

- Other Perks: This can include tuition reimbursement, wellness stipends, life insurance, disability insurance, and commuter benefits, all of which contribute to your overall financial well-being.

When evaluating a job offer, it's crucial to analyze the entire package. A role with a $70,000 salary and a phenomenal benefits package might be more lucrative than a $75,000 role with subpar benefits and high insurance premiums.

---

Key Factors That Influence Your Salary: The Ultimate Breakdown

While national averages provide a useful benchmark, your individual employee benefits specialist salary will be determined by a specific set of variables. Understanding these factors is the key to maximizing your earning potential throughout your career. This is where you can move from being a passive job-seeker to a strategic career architect.

### 1. Level of Education and Professional Certifications

Your educational background and professional credentials are the foundation of your career and a significant salary driver, particularly in the early to mid-stages.

- Bachelor’s Degree: A bachelor's degree is the standard entry requirement for most Benefits Specialist roles. Common and preferred majors include Human Resources, Business Administration, Finance, or a related field. While a degree in an unrelated field isn't a dealbreaker, relevant coursework provides a strong starting point and can justify a higher starting salary.

- Master’s Degree: An advanced degree, such as a Master of Human Resources (MHR), a Master of Business Administration (MBA), or a Master's in a specialized area like Industrial-Organizational Psychology, can significantly boost earning potential. It often serves as an accelerator to leadership roles. Professionals with a master's degree can expect to earn a salary premium of 10-20% over their counterparts with only a bachelor's, and they are fast-tracked for roles like Benefits Manager or Director of Total Rewards.

- Professional Certifications (The Game Changer): In the world of HR and benefits, certifications are not just resume-boosters; they are proof of expertise and a direct lever for higher pay.

- Certified Employee Benefit Specialist (CEBS): This is the gold standard and the most respected credential in the benefits industry. It's a rigorous, five-course program covering health, welfare, and retirement plans. Achieving the CEBS designation signals a deep, specialized knowledge that employers are willing to pay a premium for. Many senior and managerial roles list CEBS as a preferred or even required qualification.

- Certified Benefits Professional (CBP): Offered by WorldatWork, the CBP is another highly-regarded certification that is part of a broader Total Rewards framework. It demonstrates expertise in the strategic design and administration of benefits programs and is highly valued for analyst and manager roles.

- SHRM-CP and SHRM-SCP: The Society for Human Resource Management's Certified Professional (CP) and Senior Certified Professional (SCP) are broader HR certifications, but they are extremely valuable. They show a comprehensive understanding of how benefits fit into the larger HR strategy, which is critical for advancement.

- Project Management Professional (PMP): While not HR-specific, a PMP certification can be a significant differentiator, especially for specialists in large organizations who manage complex projects like HRIS implementations or company-wide open enrollment overhauls.

### 2. Years of Experience and Career Progression

As detailed in the previous section, experience is paramount. However, it's not just the *number* of years but the *quality* of that experience. Salary growth is tied to a demonstrated ability to handle increasing complexity and responsibility.

- 0-2 Years (Coordinator Level): The focus is on learning the fundamentals: processing enrollments, understanding plan documents, and mastering the HRIS. Salary growth is modest.

- 3-8 Years (Specialist/Analyst Level): This is the critical growth phase. You move from pure administration to analysis. You might be asked to benchmark a plan, resolve a complex claims appeal, or co-lead open enrollment meetings. Each new responsibility is a justification for a higher salary. Professionals who actively seek out these challenges see their pay increase much faster than those who remain in a purely administrative capacity.

- 9+ Years (Senior/Lead/Manager Level): At this stage, your value is in your strategic input. You're not just administering plans; you're helping to design them. You're managing vendor relationships, negotiating rates, ensuring compliance for the entire organization, and mentoring others. This shift from tactical execution to strategic oversight corresponds with the largest jumps in salary, pushing you well over the $100,000 mark.

### 3. Geographic Location

Where you work has a massive impact on your paycheck. Salaries are adjusted for the local cost of labor and cost of living. A higher salary in a major city is often offset by higher housing and living expenses, but it can also provide access to larger companies and more opportunities for advancement.

Top-Paying Metropolitan Areas for Compensation and Benefits Specialists (Data from BLS):

- San Jose-Sunnyvale-Santa Clara, CA

- San Francisco-Oakland-Hayward, CA

- Washington-Arlington-Alexandria, DC-VA-MD-WV

- New York-Newark-Jersey City, NY-NJ-PA

- Boston-Cambridge-Nashua, MA-NH

- Seattle-Tacoma-Bellevue, WA

In these high-cost-of-living areas, it is not uncommon for a mid-career Benefits Specialist to earn $90,000 - $110,000 or more, compared to the national median of ~$75,000.

Lower-Paying Areas: Conversely, salaries will generally be lower in rural areas and states with a lower cost of living. However, the purchasing power of that salary might be equivalent to or even greater than a higher salary in an expensive city.

The Rise of Remote Work: The increasing prevalence of remote work is adding a new layer to geographic pay. Some companies are moving to a location-agnostic pay scale, while others adjust salaries based on the employee's location, even if they are 100% remote. When considering remote roles, it is essential to clarify the company's compensation philosophy.

### 4. Company Type, Size, and Industry

The type of organization you work for is a major salary determinant.

- Large Corporations (Fortune 500): These companies typically offer the highest base salaries, most structured bonus plans, and most comprehensive benefits packages. Roles are often highly specialized (e.g., a "Retirement Plan Specialist" or "Health and Welfare Analyst"). The complexity of managing benefits for tens of thousands of employees justifies the higher pay.

- Tech Companies and Startups: The tech industry is known for competitive compensation. While a pre-revenue startup might offer a lower base salary, it is often supplemented with potentially lucrative stock options. Established tech giants (like Google, Meta, Apple) are at the top end of the pay scale for all corporate roles, including benefits specialists.

- Consulting and Professional Services Firms: Working for a benefits consulting firm (like Mercer, Aon, or Willis Towers Watson) can be a high-earning path. In these roles, you are not an internal specialist but an external consultant advising multiple client companies. This is a high-pressure, high-reward environment that often demands deep analytical skills and long hours but pays accordingly.

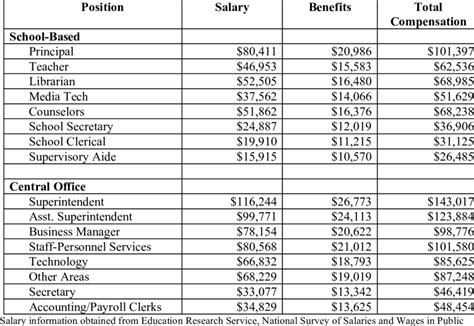

- Government (Federal, State, Local): Government roles often have lower base salaries than the private sector. However, this is frequently offset by exceptional job security, excellent government-sponsored benefits (including pensions, which are rare in the private sector), and a better work-life balance. Salaries are transparent and follow a set pay scale, such as the General Schedule (GS) for federal employees.

- Non-Profit and Healthcare/Education: These sectors are often mission-driven. Salaries tend to be on the lower end of the spectrum compared to for-profit corporations. However, they can offer rich benefits packages, particularly in healthcare and university settings (e.g., tuition remission).

### 5. Area of Specialization

As you advance in your career, you may choose to specialize. Niche expertise is a powerful salary booster because it makes you harder to replace.

- Retirement Benefits (401k/Pensions): Specialists who focus on defined contribution and defined benefit plans command high salaries due to the financial complexity, fiduciary responsibility, and stringent compliance (ERISA) involved.

- Executive Compensation: This is a highly lucrative and elite niche. These professionals design compensation packages (salary, bonuses, equity, deferred compensation) for top-level executives. This requires extreme discretion, financial modeling skills, and an understanding of securities law.

- Global / International Benefits: Managing benefits for employees across different countries is exceptionally complex due to varying laws, currencies, and cultural norms. Specialists with this experience are in high demand and are compensated generously.

- Benefits Technology / HRIS: A specialist who is an expert in configuring and managing the benefits module of a major HRIS (like Workday, SAP SuccessFactors, or Oracle) blends HR knowledge with technical skill, making them a highly valuable asset.

### 6. In-Demand Skills

Beyond your formal credentials, a specific set of skills will make you a more effective and higher-paid professional.

- Data Analysis and Financial Acumen: The ability to go beyond administration and analyze the numbers. Can you use Excel pivot tables to model the cost impact of a plan change? Can you interpret utilization data to recommend a new wellness program? This skill separates a good specialist from a great one.

- Vendor Management and Negotiation: Demonstrating that you can effectively manage vendor relationships to ensure high service levels and negotiate favorable renewal terms can show a direct, positive ROI to your employer.

- Deep Compliance Knowledge: Being a true expert in the ACA, ERISA, HIPAA, etc., is not just a requirement—it's a major value-add. Companies pay well for professionals who can navigate this complex landscape and mitigate legal and financial risks.

- Communication and Empathy: While a "soft skill," the ability to explain complex benefit concepts in a simple, clear, and empathetic way is critical. This builds employee trust and increases the perceived value of the benefits package, which is a key goal of the HR function.

---

Job Outlook and Career Growth: The Future of Benefits

When investing in a career path, it's essential to look not just at the present but also at the future. For Employee Benefits Specialists, the outlook is stable and evolving, with strong prospects for those who can adapt to emerging trends.

### Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) projects that employment for Compensation, Benefits, and Job Analysis Specialists will grow by 7 percent from 2022 to 2032. This growth rate is faster than the average for all occupations.

The BLS forecasts about 10,600 openings for these specialists each year, on average, over the decade. Most of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

Why the steady demand? The primary driver is the complexity of benefits and compensation law. As regulations around healthcare, retirement, and pay equity continue to evolve, organizations will require knowledgeable specialists to ensure they remain compliant and competitive. Furthermore, as companies fiercely compete for a limited pool of talent, a well-designed and strategically managed benefits package remains one of the most powerful tools for attraction and retention. This solidifies the benefits function as a core business need, not a discretionary expense.

### Emerging Trends Shaping the Future of the Profession

A successful benefits professional is a forward-thinker. The "what's next" in the world of work directly impacts their role. Staying ahead of these trends is key to remaining relevant and advancing your career.

1. The Rise of Holistic and Personalized Well-being: The definition of "benefits" is expanding far beyond medical and dental. Leading companies are now focused on holistic well-being, which encompasses:

- Mental Health: Robust Employee Assistance Programs (EAPs), access to therapy through apps like Talkspace or BetterHelp, and mental health days are becoming standard expectations.

- Financial Wellness: Programs that include student loan repayment assistance, financial literacy coaching, access to emergency savings funds, and retirement planning education are gaining immense popularity.

- Physical Wellness: Beyond gym memberships, this now includes stipends for home workout equipment, nutrition counseling, and access to virtual fitness classes.