Considering a career that combines high-level mathematics, financial theory, and business strategy to solve real-world problems? Welcome to the world of actuarial science. Known for its intellectual rigor and professional prestige, the actuary career path is also one of the most financially rewarding, even from the very beginning. An entry-level actuary salary is among the highest for recent graduates, often starting in the $70,000 to $90,000 range, with a clear and structured path to a six-figure income within just a few years.

This guide will break down what you can expect to earn as you launch your actuarial career, the key factors that will influence your compensation, and the bright future this profession holds.

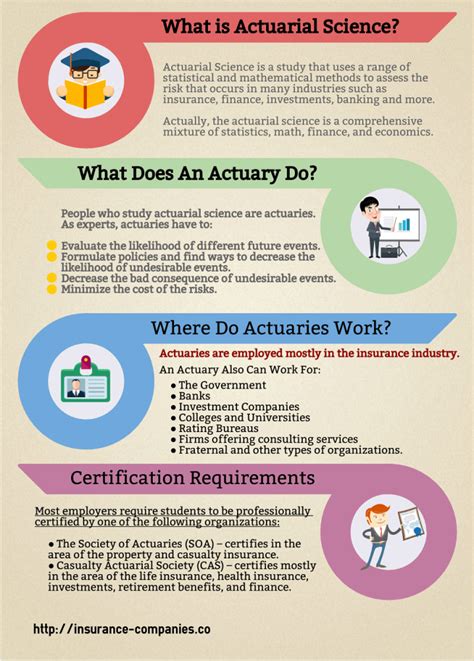

What Does an Actuary Do?

At their core, actuaries are the architects of financial security. They are professionals who use mathematics, statistics, and financial theory to measure, manage, and mitigate risk and uncertainty. You'll find them at the heart of the insurance industry, in consulting firms, and within the finance departments of major corporations.

An entry-level actuary, often titled an "Actuarial Analyst," typically supports a team of senior actuaries with tasks like:

- Data Analysis: Compiling and cleaning large datasets to identify trends.

- Financial Modeling: Building and using spreadsheets and statistical software to project future events, such as the probability of a catastrophic storm or the life expectancy of a population.

- Pricing: Helping to determine the price (premiums) for insurance policies.

- Reserving: Calculating the amount of money an insurance company needs to set aside to pay future claims.

- Exam Preparation: A significant part of the job for an entry-level actuary is studying for and passing a series of rigorous professional examinations.

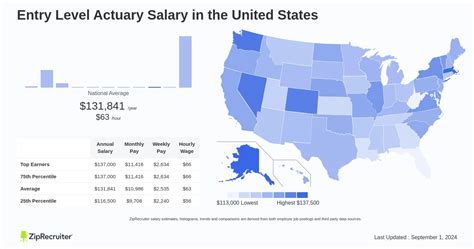

Average Actuary Salary: From Entry-Level to Senior Expert

The salary potential for an actuary is exceptional. While the starting salary is strong, the compensation growth is what truly sets this career apart.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all actuaries was $120,000 in May 2023. The lowest 10 percent earned less than $82,410, while the highest 10 percent earned more than $217,910.

For those just starting out, the picture is equally bright:

- Salary.com reports that the typical salary range for an Entry Level Actuary in the United States falls between $72,600 and $88,200, with an average of around $80,200 as of early 2024.

- Glassdoor lists the estimated total pay for an Actuarial Analyst with 0-1 years of experience at $84,000 per year, with a likely range between $74,000 and $97,000.

- Payscale notes an average base salary of approximately $75,000 for an entry-level Actuarial Analyst, emphasizing that this grows significantly with skills in financial modeling and analysis.

Crucially, these entry-level figures are just the launchpad. As you pass exams and gain experience, your salary will climb steeply.

Key Factors That Influence Salary

An actuary’s salary isn't a single number; it's a dynamic figure influenced by several key variables. Understanding these factors is essential for maximizing your earning potential.

### Years of Experience (and Exams Passed)

This is arguably the most significant driver of an actuary's salary. In this profession, experience is intrinsically linked to progress through the actuarial exam series administered by the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

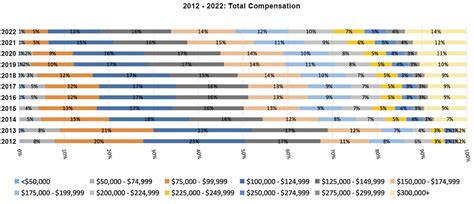

Passing exams is the primary pathway to higher credentials, and each milestone comes with a significant pay raise and often a bonus. The typical progression looks like this:

1. Entry-Level (0-3 exams): This is the "Actuarial Analyst" stage. You have a strong academic background and have demonstrated commitment by passing one or more preliminary exams.

2. Associate (ASA/ACAS): After passing a series of exams and completing other requirements, you earn your Associateship. This typically takes 3-5 years and signifies full professional competence. Reaching this level often pushes your salary well into the $110,000 - $160,000 range.

3. Fellow (FSA/FCAS): This is the highest designation. Achieving Fellowship requires several more years of exams and specialized study. Fellows are considered experts in their field and command top-tier salaries, often starting at $160,000 and rising well above $250,000 with experience.

Reputable actuarial recruiting firms like Ezra Penland and D.W. Simpson publish detailed salary surveys that show this direct correlation between exam progress and compensation.

### Geographic Location

Where you work matters. Major metropolitan areas with a high concentration of insurance companies and financial firms typically offer higher salaries to compensate for a higher cost of living.

According to BLS data, the top-paying states for actuaries include:

- New York

- Connecticut

- New Hampshire

- District of Columbia

- New Jersey

Cities like New York City, Hartford, Chicago, and Boston are well-known hubs for actuarial talent and offer competitive starting salaries to attract top candidates.

### Company Type

The type of company you work for plays a crucial role in your compensation and work-life balance.

- Insurance Carriers: This is the most common employer. Actuaries in Life & Health or Property & Casualty (P&C) insurance have stable roles with excellent benefits. P&C roles sometimes offer a slight salary premium due to the nature of the risks involved.

- Consulting Firms: Actuarial consultants often earn higher base salaries and larger bonuses. They advise multiple clients on pensions, benefits, and risk management. However, these roles typically demand longer hours and more travel.

- Government: Federal and state government agencies hire actuaries to oversee public insurance programs like Social Security and Medicare. While base salaries may be slightly lower than in the private sector, these positions often provide an excellent work-life balance and strong job security.

### Area of Specialization

As you advance, you will specialize. Your chosen field can impact your long-term earning potential. The two primary tracks are:

- Life and Health (L&H): These actuaries deal with risks related to life, health, and disability insurance, as well as retirement benefits and pensions. This field is managed by the SOA.

- Property and Casualty (P&C): These actuaries work with risks related to property damage (homes, cars) and liability (accidents, malpractice). This field is managed by the CAS and has historically seen slightly higher average salaries, particularly at the senior levels.

Emerging fields like enterprise risk management (ERM), predictive analytics, and climate change risk modeling are also creating new, high-paying opportunities for actuaries with specialized skills.

### Level of Education

A bachelor’s degree in mathematics, statistics, actuarial science, finance, or a related quantitative field is the standard entry requirement. While a master’s degree can be beneficial and may help you stand out, it is generally not a prerequisite for securing an entry-level position. Most employers place a much higher value on the number of actuarial exams you have passed than on an advanced degree.

Job Outlook

The future for actuaries is exceptionally bright. The increasing complexity of the global financial market and the need to manage new forms of risk (like cyber threats and climate change) are driving demand for actuarial talent.

The U.S. Bureau of Labor Statistics projects that employment for actuaries will grow 23 percent from 2022 to 2032. This is much faster than the average for all occupations, translating to about 2,200 new job openings each year over the decade. This robust demand ensures strong job security and continued salary growth for aspiring professionals.

Conclusion

Choosing a career as an actuary is a commitment to lifelong learning and a challenging professional journey. However, the rewards are clear and substantial. An entry-level actuary salary is among the best for new graduates, but more importantly, it is the starting point of a structured and transparent path toward significant wealth and professional influence.

For the analytically-minded individual ready to tackle complex problems, the key takeaways are:

- Expect a strong starting salary, likely between $70,000 and $90,000.

- Focus on passing exams, as this is the single most important driver of salary growth.

- Your earning potential is high, with a clear path to a six-figure income and a long-term outlook that can exceed $200,000.

- The job market is strong and growing, offering excellent security for the future.

If you are looking for a career that will challenge you intellectually and reward you financially, becoming an actuary is an outstanding choice.