In a world defined by economic complexity and digital transformation, the role of a risk analyst has never been more critical. These professionals are the strategic guardians of an organization, identifying and mitigating potential threats to its financial health and stability. If you have a sharp, analytical mind and a knack for seeing the patterns hidden within data, a career as a risk analyst can be both intellectually stimulating and highly lucrative.

But how lucrative is it? A career as a risk analyst offers substantial earning potential, with average salaries comfortably starting in the high five-figures and often soaring well into six-figure territory with experience and specialization. This guide will break down what you can expect to earn and, more importantly, how you can maximize your salary throughout your career.

What Does a Risk Analyst Do?

Before we dive into the numbers, let's briefly define the role. A risk analyst is a professional who identifies, assesses, and helps manage potential risks that could harm an organization's financial standing or reputation. They are financial detectives and strategic forecasters, using quantitative and qualitative analysis to protect a company's assets.

Key responsibilities often include:

- Analyzing financial data, market trends, and economic indicators.

- Building predictive models to forecast potential losses or impacts.

- Evaluating the risk of specific business decisions, like extending credit or making an investment.

- Ensuring compliance with government regulations and internal policies.

- Preparing detailed reports and presenting recommendations to senior management.

Average Risk Analyst Salary

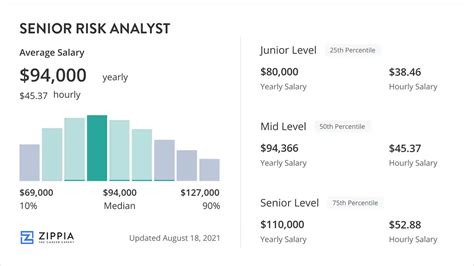

The compensation for a risk analyst is competitive, reflecting the high level of skill and responsibility required. While figures vary based on numerous factors, we can establish a solid baseline by looking at data from several authoritative sources.

According to Salary.com, as of late 2023, the median salary for a Risk Analyst in the United States is approximately $82,500. However, the typical salary range is quite broad, generally falling between $73,200 and $93,000.

Other reputable sources provide a similar picture:

- Payscale reports an average salary of around $75,400, with a common range from $57,000 to $104,000.

- Glassdoor places the average total pay (base plus additional compensation like bonuses) at approximately $96,000 per year.

It's crucial to understand that these figures represent a national average. Entry-level positions may start closer to the $65,000-$75,000 range, while senior risk analysts or managers in high-demand fields can easily command salaries of $130,000 to $150,000 or more, especially when factoring in annual bonuses.

Key Factors That Influence Salary

Your specific salary as a risk analyst isn't determined by a single number. It's a dynamic figure influenced by a combination of your qualifications, location, and the specific nature of your role. Here are the most significant factors.

###

Level of Education

A bachelor's degree in a relevant field like finance, economics, statistics, or mathematics is the standard entry point. However, advanced education can provide a significant salary boost and a competitive edge.

- Master's Degree: Earning a Master of Business Administration (MBA), a Master of Science in Finance, or a specialized Master's in Risk Management can lead to higher starting salaries and open doors to senior-level positions more quickly.

- Professional Certifications: This is a key differentiator. Holding globally recognized certifications demonstrates a high level of expertise and commitment. The two most prominent are:

- Financial Risk Manager (FRM®): Offered by the Global Association of Risk Professionals (GARP), this certification is the gold standard for financial risk, often leading to a significant salary premium.

- Professional Risk Manager (PRM™): This certification from PRMIA is another highly respected credential that validates your skills and can enhance your earning potential.

###

Years of Experience

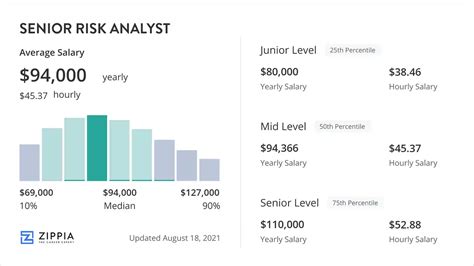

Experience is arguably the single greatest driver of salary growth in this field. As you gain expertise and a proven track record, your value to employers skyrockets.

- Entry-Level (0-2 years): Analysts at this stage are learning the ropes. Salaries typically range from $65,000 to $80,000 as they build foundational skills.

- Mid-Career (3-8 years): With several years of experience, analysts can manage more complex projects independently. Their salaries often climb to the $85,000 to $115,000 range.

- Senior/Lead (8+ years): Senior risk analysts and risk managers are strategic leaders. They command top-tier salaries, often $120,000+, with significant bonus potential, particularly in industries like investment banking.

###

Geographic Location

Where you work matters. Salaries for risk analysts vary significantly by metropolitan area, primarily due to differences in cost of living and the concentration of financial institutions. Major financial hubs consistently offer the highest compensation.

Top-Paying U.S. Cities for Risk Analysts:

1. New York, NY: The epicenter of finance, offering the highest salaries to attract top talent.

2. San Francisco, CA: Driven by both the finance and tech sectors (FinTech).

3. Boston, MA: A major hub for asset management and insurance companies.

4. Chicago, IL: A key center for trading, banking, and financial services.

5. Charlotte, NC: A rapidly growing banking and financial hub.

Working in one of these cities can result in a salary that is 15-25% or more above the national average.

###

Company Type

The industry and type of company you work for have a major impact on your paycheck. High-risk, high-reward sectors tend to offer the most lucrative compensation packages.

- Investment Banks & Hedge Funds: These are typically the highest payers, as risk analysis is core to their high-stakes operations. Total compensation, including large annual bonuses, can be substantial.

- Asset Management & Private Equity: These firms also offer highly competitive salaries to analysts who can protect and grow massive investment portfolios.

- Commercial Banks & Credit Unions: Offer strong, stable salaries, particularly for credit risk analysts.

- Insurance Companies: Actuarial and underwriting risk roles are central here, with solid compensation.

- Consulting Firms: Top consulting firms hire risk analysts to advise clients, offering excellent salaries and diverse project experience.

- Corporations (Non-Finance): Large corporations in sectors like energy, technology, and healthcare hire risk analysts for operational and financial risk management, though salaries may be slightly lower than in pure finance.

###

Area of Specialization

"Risk" is a broad term. Specializing in a high-demand area can make you an indispensable asset and boost your earnings.

- Credit Risk: Analyzing the risk that a borrower will default on a loan. This is a foundational role in any lending institution.

- Market Risk: Assessing the risk of losses arising from factors that affect the entire financial market, such as interest rate changes or currency fluctuations.

- Operational Risk: Identifying risks from failed internal processes, people, and systems—from employee fraud to IT system failures.

- Cybersecurity Risk: A rapidly growing and extremely high-demand field. Analysts specializing in identifying and mitigating risks from cyber-attacks often command premium salaries due to the critical nature of their work.

Job Outlook

The future for risk analysts is bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Financial Analysts, a category that includes risk analysts, will grow by 8 percent from 2022 to 2032, which is much faster than the average for all occupations.

The BLS attributes this growth to "a growing range of financial products and the need for in-depth knowledge of geographic regions." As the global economy becomes more interconnected and complex, the demand for skilled professionals who can navigate and mitigate risk will only increase.

Conclusion

A career as a risk analyst is a powerful choice for analytical thinkers seeking a challenging and rewarding profession. The salary potential is strong, with a clear path for significant financial growth.

Your journey to a six-figure salary is directly influenced by your decisions. To maximize your earnings, focus on these key takeaways:

1. Build a Strong Foundation: Earn a degree in a quantitative field.

2. Invest in Yourself: Pursue advanced degrees or professional certifications like the FRM or PRM to stand out.

3. Gain Diverse Experience: Don't be afraid to move between roles or specializations to build a robust skillset.

4. Target High-Growth Areas: Consider specializing in in-demand fields like cybersecurity risk and working in major financial hubs.

For those with the right skills and ambition, the path of a risk analyst offers not just excellent compensation but also a vital role in shaping the future of business.