For ambitious students and aspiring professionals, a career in finance represents a world of opportunity, intellectual challenge, and significant financial reward. It's a field where numbers tell stories, where strategic decisions can shape the future of industries, and where your analytical skills are your greatest asset. But as you stand at the threshold of this dynamic world, one pressing question likely dominates your thoughts: "What can I realistically expect for an entry-level finance salary?"

The answer, you'll find, is not a single number but a complex and exciting equation. An entry-level finance salary can range from a solid $65,000 for a corporate finance role in a lower-cost-of-living area to well over $150,000+ in total compensation for a coveted investment banking position in a major financial hub. This guide is designed to demystify that equation for you. I still remember my first internship, tasked with reconciling a seemingly minor discrepancy in a financial model that represented millions in potential investment. It was a tedious, high-pressure task, but the moment I found the error and understood its downstream impact, I grasped the immense responsibility and intellectual satisfaction that even the most junior finance roles command. That a single cell in a spreadsheet could hold so much weight was a powerful lesson in the value of precision and diligence—the very bedrock of a successful finance career.

We will move beyond simple averages to provide a comprehensive, data-driven roadmap. We'll explore the diverse career paths, break down the key factors that dictate your earning potential, and provide a step-by-step plan to help you land a top-tier role. This is your ultimate guide to understanding, navigating, and maximizing your entry-level finance salary.

### Table of Contents

- [What Does an Entry-Level Finance Professional Do?](#what-is-the-role)

- [Average Entry-Level Finance Salary: A Deep Dive](#deep-dive)

- [Key Factors That Influence Your Finance Salary](#key-factors)

- [Job Outlook and Career Growth in Finance](#job-outlook)

- [How to Get Started in a Finance Career](#get-started)

- [Conclusion: Your Financial Future Starts Now](#conclusion)

What Does an Entry-Level Finance Professional Do?

While the term "finance" is broad, the roles within it, especially at the entry level, share a common foundation built on analysis, modeling, and support. As a junior professional, you are the engine room of the financial world. Your primary function is to gather, process, and present the data that senior leaders use to make critical strategic decisions. You are not yet the one steering the ship, but you are the one meticulously charting the course and checking the instruments.

The core of most entry-level finance jobs revolves around a few key activities:

- Financial Modeling: This is arguably the most critical technical skill. You will build, maintain, and update complex spreadsheets (primarily in Microsoft Excel) to forecast a company's future performance. This can include Discounted Cash Flow (DCF) models, Leveraged Buyout (LBO) models, and valuation models for mergers and acquisitions (M&A).

- Data Gathering and Research: Your work is only as good as your data. You'll spend significant time pulling information from financial statements (10-Ks, 10-Qs), market data terminals (like the Bloomberg Terminal), industry reports, and internal company databases.

- Valuation Analysis: You will help determine the value of a company, an asset, or a security. This involves using various methodologies, such as comparable company analysis ("comps"), precedent transaction analysis, and DCF analysis.

- Presentation and Report Creation: After the analysis is done, it must be communicated effectively. A large part of your job involves creating PowerPoint presentations (pitch decks), memos, and reports that summarize your findings for senior bankers, managers, or clients.

- Due Diligence: In transaction-oriented roles (like investment banking or private equity), you will be heavily involved in due diligence—the process of verifying the financial, legal, and commercial health of a company before a deal is closed.

To make this more concrete, the specific duties can vary significantly based on the sector of finance you enter:

- Investment Banking Analyst: Works grueling hours on M&A deals, IPOs (Initial Public Offerings), and debt/equity financing. The focus is on valuation, pitch deck creation, and transaction execution.

- Corporate Finance Analyst (FP&A): Works within a non-financial company (e.g., Google, Ford, Procter & Gamble). Focuses on budgeting, forecasting, and analyzing the financial performance of the business to guide internal strategy.

- Equity Research Associate: Researches and analyzes public companies to make "buy," "sell," or "hold" recommendations for stocks. The work is highly analytical and writing-intensive.

- Commercial Banking Analyst: Analyzes the creditworthiness of businesses seeking loans, managing risk for the bank.

- Asset Management Analyst: Supports portfolio managers by researching investments (stocks, bonds, etc.) and monitoring the performance of existing holdings.

### A "Day in the Life" of a First-Year Corporate Finance Analyst

Let's follow "Maria," a Financial Planning & Analysis (FP&A) Analyst at a large technology company, to see these tasks in action.

- 8:30 AM: Maria arrives, grabs coffee, and reviews overnight emails. She checks the previous day's sales data dashboards to see if performance is tracking against the monthly forecast she helped build.

- 9:00 AM: Her manager asks her to investigate why marketing expenses in the European division are 15% over budget for the quarter. Maria begins pulling spending reports, cross-referencing them with the marketing team's campaign calendar.

- 11:00 AM: Maria spends two hours updating the divisional financial model with the latest actuals. This involves ensuring all formulas are correct and that the model balances. She flags a few key variances to discuss with her manager.

- 1:00 PM: Lunch at her desk while reviewing an industry report on a competitor's recent earnings announcement.

- 2:00 PM: Maria joins a call with the sales operations team to understand their forecast for the next quarter. She takes detailed notes, asking clarifying questions about the assumptions behind their numbers.

- 3:30 PM: Back at her desk, she begins incorporating the new sales forecast into her financial model and starts drafting a few slides for the upcoming monthly business review presentation.

- 5:00 PM: She meets with her manager to review her findings on the marketing budget overspend. They agree on a few follow-up questions for the marketing director.

- 6:00 PM: Maria finalizes her presentation slides, sends a summary email of her day's key tasks, and plans her to-do list for tomorrow. She heads home around 6:30 PM, a typical end to a non-peak day.

This example illustrates the blend of routine analysis, ad-hoc investigation, and collaborative communication that defines most entry-level finance roles.

Average Entry-Level Finance Salary: A Deep Dive

Now for the central question: How much does this work pay? The compensation structure in finance is often more complex than in other industries, typically consisting of a base salary and a performance-based bonus. The bonus component can range from a small percentage of your base in some roles to over 100% in others, drastically affecting your total annual compensation.

### National Averages and Typical Ranges

First, let's establish a baseline. The U.S. Bureau of Labor Statistics (BLS) provides a broad overview. For "Financial Analysts," a category that encompasses many entry-level roles, the median annual wage was $99,890 as of May 2023. The lowest 10 percent earned less than $59,430, and the highest 10 percent earned more than $176,570. While this is a useful benchmark, it includes professionals at all experience levels.

For a more granular view focused on entry-level positions, we turn to industry-specific salary aggregators.

- According to Salary.com, as of late 2023, the typical salary for a Financial Analyst I (entry-level) in the United States falls between $62,501 and $73,201, with a median of $67,613.

- Payscale.com reports the average base salary for an entry-level Financial Analyst is around $65,000 per year.

- Glassdoor.com data, which includes user-submitted reports, suggests a total pay range (including bonuses and other compensation) for an entry-level Financial Analyst is often between $68,000 and $95,000 annually in the US.

However, these averages are heavily skewed by the prevalence of corporate finance roles. For high-finance positions like investment banking, the numbers are substantially different. A first-year Investment Banking Analyst in a major hub like New York can expect a base salary of $110,000 to $125,000, with an end-of-year bonus that can range from $40,000 to $90,000+, bringing their first-year total compensation to $150,000 - $215,000.

### Salary Growth by Experience Level

Your salary will not remain static. Finance is a field that rewards experience and proven performance. Here is a typical salary progression, keeping in mind that these are general estimates and can vary wildly based on the factors we'll discuss in the next section.

| Career Stage | Years of Experience | Typical Base Salary Range (Corporate Finance) | Typical Total Compensation (Investment Banking) |

| :--- | :--- | :--- | :--- |

| Entry-Level Analyst | 0-2 Years | $65,000 - $85,000 | $150,000 - $250,000 |

| Mid-Career/Senior Analyst | 3-5 Years | $85,000 - $115,000 | $275,000 - $450,000 (as an Associate) |

| Manager/Associate | 5-8 Years | $110,000 - $150,000 | $500,000 - $700,000+ (as a Vice President) |

| Senior/Director Level | 9+ Years | $150,000 - $250,000+ | $750,000 - $2,000,000+ (as a Director/MD) |

*Source: Consolidated data from BLS, Salary.com, Glassdoor, and industry reports like the Robert Half Salary Guide.*

### Understanding Your Total Compensation Package

It's a mistake to focus solely on the base salary. Your total compensation package is a more accurate measure of your earnings. Here’s a breakdown of the typical components:

- Base Salary: This is your fixed, predictable income paid bi-weekly or monthly. It forms the foundation of your compensation.

- Annual Performance Bonus: This is the variable, "at-risk" portion of your pay. In corporate finance, it might be 5-15% of your base salary, tied to both your performance and the company's success. In investment banking, private equity, and hedge funds, the bonus is the main event and can be 50-150% (or more) of your base salary, heavily tied to deal flow and individual contribution.

- Signing Bonus: Often offered to highly sought-after candidates, particularly in investment banking and consulting, to entice them to accept an offer. This can range from $5,000 to $25,000 or more.

- Profit Sharing: Some firms distribute a portion of their profits to employees. This is common in smaller, boutique firms and asset management companies.

- Stock Options and Restricted Stock Units (RSUs): More common in corporate finance roles at public companies, this gives you an ownership stake. RSUs vest over a period of time (e.g., 4 years), providing a powerful incentive to stay with the company.

- Retirement Savings: This includes 401(k) plans. A key benefit is the employer match. A company that matches 100% of your contributions up to 6% of your salary is effectively giving you a 6% raise.

- Other Perks: These can include health insurance, tuition reimbursement for further education (like an MBA or CFA), wellness stipends, and subsidized meals (a famous perk in banking to keep you working late).

When evaluating a job offer, you must look at this entire package. A lower base salary with an excellent bonus structure, strong 401(k) match, and great health benefits can often be more valuable than a higher base salary with minimal extras.

Key Factors That Influence Your Finance Salary

Your entry-level finance salary is not a lottery; it's determined by a set of predictable and influenceable factors. Understanding these variables is the first step toward maximizing your earning potential. This is the most critical section for anyone looking to strategically plan their finance career for optimal compensation.

### 1. Level of Education: The Foundation

Your educational background is the first filter used by recruiters. While a bachelor's degree is the minimum requirement, its nature and source matter immensely.

- Degree Subject: A degree in Finance, Economics, Accounting, or a quantitative field like Mathematics or Statistics is standard. These programs provide the theoretical and technical foundation employers expect. A general business or liberal arts degree can work, but you'll need to demonstrate your quantitative aptitude through coursework, internships, and extracurriculars.

- Target vs. Non-Target Schools: This is a significant, if controversial, factor, especially for high-finance roles like investment banking and private equity. "Target schools" are universities (often Ivy League and other top-tier institutions like MIT, Stanford, UChicago) from which top banks and firms actively recruit. Graduating from a target school provides a significant advantage in networking and securing interviews, which directly correlates with higher-paying jobs. A graduate from a "non-target" state university can absolutely break in, but it requires more proactive networking and a stellar academic/internship record.

- Advanced Degrees:

- Master's in Finance (MFin): This specialized one-year program can give a recent graduate a competitive edge and potentially a higher starting salary (a 5-15% bump) over a candidate with only a bachelor's degree, especially for those from non-target undergrad programs.

- Master of Business Administration (MBA): An MBA is a career accelerator, not typically an entry-level degree. It's for professionals with 3-6 years of experience looking to pivot or move up. An MBA from a top-10 program can double or triple a pre-MBA salary, vaulting professionals into senior associate roles in banking or consulting with total compensation packages often exceeding $300,000.

- Professional Certifications: While usually pursued after starting your career, awareness of them is key.

- Chartered Financial Analyst (CFA): The gold standard for investment management (equity research, asset management). Passing CFA Level I while in school or just after graduating signals a serious commitment and can significantly boost your resume, potentially leading to a higher starting salary offer. A full CFA charter holder can earn a salary premium of 15-20% or more over their non-chartered peers.

- Certified Public Accountant (CPA): Essential for accounting roles, but also highly respected in corporate finance and M&A, where deep knowledge of accounting is critical.

- Certified Financial Planner (CFP): The key designation for personal financial advisors and wealth management professionals.

### 2. Years of Experience: The Value of "Reps"

Experience is the single greatest driver of salary growth over the long term. In finance, this is often formalized into a very structured promotion and compensation path.

- Internships (The "Zero" Year of Experience): In finance, internships are not optional; they are a prerequisite. A summer analyst internship at a reputable firm is the primary pipeline into a full-time, high-paying job. These internships are well-paid, often at a pro-rated salary equivalent to a first-year analyst (e.g., a $110,000 base salary pro-rated for 10 weeks). More importantly, a successful internship often leads directly to a full-time offer with a signing bonus. Lacking a relevant finance internship puts you at a severe disadvantage.

- Entry-Level (0-2 Years): Analyst: As we've discussed, this is the learning phase. You're building models, creating decks, and absorbing as much as possible. Salary growth comes primarily from the annual increase in bonus potential and a small base salary bump each year.

- Post-Analyst (2-5 Years): Associate: The first major promotion. In investment banking, analysts often leave after 2-3 years or get promoted to "Associate." This comes with a significant pay jump. A first-year Associate's total compensation can be in the $275,000 - $450,000 range. In corporate finance, this might be a promotion to "Senior Financial Analyst," with a base salary moving into the $85,000 - $115,000 range plus a larger bonus.

- Mid-Career (5-10 Years): Vice President / Manager: At this stage, you transition from pure execution to managing projects and junior staff. Responsibility and compensation grow accordingly. A Vice President in banking can earn $500,000 - $700,000+, while a Finance Manager in a corporation might earn $120,000 - $160,000+.

### 3. Geographic Location: The Cost of Living & Opportunity Premium

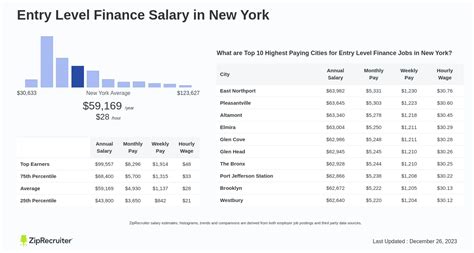

Where you work has a monumental impact on your salary, driven by cost of living and the concentration of financial activity.

- Top-Tier Financial Hubs: New York City is the undisputed king, commanding the highest salaries across all finance sectors. Other top-tier hubs include San Francisco/Bay Area (strong in tech finance and venture capital), Boston (asset management hub), and Chicago (derivatives, commercial banking). Expect salaries in these cities to be 15-30% higher than the national average.

- Second-Tier Hubs: Cities like Charlotte (a major banking center for Bank of America and Wells Fargo), Dallas, Los Angeles, and Houston (energy finance) offer strong opportunities and salaries that are slightly below the top tier but still well above the national average, often with a more favorable cost of living.

- Rest of the Country: In most other cities, you'll find primarily corporate finance, commercial banking, and financial advising roles. Salaries will be closer to the national averages published by Salary.com and Payscale, reflecting the lower cost of living and different industry mix.

Here's a sample comparison for a "Financial Analyst I" role, based on data from salary aggregators which adjust for location:

| City | Estimated Median Base Salary |

| :--- | :--- |

| New York, NY | $85,000 |

| San Francisco, CA | $88,000 |

| Chicago, IL | $74,000 |

| Charlotte, NC | $71,000 |

| Dallas, TX | $70,000 |

| Kansas City, MO | $65,000 |

*Note: This table reflects corporate finance roles. For investment banking, base salaries are often standardized across major offices, but bonuses can still vary.*

### 4. Company Type & Size: The Great Divide

The type of firm you work for is perhaps the most significant determinant of your starting salary and lifestyle.

- Investment Banks (Bulge Brackets & Elite Boutiques): Firms like Goldman Sachs, J.P. Morgan, Morgan Stanley, Lazard, and Evercore offer the highest entry-level compensation packages. As mentioned, total compensation can easily exceed $150,000. The trade-off is famously intense work culture, with 80-100 hour weeks being common.

- Private Equity & Venture Capital: These are "buy-side" roles. While incredibly lucrative, it is extremely rare to get an entry-level job straight out of undergrad. The standard path is to work for 2-3 years in investment banking or top-tier consulting first, then move to PE/VC as an Associate.

- Corporate Finance (Fortune 500): Working in the finance department of a large, established company like Apple, Johnson & Johnson, or a major industrial firm. Salaries are strong, benefits are excellent, and the work-life balance is significantly better (45-55 hours/week). An entry-level salary might be $70,000 - $85,000 with a 5-10% bonus.

- Commercial Banking: Roles at large banks like Chase or Bank of America focused on lending to businesses. Offers good stability, reasonable hours, and solid pay. Entry-level credit analysts can expect salaries in the $65,000 - $80,000 range plus a small bonus.

- Asset Management & Hedge Funds: These buy-side roles can also be very high-paying, sometimes rivaling investment banking, especially at top hedge funds. Entry-level compensation at a large asset manager might be $85,000 - $100,000 plus a significant bonus tied to fund performance.

- Startups: A startup finance role offers a different value proposition. The base salary will likely be lower than a corporate job (e.g., $60,000 - $75,000), but it's often supplemented with stock options. This is a high-risk, high-reward play on the company's future success.

- Government: Roles at the SEC, Federal Reserve, or Department of the Treasury offer unparalleled stability and benefits but the lowest salaries in the field. An entry-level role might start in the $55,000 - $70,000 range, based on the government's GS pay scale.

### 5. Area of Specialization: Finding Your Niche

Within these companies, your specific function also matters.

- Mergers & Acquisitions (M&A): Universally considered one of the most prestigious and highest-paying groups within an investment bank.

- Financial Planning & Analysis (FP&A): The core of most corporate finance departments. A very common and stable entry point.

- Treasury: Manages a company's cash, debt, and financial risk. A more specialized and often less stressful corporate role than FP&A.

- Risk Management: A growing and critical field, especially after the 2008 financial crisis. Professionals analyze and mitigate credit risk, market risk, and operational risk for financial institutions. Compensation is strong and rising.

- Quantitative Finance ("Quants"): Requires a heavy background in math, physics, or computer science. These professionals build the complex algorithms used in high-frequency trading and derivatives pricing. Compensation is exceptionally high, often exceeding traditional investment banking.

### 6. In-Demand Skills: Your Salary Boosters

Finally, the specific, demonstrable skills you bring to the table can directly impact your offer. These are the tools of the trade, and mastery commands a premium.

- Advanced Microsoft Excel: This is non-negotiable. You must be a master of PivotTables, VLOOKUP/HLOOKUP (or better yet, XLOOKUP), INDEX/MATCH, and complex nested formulas. Keyboard shortcut proficiency is a must.

- Financial Modeling: The ability to build a clean, dynamic, three-statement financial model from scratch is the single most valuable technical skill. Showcasing this in an interview case study is critical. Knowledge of DCF, LBO, and M&A modeling is key for high-finance roles.

- Presentation & Communication: You can have the best